What is the minimum opening deposit? | A Comprehensive Guide

What is the minimum opening deposit? When it comes to opening a new bank account, one of the first things you’ll need to consider is the minimum …

Read Article

When it comes to trading in the forex market, one crucial aspect that every trader must understand is the concept of forex commission. Forex commission refers to the fee that brokers charge for executing trades on your behalf. This fee can vary depending on the broker and the type of trading account you have.

Forex commission can be calculated in different ways:

It is important to understand how forex commission can impact your trading profitability:

2. Transparency - Understanding the commission structure allows traders to have better visibility into their trading costs and make informed decisions. It is essential to know how much you are paying in commission for each trade.

3. Value for money - While low commission rates may seem attractive, it is crucial to consider the overall value and services provided by the broker. A broker with a higher commission but superior trading platform and customer support may offer better value for money in the long run.

2. Transparency - Understanding the commission structure allows traders to have better visibility into their trading costs and make informed decisions. It is essential to know how much you are paying in commission for each trade.

3. Value for money - While low commission rates may seem attractive, it is crucial to consider the overall value and services provided by the broker. A broker with a higher commission but superior trading platform and customer support may offer better value for money in the long run.

In conclusion, gaining a solid understanding of forex commission is crucial for every forex trader. By knowing the different types of commission structures and how they can impact your trading, you can make more informed decisions and optimize your trading strategy.

Forex commission refers to the fee charged by a broker or a financial institution for facilitating a trade in the foreign exchange market. When traders enter into a forex transaction, they are required to pay a small fee to the broker for their services and for providing access to the market.

The forex commission can be calculated in different ways, depending on the broker’s fee structure. It can be a fixed fee per trade or a percentage of the total trade volume. The commission is typically deducted from the trader’s account when the trade is executed.

Forex commissions are an essential source of revenue for brokers, as they earn money by facilitating trades and providing access to the market. The commission can vary depending on the broker’s services and the type of trade. Some brokers may offer lower commission rates for higher trade volumes or for frequent traders.

Read Also: Choosing the Right Chart for Successful Commodity Trading

It is important for traders to understand the commission structure of their chosen broker before starting to trade in the forex market. Different brokers may have different commission rates, which can impact the overall profitability of trades. Traders should consider the commission along with other factors such as spreads, leverage, and customer support when choosing a broker.

While forex commissions are an additional cost for traders, they are an essential part of the trading process. Brokers provide valuable services such as market analysis, order execution, and access to liquidity. The commission charged helps cover the costs associated with these services and ensures the smooth functioning of the forex market.

Read Also: Calculating CB Consumer Confidence: A Comprehensive Guide

In summary, forex commission is the fee charged by brokers for facilitating trades in the foreign exchange market. Traders should carefully consider the commission structure of their chosen broker when trading in forex, as it can impact their overall trading costs and profitability.

Forex commission is a fee that brokers charge to execute trades in the foreign exchange market. It is an essential aspect of forex trading and can have a significant impact on your overall trading costs and profitability. Understanding how forex commission works is crucial for any trader looking to engage in this market.

The concept of forex commission revolves around the fact that brokers act as intermediaries between traders and the forex market. They provide the platform for traders to access the market and execute trades. In return for their services, brokers charge a fee, which is typically in the form of a commission.

The importance of understanding forex commission lies in its direct impact on your trading costs. The commission is usually a percentage of the trade’s value and can vary depending on the broker and the type of account you have. For example, some brokers may offer lower commission rates for high-volume traders, while others may have flat commission fees for all trades.

By being aware of your broker’s commission structure, you can calculate the costs of your trades and make informed decisions. It allows you to compare different brokers and choose the one that offers the most favorable commission rates for your trading style and volume.

Moreover, understanding forex commission helps you manage your risk and avoid unnecessary expenses. High commission rates can eat into your profits and make it challenging to generate consistent returns. By choosing a broker with competitive commission rates, you can optimize your trading performance and maximize your profits.

In conclusion, forex commission is a vital aspect of forex trading. It is the fee that brokers charge for executing trades and can significantly impact your trading costs and profitability. By understanding the concept and importance of forex commission, you can make informed decisions and choose the broker that best suits your trading needs.

Forex commission is a fee charged by brokers for facilitating a foreign exchange transaction. It is usually a small percentage of the trade value and can be either charged per trade or spread across multiple trades.

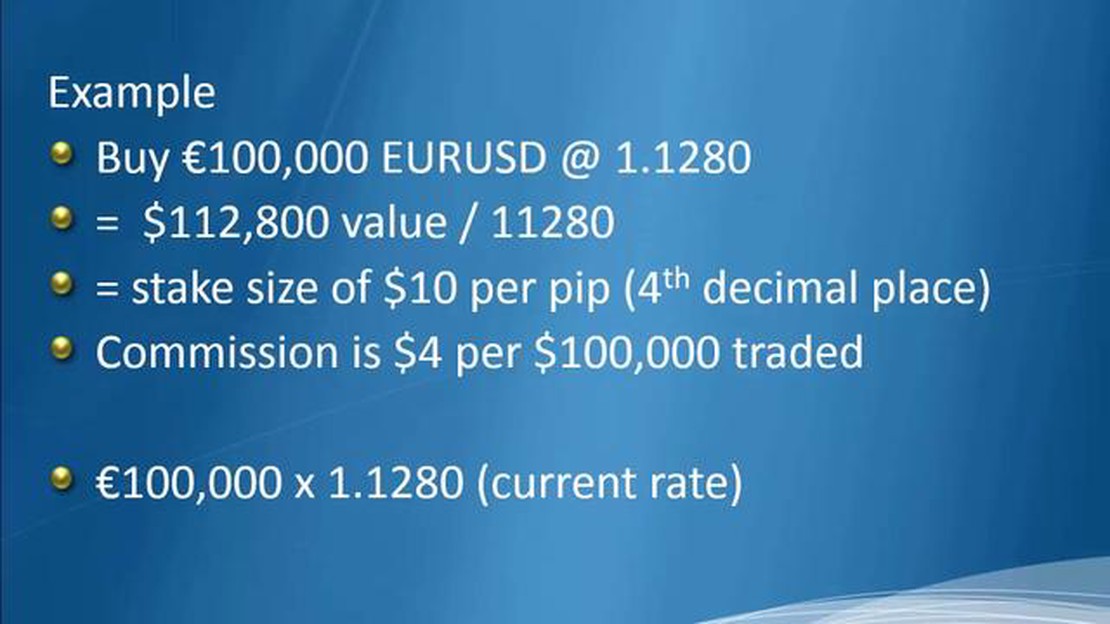

Forex commission is typically calculated as a percentage of the trade value. For example, if the commission rate is 0.1% and the trade value is $10,000, the commission would be $10. The actual calculation method may vary depending on the broker.

No, not all brokers charge Forex commission. Some brokers offer commission-free trading and make their profit through other means, such as widening the spread or charging a fixed fee.

No, Forex commission is just one of the costs that traders have to consider. They may also need to pay other fees, such as spreads, swaps, and account maintenance fees. It is important to carefully review all the costs involved before choosing a broker.

Choosing a broker based solely on the lowest commission is not always the best approach. It is important to consider other factors, such as the broker’s reputation, trading platform, customer support, and overall trading conditions. A slightly higher commission may be worth it if the broker provides a better overall trading experience.

What is the minimum opening deposit? When it comes to opening a new bank account, one of the first things you’ll need to consider is the minimum …

Read ArticleTrading Bollinger Bands in Forex: Proven Strategies and Techniques Are you interested in trading Forex and looking for a reliable strategy to help you …

Read ArticleHow to Use 20, 50, and 200 EMA in Trading When it comes to trading, understanding and effectively using technical indicators can make all the …

Read ArticleSBI Bank’s Forex Service: All You Need to Know Are you interested in foreign exchange trading? In today’s globalized world, understanding the …

Read ArticleWhat is the most affordable method to purchase currency? In today’s globalized world, buying currency has become a necessity for many individuals and …

Read ArticleDecoding Option Chain Data: A Comprehensive Guide Stock options can be a valuable tool for investors looking to diversify their portfolios or hedge …

Read Article