Understanding the Triple Moving Average and How It Can Improve Your Trading Strategy

What is the triple moving average? The triple moving average is a technical analysis tool that can greatly improve your trading strategy. It involves …

Read Article

When it comes to investing, there are many different options available to choose from. One option that often comes up is discounted options. But what exactly are discounted options? And how do they work?

Discounted options are financial instruments that give the holder the right but not the obligation to buy or sell an underlying asset at a predetermined price within a specific time period. These options are valued at a discount to their intrinsic value, which is the difference between the current price of the underlying asset and the strike price of the option.

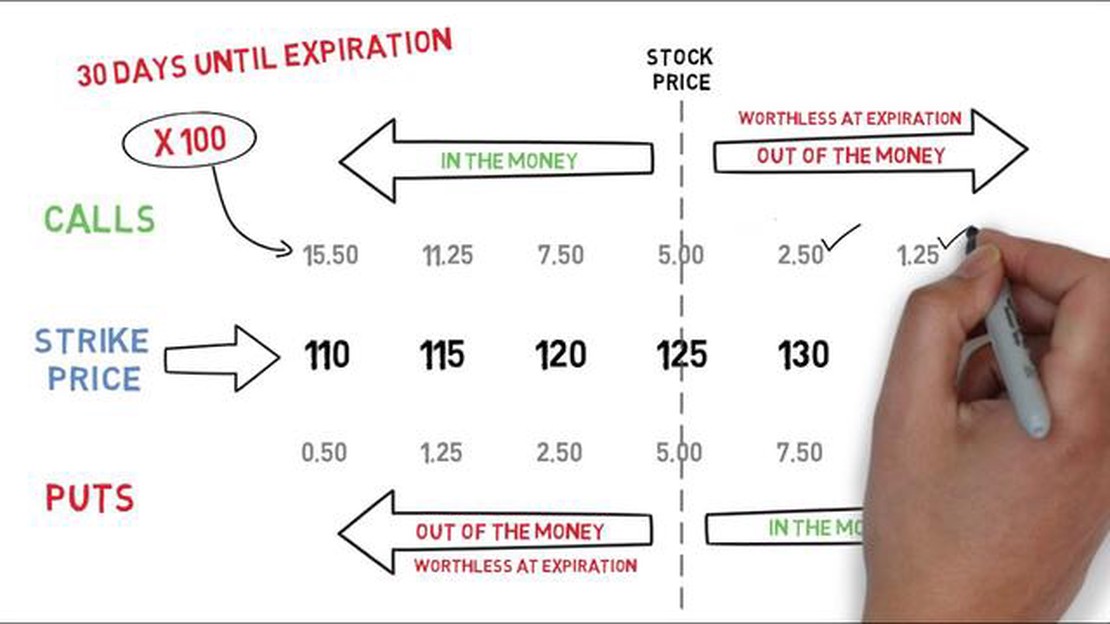

There are two main types of discounted options: call options and put options. A call option gives the holder the right to buy the underlying asset at the strike price, while a put option gives the holder the right to sell the underlying asset at the strike price. Both types of options can be discounted based on various factors such as the time remaining until expiration, market volatility, and interest rates.

Discounted options can be a useful tool for investors looking to profit from market movements without having to commit to buying or selling the underlying asset. By purchasing discounted call options, investors can profit from an increase in the price of the underlying asset, while purchasing discounted put options allows investors to profit from a decrease in the price of the underlying asset. However, it’s important to note that options trading carries risks and may not be suitable for all investors.

Discounted options are a type of financial instrument that give the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specific time frame. These options are referred to as “discounted” because their price is lower than the market value of the underlying asset.

The price of a discounted option is determined by several factors, including the current market price of the underlying asset, the strike price (the predetermined price), the time remaining until expiration, and the volatility of the market. When the market price of the underlying asset is lower than the strike price, the option is considered “in the money,” and the holder of the option can exercise it to buy or sell the asset at a profit.

One of the key advantages of discounted options is their potential for leverage. Because the cost of the option is lower than the market value of the underlying asset, the investor can control a larger position for a smaller initial investment. This allows investors to potentially amplify their returns if the price of the underlying asset moves in their favor.

Discounted options can be used for various purposes, including speculating on the price movement of an underlying asset, hedging against potential price fluctuations, and generating income through selling options. However, it’s important to note that options trading involves risks, and investors should carefully consider their risk tolerance and investment objectives before participating in this market.

Read Also: How to Determine Stock Price Based on Option Price: A Complete Guide

In conclusion, discounted options are financial instruments that give investors the right to buy or sell an underlying asset at a predetermined price within a specific time frame. These options offer the potential for leverage and can be used for various investment strategies.

Investing in discounted options can provide numerous benefits for investors. Here are some of the key advantages:

Overall, investing in discounted options can be a valuable addition to an investor’s toolkit. However, it is important to note that options trading involves risks and may not be suitable for all investors. It is recommended to consult with a financial advisor or professional before engaging in options trading.

When it comes to discounted options, there are several strategies that investors can employ to maximize their profits. These strategies involve carefully analyzing the market and making strategic decisions based on the current conditions. Here are a few strategies to consider:

Remember, investing in discounted options can be risky, and it’s important to consult with a financial advisor or do thorough research before making any investment decisions. These strategies are meant to provide a starting point for maximizing profits with discounted options, but individual circumstances may vary.

Discounted options are financial instruments that give the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified period. These options are priced at a discount compared to their intrinsic value, allowing investors to potentially profit from price movements in the underlying asset.

Read Also: 2023 Dollar to MYR Forecast: What to Expect

Discounted options are different from regular options in terms of pricing. While regular options are priced based on their intrinsic value and time value, discounted options are priced at a discount to their intrinsic value. This means that investors can potentially buy discounted options at a lower price and profit from price movements in the underlying asset.

Several factors can affect the pricing of discounted options. These include the current price of the underlying asset, the strike price of the option, the time remaining until expiration, and the volatility of the underlying asset. Additionally, market conditions and interest rates can also impact the pricing of discounted options.

Trading discounted options can offer several advantages. Firstly, they can provide potentially higher returns compared to regular options, as they are priced at a discount. Secondly, discounted options can be used as a hedging tool to offset potential losses in other investments. Additionally, trading discounted options can allow investors to gain exposure to the underlying asset without actually owning it.

While discounted options can offer potential opportunities for profit, they can also be complex and involve higher levels of risk compared to traditional options. Therefore, beginners in options trading may need to first develop a solid understanding of options concepts and strategies before trading discounted options. Consulting with a financial advisor or conducting thorough research is recommended.

Discounted options are financial derivatives that give the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specified date. These options are priced at a discount because of factors such as time value and market conditions.

Discounted options are priced using various mathematical models that take into account factors such as the current price of the underlying asset, the strike price, the time remaining until expiration, volatility, and interest rates. The most commonly used model for pricing options is the Black-Scholes model.

What is the triple moving average? The triple moving average is a technical analysis tool that can greatly improve your trading strategy. It involves …

Read ArticleWho owns Zorro? Since his creation in 1919 by pulp writer Johnston McCulley, Zorro has captured the imaginations of millions around the world. The …

Read ArticleUnderstanding Margin Call in Forex Trading Forex trading involves buying and selling currencies in the foreign exchange market. One of the key aspects …

Read ArticleHow to Trade with ADX The Average Directional Movement Index (ADX) is a popular technical analysis indicator that is used to determine the strength of …

Read ArticleWhat happens to stock price after earnings? Earnings reports are a key indicator for investors and analysts to assess the financial health of a …

Read ArticleWho is a day trader in forex? Day trading in the forex market is a popular and exciting way to participate in the world of trading. But what exactly …

Read Article