Understanding Forex ATR Values: A Key Measure for Volatility and Risk Assessment

Understanding Forex ATR Values When it comes to trading in Forex markets, understanding and managing risk is crucial. One key measure that traders use …

Read Article

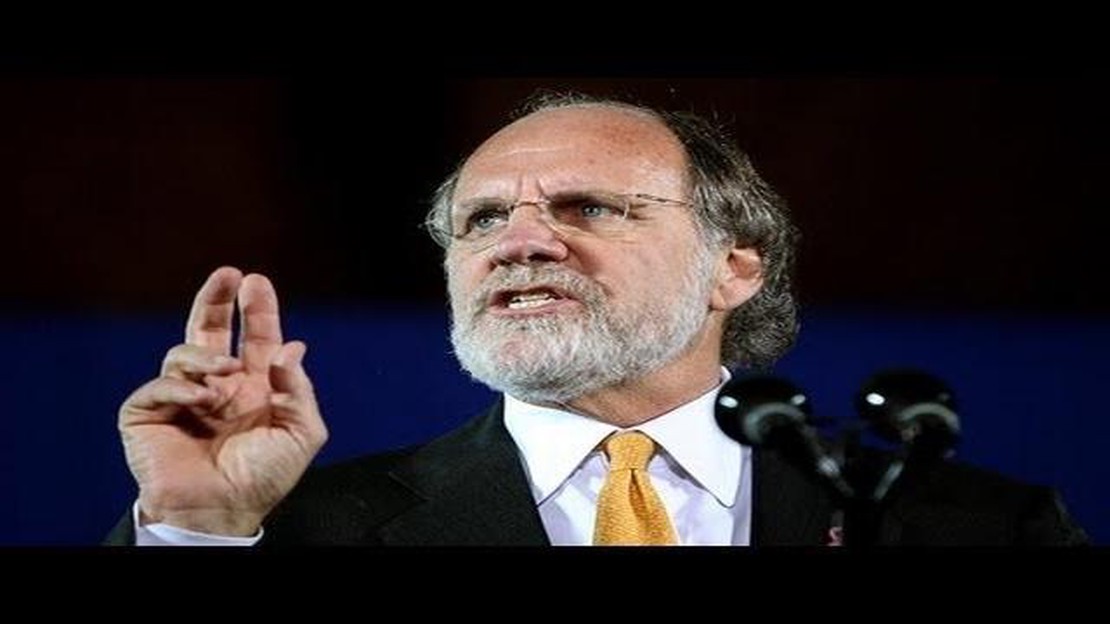

The collapse of MF Global, a global financial services firm, in October 2011 sent shockwaves throughout the financial industry. The company, led by former New Jersey Governor Jon Corzine, filed for bankruptcy after making risky bets on European sovereign debt. As a result, thousands of MF Global customers were left reeling, unsure if they would ever see their lost funds again.

Regulators and investigators were quick to step in, trying to determine what went wrong and who was to blame. The Commodity Futures Trading Commission (CFTC), Securities and Exchange Commission (SEC), and Department of Justice (DOJ) launched investigations into MF Global’s actions. It was revealed that the company had improperly used customer funds to cover its own trading losses, a serious violation of federal law.

While the investigations were ongoing, MF Global customers faced the uncertainty of whether their lost funds would be fully compensated. Many feared that they would never recover their money, and that the collapse of the company would leave them financially devastated. However, efforts were made to recover as much of the lost funds as possible and return them to the customers.

In the end, MF Global customers did receive some compensation for their lost funds, although not all were fully reimbursed. The CFTC and bankruptcy trustee reached a settlement, under which the customers were able to recover around 80% of their funds. While this was a significant recovery, it still left some customers with substantial losses. The case highlighted the need for stronger regulations and oversight in the financial industry to protect customers from such devastating losses in the future.

MF Global was a major global financial derivatives broker that declared bankruptcy on October 31, 2011. The company primarily served institutional clients such as hedge funds and pension funds, and was known for its extensive use of proprietary trading and complex investment strategies.

The bankruptcy of MF Global was primarily caused by the company’s exposure to European sovereign debt, particularly in Greece, Portugal, Italy, Ireland, and Spain. As these countries faced significant financial challenges, the value of their bonds declined, leading to substantial losses for MF Global.

As a result of the bankruptcy, thousands of customers were impacted and faced the loss of funds that were being held by MF Global. Many of these customers were individual traders and farmers who used the company’s services to hedge against price fluctuations in commodities such as wheat, corn, and soybeans.

Efforts were made to recover and distribute the funds to the customers. However, the process was complex and faced significant challenges. It was discovered that MF Global had improperly used some of its customers’ funds to cover its own trading losses, which resulted in a deficit in customer accounts.

Read Also: Understanding Nifty and Sensex: What Every Investor Should Know

After years of legal proceedings and investigations, the bankruptcy trustee was able to recover a portion of the funds, but not all customers received full compensation for their losses. The final distribution percentages varied depending on the type of account and the nature of the funds held.

Overall, the MF Global bankruptcy was a significant event in the financial industry, highlighting the risks and complexities inherent in the derivatives market. Despite efforts to compensate customers, the incident served as a reminder of the need for strong regulations and oversight in the financial industry to protect investors and maintain market stability.

When MF Global, a global financial derivatives broker, collapsed in 2011, it resulted in a significant loss of customer funds. The bankruptcy exposed the vulnerabilities in the firm’s risk management and financial controls, leading to a chaotic situation for its clients.

Initially, it was estimated that approximately $1.6 billion in customer funds had gone missing. The subsequent investigations revealed that the firm had used customer funds to cover its own proprietary trading losses, leading to a violation of segregated fund requirements. Many MF Global customers, ranging from individual traders to large institutional investors, found themselves unable to access their funds.

The loss of customer funds had severe consequences for the affected individuals and organizations. It hindered their ability to make trades, meet margin calls, and manage their financial obligations. The uncertainty surrounding the status of the missing funds caused significant distress and financial hardship for many customers.

In the aftermath of the bankruptcy, efforts were made to recover and distribute the lost funds to MF Global’s customers. The legal process to recoup the funds was complex and lengthy, involving negotiations with various stakeholders and marshaling of assets. Ultimately, a large portion of the missing funds were recovered and returned to the customers through a claims process.

However, it is important to note that not all customers received full compensation for their losses. The recovery process resulted in a partial restitution, with customers receiving a percentage of their funds based on the available assets. The distribution of recovered funds was prioritized to cover specific categories of customers, such as individuals with small accounts, ahead of larger institutional clients.

The MF Global bankruptcy and the loss of customer funds served as a wake-up call for regulators and market participants. It highlighted the need for stronger oversight and risk management practices in the financial industry, particularly regarding the protection of customer assets. The event also prompted reforms aimed at enhancing the safeguards for customer funds and improving the transparency within the derivatives market.

Read Also: Understanding the Impulse Response of the Moving Average System

In conclusion, the MF Global bankruptcy resulted in a significant loss of customer funds, leading to financial hardships for many. While efforts were made to recover and distribute the funds, not all customers received full compensation. The event served as a catalyst for reforms to strengthen customer asset protection in the financial industry.

No, not all MF Global customers received full compensation for their lost funds. While some customers were able to recover most, if not all, of their funds, others received only a percentage of their investments back.

Not all customers received full compensation because the bankruptcy proceedings and the liquidation process of MF Global’s assets resulted in a limited pool of funds available to distribute to customers. The distribution process prioritized certain claims over others, and some customers with smaller investments may not have received full compensation.

Yes, some MF Global customers were able to recover a portion of their lost funds. The bankruptcy proceedings and the liquidation process resulted in a distribution of funds to customers, albeit not always in full. The amount received varied depending on factors such as the size of the investment and the priority of the claim.

The amount of investments that MF Global customers were able to recover varied from case to case. Some customers received a significant percentage of their investments back, while others received only a small portion or none at all. It depended on factors such as the size of the investment, the priority of the claim, and the available funds for distribution.

Several actions were taken to compensate MF Global customers. The bankruptcy proceedings and liquidation process allowed for the distribution of funds to customers. Additionally, there were investigations into the actions of MF Global and its executives, and legal actions were taken against those responsible for the firm’s collapse, with the intention of recovering funds for customers.

Understanding Forex ATR Values When it comes to trading in Forex markets, understanding and managing risk is crucial. One key measure that traders use …

Read ArticleIs GMC a Reliable and High-Quality Brand? GMC, short for General Motors Company, is a well-established car manufacturer that has been producing …

Read ArticleHow much is $1 AUD in yuan? The Australian dollar (AUD) is the official currency of Australia, a country located in Oceania. The currency is commonly …

Read ArticleCan Traders Learn Coding? Unveiling the Hidden Potential Trading has long been associated with expertise in finance, risk management, and market …

Read ArticleIs ABCD Pattern Reliable? Trading is a complex and dynamic market that requires constant analysis and understanding of various patterns and …

Read ArticleUnderstanding the EMA Indicator: A Comprehensive Guide Technical analysis is an essential tool for traders and investors to make informed decisions in …

Read Article