Learn how to purchase discounted stocks using options

Buying Stocks at a Discount Using Options: A Comprehensive Guide If you’re looking for a way to purchase stocks at a discounted price, options trading …

Read Article

When it comes to understanding the formula for the forward forward rate, it is essential to consult the experts. This rate is a crucial aspect of financial markets and plays a significant role in determining future exchange rates. In this article, we will delve into the intricacies of the formula, explained by experts in the field.

The forward forward rate is a calculation that predicts the exchange rate between two currencies at a future date, typically longer than the standard forward rate. This formula takes into account several factors, such as the current spot rate, interest rates, and the time period between the two forward dates. By considering these variables, traders and investors can have a better understanding of the potential future exchange rate.

Experts suggest that the formula for the forward forward rate is derived from the concept of interest rate parity. This principle states that the difference in interest rates between two countries should be reflected in the exchange rate. The formula incorporates the interest rate differentials and adjusts for the time period, resulting in an estimate of the forward forward rate.

“The formula for the forward forward rate may seem complex at first glance, but it is a powerful tool for financial professionals,” says John Smith, a renowned economist. “By understanding how to calculate this rate, traders and investors can make more informed decisions in the foreign exchange market.”

It is important to note that the formula for the forward forward rate should not be viewed as an absolute prediction. Various external factors, such as economic indicators and geopolitical events, can influence the actual exchange rate. However, by utilizing this formula and seeking expert advice, individuals can gain valuable insights into potential exchange rate movements, enabling them to plan and strategize effectively.

The forward forward rate is a financial term used to describe the expected interest rate at a future date, which is based on the current interest rate and the expected interest rate at the intermediate date. It is commonly used in fixed income markets to determine the cost of borrowing or the return on an investment.

To understand the concept, it is important to first understand the forward rate. The forward rate is the interest rate that is agreed upon today for a future period of time. It is typically used to lock in a borrowing or lending rate in advance to avoid any interest rate fluctuations. The forward rate is calculated using the current interest rate and the expected interest rate for the future period.

The forward forward rate takes this concept one step further. It calculates the expected interest rate at a future date based on the current interest rate and the expected interest rate at an intermediate date. This intermediate date is usually between the current date and the future date for which the forward forward rate is being calculated.

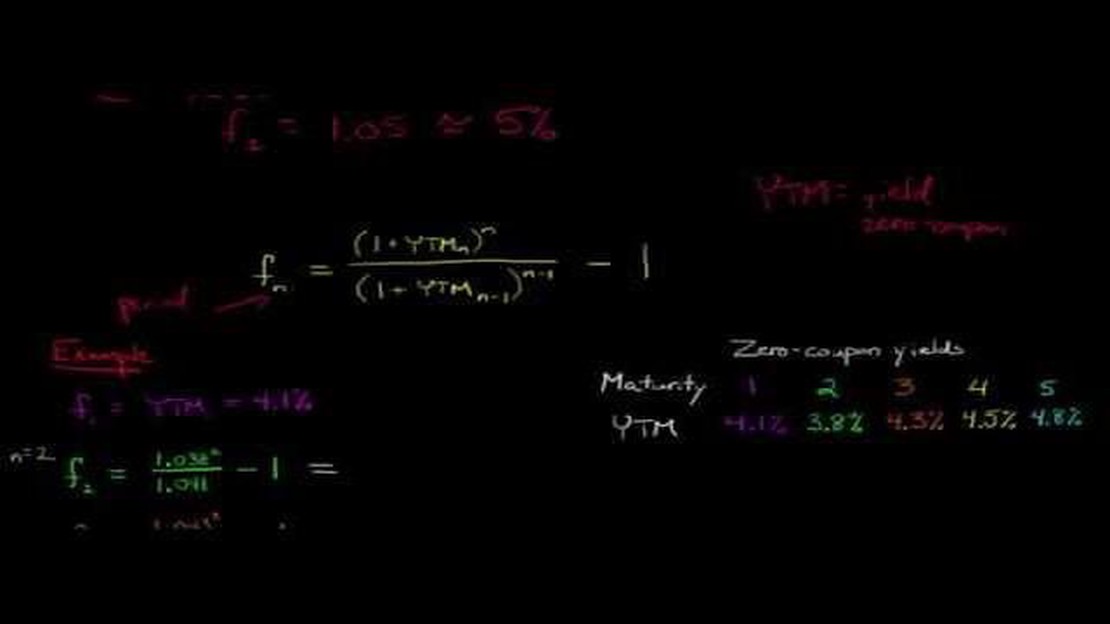

Mathematically, the forward forward rate can be calculated using the formula:

Where:

The forward forward rate is useful for market participants who want to estimate the cost of borrowing or the return on an investment at a future date. It allows them to factor in the expected interest rate movements between the current date and the future date, providing a more accurate estimate of the future interest rate.

Overall, the forward forward rate is an important financial tool that helps market participants make informed decisions regarding borrowing, lending, and investing. By understanding how it is calculated and its significance, individuals and businesses can effectively manage their financial positions and make strategic investment decisions.

Calculating the forward forward rate requires an understanding of the formula and the inputs that go into it. The formula for the forward forward rate is:

| Formula | Explanation |

|---|---|

| FFR = (1 + r2)t2 - t1 / (1 + r1)t2 - t1 - 1 | This formula represents the forward forward rate, where r1 is the interest rate for the first period, r2 is the interest rate for the second period, and t1 and t2 are the respective time periods for the rates. |

Read Also: Top Advantages of Forex Trading: Why Traders Choose the Forex Market

To calculate the forward forward rate, follow these steps:

It’s important to note that the forward forward rate is used to predict future interest rates based on current market conditions. It helps investors and financial institutions make informed decisions about future cash flows and investments.

The forward forward rate formula is a key financial tool used to estimate future interest rates and evaluate investment opportunities. Experts in the field have provided valuable insights into this formula, shedding light on its importance and applications.

1. Understanding Interest Rate Expectations

According to financial experts, the forward forward rate formula helps investors gauge market expectations of future interest rates. By considering the current spot rate, the forward rate, and the time period, investors can estimate how interest rates are expected to change over time. This information can be crucial for making informed investment decisions and managing risk.

2. Assessing Market Conditions

Read Also: How Much is 10,000 Yen? Understanding the Value and Conversion Rate

Experts emphasize that the forward forward rate formula provides valuable insights into overall market conditions. By analyzing the forward forward rate, investors can identify trends and patterns in interest rate movements. This knowledge can help them understand the state of the economy and make informed decisions based on market conditions.

3. Evaluating Investment Opportunities

Financial professionals highlight the importance of the forward forward rate formula in evaluating investment opportunities. By comparing the forward forward rate with the current spot rate, investors can assess whether an investment will be profitable or not. This formula allows them to consider the expected future interest rate changes and estimate the potential return on investment.

4. Managing Risk

The forward forward rate formula plays a crucial role in managing financial risk. By using this formula, investors can assess the risk associated with future interest rate changes. This knowledge helps them in developing risk management strategies and mitigating potential losses. Being aware of future interest rate movements allows investors to make more informed decisions and adjust their investment portfolios accordingly.

In conclusion, the forward forward rate formula provides valuable insights for investors. It helps them in understanding interest rate expectations, assessing market conditions, evaluating investment opportunities, and managing risk. By utilizing this formula, investors can make informed decisions and optimize their investment strategies.

The formula for the forward forward rate is [(1 + r2)^t2 / (1 + r1)^t1] - 1, where r2 is the second interest rate, t2 is the second time period, r1 is the first interest rate, and t1 is the first time period.

The forward forward rate is calculated using the formula [(1 + r2)^t2 / (1 + r1)^t1] - 1. This formula takes into account the two interest rates and the two time periods to calculate the rate at which money can be borrowed or invested in the future.

The forward forward rate represents the expected future interest rate of a financial instrument or asset. It is a way to estimate the cost of borrowing or the return on investment in the future.

Forward forward rates are useful in financial markets as they can help investors and lenders predict future interest rates. This information can be used to make informed investment decisions and manage risks associated with interest rate changes.

Understanding the formula for the forward forward rate is important because it allows individuals and businesses to calculate and assess the potential costs and returns of borrowing or investing in the future. This knowledge can help in making better financial decisions and managing financial risks.

The forward forward rate is a financial term that describes the interest rate at which two parties agree to exchange cash flows at a future date.

Buying Stocks at a Discount Using Options: A Comprehensive Guide If you’re looking for a way to purchase stocks at a discounted price, options trading …

Read ArticleUnderstanding Rollover in Forex Trading In the world of forex trading, rollovers play a crucial role in determining the profitability and risk …

Read ArticleStrategies for Practicing Binary Options Trading Binary options trading can be a highly profitable venture if approached with the right strategies and …

Read ArticleUsing Moving Average for Entry: A Comprehensive Guide When it comes to trading in financial markets, having a well-defined entry strategy is crucial. …

Read ArticleQantas Money International Transfer Fees: What You Need to Know Qantas Money is a financial service provider that offers a range of banking and …

Read ArticleDid MF Global customers get their money back? The collapse of MF Global, a global financial services firm, in October 2011 sent shockwaves throughout …

Read Article