Understanding forex buying rate and its significance in currency trading

What is forex buying rate? Forex, or foreign exchange, is a decentralized market for trading different currencies. It is the largest and most liquid …

Read Article

Investing in the stock market can be a daunting task, as there are constantly new strategies and trends to consider. One strategy that has gained significant attention in recent years is skew strategies. Skew strategies involve taking advantage of the options market to profit from stocks that are expected to have a significant price movement.

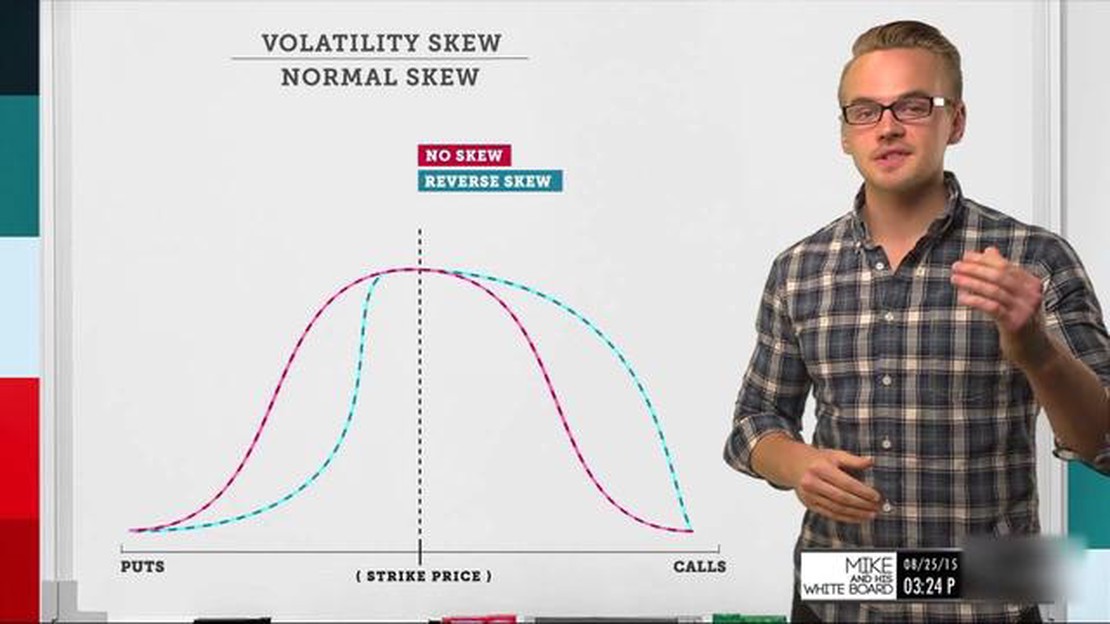

Skew refers to the imbalance in the pricing of put and call options. Put options give investors the right to sell a stock at a certain price, while call options give investors the right to buy a stock at a certain price. When the skew is high, it means that put options are more expensive than call options, indicating that investors are more bearish on the stock.

Skew strategies allow investors to profit from this pricing imbalance. By understanding the factors that affect skew and identifying stocks with high skew, investors can make strategic options trades that have the potential for significant gains. Skew strategies can be particularly useful during times of market uncertainty or when there is expected news or events that could impact a stock’s price.

However, it is important to note that skew strategies come with risks. Options trading is inherently risky, and skew strategies are no exception. It requires a deep understanding of options pricing, as well as the ability to accurately predict price movements. Additionally, the market can be unpredictable, and even the most well-thought-out skew strategy may not always result in a profit.

In conclusion, understanding skew strategies is essential for successful investment in the stock market. By taking advantage of the pricing imbalance in the options market, investors can potentially profit from stocks that are expected to have significant price movements. However, it is crucial to approach skew strategies with caution, as they come with their own set of risks. As with any investment strategy, thorough research and careful consideration are necessary before implementing skew strategies.

Skew strategies are a key component in successful investment. Skew refers to the imbalance or asymmetry in the distribution of returns in an investment. It is important to understand skew and utilize skew strategies in order to optimize investment outcomes.

Skew strategies help investors navigate the risks and uncertainties of the financial market by providing a framework for managing downside risk. By understanding and analyzing the skew of an investment, investors can make informed decisions about risk exposure and potential return.

One of the main reasons why skew strategies are important is that they can help investors protect against large losses. By properly managing downside risk, investors can limit the impact of negative market events and preserve capital. This is especially important during times of market volatility or economic downturns.

Furthermore, skew strategies can also help investors take advantage of potential opportunities. By identifying investments with positive skew, investors can position themselves to potentially capture higher returns. This can be particularly beneficial in markets where positive outliers are more likely to occur.

Another benefit of skew strategies is that they can enhance portfolio diversification. By incorporating investments with different skew characteristics, investors can create a more balanced and resilient portfolio. This can help reduce the overall risk and increase the potential for long-term growth.

In conclusion, the importance of skew strategies cannot be overstated. They provide a framework for managing risk, protecting capital, and optimizing returns. By understanding and utilizing skew strategies, investors can navigate the complexities of the financial market and increase the likelihood of successful investment outcomes.

Skew strategies are a powerful tool in the world of investment. They allow investors to take advantage of the natural asymmetry of markets to maximize returns. By understanding skew and implementing strategies that capitalize on it, investors can achieve higher profits and minimize risks.

Read Also: Did MF Global customers receive full compensation for their lost funds?

Skew is a measure of the extent to which the probability distribution of an asset’s returns is not symmetric. In simple terms, it shows the likelihood of extreme outcomes. Skew can be positive, which means that there is a higher probability of the asset experiencing large gains. Or it can be negative, indicating a higher likelihood of large losses. By analyzing skew, investors can identify opportunities to maximize returns.

One way to maximize returns with skew strategies is by focusing on assets with positive skew. These assets tend to have a lower probability of large losses and a higher probability of large gains. By allocating a larger portion of their portfolio to these assets, investors can increase their chances of achieving higher returns. However, it is important to note that positive skew does not guarantee success. Investors should still conduct thorough research and analysis before making any investment decisions.

Another strategy to maximize returns with skew is by implementing option strategies. Options are derivatives that derive their value from an underlying asset, such as a stock or commodity. By using options, investors can take advantage of the skew of the underlying asset to generate profits.

For example, one popular strategy is the long call skew strategy. This strategy involves buying a call option with a strike price below the current market price of the underlying asset. By doing so, investors can profit from any significant upside movements in the asset while limiting their downside risk. Similarly, the long put skew strategy involves buying a put option with a strike price above the current market price, allowing investors to profit from downside movements in the asset.

In conclusion, understanding skew and utilizing skew strategies can be the key to maximizing investment returns. By identifying assets with positive skew and implementing option strategies, investors can increase their chances of achieving higher profits while minimizing risks. However, it is important to remember that investing always carries risks, and thorough research and analysis are crucial before making any investment decisions.

Effective risk management is essential when implementing skew strategies in investment. Skew refers to the asymmetry in the distribution of returns for a particular investment or portfolio. Skew strategies aim to take advantage of this skewness by using options and other derivative instruments.

When implementing skew strategies, it is important to carefully consider the potential risks involved. Skewness can result in skewed returns, with the potential for large losses in certain scenarios. Therefore, risk management plays a crucial role in successful implementation.

One key aspect of risk management in skew strategies is understanding and managing downside risk. This involves assessing the potential for losses and implementing measures to mitigate these risks. For example, setting stop-loss orders or using other risk mitigation techniques can help limit losses in case of adverse market movements.

Read Also: Reporting Non-Qualified Stock Options: A Complete Guide

| Skew Strategies | Risk Management |

| - Take advantage of skewness in the distribution of returns | - Assess potential downside risk |

| - Use options and derivative instruments | - Implement measures to mitigate risk |

| - Aim for positive asymmetry in returns | - Set stop-loss orders |

Another important aspect of risk management in skew strategies is diversification. By diversifying the investment portfolio across different assets and strategies, investors can reduce the overall risk and potential losses. This can help offset potential losses from specific skew strategies with gains from other investments.

Furthermore, ongoing monitoring and adjustments are crucial in risk management for skew strategies. Market conditions can change, and the skewness of returns may vary over time. Therefore, regular monitoring and making necessary adjustments to the skew strategies can help ensure that risk is effectively managed and potential losses are minimized.

In conclusion, risk management is a critical component in successfully implementing skew strategies in investment. It involves understanding and managing downside risk, diversifying the portfolio, and ongoing monitoring and adjustments. By effectively managing risk, investors can increase their chances of achieving successful outcomes with skew strategies.

A skew strategy in investment refers to a trading or investing approach that takes advantage of the difference in implied volatility among different options contracts. It involves buying options contracts with a higher implied volatility and selling options with a lower implied volatility to potentially profit from the difference.

A skew strategy works by identifying options contracts with a significant difference in implied volatility. The investor buys options with higher implied volatility and sells options with lower implied volatility to create a position that can profit from this difference. The strategy relies on the hope that the implied volatility levels will converge over time, resulting in a profit.

Using a skew strategy in investment can provide several advantages. First, it allows investors to potentially profit from the difference in implied volatility, which can result in significant gains if the volatility levels converge. Second, it provides a way to hedge against market fluctuations by taking positions that offset each other. Finally, the strategy can be used to take advantage of market inefficiencies and generate consistent returns.

Skew strategies, like any investment approach, come with their own set of risks. One of the main risks is that the implied volatility levels may not converge as expected, resulting in potential losses. Additionally, market conditions and economic factors can impact the performance of the strategy. It is also important to carefully manage the risk exposure and position size to avoid significant losses.

Skew strategies can be suitable for certain types of investors, particularly those who have a good understanding of options trading and are comfortable with the risks involved. It is important for investors to have a solid knowledge of options and volatility dynamics before implementing skew strategies. Additionally, investors should carefully assess their risk tolerance and investment goals before deciding if skew strategies are appropriate for them.

A skew strategy in investment refers to a type of investment strategy that focuses on profiting from the asymmetrical movements in the prices of related financial instruments. It involves taking positions in options or other derivative instruments to benefit from the difference in value between different strike prices or expiration dates.

A skew strategy works by taking advantage of the difference in implied volatility between options with different strike prices or expiration dates. By purchasing and selling options with different strike prices or expiration dates, investors can profit from the change in the relationship between these options as the underlying asset’s price fluctuates.

What is forex buying rate? Forex, or foreign exchange, is a decentralized market for trading different currencies. It is the largest and most liquid …

Read ArticleMeet the 24 Year Old Millionaire Trader Have you ever wondered what it takes to become a millionaire at such a young age? Meet John Johnson, a 24 year …

Read ArticleUnderstanding whether RSI is leading or lagging When it comes to technical analysis in the world of trading, one of the most popular indicators is the …

Read ArticleShould I increase buffer size? Buffer size is a crucial parameter when it comes to data processing and storage, particularly in computer systems. It …

Read ArticleUnderstanding OEC in Trade: Explained When it comes to international trade, one of the key factors that determines a country’s competitiveness is its …

Read ArticleAddress of PKO Bank in Poland If you are looking for the address of a PKO Bank branch in Poland, you have come to the right place. PKO Bank Polski is …

Read Article