Is crude oil a profitable commodity for trading?

Is Crude Oil a Good Option for Trading? Crude oil has long been considered one of the most sought-after and profitable commodities for trading. It is …

Read Article

Market analysis plays a crucial role in successful forex trading. As a trader, it is important to understand the intricacies of the market and analyze its various aspects in order to make informed decisions. One of the key components of market analysis is understanding the different market trends.

Market trends can be categorized into three main types: uptrend, downtrend, and sideways trend. By analyzing these trends, traders can identify potential opportunities and risks, and tailor their trading strategies accordingly. For example, during an uptrend, traders can look for buying opportunities, while during a downtrend, selling opportunities might be more favorable.

In addition to identifying trends, market analysis also involves analyzing price patterns and indicators. Various technical analysis tools, such as moving averages, support and resistance levels, and Fibonacci retracements, can help traders determine potential entry and exit points. By studying these patterns and indicators, traders can gauge market sentiment and make more accurate predictions about future price movements.

Another important aspect of market analysis is understanding fundamental factors that can influence the market. This includes economic data, geopolitical events, and central bank policies. By staying informed about these factors, traders can anticipate potential market moves and adjust their trading strategies accordingly. For example, if there is a significant economic announcement or an unexpected geopolitical event, traders can take steps to protect their positions or take advantage of the potential opportunities.

In conclusion, market analysis is a crucial aspect of forex trading. By understanding different market trends, analyzing price patterns and indicators, and staying informed about fundamental factors, traders can make better informed decisions and increase their chances of success in the forex market.

Market analysis plays a crucial role in forex trading as it helps traders make informed decisions. By analyzing the market, traders can gain insight into the current and future market trends, identify potential trading opportunities, and assess the risks associated with those opportunities.

There are two types of market analysis: technical analysis and fundamental analysis. Technical analysis involves studying historical price data and identifying patterns or trends to predict future price movements. Traders use various tools and indicators to analyze charts and make trading decisions based on price action.

On the other hand, fundamental analysis involves analyzing economic indicators, geopolitical events, and other factors that can impact the value of currencies. Traders who use fundamental analysis study news releases, economic reports, and central bank statements to anticipate how these events will impact the forex market.

Both types of market analysis are important in forex trading, and traders often use a combination of the two to make well-informed trading decisions. For example, a trader may use technical analysis to identify a potential trend reversal, but also consider the impact of a major economic event that could disrupt that trend.

Market analysis also helps traders manage risk in forex trading. By analyzing the market, traders can set appropriate stop-loss levels and take-profit targets. They can also identify potential areas of support and resistance, which can help them determine where to enter and exit trades.

Read Also: Understanding Interest Rates in Options: A Comprehensive Guide

In conclusion, market analysis is a crucial part of forex trading. It helps traders understand the market conditions, identify trading opportunities, and manage risk. Both technical and fundamental analysis are important tools that traders can use to make informed trading decisions. By staying updated on market analysis, traders can increase their chances of success in the forex market.

Forex trading is a highly dynamic and fast-paced market, where currency prices fluctuate constantly. In order to make informed decisions and optimize their trading strategies, traders need to understand the importance of analysis.

Analysis is a crucial tool in Forex trading, as it allows traders to assess the market conditions, identify trends, and predict potential price movements. There are two main types of analysis: technical analysis and fundamental analysis.

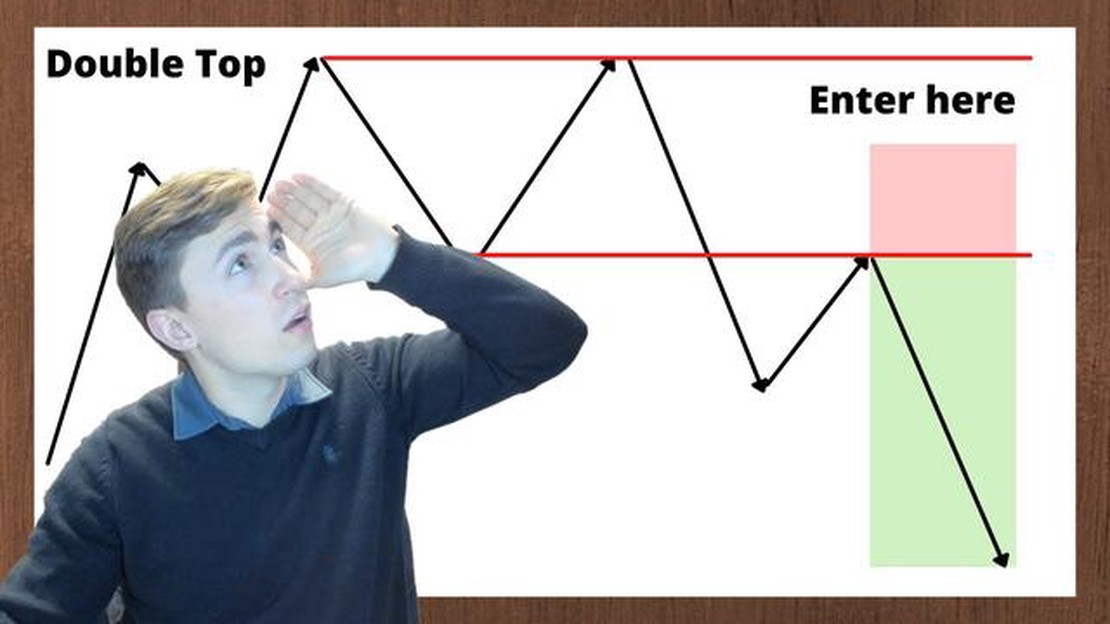

Technical analysis involves studying historical price data and using various indicators, patterns, and charting tools to identify potential entry and exit points. Traders who use technical analysis believe that past price movements can provide valuable insights into future price movements. They analyze charts, monitor price patterns, and study various technical indicators to make informed trading decisions.

On the other hand, fundamental analysis focuses on examining economic, political, and social factors that can impact currency prices. Traders who use fundamental analysis evaluate economic indicators, such as GDP growth, interest rates, inflation rates, and employment data, to assess the overall health of a country’s economy. They also keep an eye on geopolitical events, such as elections or policy changes, as these can have a significant impact on currency values.

Both technical and fundamental analysis play a crucial role in Forex trading, and many successful traders use a combination of both approaches. By combining the insights gained from both types of analysis, traders can obtain a more comprehensive understanding of the market and make more accurate predictions.

Read Also: Understanding the 1 2 3 rule in trading and how it can impact your investments

Analysis also helps traders to manage their risks effectively. By analyzing market conditions and identifying potential entry and exit points, traders can set appropriate stop-loss orders and take-profit levels. This helps them to protect their capital and minimize potential losses.

Furthermore, analysis allows traders to identify trading opportunities and create profitable strategies. By studying charts and market patterns, traders can spot potential trends and anticipate market movements. This enables them to make timely decisions and take advantage of profitable trading opportunities.

In conclusion, analysis is an essential component of successful Forex trading. It provides traders with valuable insights into market conditions, helps them make informed decisions, manage risks, and identify profitable trading opportunities. By understanding the importance of analysis and utilizing it effectively, traders can increase their chances of success in the dynamic and challenging Forex market.

Market analysis in Forex trading refers to the process of examining and evaluating various factors that may affect the price movement of currency pairs. It involves studying economic indicators, political events, central bank decisions, and other relevant information to make informed trading decisions.

Market analysis is crucial in Forex trading because it helps traders identify potential trading opportunities and reduce risk. By analyzing the market, traders can determine when to enter or exit trades, and predict future price movements with greater accuracy.

There are three main types of market analysis in Forex trading: fundamental analysis, technical analysis, and sentiment analysis. Fundamental analysis focuses on economic and political factors, technical analysis uses historical price data and chart patterns, while sentiment analysis examines market sentiment and investor behavior.

Fundamental analysis helps in Forex trading by providing insights into the underlying forces that drive currency prices. It involves analyzing economic indicators, such as GDP, inflation rates, employment data, and central bank policies, to evaluate the strength or weakness of a currency and make trading decisions accordingly.

Technical analysis is a method of analyzing currency price movements based on historical data, mainly through the use of charts and indicators. It helps traders identify trends, support and resistance levels, and patterns that can be used to predict future price movements and make profitable trading decisions.

Market analysis is important in forex trading because it helps traders make informed decisions about whether to buy or sell currencies. By analyzing market trends, economic indicators, and other factors, traders can better predict price movements and potentially profit from them.

Is Crude Oil a Good Option for Trading? Crude oil has long been considered one of the most sought-after and profitable commodities for trading. It is …

Read ArticleIs DCFX regulated? When it comes to investing in financial markets, it is crucial to understand the regulatory status of the platform or company you …

Read ArticleEmirates suspends flights to Nigeria: What’s the reason? Emirates, one of the world’s largest airlines, has recently announced the suspension of …

Read ArticleOptions during market crash: What you need to know A market crash refers to a sudden and significant decline in the value of stocks and other …

Read ArticleBest Share Platforms in Australia Investing in shares can be a great way to grow your wealth and secure your financial future. As an Australian …

Read Article4 Types of API: A Comprehensive Guide Application Programming Interfaces (APIs) play a crucial role in modern software development. They allow …

Read Article