Are Tikka stocks bedded? Find out the truth here!

Are Tikka stocks bedded? When it comes to precision shooting, having a properly bedded stock can make a world of difference. Bedding a stock involves …

Read Article

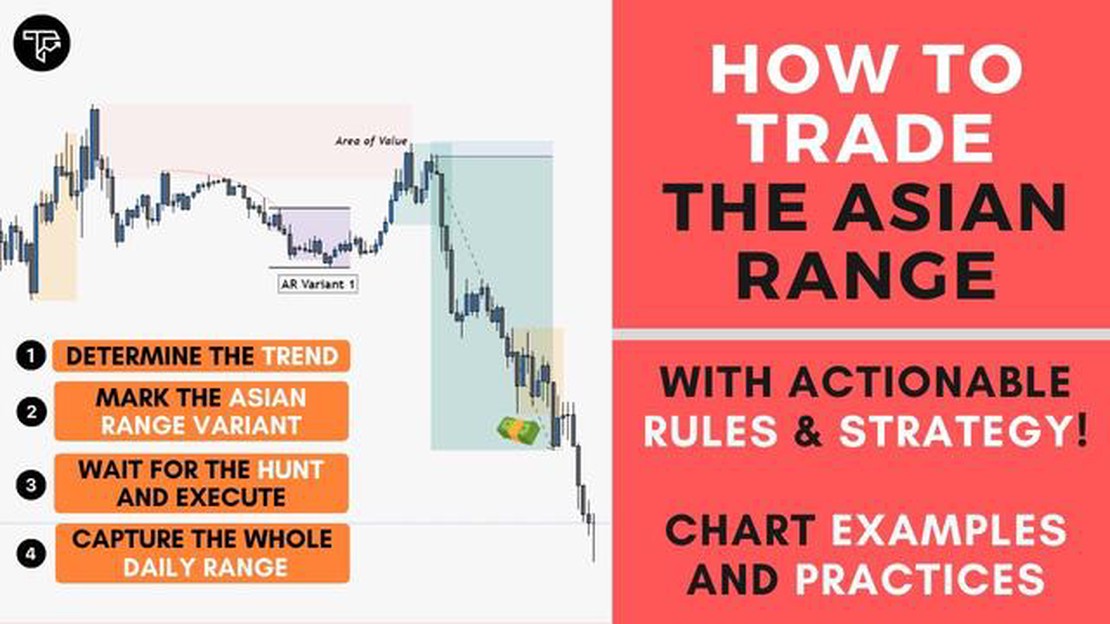

The Asian range is a period of time during the Forex trading day when the markets in Asia are the most active. During this time, currency pairs tend to trade in a relatively tight range, providing opportunities for traders to profit from short-term price fluctuations.

Trading the Asian range can be a profitable strategy if done correctly. However, it requires a specific set of skills and strategies to be successful. In this article, we will explore some proven strategies and tips that can help you trade the Asian range effectively.

One of the most important things to keep in mind when trading the Asian range is patience. The market tends to be less volatile during this time, which means that price movements may be slower and less predictable. As a trader, it is important to wait for clear trading opportunities and not force trades based on impatience or a desire to be active in the market.

“The key to successful trading is not predicting the future, but managing risk in the present.” – Mark Douglas

Another important strategy when trading the Asian range is to use technical analysis to identify key support and resistance levels. These levels can act as potential entry and exit points for trades. By carefully analyzing price charts and identifying these levels, traders can increase their chances of making profitable trades.

In addition, using a combination of indicators can also be effective when trading the Asian range. Indicators such as moving averages, RSI, and MACD can provide valuable insights into market trends and help identify potential reversals or breakouts.

Finally, it is important to closely monitor economic news releases and events during the Asian range. Despite its generally quieter nature, unexpected news or events can still have a significant impact on currency pairs. By staying informed and reacting quickly to market changes, traders can minimize risks and maximize profits.

In conclusion, trading the Asian range in Forex can be a profitable strategy if approached with the right skills and strategies. By being patient, using technical analysis, and closely monitoring economic events, traders can increase their chances of success in this unique trading time period.

Trading in the forex market can be a highly profitable venture if you understand the different trading sessions and their characteristics. One of these sessions, known as the Asian trading session, offers unique opportunities for traders.

The Asian trading session starts with the opening of the Tokyo market and includes the trading activities from other major financial centers in Asia such as Hong Kong, Singapore, and Sydney. This session accounts for a significant portion of the overall forex market trading volume.

One characteristic of the Asian trading session is its relatively low volatility compared to other trading sessions, such as the London or New York sessions. This lower volatility can make it challenging for traders who prefer fast-paced and highly volatile markets. However, understanding the Asian range can help traders capitalize on the price movements within this session.

Read Also: What is the exchange rate? Learn everything you need to know about exchange rates

The Asian range refers to the range in which a currency pair trades during the Asian trading session. Traders can analyze and identify the highest and lowest points of this range to determine potential trading opportunities. One common approach is to trade the breakouts of these range levels.

Traders can use technical tools such as support and resistance levels, trend lines, and moving averages to identify the Asian range and potential breakout points. These tools can provide valuable insights into the price movements during this session.

It is important to note that the Asian range is influenced by economic news and events from Asia, as well as from other major financial centers around the world. Traders should stay updated with the latest news and announcements that may impact the Asian range and adjust their trading strategies accordingly.

Additionally, it is crucial to manage risk effectively when trading the Asian range. Due to the lower volatility, sudden market movements can be relatively rare during this session. Traders should set appropriate stop-loss orders and consider their risk appetite when placing trades.

In conclusion, understanding the Asian range in forex trading is essential for traders looking to capitalize on the opportunities presented during the Asian trading session. By analyzing the range and using appropriate technical tools, traders can identify potential breakout points and adjust their strategies accordingly. Staying updated with economic news and managing risk effectively are also crucial aspects of trading the Asian range successfully.

The Asian Range, also known as the Asian Session Range or the Tokyo Range, refers to the specific time period during which the foreign exchange market is most active in the Asian region. This time period usually starts at the beginning of the Tokyo session, which is around 00:00 GMT, and extends until about 09:00 GMT.

During the Asian Range, the forex market experiences relatively lower volatility compared to other market sessions, such as the London or New York sessions. This is primarily due to the fact that most major financial centers in the Asian region, including Tokyo, Hong Kong, and Singapore, are closed during this time. As a result, trading volume and liquidity are generally lower.

However, even though the Asian Range is generally characterized by lower volatility, it still presents opportunities for traders to make profitable trades. One key characteristic of the Asian Range is that it often exhibits a range-bound market conditions, where prices tend to trade within a relatively narrow range. This can be attributed to the lack of significant market-moving news and events during this session.

Read Also: Complete Guide: How to Buy USD in RCBC - Step by Step

Traders who are able to successfully trade the Asian Range employ a variety of strategies and techniques. Some traders aim to profit from the price oscillations within the range by buying at the lower end of the range and selling at the upper end. Others may use breakout strategies, where they wait for the price to break out of the range and trade in the direction of the breakout. Additionally, traders may also use technical indicators or chart patterns to identify potential trading opportunities within the Asian Range.

It is worth noting that while the Asian Range can present opportunities for profitable trades, it may not be suitable for all traders. It requires a certain level of skill and experience to trade successfully during this session, as traders need to be able to adapt to the unique characteristics of the Asian market. Additionally, traders should also be mindful of the potential impact of news releases and events from other market sessions, which may cause increased volatility and disrupt the range-bound market conditions.

The Asian range in Forex trading refers to the period of time during the Asian session when the price of a currency pair is relatively stable and moves within a narrow range. It is often characterized by lower volatility and lower trading volume compared to other trading sessions.

Trading the Asian range strategy is popular among Forex traders because it allows them to take advantage of the relatively stable and predictable market conditions during the Asian session. This strategy is especially useful for traders who prefer a more relaxed and less volatile trading environment.

Some proven strategies for trading the Asian range in Forex include range trading, breakout trading, and mean-reversion trading. Range trading involves buying at the lower range and selling at the upper range, while breakout trading involves entering a trade when the price breaks out of the range. Mean-reversion trading involves taking trades when the price reverts back to the mean value within the range.

Some tips for successfully trading the Asian range in Forex include identifying the key support and resistance levels within the range, using technical indicators to confirm trade signals, being patient and waiting for clear trading opportunities, managing risk by using stop-loss orders, and keeping up with market news and events that may affect the range.

Some advantages of trading the Asian range in Forex include lower volatility, which reduces the risk of sudden price fluctuations, a more relaxed trading environment, and the ability to plan and execute trades based on the predictable price movement within the range. Additionally, trading the Asian range allows traders to take advantage of different time zones and trade outside of their normal trading hours.

The Asian range refers to the specific time period during which the Asian markets are open for trading. It is usually considered to be the quietest session in the Forex market, with relatively low volatility compared to the European and American sessions.

Trading the Asian range can be challenging because the market tends to be less active and volatile during this time. This can make it harder to find good trading opportunities and may require traders to be more patient and disciplined with their trading strategies.

Are Tikka stocks bedded? When it comes to precision shooting, having a properly bedded stock can make a world of difference. Bedding a stock involves …

Read ArticleWhat to expect when selling before T 2 When it comes to selling before T 2, there are several consequences that sellers need to be aware of. T 2, …

Read ArticleThe Momentum Meter Indicator in MT4 - A Comprehensive Guide The Momentum Meter indicator is a powerful tool available on the MetaTrader 4 (MT4) …

Read ArticleHow Much Volume is Good for Trading? When it comes to trading, one of the key factors that can greatly influence your success is the trading volume. …

Read ArticleEUR USD Projection: Analysis and Predictions The EUR/USD currency pair is one of the most closely watched and volatile currency pairs in the world. As …

Read ArticleUnderstanding the Functioning of CSE Search engines have become an essential part of our daily lives, helping us access vast amounts of information …

Read Article