Can Forex Traders on Reddit Be Trusted? Uncovering the Legitimacy

Are forex traders legit reddit? Forex trading has become increasingly popular in recent years, with individuals from all walks of life trying their …

Read Article

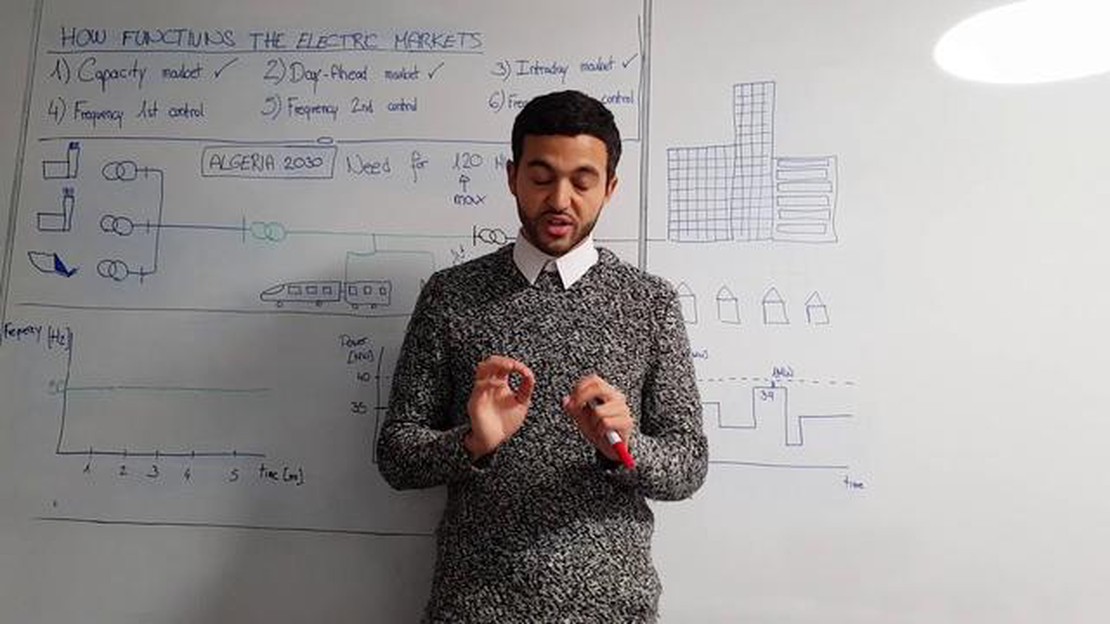

Electricity trading is a vital part of the modern energy market, allowing businesses and consumers to buy and sell electricity in a flexible and efficient manner. In this article, we will explore electricity trading through a concrete example, shedding light on the intricacies of this complex process.

Imagine a power company that generates electricity. They have a surplus of electricity that they wish to sell to another company. This is where electricity trading comes into play. By participating in the electricity market, the power company can sell their excess electricity to another company who needs it.

One method of electricity trading is through bilateral contracts. These contracts are negotiated directly between the buyers and sellers, allowing for personalized agreements that meet the specific needs and demands of both parties. Bilateral contracts provide stability and security for both the buyer and seller, as they can agree on the price, quantity, and duration of the electricity trade.

In addition to bilateral contracts, electricity trading can also occur through electricity exchanges. These exchanges function as marketplaces where multiple participants can buy and sell electricity in a transparent and competitive environment. They provide a platform for price discovery, where supply and demand interact to determine the market price of electricity.

Overall, electricity trading plays an essential role in ensuring a reliable and efficient supply of electricity. Whether through bilateral contracts or exchanges, this process enables power companies to efficiently manage their electricity supply and demand, while providing opportunities for buyers to access electricity at competitive prices. By understanding the nuances of electricity trading, we can appreciate the intricate workings of the energy market and its ability to meet the growing demands for electricity.

Electricity markets are complex systems that bring together producers, consumers, and traders of electricity to ensure a reliable and efficient supply of electrical power. These markets help to balance the supply and demand of electricity in real-time, ensuring that there is always enough electricity available to meet the needs of consumers.

One of the key elements of electricity markets is the wholesale market, where electricity is bought and sold in bulk. This market allows generators to sell their electricity to utilities and other large consumers, who then distribute it to end consumers. The wholesale market operates through a system of auctions, where electricity prices are determined based on supply and demand.

Another important aspect of electricity markets is the retail market, which is where end consumers can choose their electricity suppliers and pricing plans. In the retail market, consumers have the option to purchase electricity from alternative suppliers, in addition to their local utility. This competition helps to drive down electricity prices and provides consumers with more choice and flexibility.

Electricity markets also utilize various market mechanisms, such as spot markets, futures markets, and forward contracts, to manage risk and ensure stable prices. These mechanisms allow market participants to trade electricity at different time intervals, ranging from real-time to several years in advance. This helps to hedge against price volatility and provides market participants with greater financial stability.

Overall, understanding electricity markets is crucial for anyone involved in the electricity industry, including producers, consumers, and traders. By understanding how these markets work, participants can make informed decisions and utilize market mechanisms to their advantage.

Read Also: Will Thai baht go up or down? Expert analysis and predictions

| Types of Electricity Markets | Description |

|---|---|

| Wholesale Market | Bulk buying and selling of electricity between generators and utilities |

| Retail Market | Market where end consumers can choose their electricity suppliers and pricing plans |

| Spot Market | Market where electricity is bought and sold for immediate delivery |

| Futures Market | Market where electricity is bought and sold for future delivery |

| Forward Contracts | Agreements to buy or sell electricity at a predetermined price at a future date |

Electricity trading is the process of buying and selling electricity on various markets. It has become an integral part of the electric power industry, allowing market participants to trade in electricity as a commodity.

There are several types of electricity markets where trading occurs, including wholesale electricity markets, forward markets, spot markets, and derivatives markets. Each market serves a different purpose and has its own unique characteristics.

In wholesale electricity markets, electricity is traded in large quantities between generators, retailers, and other market participants. These markets provide an opportunity for generators to sell their electricity to retailers, who then supply it to end consumers.

Forward markets enable participants to buy or sell electricity at a specified price for future delivery. This allows market participants to hedge against price fluctuations and manage their risk. Forward contracts provide stability and certainty in electricity prices for both buyers and sellers.

Spot markets, on the other hand, involve trading electricity for immediate delivery. Market participants place bids and offers for electricity at specific locations and prices. Spot markets are often used to balance supply and demand in real-time, ensuring that the electricity grid remains stable.

Read Also: Is it possible to begin Forex trading with $1000? Expert advice and tips

Derivatives markets offer financial instruments that allow market participants to manage their exposure to price volatility in the electricity market. These instruments include futures contracts, options contracts, and swaps. Derivatives markets provide liquidity and enable market participants to hedge their positions.

Electricity trading is facilitated by various entities, such as power exchanges, brokers, and independent system operators (ISOs). These entities provide the necessary infrastructure and regulatory framework to ensure fair and efficient trading.

In summary, electricity trading plays a crucial role in the electric power industry, allowing market participants to buy, sell, and manage their exposure to electricity prices. It is a complex and dynamic market that requires expertise and a deep understanding of market fundamentals.

Electricity trading is the buying and selling of electricity in the wholesale market. It involves the trading of electricity contracts, which allow market participants to purchase or sell electricity at a predetermined price for a specified period of time.

Electricity trading works through a competitive market system. Market participants, such as generators, suppliers, and traders, submit their bids and offers for electricity contracts to an organized market platform. These bids and offers are matched by a market operator based on price and availability, and trades are executed.

Electricity trading brings several benefits. It promotes competition, which leads to more efficient prices and better value for consumers. It also allows for the integration of renewable energy sources into the grid, as traders can buy and sell electricity from different sources. Additionally, electricity trading can help to manage supply and demand imbalances, ensuring a reliable and stable electricity supply.

There are several risks involved in electricity trading. Market participants are exposed to price risk, as the price of electricity can fluctuate due to changes in supply and demand. They are also exposed to operational and financial risks, such as the risk of equipment failure, the risk of default by a counterparty, or the risk of financial loss due to market volatility. Risk management tools, such as hedging strategies, are used to mitigate these risks.

Sure! Let’s say there is a wind farm operator who expects high wind generation in the coming weeks. They decide to sell electricity contracts for this period, hoping to profit from the expected high output. Meanwhile, a coal-fired power plant operator expects a maintenance shutdown and needs to cover their production shortfall. They decide to buy electricity contracts to meet their needs during this period. Through an electricity trading platform, the wind farm operator and the power plant operator can enter into a contract agreement at an agreed price and volume, benefiting both parties.

Are forex traders legit reddit? Forex trading has become increasingly popular in recent years, with individuals from all walks of life trying their …

Read ArticleSteps to Join a Trading Community Are you interested in trading but not sure where to start? Joining a trading community can be a great way to learn …

Read ArticleUnderstanding Exponential Weighted Moving Average Decay Exponential Weighted Moving Average (EWMA) decay is a mathematical concept widely used in …

Read ArticleUnderstanding Sentiment Index: Definition, Uses, and Importance The sentiment index is a powerful tool for analyzing and understanding public opinion. …

Read ArticleHow does the MA model work? In today’s fast-paced business world, it is crucial for companies to stay ahead of the curve and constantly innovate. One …

Read ArticleOptions Trading Availability at Citi Bank Options trading is a popular investment strategy that offers opportunities for potentially high returns. …

Read Article