Forex Fury Review: A Comprehensive Analysis of its Performance and Features

Forex Fury Review: Is it a Reliable Trading Robot? Forex Fury is a popular automated trading system that has been gaining traction among forex …

Read Article

IC Markets is a popular online forex broker that offers trading services to clients all around the world. One of the most common questions asked by potential investors is “What is the minimum deposit for IC Markets?” This article aims to provide an answer to that question.

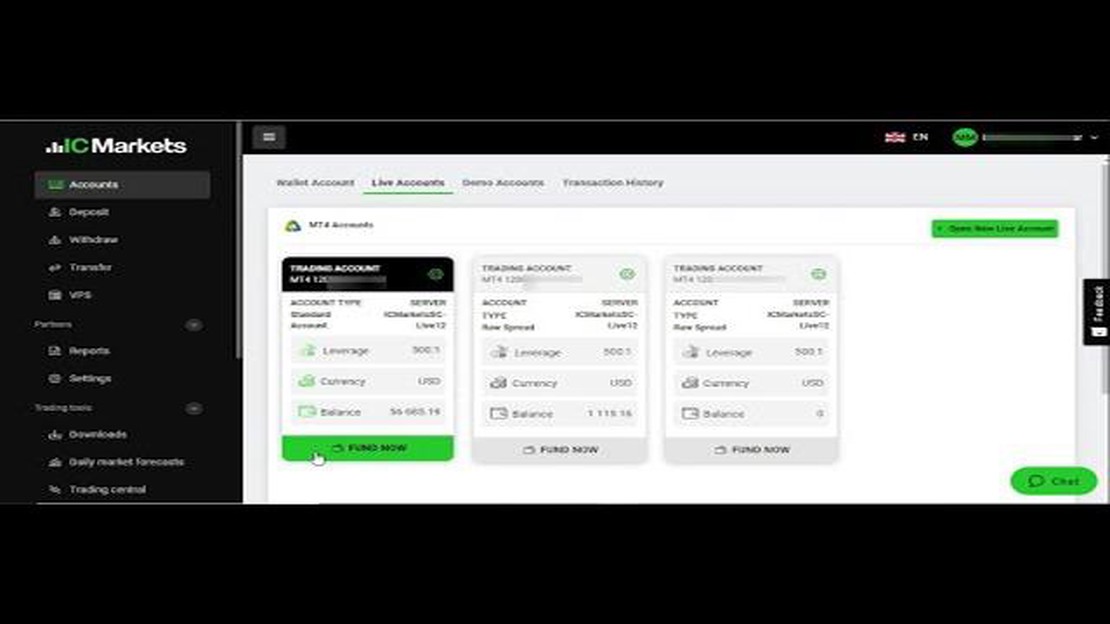

The minimum deposit required by IC Markets depends on the type of trading account you choose. They offer three types of accounts: Standard, Raw Spread, and cTrader. The minimum deposit for the Standard account is $200, while for the Raw Spread and cTrader accounts, it is $500.

It is important to note that this minimum deposit requirement is applicable only to the initial deposit. Once you have opened an account with IC Markets, there is no minimum balance requirement, and you can deposit or withdraw funds as per your trading needs.

In addition to the minimum deposit requirement, IC Markets also offers various funding options for its clients. You can choose to fund your account using bank transfers, credit/debit cards, or online payment processors such as Neteller and Skrill.

In conclusion, the minimum deposit for IC Markets depends on the type of trading account you choose and ranges from $200 to $500. It is important to understand these requirements before opening an account with IC Markets to ensure that you meet the necessary funding criteria.

Disclaimer: Trading forex involves a high level of risk and may not be suitable for all investors. It is important to carefully consider your investment objectives and seek independent financial advice if necessary.

When it comes to trading with IC Markets, one of the key factors to consider is the minimum deposit required to open an account. The minimum deposit is the amount of money that you need to deposit into your account in order to start trading with IC Markets.

IC Markets offers different account types, each with its own minimum deposit requirement. Here are the minimum deposit requirements for the different account types:

It’s important to note that these minimum deposit requirements are subject to change, so it’s always a good idea to check the IC Markets website for the most up-to-date information.

When deciding which account type to choose, it’s important to consider your individual trading needs and preferences. If you’re just starting out or have a limited trading budget, the Standard Account or Raw Spread Account may be a good option. If you prefer trading with the cTrader platform or require an Islamic account, you may opt for the cTrader Account or Islamic Account, respectively.

In addition to the minimum deposit, it’s also important to consider other factors when choosing a broker, such as trading fees, spreads, customer support, and available trading platforms. Conducting thorough research and comparing different brokers will help you make an informed decision and find the best fit for your trading needs.

Overall, the minimum deposit required by IC Markets is relatively low compared to some other brokers, making it accessible to traders with different budgets. Whether you’re a beginner or an experienced trader, IC Markets offers a range of account types to suit your needs, along with competitive trading conditions.

Disclaimer: The information in this article is for informational purposes only and does not constitute financial advice. Trading in the financial markets carries a high level of risk and may not be suitable for all investors. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks.

IC Markets is a leading online forex and CFD broker that offers a range of trading options to its clients. One of the factors that potential traders should consider when choosing a broker is the minimum deposit requirements. This refers to the amount of money that must be deposited in an account in order to start trading with a broker.

IC Markets has different minimum deposit requirements depending on the account type. For the Standard account, the minimum deposit required is $200. This account type is suitable for novice traders who are just starting out in the forex market. It offers competitive spreads and no commission fees.

Read Also: What is the Fair Price of an Option Contract? Discover the Right Price Here!

For traders who require more advanced features and want access to a wider range of markets, IC Markets offers the Raw Spread account. The minimum deposit requirement for this account type is $200, making it accessible to a broader range of traders. The Raw Spread account offers tight spreads and a low commission fee per trade.

In addition to the Standard and Raw Spread accounts, IC Markets also offers a third account type called the cTrader account. This account requires a minimum deposit of $1,000 and is specifically designed for traders who prefer to use the cTrader platform. The cTrader account offers ECN-like market execution and provides traders with enhanced trading features.

It is important for potential traders to be aware of the minimum deposit requirements when considering IC Markets as their broker. By understanding these requirements, traders can assess whether they can meet the minimum deposit requirements and choose the account type that best suits their trading needs.

Several factors influence the minimum deposit required by IC Markets. These factors include:

Read Also: Understanding the Law of Moving Average: Definition, Calculation, and Application

1. Account Type: IC Markets offers different account types, such as Standard, True ECN, and cTrader Raw Spread accounts. Each account type may have different minimum deposit requirements. The more advanced and feature-rich the account type, the higher the minimum deposit is likely to be.

2. Trading Platform: IC Markets provides various trading platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader. Depending on the chosen trading platform, the minimum deposit may vary. Some platforms may require a higher minimum deposit to enable access to specific features or advanced trading tools.

3. Regulatory Requirements: IC Markets operates under multiple regulatory bodies, such as the Australian Securities and Investments Commission (ASIC), the Cyprus Securities and Exchange Commission (CySEC), and the Seychelles Financial Services Authority (FSA). Each regulatory body might have specific minimum deposit requirements that IC Markets needs to adhere to.

4. Geographic Region: IC Markets caters to clients from various countries and regions worldwide. The minimum deposit required may differ based on the client’s geographic location. This could be due to local regulations, currency conversion rates, or other logistical considerations.

5. Leverage Level: Leverage is a tool that amplifies trading positions, allowing traders to control larger positions with a smaller initial investment. The level of leverage offered by IC Markets may influence the minimum deposit requirements. Higher leverage ratios might require a larger initial deposit to accommodate potential risks associated with leveraged trading.

6. Promotional Offers: IC Markets occasionally offers promotional bonuses or incentives to attract new clients. These offers may impact the minimum deposit required, providing traders with an opportunity to open an account with a lower initial investment during these promotional periods.

It’s important to note that IC Markets’ minimum deposit requirements are subject to change. Traders should refer to the official IC Markets website or contact their customer support for the most up-to-date information regarding minimum deposit requirements.

The minimum deposit required at IC Markets is $200. This is the minimum amount you need in order to start trading with the broker.

No, there is no specific minimum deposit for different account types at IC Markets. The minimum deposit of $200 applies to all account types offered by the broker.

No, it is not possible to start trading with IC Markets with less than $200. $200 is the minimum amount required to open an account and start trading with the broker.

Yes, the minimum deposit requirement of $200 applies to all trading instruments offered by IC Markets. Whether you are trading Forex, CFDs, or other instruments, the minimum deposit remains the same.

No, there are no exceptions or special offers for lower minimum deposits at IC Markets. The minimum deposit requirement is $200, and this applies to all traders regardless of their trading experience or account type.

The minimum deposit required to open an account with IC Markets is $200 for the standard account and $1,000 for the Raw Spread account.

Forex Fury Review: Is it a Reliable Trading Robot? Forex Fury is a popular automated trading system that has been gaining traction among forex …

Read ArticleWhat is the formula for forward forward rate? When it comes to understanding the formula for the forward forward rate, it is essential to consult the …

Read ArticleIs Quotex Legal in Malaysia? Quotex is an online trading platform that has gained a lot of popularity in recent years. It offers a wide range of …

Read ArticleIs Wise a Russian bank? Wise is a financial company that provides online money transfer and currency exchange services. It was founded in 2011 by two …

Read ArticleDoes Elliot Wave work? The Elliot Wave Theory is a popular tool used by traders and investors to predict future price movements in financial markets. …

Read ArticleSEC Fines BNP for Violations In a recent development, global banking giant BNP Paribas has been slapped with a hefty fine by the US Securities and …

Read Article