Find out the Top Forex Broker Offering Trading with Just 1 USD

Best Forex Broker for Trading with 1 USD If you are interested in forex trading and want to start with a small investment, there are several brokers …

Read Article

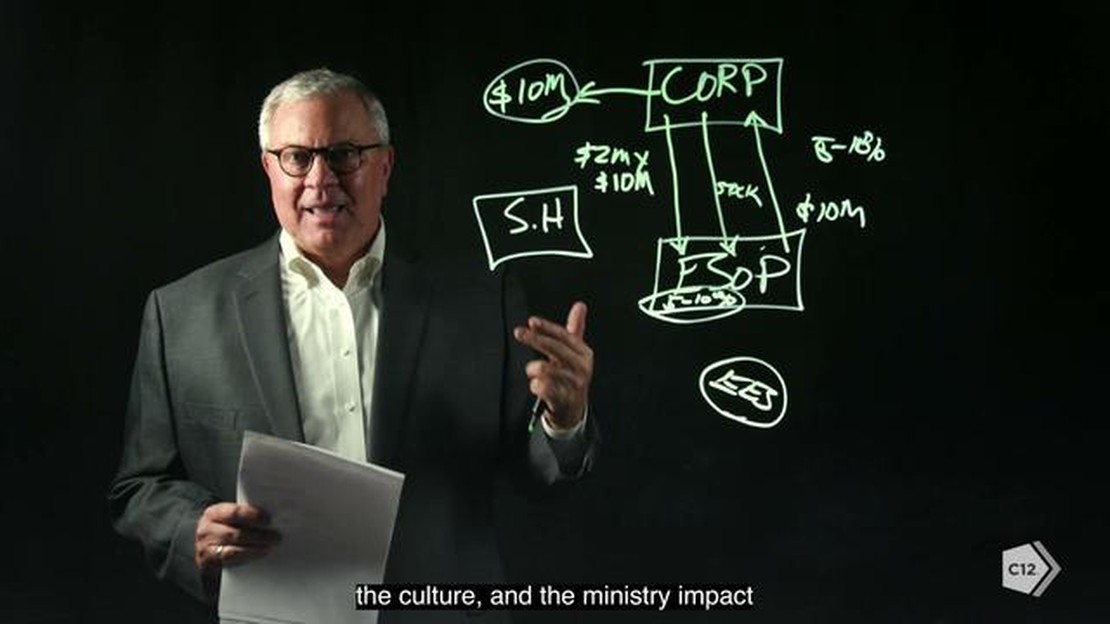

Creating an Employee Stock Ownership Plan (ESOP) can be a beneficial strategy for both business owners and employees alike. An ESOP is a retirement plan that allows employees to become partial owners of the company they work for. By offering employees the opportunity to purchase company stock, businesses can incentivize their workforce while also providing a potential retirement benefit.

Implementing an ESOP involves several key steps. First, business owners must assess the feasibility and suitability of an ESOP for their company. This includes evaluating the financial stability and profitability of the business, as well as considering the long-term goals and vision for the company. Once the decision to move forward with an ESOP is made, a plan administrator should be chosen to oversee the implementation and ongoing management of the plan.

The next step is to establish the valuation of the company. The value of the business will determine the price at which employees can purchase company stock. This valuation may require the expertise of a professional appraiser or financial advisor, who will assess the company’s financial statements, assets, and future prospects. Once the valuation is complete, it is important to communicate the plan details and benefits to employees in a transparent and comprehensive manner.

Finally, the company must create a trust to hold the shares of company stock on behalf of the employees. The trust is managed by a trustee, who is responsible for ensuring the interests of the employees are protected. The company will then contribute funds to the trust to purchase shares of company stock, which are allocated to eligible employees based on their compensation or length of service.

An Employee Stock Ownership Plan (ESOP) is a type of retirement plan that allows employees to become owners of the company they work for. It is a form of employee benefit plan where employees are offered shares of the company’s stock as part of their compensation package.

In an ESOP, the company provides a portion of its stock to a trust, which holds the shares on behalf of the employees. The trust then allocates shares to individual employee accounts based on various factors such as years of service, salary, or other predetermined formulas.

ESOPs offer several benefits for both the company and its employees. For the company, an ESOP can help attract and retain top talent, motivate employees through ownership, and provide a tax-advantaged exit strategy for owners who are looking to sell their ownership stake.

For employees, participating in an ESOP allows them to have a direct stake in the company’s success. As owners, they have a vested interest in the company’s performance and can benefit from any increase in the value of the company’s stock. Additionally, the contributions made to an ESOP are typically tax-deductible for the company and tax-deferred for the employees.

ESOPs can be structured in different ways and have varying levels of employee participation. Some companies may offer additional retirement savings options alongside an ESOP, such as a 401(k) plan, while others may have an ESOP as the primary retirement benefit.

Overall, an Employee Stock Ownership Plan offers a unique opportunity for employees to share in the success of the company they work for and build wealth over time. It can be a valuable tool for both employee retention and overall business growth.

An Employee Stock Ownership Plan (ESOP) is a retirement benefit plan that allows employees to own a portion of the company they work for. This plan can offer numerous benefits for both employees and employers.

One of the primary benefits of an ESOP is that it provides employees with a direct stake in the company’s success. By owning company stock, employees have a financial interest in the company’s performance and are therefore motivated to work harder, increase productivity, and contribute to the company’s growth.

ESOPs can also be used as a tool for succession planning, providing a mechanism for business owners to gradually sell their ownership interests to employees. This can help ensure a smooth transition of ownership and management, maintaining the company’s stability and continuity.

Another benefit of an ESOP is its tax advantages. Contributions made by the company to the ESOP are tax-deductible, and dividends paid on ESOP stock are also tax-free. This can provide significant cost savings for employers while benefiting employees in the form of increased retirement savings.

Furthermore, an ESOP can help attract and retain talented employees by offering an additional retirement savings option. It can serve as a powerful incentive to join and stay with a company, as employees are enticed by the opportunity to become shareholders and benefit from the company’s success.

In summary, an ESOP can be a valuable tool for both employees and employers. It aligns the interests of the workforce with those of the company, facilitates successful ownership transitions, provides tax advantages, and helps attract and retain top talent.

| Benefits | Purpose |

|---|---|

| Direct stake in company | Succession planning |

| Motivation and increased productivity | Smooth ownership transition |

| Tax advantages | Cost savings for employers |

| Attraction and retention of talent | Additional retirement savings option |

Read Also: Can I exchange currency at the airport?

Setting up an Employee Stock Ownership Plan (ESOP) for your company can be a complex process, but it can offer several benefits for both employers and employees. Here are some simple steps to guide you through the process:

1. Determine your goals: Before diving into the setup process, assess why you want to establish an ESOP. Are you looking to provide an exit strategy for the current owner(s), incentivize employees, or increase cash flow?

Read Also: Is there a free exchange rate API? Find out here

2. Conduct a feasibility study: Determine whether an ESOP is a viable option for your company. Evaluate the financial and legal implications, as well as the potential tax benefits.

3. Engage professional advisors: Seek expert advice from attorneys, accountants, and valuation professionals who specialize in ESOPs. They can help you navigate the complexities and ensure compliance with legal requirements.

4. Develop a comprehensive plan: Work with your advisors to design an ESOP that aligns with your goals and complies with regulatory guidelines. This includes determining eligibility criteria, vesting schedules, and contribution methods.

5. Conduct a valuation: Obtain a professional valuation of your company to determine its worth. This will help establish the price for shares to be allocated to employees and guide ongoing valuations.

6. Establish a trust: Create an ESOP trust, which will hold the allocated shares on behalf of the employees. Engaging a trustee to manage the trust is also crucial.

7. Communicate with employees: Clearly communicate the benefits and mechanics of the ESOP to your employees. Provide educational materials and conduct meetings to ensure everyone understands the opportunities and responsibilities involved.

8. Obtain necessary approvals: Seek any required approvals from company stakeholders, such as shareholders or the board of directors.

9. Implement the ESOP: Once all approvals have been obtained, execute the plan by transferring shares to the ESOP trust and allocating them to eligible employees.

10. Monitor and review: Regularly review the performance and compliance of the ESOP. Seek guidance from your professional advisors to ensure ongoing compliance with relevant laws and regulations.

By following these steps, you can set up an ESOP that benefits both your company and its employees, fostering a sense of ownership and rewarding long-term commitment.

An Employee Stock Ownership Plan (ESOP) is a type of employee benefit plan that allows employees to become owners of company stock. The company contributes to a trust fund that buys shares of the company’s stock, and employees receive shares based on their compensation.

A company may choose to implement an Employee Stock Ownership Plan (ESOP) for a variety of reasons. Some benefits include: providing employees with an ownership stake and a financial incentive to perform well, offering a tax-advantaged way to transfer ownership, and potentially improving employee retention and morale.

Yes, there are tax advantages to setting up an Employee Stock Ownership Plan (ESOP). For example, contributions made to the ESOP are tax-deductible for the company, and employees who receive stock through the ESOP may be eligible for certain tax benefits, such as tax deferral on the stock until it is sold.

Employees can benefit from an Employee Stock Ownership Plan (ESOP) in a few ways. Firstly, they have the opportunity to become owners of company stock, which can potentially increase in value over time. Secondly, they may receive dividends on their stock holdings. Lastly, employees can also benefit from the potential tax advantages associated with the ESOP.

The steps for creating an Employee Stock Ownership Plan (ESOP) may vary depending on the company and its specific circumstances, but some common steps include: determining the objectives of the ESOP, conducting a feasibility study, obtaining a valuation of the company, creating a trust to hold the company stock, developing a plan document, and implementing the plan with appropriate communication and education for employees.

An Employee Stock Ownership Plan (ESOP) is a type of retirement plan in which a company provides its employees with ownership interest in the company through the allocation of stock.

Best Forex Broker for Trading with 1 USD If you are interested in forex trading and want to start with a small investment, there are several brokers …

Read ArticleWhere to Find the Best US Exchange Rate When traveling to or doing business with the United States, having the best exchange rate can significantly …

Read ArticleIs forex trading really profitable? Forex, short for foreign exchange, is the largest and most liquid financial market in the world. It’s a …

Read ArticleShould PE ratio be higher than industry average? When it comes to evaluating the performance and value of a company, there are several factors to …

Read ArticleForex or Binary Options: Which One Carries More Risk? When it comes to trading financial markets, there are various options available for investors. …

Read ArticleUnderstanding the Difference Between Stock Option Grant and Vesting When it comes to employee benefits and compensation, stock options are a commonly …

Read Article