Is MCX Trading Legal in India? Key Facts and Regulations

Is MCX Trading Legal in India? MCX trading, also known as Multi Commodity Exchange trading, is a popular form of investment in India. Investors can …

Read Article

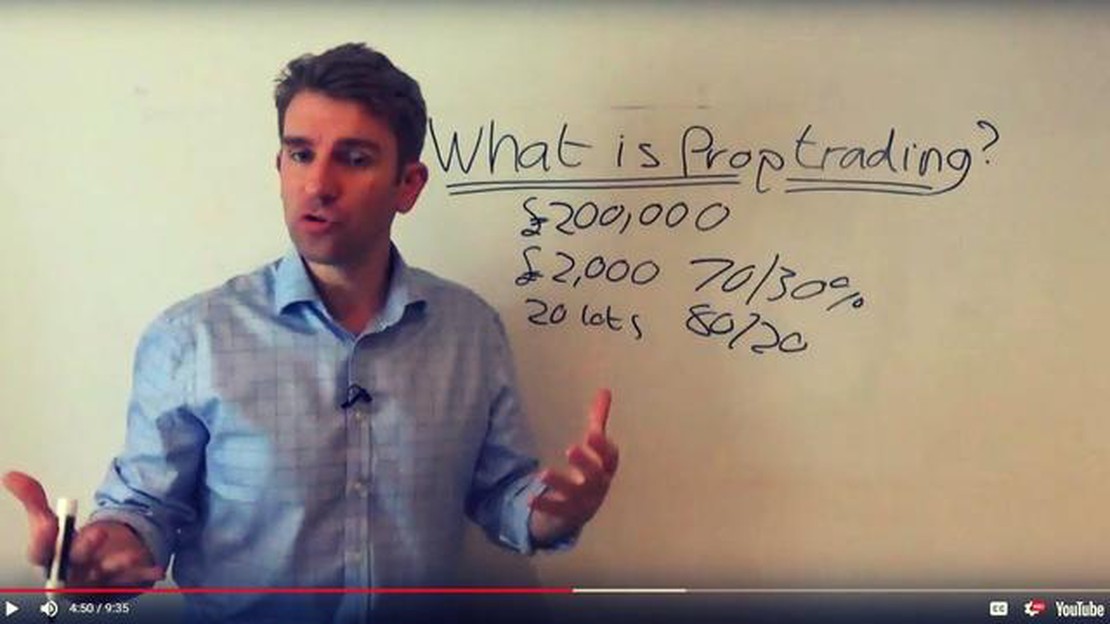

Proprietary trading firms, also known as prop shops, are financial institutions that engage in trading financial instruments using their own capital. These firms generate income through various revenue models, which are designed to take advantage of market opportunities and maximize profits.

One common revenue model used by prop shops is market making. Market makers provide liquidity to the markets by quoting both buy and sell prices for a particular financial instrument. They earn income from the spread between the buying and selling prices, known as the bid-ask spread. The wider the spread, the higher the potential profit for the market maker. This revenue model allows prop shops to profit from the volume of trades and the volatility of the market.

In addition to market making, prop shops may also generate income through proprietary trading. Proprietary traders are individuals or teams within the firm who trade financial instruments based on their own analysis and strategies. They aim to profit from fluctuations in the prices of these instruments. The income generated from proprietary trading comes from the gains made on successful trades. This revenue model requires expertise and a deep understanding of the financial markets.

Another source of income for prop shops is through fees and commissions. Some firms offer trading services for external clients and charge fees for executing their trades. These fees can be based on a fixed percentage of the trade value or a flat fee per trade. Prop shops may also earn commissions from facilitating initial public offerings (IPOs) or other capital-raising activities for corporate clients.

Overall, prop shops employ a combination of market making, proprietary trading, and fee-based services to generate income. Their success depends on their ability to accurately assess market conditions, develop profitable trading strategies, and execute trades efficiently. With access to advanced trading technology and a team of experienced traders, prop shops strive to stay ahead of the competition and generate consistent profits.

Prop shops, or proprietary trading firms, rely on various revenue models to generate income. These firms engage in trading activities using their own money, rather than client funds. Here are some common ways that prop shops make money:

1. Trading Profits: The primary source of income for prop shops is the profits generated from their trading activities. These firms employ skilled traders who take positions in different financial instruments such as stocks, options, futures, or currencies. By leveraging their expertise and market knowledge, prop traders aim to generate consistent profits for the firm.

2. Spread and Commission Income: Prop shops may also earn income through spreads and commissions. When executing trades on behalf of clients or through exchanges, these firms may charge a spread or commission fee. This fee represents the difference between the bid and ask price for a trade or a fixed percentage of the transaction value.

3. Interest Income: Prop shops may generate income through interest earned on their trading capital. When traders hold positions overnight or invest excess funds, they may earn interest on those funds. This interest income can contribute to the overall profitability of prop shops.

4. Technology and Data Services: Some prop shops develop and sell trading technologies or provide data services to other market participants. These technology and data services can include trading platforms, risk management tools, algorithmic trading systems, market data feeds, or data analytics solutions. By monetizing their technological capabilities, prop shops can diversify their income streams.

5. Proprietary Research and Analysis: Prop shops may also generate income by providing proprietary research and analysis to clients or other market participants. These firms employ research analysts and strategists who analyze market trends, develop trading strategies, and provide insights to clients. By offering valuable research and analysis, prop shops can attract clients and generate revenue.

Read Also: How to Calculate Weighted Average: Simple Example and Step-by-Step Guide

6. Investor Capital: Some prop shops may raise capital from external investors to fund their trading activities. These firms might offer investors the opportunity to invest in their trading strategy, providing potential returns based on the firm’s performance. By attracting investor capital, prop shops can increase their funds under management and potentially earn a share of profits.

Overall, prop shops employ a combination of these revenue models to generate income. The success of these firms relies on their trading expertise, technological capabilities, and ability to adapt to changing market conditions.

Proprietary trading firms, also known as prop shops, generate their income through various revenue models. These firms engage in speculative trading activities using their own money, rather than client funds. Understanding their revenue models is crucial, as it provides insights into the profitability and sustainability of these firms.

One common revenue model employed by prop shops is arbitrage. Arbitrage involves taking advantage of price discrepancies in different markets or exchanges. By quickly buying and selling securities, commodities, or currencies at different prices, traders can lock in a risk-free profit. Prop shops leverage their technology and speed to execute these arbitrage trades, generating income from the price differentials.

Another revenue model utilized by proprietary trading firms is market making. Market makers provide liquidity to the financial markets by continuously quoting bid and ask prices for certain securities. They earn money through the bid-ask spread, which represents the difference between the buying price and selling price. Prop shops excel in market making by actively quoting prices and providing liquidity, earning income from the spreads and transaction fees.

Some prop shops also generate income through proprietary trading strategies. These strategies involve the development and implementation of trading algorithms and models to generate profits from market movements. Proprietary trading firms invest heavily in research, technology, and infrastructure to develop and execute these strategies. By accurately predicting market trends and taking positions accordingly, they can earn significant profits and generate a reliable revenue stream.

Read Also: 1 Korean Won to 1 PHP: The Current Exchange Rate and Conversion

Additionally, proprietary trading firms may also generate income through fees and commissions. They may charge clients fees for access to their trading platforms, research, or educational resources. Additionally, they may receive commissions from facilitating trades for external clients or through partnerships with other financial institutions.

To summarize, proprietary trading firms generate income through various revenue models, including arbitrage, market making, proprietary trading strategies, and fees/commissions. These firms leverage their expertise, technology, and speed to capitalize on market opportunities and generate profits. Understanding these revenue models is essential for evaluating the performance and profitability of prop shops.

A prop shop, short for proprietary trading shop, is a firm that trades with its own capital rather than with client funds. It aims to generate profits from the financial markets through various trading strategies and techniques.

Prop shops generate income through a variety of revenue models. Some common methods include trading commissions, arbitrage opportunities, market-making activities, proprietary trading strategies, and investment in long-term projects.

Trading commissions refer to fees charged by prop shops to clients who execute trades through their platform. These fees contribute to the overall revenue of the firm.

Arbitrage opportunities arise when there are price discrepancies between different markets or assets. Prop shops can generate income by quickly identifying and exploiting these opportunities for profit.

Market-making activities involve providing liquidity to the market by constantly buying and selling financial instruments. Prop shops earn income through the bid-ask spread, which is the difference between the buying and selling prices.

Prop shops generate income through various revenue models, such as taking a share of traders’ profits, charging trading commissions, and earning interest on traders’ account balances.

Some prop shops may charge fees for using their trading platforms, while others may provide the platforms for free. The fees, if applicable, are typically based on factors such as trading volume or the types of services offered.

Is MCX Trading Legal in India? MCX trading, also known as Multi Commodity Exchange trading, is a popular form of investment in India. Investors can …

Read ArticleWhat does POA stand for in shipping? When it comes to the world of shipping and logistics, there are a multitude of acronyms and terms that can seem …

Read ArticleHow to set up Level 2 on Etrade Level 2 data is an essential tool for traders, providing real-time market depth and order book information. Etrade …

Read ArticleTransfer Fee for Iremit: How Much Does it Cost? Are you looking to send money abroad and wondering about the transfer fees? Look no further! In this …

Read ArticleExploring the Four Types of Trading Styles Trading in the financial markets can be an exciting and potentially profitable endeavor. However, there are …

Read ArticleCalculating Capital Gains on ESOP When it comes to calculating capital gains on an Employee Stock Ownership Plan (ESOP), it’s essential to have a …

Read Article