Understanding Moving Averages Divergence: A Comprehensive Guide

Understanding the Divergence of Moving Averages When it comes to technical analysis, moving averages are one of the most widely used and versatile …

Read Article

When it comes to international finance, one key concept that traders and investors need to understand is the interest rate differential between two countries. This differential can have a significant impact on currency values and exchange rates, making it an important factor to consider when making financial decisions in the global market. In this article, we will explore what exactly the interest rate differential is, how it is calculated, and why it is crucial for understanding the dynamics of currency markets.

The interest rate differential, simply put, is the difference between the interest rates in two countries. It represents the discrepancy between the cost of borrowing or lending money in one country versus another. This disparity is influenced by various factors, including the monetary policy of each country’s central bank, inflation rates, economic stability, and market expectations. A higher interest rate in one country compared to another often indicates a higher return on investments, attracting foreign capital and causing the currency to appreciate.

The interest rate differential plays a crucial role in foreign exchange markets because it affects the demand and supply of currencies. When there is a significant interest rate difference between two countries, traders and investors are incentivized to borrow money in the lower interest rate country and invest it in the higher interest rate country, leading to a higher demand for the latter currency and potentially appreciating its value. Conversely, if the interest rate differential narrows or becomes negative, capital may flow out of the higher interest rate country, causing its currency to depreciate. Therefore, monitoring and understanding the interest rate differential can provide insights into future currency movements and help traders and investors make informed decisions.

In conclusion, the interest rate differential between two countries is a critical element in international finance, influencing currency values and exchange rates. By analyzing this differential, traders and investors can assess the attractiveness of different markets, consider the potential returns on their investments, and anticipate possible currency movements. It is essential to stay updated with the latest economic data, central bank policies, and global market trends to accurately evaluate the interest rate differentials and their impact on exchange rates.

In the world of finance and economics, the interest rate differential plays a crucial role in determining the flow of capital between two countries. It is the difference in interest rates between the central banks of two countries and is often used as a tool by policymakers to influence the exchange rate and the flow of money.

The interest rate differential is a key factor for investors and traders who engage in currency trading or invest in foreign countries. It reflects the difference in the returns offered by different countries’ financial markets and can have a significant impact on the value of currencies. When there is a higher interest rate in one country compared to another, it attracts investors seeking higher returns, resulting in an increased demand for the currency of that country.

For example, let’s consider two countries, Country A and Country B. If the interest rate in Country A is higher than in Country B, investors are more likely to invest in Country A. As a result, the demand for Country A’s currency will increase, causing the currency to appreciate in value relative to Country B’s currency.

On the other hand, if the interest rate in Country B is higher, investors may choose to invest in Country B, leading to an increased demand for Country B’s currency and causing it to appreciate relative to Country A’s currency.

The interest rate differential can also have implications for trade between two countries. When the interest rate in one country is significantly higher than in another, it can lead to carry trade opportunities. Carry trade involves borrowing money in a low-interest-rate currency and investing in a higher-yielding currency. This can lead to an increase in investments and economic activity in the country with higher interest rates.

However, it is important to note that interest rate differentials are not the only factor influencing currency values. Other factors such as economic growth, inflation, political stability, and market sentiment also play important roles.

Read Also: How is phantom stock paid out? | A complete guide on phantom stock payouts

To track and understand interest rate differentials, investors and traders often rely on central bank announcements, economic indicators, and market data. These sources provide insights into changes in interest rates, which can have a significant impact on currency values.

In conclusion, understanding the interest rate differential between two countries is crucial for investors, traders, and policymakers. It helps in determining the flow of capital, influencing exchange rates, and can provide opportunities for profitable investments.

The interest rate differential is a key concept in understanding the relationship between two countries’ interest rates. It refers to the difference between the interest rates of two countries. The interest rate differential plays a crucial role in driving capital flows and determining the value of currencies.

When there is a higher interest rate in one country compared to another, it creates an incentive for investors to move their capital to the country with the higher interest rate. This is because they can earn a higher return on their investments. As a result, the demand for the currency of the country with the higher interest rate increases, leading to a strengthening of its currency.

Read Also: The Four Core Trading Principles: A Comprehensive Guide

Conversely, when a country has a lower interest rate compared to another, there is less incentive for investors to hold that currency. They are likely to move their capital to the country with the higher interest rate in search of better returns. This can lead to a depreciation of the currency with the lower interest rate.

The interest rate differential is influenced by various factors, including central bank policies, inflation rates, economic growth prospects, and geopolitical events. Central banks have the power to set and adjust interest rates to manage inflation and stimulate or restrain economic activity.

Traders and investors closely monitor changes in the interest rate differentials between countries. They use this information to make decisions on currency trades and investments. Understanding the interest rate differential can help traders anticipate potential currency movements and manage their risk exposure.

In conclusion, the interest rate differential between two countries is an important concept that influences currency values and capital flows. It is affected by various economic and geopolitical factors and is closely monitored by traders and investors. Understanding the interest rate differential can provide insights into currency movements and help in making informed trading decisions.

The interest rate differential between two countries refers to the difference in interest rates set by their respective central banks. It is the contrast between the rates at which the banks lend money to commercial banks.

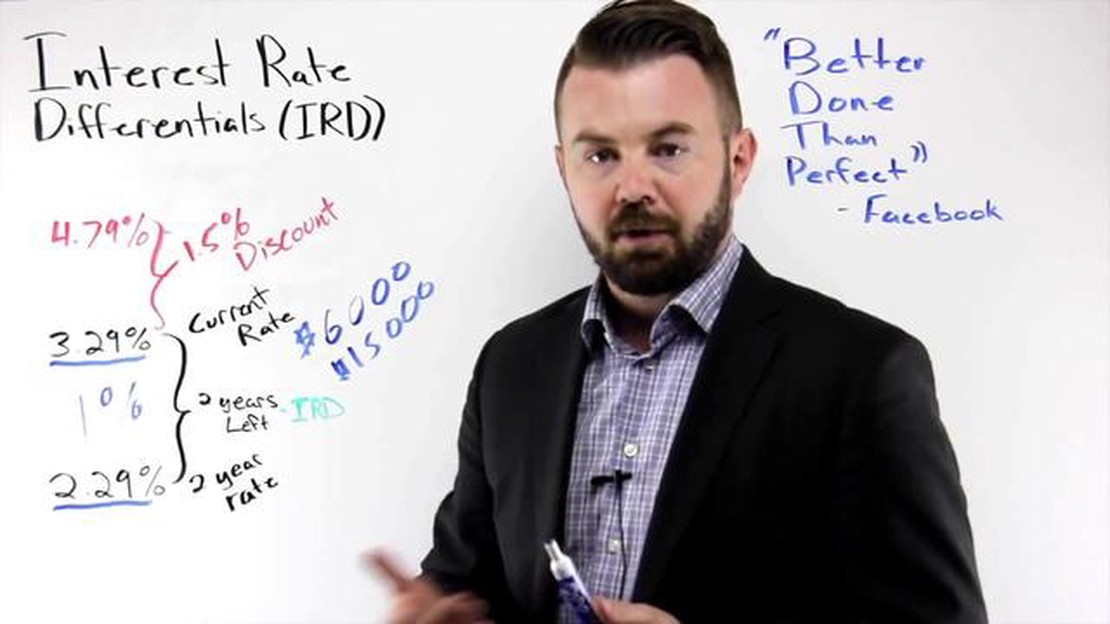

The interest rate differential is calculated by subtracting one country’s interest rate from the other’s. For example, if Country A has an interest rate of 5% and Country B has an interest rate of 2%, the interest rate differential would be 3%.

The interest rate differential is important because it affects the flow of capital between two countries. If one country has a higher interest rate than another, it is more attractive for investors to put their money in that country’s currency, leading to an increase in demand for that currency and appreciation in its value.

The interest rate differential has a direct impact on exchange rates. If one country has a higher interest rate than another, it will attract more foreign capital, increasing the demand for its currency and causing it to appreciate in value. Conversely, if one country has a lower interest rate, its currency may depreciate as investors seek higher returns elsewhere.

Understanding the Divergence of Moving Averages When it comes to technical analysis, moving averages are one of the most widely used and versatile …

Read ArticleDo Forex Robots Work on Android? In recent years, forex trading has become increasingly popular, with more and more people seeking to make profits in …

Read ArticleMF Global Losses: A Closer Look at the Financial Fallout In the world of finance, few events have captured as much attention and controversy as the …

Read ArticleHow to Listen to BBC Radio in Pakistan If you’re living in Pakistan and want to listen to BBC Radio, you may be wondering how to access it. BBC Radio …

Read ArticleBest Brokerage Firm Options in Australia If you’re looking to invest in the Australian market, choosing the right broker is crucial. A broker acts as …

Read ArticleWhat is a bearish moving average? A bearish moving average is a technical indicator used in financial markets to identify a potential downtrend. It is …

Read Article