Learn how to buy options on S&P and maximize your investment

How to Buy Options on S&P Options trading can be a lucrative way to invest in the stock market, and learning how to buy options on the S&P index can …

Read Article

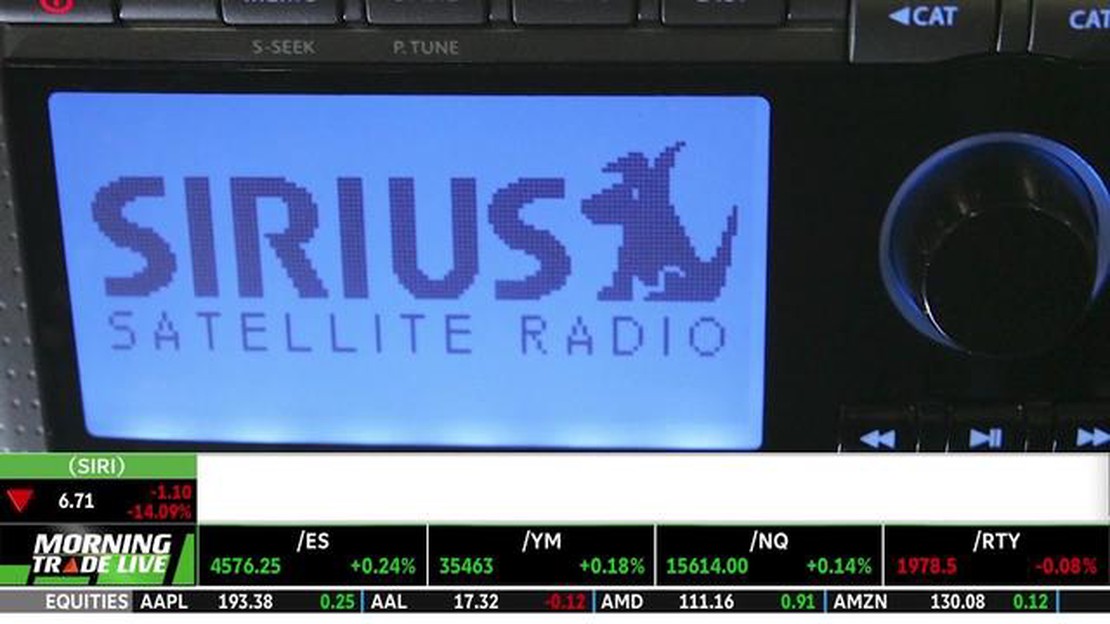

Sirius XM Holdings Inc. (NASDAQ: SIRI) is a leading satellite radio company that offers a wide range of entertainment and music channels to subscribers across North America. With a market cap of over $20 billion, Sirius XM has been a popular stock among investors looking for exposure to the media industry.

But is Sirius XM stock a good buy? Let’s take a closer look at the expert analysis and market trends.

One of the key factors to consider when evaluating Sirius XM’s potential as an investment is its strong subscriber base. The company boasts over 30 million subscribers, making it the largest radio broadcaster in the United States. This large and loyal customer base provides a stable source of revenue for Sirius XM and positions the company well for future growth.

Furthermore, Sirius XM has been successful in diversifying its revenue streams beyond satellite radio. The company has expanded into streaming services, podcasts, and connected vehicle services, which have become increasingly popular in recent years. This diversification strategy has helped Sirius XM stay competitive in a rapidly evolving media landscape.

Despite these positive trends, it is important to note that Sirius XM faces challenges in a highly competitive industry. Streaming platforms like Spotify and Apple Music have gained significant market share and pose a threat to Sirius XM’s dominance. Additionally, the company’s heavy reliance on automotive partnerships for subscriber growth exposes it to potential risks during economic downturns or shifts in consumer preferences.

In conclusion, while Sirius XM stock has shown strong performance and has a solid subscriber base, it is important for investors to carefully assess the company’s competitive position and growth prospects. Considering the expert analysis and market trends, Sirius XM stock may be a good buy for investors seeking exposure to the media industry, but it is not without risks.

Sirius XM Holdings Inc. is a satellite radio company that has been a pioneer in the industry since its establishment in 2008. Over the years, the company has built a strong reputation for its high-quality content and extensive coverage, making it a top choice for millions of subscribers.

Investors interested in buying Sirius XM stock should carefully evaluate its potential before making a decision. One key factor to consider is the company’s market trends and performance. Sirius XM has consistently shown growth and profitability, with increasing revenue and a strong subscriber base. This indicates a positive outlook for the company’s stock.

Furthermore, expert analysis and forecasts are essential in determining whether Sirius XM stock is worth buying. Many financial experts recommend Sirius XM as a good buy, citing its strong market position, competitive advantage, and strategic partnerships. These factors contribute to the company’s potential for future growth and long-term success.

It is also worth noting that the satellite radio industry has shown resilience over the years, attracting a loyal customer base and generating steady revenue. This stability makes Sirius XM stock an attractive investment option, especially for investors looking for a reliable and predictable income source.

While analyzing the potential of any stock is crucial, investors should also consider diversifying their portfolio and not solely rely on a single stock. This reduces the risk associated with investing and ensures a balanced investment strategy.

In conclusion, considering Sirius XM’s strong market position, consistent growth, and positive expert analysis, its stock is definitely worth considering as a potential investment. However, as with any investment decision, it is important to conduct thorough research and consult with a financial advisor to make an informed decision based on individual financial goals and risk tolerance.

When considering whether Sirius XM stock is a good buy, it is important to weigh the potential pros and cons. Here is a breakdown of the key factors to consider:

Read Also: Understanding the Moving Average of an Interval: A Comprehensive Guide4. Growing in-car entertainment market: As more vehicles come with built-in satellite radios, the in-car entertainment market is expanding. This provides a growth opportunity for Sirius XM as it can reach a larger audience and increase its subscriber base.

Read Also: Who Manages Forex? - Understanding the Management Structure of the Forex Market2. Increased competition: Sirius XM faces competition from streaming services and other forms of entertainment. The rise of music streaming platforms and podcasts could potentially erode its subscriber base and market share. 3. Debt burden: Sirius XM has a substantial amount of debt, which can limit its flexibility and increase financial risk. The company needs to manage its debt levels effectively to ensure long-term sustainability. 4. Regulatory challenges: The satellite radio industry is subject to regulatory oversight, which can impact Sirius XM’s operations and profitability. Changes in regulations or licensing fees could have financial implications for the company.

Ultimately, whether Sirius XM stock is a good buy depends on an individual investor’s risk tolerance and long-term investment goals. It’s important to carefully consider the pros and cons before making a decision.

This section will provide an analysis of the performance and forecast for Sirius XM stock. It is important to consider market trends when making investment decisions.

Over the past few years, Sirius XM stock has shown a steady increase in value. The company has seen consistent revenue growth, reaching record highs in recent quarters. This positive performance can be attributed to several factors, including a loyal customer base and the popularity of their satellite radio service.

In terms of market trends, the subscription-based business model of Sirius XM has proven to be resilient. Despite the rise of streaming services such as Spotify and Apple Music, Sirius XM has been able to maintain and even grow its subscriber base. This is due to the unique content offerings and partnerships that the company has cultivated over the years.

Looking towards the future, analysts are optimistic about the prospects of Sirius XM stock. The company continues to invest in new technologies and expand its content offerings to attract a wider audience. Additionally, the growing popularity of connected cars presents an opportunity for Sirius XM to further increase its subscriber base.

In conclusion, market trends indicate that Sirius XM stock is a good buy. Its consistent performance, loyal customer base, and strong market position make it an attractive investment option. As always, it is important for investors to conduct thorough research and consider their own financial goals before making any investment decisions.

Sirius XM stock refers to the shares of Sirius XM Holdings Inc., which is a broadcasting company that provides satellite radio services.

There are a few reasons to consider buying Sirius XM stock. Firstly, the company has a strong market position and a large customer base. Additionally, Sirius XM has been experiencing steady growth and has a track record of generating strong revenue and cash flow. Finally, the company has been investing in new technologies and content, which could drive future growth.

While there are potential rewards to investing in Sirius XM stock, there are also some risks to consider. One risk is increased competition from streaming services and other media platforms. Additionally, changes in consumer preferences or economic conditions could impact the demand for satellite radio services. Lastly, regulatory changes or legal issues could also pose risks to the company’s operations.

Opinions among experts about investing in Sirius XM stock may vary. Some experts may view the stock as a good buy due to its strong market position and growth potential. Others may have concerns about increased competition or other risks. It’s always a good idea to do your own research and consider multiple viewpoints before making any investment decisions.

Recently, Sirius XM stock has been performing well. The company has reported strong financial results and has seen an increase in subscribers. The stock price has also been on an upward trend, reaching new highs. However, as with any investment, it’s important to keep track of the market trends and regularly evaluate the company’s performance.

How to Buy Options on S&P Options trading can be a lucrative way to invest in the stock market, and learning how to buy options on the S&P index can …

Read ArticleUnderstanding Forex Commission: What You Need to Know When it comes to trading in the forex market, one crucial aspect that every trader must …

Read ArticleCan Averaging be Used in a Perpetual System? Many proponents of averaging as a decision-making tool argue that it can be a powerful method for …

Read ArticleStep-by-Step Guide to Claiming Your Bonus on InstaForex Are you a new trader looking to get started with InstaForex? Or maybe you’re an existing …

Read ArticleWhen to buy on the 200-day moving average? Traders are constantly searching for an edge in the volatile and unpredictable world of the financial …

Read ArticleExponential Weighted Moving Average in Python: How it Works and Why it’s Important Exponential weighted moving average (EWMA) is a popular statistical …

Read Article