How to Spot a Fake Breakout: Key Indicator Revealed

Identifying a False Breakout: Indicators and Strategies Breakouts are a common occurrence in financial markets, but not all breakouts are created …

Read Article

Interest rates play a crucial role in the world of options trading. Whether you are a beginner or an experienced trader, having a solid understanding of how interest rates impact options can greatly enhance your trading strategies and overall profitability. In this comprehensive guide, we will delve into the intricacies of interest rates and explore their effects on options pricing and trading.

Interest rates are the cost of borrowing money and represent the opportunity cost of not having that money available for other uses. They are typically set by central banks and influence the overall cost of credit in an economy. In the options market, interest rates have a direct impact on the pricing of options contracts.

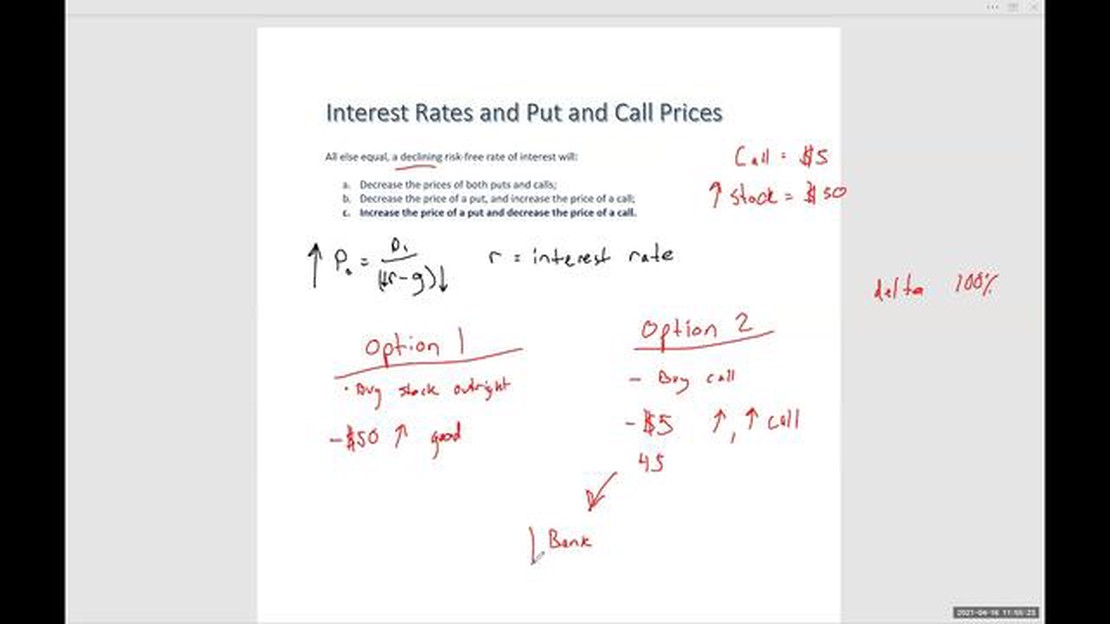

When interest rates rise, the cost of borrowing money increases. This has a ripple effect on the pricing of options. Higher interest rates increase the cost of carry for options, leading to higher prices for call options and lower prices for put options.

Understanding interest rates is crucial for several reasons. First, interest rates affect the pricing of options. Second, interest rates can impact the profitability of certain options strategies. Finally, interest rates can provide insight into the overall state of the economy and market sentiment. By understanding and monitoring interest rates, traders can make more informed decisions about their options trades.

Interest rates play a crucial role in options trading. They are the cost associated with borrowing money to purchase options or the return on investment for lending money when writing options.

When you buy an option, you are essentially paying a premium to the seller for the right, but not the obligation, to buy or sell an underlying asset at a specific price within a certain time frame. The interest rate affects the price of the option because it determines the cost of borrowing money to purchase the option.

On the other hand, when you sell (or write) an option, you receive a premium from the buyer in exchange for taking on the obligation to buy or sell the underlying asset at a specific price within a certain time frame. The interest rate affects the price of the option because it determines the return on investment for lending money when writing the option.

The higher the interest rate, the more expensive it is to buy an option, because the cost of borrowing money is higher. Conversely, a higher interest rate can also make selling options more attractive, as it increases the return on investment for lending money.

It is important to note that interest rates can vary depending on several factors, including the overall market conditions, the creditworthiness of the borrower, and the duration of the loan. As an options trader, it is essential to stay informed about current interest rates and their potential impact on the prices of options.

Understanding the role of interest rates in options is crucial for making informed trading decisions and managing risk effectively. By considering the prevailing interest rates and their impact on option prices, traders can better evaluate the potential risks and rewards of their options positions.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. The trading of options involves risks, and individuals should seek advice from a financial professional before engaging in options trading.

Interest rates play a crucial role in the pricing and valuation of options. They are influenced by various factors, both macroeconomic and market-specific, which can impact the cost of borrowing and the risk premium associated with options.

Read Also: Learn how to trade forex without incurring any losses | Step-by-step guide

1. Macroeconomic Factors:

Interest rates are influenced by broader macroeconomic factors such as inflation, economic growth, and monetary policy. Central banks, like the Federal Reserve in the United States, set interest rates to control inflation and stimulate or slow down economic activity. Higher inflation expectations or stronger economic growth can lead to higher interest rates, increasing the cost of borrowing and affecting the pricing of options.

2. Risk-Free Rate:

The risk-free rate is an important consideration in option pricing models, such as the Black-Scholes model. It represents the return an investor can earn with zero risk. Typically, the risk-free rate is based on the yield of government bonds, such as U.S. Treasury bonds. Changes in the risk-free rate directly impact option prices, as higher rates increase the cost of carrying the underlying asset and decrease the present value of future cash flows associated with the options.

3. Option Maturity:

The time to expiration, or maturity, of an option also affects interest rates. Longer-dated options require a longer duration of borrowing or lending, which can impact interest rates. Generally, longer maturities come with higher interest rates, reflecting the greater uncertainty associated with longer-term investments.

Read Also: Understanding the mechanics of stock option startup: How it works

4. Credit Risk:

Credit risk refers to the likelihood that the counterparty in an options transaction may default on their obligations. Higher credit risk may lead to higher interest rates to compensate for the additional risk. The creditworthiness and financial stability of the counterparties in options trading can impact interest rates, especially in more complex options strategies.

5. Market Supply and Demand:

Supply and demand dynamics in the options market also affect interest rates. Higher demand for options can lead to an increase in their prices, resulting in lower implied volatility and lower interest rates. Conversely, higher supply or decreased demand can lead to lower option prices, higher implied volatility, and higher interest rates.

Conclusion:

Interest rates in options are influenced by a variety of factors, including macroeconomic conditions, the risk-free rate, option maturity, credit risk, and market supply and demand. Understanding these factors can help option traders assess the impact of interest rates on option prices and make more informed investment decisions.

Interest rates are the cost of borrowing money and they play a crucial role in options trading. They impact the pricing of options as well as the cost of carrying positions. Higher interest rates could increase the cost of borrowing and make options more expensive, while lower interest rates could decrease the cost of borrowing and make options cheaper.

Changes in interest rates can have a significant impact on the value of options. When interest rates rise, the cost of carrying a position increases, which can decrease the value of options. Conversely, when interest rates fall, the cost of carrying a position decreases, which can increase the value of options.

Interest rates have an inverse relationship with call options. When interest rates rise, the cost of carrying a position increases, which can decrease the value of call options. Conversely, when interest rates fall, the cost of carrying a position decreases, which can increase the value of call options.

Interest rates have a direct relationship with put options. When interest rates rise, the cost of carrying a position increases, which can increase the value of put options. Conversely, when interest rates fall, the cost of carrying a position decreases, which can decrease the value of put options.

Traders can account for interest rates by considering them when pricing options and determining their trading strategies. They can use option pricing models that take interest rates into account, such as the Black-Scholes model. Additionally, they can monitor changes in interest rates and adjust their positions accordingly to take advantage of any potential opportunities caused by changing interest rates.

Identifying a False Breakout: Indicators and Strategies Breakouts are a common occurrence in financial markets, but not all breakouts are created …

Read ArticleHow Many Monitors Do You Need for Forex Trading? When it comes to forex trading, having the right tools and equipment can make a significant …

Read ArticleUsing a Forex Card in Any Country: Is it Possible? Forex cards are a popular choice for travelers when it comes to managing their finances abroad. …

Read ArticleUnderstanding the Difference between RSU and Vested Stock Options When it comes to compensation packages offered by employers, it’s important for …

Read ArticleCalculating Tax on Stock Trading Investing in the stock market can be an exciting and potentially rewarding venture. However, it is important to …

Read ArticleExploring the Concepts of Fibonacci Indicators When it comes to technical analysis in the financial markets, Fibonacci indicators have become a …

Read Article