Trade of the Olmecs: Evidence and Implications | Ancient Mesoamerican Civilization

Trade in the Olmec Civilization: Uncovering Ancient Networks The Olmecs, a pre-Columbian civilization that thrived in Mesoamerica from 1200 BCE to 400 …

Read Article

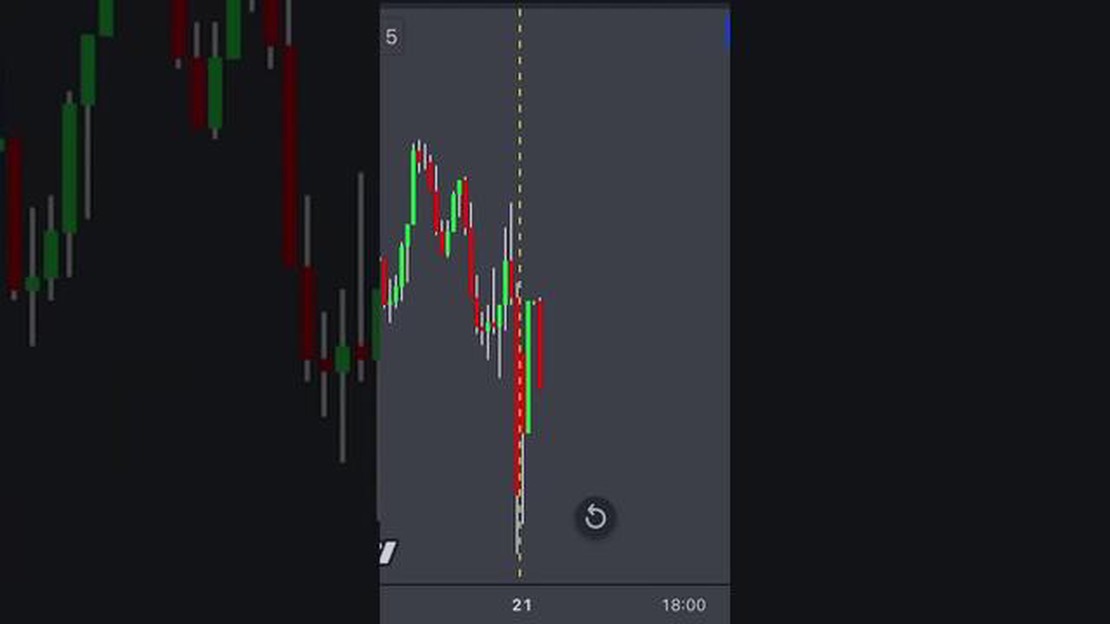

The British pound (GBP) has been a subject of much debate and speculation in recent months, as the currency has experienced significant volatility. Traders and investors are closely watching the pound’s price movements to determine whether it is bullish or bearish in the current market environment.

There are several factors that are influencing the GBP’s price outlook. One of the main factors is the ongoing Brexit negotiations between the United Kingdom and the European Union. The uncertainty surrounding the outcome of these negotiations has led to increased volatility in the pound’s value.

Another factor that is impacting the GBP’s price is the domestic economic data. Recent economic indicators have shown mixed results, with some indicators indicating a strong economic recovery while others suggesting a slowdown. These conflicting signals have contributed to the uncertainty in the GBP’s price direction.

Furthermore, global economic factors such as the ongoing COVID-19 pandemic and geopolitical tensions are also playing a role in the GBP’s price movements. The pandemic has had a profound impact on the global economy, and any significant developments regarding the virus or the vaccination efforts can have a direct impact on the pound’s value.

Given the complexity of the current market environment, it is difficult to definitively determine whether the GBP is bullish or bearish. Traders and investors are advised to closely monitor the various factors influencing the pound’s price and make informed decisions based on market analysis and risk management strategies.

In conclusion, the GBP’s price outlook is currently uncertain due to various factors such as Brexit negotiations, domestic economic data, global economic factors, and geopolitical tensions. Traders and investors should exercise caution and conduct thorough analysis before making any trading decisions involving the British pound.

In this section, we will analyze the price of GBP and determine whether it is bullish or bearish. The GBP has been experiencing some volatility in recent weeks, with fluctuations in its value against major currencies such as the USD and EUR.

One key factor that has been impacting the GBP is the ongoing Brexit negotiations. The uncertainty surrounding the UK’s exit from the European Union has led to fluctuations in the currency’s value. Positive developments in the negotiations, such as the signing of a trade deal, can lead to a bullish outlook for the GBP, as it will likely strengthen against other currencies. On the other hand, setbacks or delays in the negotiations can have a bearish effect on the GBP, causing it to weaken.

Another factor to consider is the state of the UK economy. Economic indicators, such as GDP growth, employment rates, and inflation levels, can provide insight into the strength of the GBP. If the UK economy is performing well and showing signs of growth, it can support a bullish outlook for the GBP. Conversely, if the economy is struggling or facing challenges, it can contribute to a bearish outlook for the currency.

Technical analysis is also an important tool in determining the price trend of the GBP. By examining historical price data, chart patterns, and indicators such as moving averages and support/resistance levels, analysts can identify potential price movements. If the technical analysis suggests that the GBP is likely to continue its upward trend, it indicates a bullish outlook. Conversely, if the analysis signals a potential downward trend, it indicates a bearish outlook.

Overall, the price analysis of GBP involves considering various factors such as Brexit negotiations, the state of the UK economy, and technical analysis. Keeping a close eye on these factors can help traders and investors make informed decisions and anticipate potential price movements in the GBP.

Read Also: Understanding the Types of Options Traded on NSE - A Comprehensive Guide

When considering the outlook for the GBP, it is important to assess both the bullish and bearish factors at play. This analysis can help traders and investors make informed decisions about their GBP positions.

On the bullish side, there are several factors that could support a positive outlook for the GBP. Firstly, the UK’s successful vaccine rollout and easing of COVID-19 restrictions have boosted economic recovery prospects. This has led to increased business and consumer confidence, which could drive demand for the GBP.

In addition, the UK’s progress in trade negotiations and its ability to reach post-Brexit agreements with other countries could provide further support for the GBP. Successful trade agreements would enhance the UK’s economic prospects and strengthen investor sentiment towards the currency.

Furthermore, the Bank of England’s monetary policy decisions and interest rate outlook can also impact the GBP’s bullish prospects. If the central bank adopts a hawkish stance and signals potential interest rate hikes, this could attract investors and strengthen the currency.

However, there are also bearish factors that could weigh on the GBP’s outlook. The uncertainty surrounding the post-Brexit landscape and the potential for disruption in trade may dampen investor confidence and limit upside potential for the GBP.

In addition, geopolitical factors and global economic conditions can also impact the GBP’s outlook. Any negative developments on the global stage, such as trade conflicts or economic downturns, could lead to risk aversion and weaken the GBP.

Read Also: Is it possible to predict trading? Discover the truth and strategies to boost your trading success

It is crucial for traders and investors to closely monitor these factors and stay informed about the latest news and developments that could influence the GBP’s bullish or bearish outlook. By carefully assessing these factors, individuals can make more informed decisions about their GBP positions and potentially capitalize on market opportunities.

Several factors can influence the value of GBP. These factors include:

These factors, along with others, can create a complex environment for GBP trading and investing. Traders and investors need to stay informed and monitor these factors to make informed decisions about GBP.

Currently, there are several factors that are impacting the GBP price. One major factor is the ongoing Brexit negotiations, which have created uncertainty and volatility in the GBP market. Additionally, economic data, such as GDP and inflation reports, can also impact the GBP price. Finally, political events, both domestic and international, can have an effect on the GBP price.

The outlook for the GBP in the near future is uncertain. The outcome of the ongoing Brexit negotiations will likely play a significant role in determining the strength or weakness of the GBP. If a favorable trade deal is reached, the GBP could strengthen. However, if the negotiations result in a no-deal Brexit or other negative economic repercussions, the GBP could weaken.

A change in UK interest rates can have a significant impact on the GBP price. If the Bank of England decides to raise interest rates, it could signal confidence in the UK economy and lead to an increase in the value of the GBP. On the other hand, if the Bank of England lowers interest rates, it could indicate concerns about the economy and result in a decrease in the value of the GBP.

Yes, there are several major economic events and announcements that could impact the GBP price in the coming weeks. These include the release of GDP growth figures, inflation reports, and unemployment data. Additionally, any developments in the ongoing Brexit negotiations could also have a significant impact on the GBP price.

There are several potential risks for the GBP in the current market environment. One major risk is the uncertainty surrounding the outcome of the Brexit negotiations. If a no-deal Brexit occurs, it could have a negative impact on the GBP. Additionally, political events, both domestic and international, can also pose risks to the GBP. Economic factors, such as inflation and GDP growth, can also impact the GBP price.

According to the analysis, GBP is currently in a bearish trend and is expected to continue falling in the near future.

The current GBP price movement is primarily influenced by Brexit uncertainty, economic data releases, and market sentiment towards the UK economy.

Trade in the Olmec Civilization: Uncovering Ancient Networks The Olmecs, a pre-Columbian civilization that thrived in Mesoamerica from 1200 BCE to 400 …

Read ArticleTrading the Asian Range in Forex: A Comprehensive Guide The Asian range is a period of time during the Forex trading day when the markets in Asia are …

Read ArticleUnderstanding the Concept of Trading Strategy Trading strategy is a crucial aspect of the financial markets, guiding traders in making informed …

Read ArticleHow to record ESOP on a balance sheet Recording ESOP on a Balance Sheet: Step-by-Step Guide Table Of Contents What is ESOP and why is it important? …

Read ArticleWhat is forex application? Forex, also known as foreign exchange, is the global decentralized market for trading various currencies. It is the largest …

Read ArticleUnderstanding the Pinocchio Strategy The market can be a complex and unpredictable place, where investors are constantly searching for clues to help …

Read Article