Everything You Need to Know About SMC Trading

Learn about SMC Trading: Understanding Its Basics and Benefits SMC Trading is a leading company in the field of online trading and investment. With …

Read Article

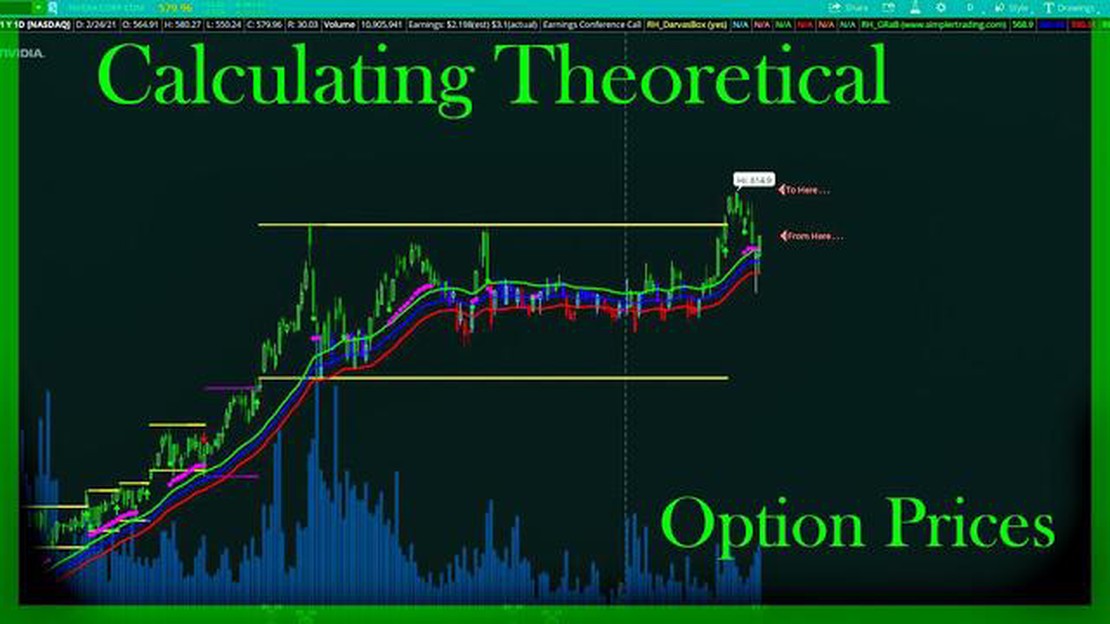

When it comes to investing in the stock market, one crucial aspect that investors often consider is the price of a stock. However, determining the true value of a stock can sometimes be a complex task. One approach that can help investors in this process is to analyze the option prices of the underlying stock.

Options are financial derivatives that derive their value from an underlying asset, such as a stock. By analyzing the prices of options associated with a particular stock, investors can gain insights into the market’s expectation of the stock’s future performance. This practice, known as option pricing theory, is based on various factors, including the stock’s current price, time to expiration, and implied volatility.

One commonly used model for option pricing is the Black-Scholes-Merton model, which takes into account these factors and provides an estimate of the fair value of an option. By using this model, along with accurate data on option prices, investors can reverse-engineer the stock price implied by the option prices. This can be a valuable tool for investors, as it can help them gauge the market’s perception of a stock’s value and make more informed investment decisions.

It is worth noting that option prices are influenced by various market forces and can change rapidly. Therefore, determining a stock’s price based solely on option prices may not provide a definitive answer. It is important for investors to consider other fundamental and technical factors in conjunction with option pricing analysis to gain a comprehensive understanding of a stock’s potential value.

In conclusion, analyzing option prices can be a useful approach for investors to determine the fair value of a stock. By considering various factors and employing option pricing models, investors can gain insights into the market’s perception of a stock’s worth. However, it is crucial to remember that option prices should be used as one tool among many in the investment analysis process.

Stock price determination is a complex process that involves various factors and market dynamics. It is important for investors to understand how stock prices are determined to make informed investment decisions. Here are some key points to understand about stock price determination:

Overall, stock price determination is a complex interplay of various factors, including supply and demand dynamics, company fundamentals, market sentiment, industry trends, and market efficiency. By considering these factors and conducting careful analysis, investors can gain a better understanding of how stock prices are determined and make more informed investment decisions.

Read Also: GPS Forex Robot Cost: What To Expect And Is It Worth It?

Option prices play a crucial role in stock valuation, as they provide important information about market expectations and sentiment regarding a particular stock. Options are financial contracts that give investors the right, but not the obligation, to buy or sell a stock at a specific price within a specific time frame.

When investors buy or sell options, they are effectively making bets on the future direction of a stock’s price. The price of an option is influenced by various factors, including the underlying stock price, the strike price, the time to expiration, and market volatility. By analyzing option prices, investors can gain insights into market expectations for a particular stock.

One key concept related to option pricing is implied volatility. Implied volatility is a measure of the market’s expectations for future price fluctuations of a stock. Higher implied volatility typically leads to higher option prices, as investors are willing to pay more for the potential for larger price swings.

In addition to implied volatility, option prices also reflect the time value of money. Options with longer time to expiration tend to have higher prices, as there is more time for the underlying stock price to move and potentially reach the strike price. This time value component is known as extrinsic value.

Another important aspect of option price in stock valuation is the relationship between the option price and the stock price. If the option is for a call (the right to buy the stock), the option price tends to increase as the stock price rises. Conversely, if the option is for a put (the right to sell the stock), the option price increases as the stock price decreases.

Overall, analyzing option prices can help investors assess the market’s expectations for a stock and incorporate this information into their stock valuation models. By understanding the role of option prices in stock valuation, investors can make more informed investment decisions and potentially identify opportunities for profit.

Read Also: Is Namibian Dollar Linked to Rand? Understanding the Currency Relationship

The price of an option is directly influenced by the price of the underlying stock. As the stock price increases, the option price tends to increase as well. Conversely, when the stock price decreases, the option price typically decreases as well.

Determining the stock price based on option price requires the use of the Black-Scholes model or other advanced options pricing models. These models take into account various factors such as the option’s strike price, time to expiration, interest rate, and volatility to calculate the theoretical price of the option. By inputting the option price into the model, you can solve for the implied volatility, which can then be used to estimate the stock price.

The Black-Scholes model is a mathematical model used to calculate the theoretical price of options. It was developed by economists Fischer Black and Myron Scholes in 1973. The model takes into account variables such as the option’s strike price, time to expiration, interest rate, current stock price, and volatility to determine the fair value of the option.

While option prices can provide valuable insights into the market’s expectations for future stock prices, there are limitations to using this method. Option prices are influenced by many factors other than the stock price itself, such as time to expiration, interest rates, and market volatility. Additionally, options are traded in a market separate from the stock market, and option prices can be subject to supply and demand dynamics that may not perfectly reflect the true value of the underlying stock.

Option prices can provide some indication of market sentiment and expectations regarding future stock price movements. For example, if call options are trading at high prices relative to put options, it may suggest that market participants are bullish and expect the stock price to increase. However, it is important to note that option prices are just one piece of information and should be used in conjunction with other analysis techniques to make informed investment decisions.

The price of stock options is directly related to the price of the underlying stock. As the stock price increases, the price of call options also increases, while the price of put options decreases. Conversely, as the stock price decreases, the price of call options decreases and the price of put options increases.

Learn about SMC Trading: Understanding Its Basics and Benefits SMC Trading is a leading company in the field of online trading and investment. With …

Read ArticleHow Long Does It Take to Become a Trader? If you’ve ever wondered how long it takes to become a successful trader, the answer may surprise you. …

Read ArticleUnderstanding the Candlestick Theory The candlestick theory is a powerful tool used by traders to analyze and predict market movements. Dating back to …

Read ArticleWhat is the S& The S&P 500 Index is one of the most widely followed stock market indices in the world. It is a market-capitalization weighted index of …

Read ArticleBuying Stocks at a Discount with Options: A Comprehensive Guide Options are a powerful tool that can be used to buy stocks at a discounted price. This …

Read ArticleUnderstanding Options Trading in Crypto If you’re looking to diversify your cryptocurrency portfolio or explore new investment strategies, options …

Read Article