Understanding FX Swap Example: Definition, Anatomy, and Practical Applications

Understanding FX Swap Examples and Their Application Foreign exchange (FX) swaps are an essential tool in the global financial markets. They allow …

Read Article

The foreign exchange market, also known as the forex market, is the largest and most liquid financial market in the world. It is where currencies are traded, enabling businesses, governments, and individuals to buy and sell currencies to facilitate international trade and investment. One of the key concepts in the forex market is the quote currency, which plays a crucial role in determining exchange rates and the value of currencies.

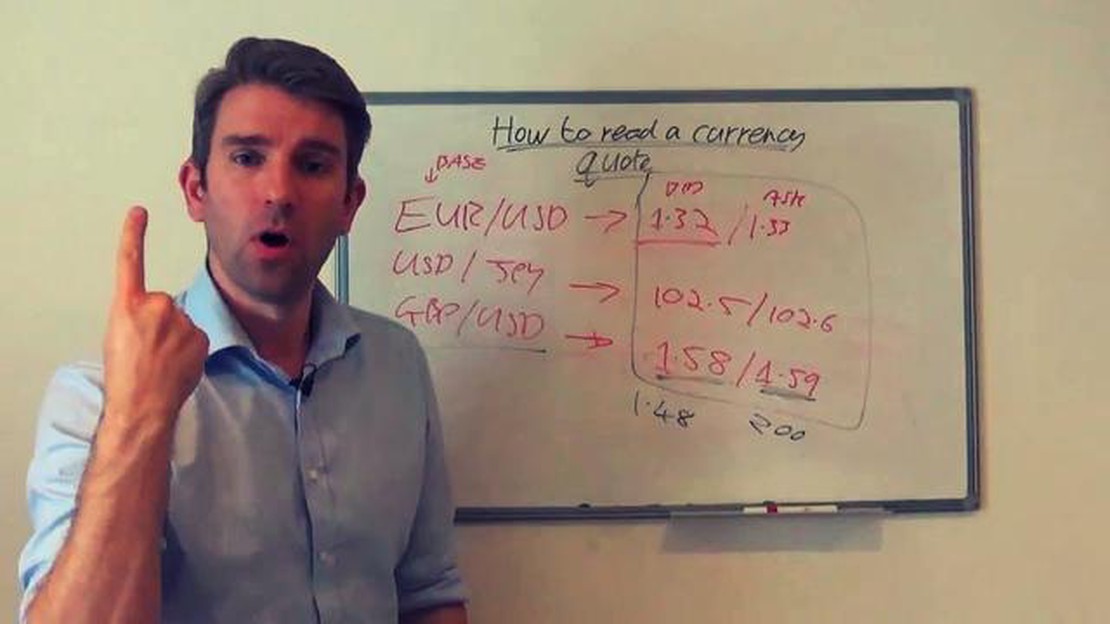

In the forex market, currencies are traded in pairs, with one currency being the base currency and the other currency being the quote currency. The base currency is the currency against which other currencies are quoted, and the quote currency is the currency in which the exchange rate is quoted. For example, in the EUR/USD currency pair, the euro is the base currency and the US dollar is the quote currency.

The quote currency is important because it determines the value of the base currency. The exchange rate between the base currency and the quote currency indicates how much of the quote currency is needed to purchase one unit of the base currency. For example, if the EUR/USD exchange rate is 1.10, it means that one euro can be exchanged for 1.10 US dollars.

The choice of quote currency is determined by market conventions and the relative importance of the currencies in a particular currency pair. In major currency pairs such as EUR/USD, USD/JPY, and GBP/USD, the US dollar is often chosen as the quote currency due to its status as a dominant global currency and its liquidity in the forex market.

In foreign exchange markets, quote currency refers to the second currency in a currency pair. It is the currency that is used to quote the exchange rate of the base currency. The base currency is the first currency in the pair and represents the currency being bought or sold.

The quote currency is also known as the “counter currency” or “secondary currency” in some cases. It is important to understand that the quote currency is always expressed in terms of the base currency.

For example, in the currency pair EUR/USD, the euro (EUR) is the base currency, and the U.S. dollar (USD) is the quote currency. The exchange rate represents the amount of quote currency needed to buy one unit of the base currency.

In forex trading, understanding the quote currency is crucial because it determines the value of the base currency in relation to the quote currency. Traders use this information to make decisions on buying or selling currency pairs based on the expected changes in exchange rates.

It is common for major currencies, such as the U.S. dollar, euro, British pound, and Japanese yen, to be quoted as the quote currency in different currency pairs. However, some currencies, especially those of smaller economies, may also be quoted as the base currency in specific pairs.

Overall, quote currency plays a significant role in foreign exchange markets as it determines the value of the base currency and helps traders analyze and make decisions on currency trading.

Read Also: What Happens When Margin Level Hits Zero?

The quote currency plays a critical role in foreign exchange markets as it determines the value of the base currency and facilitates the conversion of one currency into another. It is the currency in which the exchange rate is quoted and reflects how much of the quote currency is required to buy one unit of the base currency.

The quote currency is important because it provides traders and investors with vital information about the value of a currency pair. By comparing the value of the quote currency to other currencies, market participants can make informed decisions about when to buy or sell a particular currency.

Furthermore, the quote currency allows for efficient price discovery and market liquidity. The exchange rate between two currencies is constantly changing as a result of supply and demand dynamics, which are reflected in the exchange rate quotes for currency pairs. Traders and investors rely on these quotes to determine the fair value of a currency and to execute trades in the market.

Another important aspect of the quote currency is its use as a benchmark currency in the foreign exchange market. Many currencies are quoted with the U.S. dollar as the quote currency, such as USD/EUR or USD/JPY. This is because the U.S. dollar is the most widely traded currency and is considered the benchmark for other currencies.

Additionally, the quote currency is crucial for calculating profits and losses in forex trading. When traders buy or sell a currency pair, they do so with the expectation that the exchange rate will move in their favor, allowing them to profit. The quote currency determines the monetary value of these profits or losses.

In summary, the quote currency is important in foreign exchange markets because it determines the value of the base currency, provides vital information for traders and investors, facilitates price discovery and market liquidity, serves as a benchmark currency, and enables the calculation of profits and losses in forex trading.

Read Also: Does Hedging Work in Day Trading? The Pros and Cons of Hedging Strategies

The value of quote currency in foreign exchange markets is influenced by a multitude of factors that can impact its strength or weakness. These factors include:

| Factors | Description |

|---|---|

| Interest Rates | Higher interest rates in the country of the quote currency can attract foreign investors, leading to an increase in demand and a rise in its value. Conversely, lower interest rates can result in decreased demand and a decline in value. |

| Inflation | High levels of inflation in the country can erode the purchasing power of its currency and decrease its value relative to other currencies. On the other hand, lower inflation rates can bolster the value of the quote currency. |

| Economic Performance | A strong and growing economy can enhance market confidence in the quote currency, attracting investment and increasing its value. Conversely, a weak economy can lower confidence and lead to a depreciation in value. |

| Political Stability | A stable political environment can provide certainty and reduce risk, making the quote currency more attractive to investors and potentially increasing its value. Political instability, on the other hand, can lead to a decrease in value as investors become wary. |

| Trade Balance | A positive trade balance, where a country exports more than it imports, can generate demand for the quote currency as it is needed to purchase goods and services. This can increase its value. Conversely, a negative trade balance can put pressure on the quote currency’s value. |

| Market Sentiment | Collective market sentiment and investor confidence can heavily influence the value of the quote currency. Positive sentiment can drive demand and increase the currency’s value, while negative sentiment can result in a decrease in value. |

Traders in foreign exchange markets closely monitor these factors and their potential impacts on the value of quote currency. By understanding and analyzing these factors, traders can make informed decisions and effectively participate in the foreign exchange market.

The quote currency is the second currency listed in a currency pair and it represents the price at which the base currency can be bought or sold in the market. It plays a crucial role in determining the value of the base currency and the overall exchange rate.

The quote currency is important because it helps determine the value of the base currency. The exchange rate between two currencies is essentially the price of one currency in terms of the other, and this is influenced by the quote currency. It helps traders and investors understand the value of a currency relative to another currency.

The quote currency affects foreign exchange trading by influencing the exchange rate. When the value of the quote currency changes, it directly impacts the value of the base currency and the exchange rate between the two currencies. Traders and investors need to consider the quote currency when making trading decisions.

Yes, in some currency pairs, the quote currency can also be the base currency. It depends on the currency pair being traded. For example, in the EUR/USD currency pair, the euro is the base currency and the U.S. dollar is the quote currency. However, in the USD/JPY currency pair, the U.S. dollar is the base currency and the Japanese yen is the quote currency.

Currency pairs have a specific order for the base and quote currency to maintain consistency and standardization in the foreign exchange markets. This allows traders and investors to easily identify the base currency and understand the exchange rate. The order is based on convention and is universally recognized in the financial industry.

Understanding FX Swap Examples and Their Application Foreign exchange (FX) swaps are an essential tool in the global financial markets. They allow …

Read ArticleHow to Buy or Sell to Open a Put Option Put options are financial derivatives that give the holder the right, but not the obligation, to sell an asset …

Read ArticleWhat is the formula for autoregressive model? The autoregressive model, also known as AR model, is a fundamental concept in time series analysis. It …

Read ArticleLearn more about the FTSE MIB 40 index The FTSE MIB 40 Index, also known as the FTSE Milano Indice di Borsa, is the primary stock market index for the …

Read ArticleUnderstanding Poi Trading: An Introduction to This Art and Practice Welcome to our comprehensive guide to poi trading! Whether you’re new to the world …

Read ArticleChoosing the best MACD indicator combination When it comes to trading in the financial markets, having a reliable and accurate indicator is crucial …

Read Article