Find Out the Hourly Rates of Movers Near New York, NY

Hourly Rates for Movers near New York NY If you are planning a move in or around New York, NY, one of the most important factors to consider is the …

Read Article

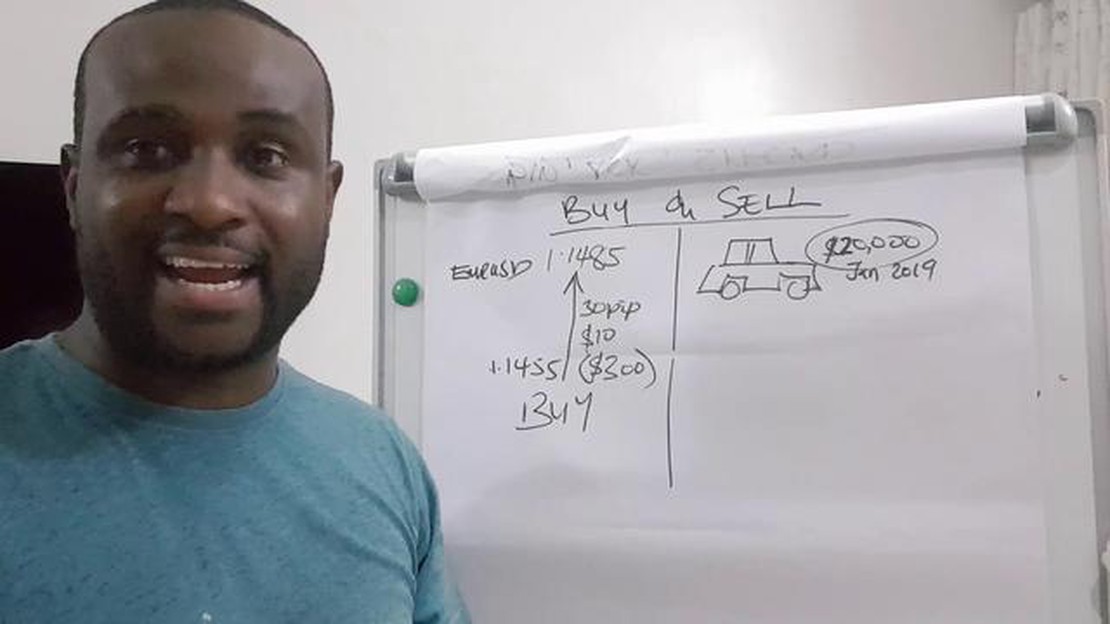

Forex, or foreign exchange, is a decentralized market for trading different currencies. It is the largest and most liquid market in the world, with an average daily trading volume of trillions of dollars. Traders in the forex market buy and sell currencies with the aim of making a profit. When engaging in currency trading, it is essential to understand the concept of the forex buying rate and its significance.

The forex buying rate refers to the amount of one currency that needs to be paid in order to acquire a unit of another currency. For example, if the buying rate for USD/EUR is 1.2, it means that one needs to pay 1.2 euros to acquire 1 US dollar. The buying rate is determined by market factors such as supply and demand, interest rates, geopolitical events, and economic indicators.

The significance of the forex buying rate lies in its role as a key determinant of currency exchange rates. Currency exchange rates are constantly fluctuating due to a variety of factors, and the buying rate plays a crucial role in these fluctuations. Traders and investors analyze buying rates and exchange rates to make informed decisions about when to buy or sell currencies.

Understanding the forex buying rate can also help traders assess the value of a currency. A higher buying rate indicates a stronger currency, while a lower buying rate suggests a weaker currency. Traders can use this information to speculate on the future direction of a currency’s value and make profitable trades.

In conclusion, the forex buying rate is an important concept in currency trading. It represents the amount of one currency that needs to be paid to acquire another currency and serves as a key determinant of currency exchange rates. By understanding the buying rate and its significance, traders can make informed decisions and potentially profit from fluctuations in currency values.

The forex buying rate refers to the exchange rate at which a trader can purchase a particular currency in the forex market. This rate is determined by various factors, including supply and demand dynamics, economic indicators, and geopolitical events.

When engaging in currency trading, it is essential to understand the forex buying rate as it influences the overall profitability of a trade. The buying rate represents the value of one currency in terms of another currency and plays a crucial role in determining the cost of acquiring foreign currency.

Forex buying rates are typically quoted by financial institutions, such as banks or currency exchange services, and are constantly updated as market conditions change. Traders can access these rates through various platforms, including online trading platforms and financial news outlets.

Read Also: Reasons why Interactive Brokers does not allow options trading

It’s important to note that the forex buying rate is different from the forex selling rate, also known as the exchange rate at which a trader can sell a particular currency. The difference between the buying and selling rates is known as the spread, which represents the profit margin for financial institutions.

Traders need to monitor the forex buying rate closely to make informed trading decisions. A favorable buying rate allows traders to acquire a larger amount of foreign currency for a given amount of their domestic currency. On the other hand, an unfavorable buying rate can increase the cost of acquiring foreign currency and potentially decrease the profitability of a trade.

Understanding the forex buying rate also helps traders evaluate the strength or weakness of different currencies. A higher buying rate suggests a stronger currency, indicating increased demand for that currency compared to others. Conversely, a lower buying rate indicates a weaker currency, relative to others, and lower demand.

In conclusion, the forex buying rate plays a significant role in currency trading as it determines the cost of acquiring foreign currency and influences the overall profitability of trades. Traders should closely monitor buying rates and stay updated with market conditions to make informed trading decisions.

Forex buying rate is the exchange rate at which a trader can buy a particular currency pair. It represents the amount of one currency that needs to be paid in order to purchase another currency. The buying rate is determined by several factors, including the supply and demand for the currencies in the market.

The forex buying rate is essential in currency trading because it determines the cost of purchasing a currency. Traders use this rate to calculate the amount of money required to buy a specific currency pair and to assess the profitability of their trades.

The buying rate is typically lower than the selling rate, which is the rate at which a trader can sell a currency pair. The difference between the buying rate and selling rate is known as the spread, which represents the profit margin for the forex broker or dealer.

| Key Points |

|---|

| The forex buying rate is the exchange rate at which a trader can buy a particular currency pair. |

| It represents the cost of purchasing a currency and is used to calculate the required amount of money for a trade. |

| The buying rate is lower than the selling rate, and the difference between the two is known as the spread. |

| Traders use the buying rate to assess the profitability of their trades and make informed decisions in the forex market. |

Read Also: Is Forex Trading Legal in Nepal? Find Out Here

Understanding the forex buying rate is crucial for traders as it enables them to determine the cost of obtaining a specific currency and make informed decisions in the forex market. By monitoring and analyzing changes in the buying rate, traders can identify opportunities for profit and manage their risks effectively.

Forex buying rate refers to the rate at which a trader can purchase a particular currency. It is calculated by considering various factors such as supply and demand, interest rates, geopolitical events, and economic indicators.

The forex buying rate is important in currency trading because it determines the amount of one currency that can be exchanged for another. Traders use the buying rate to make informed decisions about when to buy or sell currencies, as it directly impacts their potential profits or losses.

The forex buying rate affects international trade by influencing the cost of imported goods and services. A higher buying rate means the local currency is stronger, making imports relatively cheaper. Conversely, a lower buying rate makes imports more expensive, potentially affecting the balance of trade and overall economic competitiveness.

Fluctuations in the forex buying rate can be caused by a variety of factors, including changes in interest rates, inflation rates, political instability, economic indicators such as GDP and unemployment data, market speculation, and global events such as natural disasters or conflicts.

Traders can take advantage of changes in the forex buying rate by buying a currency when it is expected to strengthen and selling it when it is expected to weaken. This strategy, known as currency speculation, can result in profits if the trader can accurately predict and react to changes in the buying rate.

Forex buying rate refers to the exchange rate at which a trader or investor can buy a particular currency in the foreign exchange market. It represents the amount of foreign currency that can be obtained by selling one unit of domestic currency.

Hourly Rates for Movers near New York NY If you are planning a move in or around New York, NY, one of the most important factors to consider is the …

Read ArticleIs Meta Trader 4 a demo account? Meta Trader 4 (MT4) is a popular trading platform used by traders all over the world. It offers a wide range of …

Read ArticleAre losses on options tax deductible? Options trading can be a risky endeavor, and while it offers the potential for significant gains, it also …

Read ArticleTypes of Hammers in Forex: A Comprehensive Guide Forex trading involves the buying and selling of currencies in order to make a profit. This financial …

Read ArticleBest Strategy for Options Trading: A Comprehensive Guide Options trading can be a lucrative investment strategy if approached with the right knowledge …

Read ArticleForex Market Opening Time on Sunday in the UK The forex market is a decentralized global market for the trading of currencies. It operates 24 hours a …

Read Article