Understanding the Role of Moving Average in Sales Trend Analysis

Understanding the concept of moving average in sales trend In the world of business, understanding and predicting sales trends is essential for …

Read Article

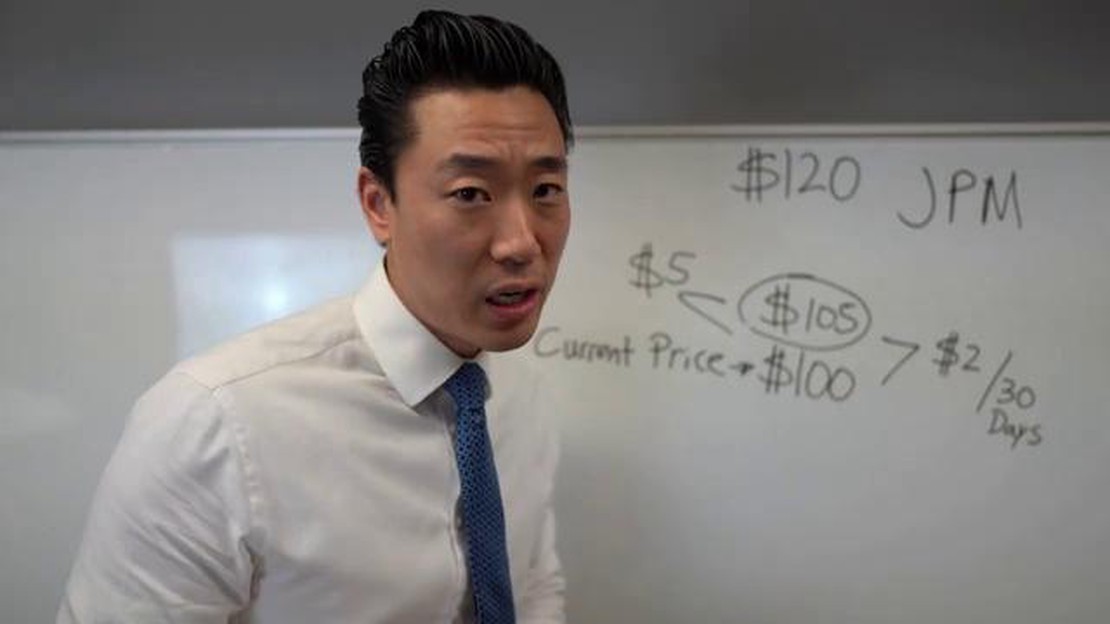

When it comes to investing, there are various strategies that traders employ to maximize returns and minimize risk. One such strategy is the covered call, which is often considered a bullish strategy. A covered call involves selling a call option on an underlying asset that the investor already owns. This strategy can offer potential benefits, but it also comes with its fair share of drawbacks.

One of the main advantages of a covered call strategy is that it allows investors to generate income from their existing holdings. By selling call options, investors earn premiums, which can add to their overall returns. Additionally, the investor still benefits from any appreciation in the underlying asset’s price, up to the strike price of the call option.

However, there are also potential downsides to this strategy. One of the main drawbacks is that the investor’s upside potential is limited. If the price of the underlying asset rises significantly above the strike price of the call option, the investor will miss out on any additional profits beyond that point. Additionally, if the price of the underlying asset were to decline, the investor may experience losses or be forced to hold onto an asset that is losing value.

In conclusion, the covered call strategy can be an effective way for investors to generate income and potentially benefit from modest price appreciation. However, it is important to understand the limitations and risks associated with this strategy. Traders should carefully evaluate their risk tolerance and investment goals before implementing a covered call strategy. As with any investment strategy, it is important to diversify and seek professional advice if needed.

A covered call options strategy is often seen as a bullish strategy because it allows an investor to generate income while also benefiting from potential stock price appreciation.

In a covered call strategy, an investor sells a call option on a stock that they already own. By selling the call option, the investor collects a premium, which provides immediate income. If the stock price remains below the strike price of the call option, the investor keeps the premium and continues to own the stock. This is a bullish outcome because the investor benefits from the stock price staying the same or increasing.

However, if the stock price goes above the strike price of the call option, the investor may be obligated to sell their stock at the strike price. While this means potentially missing out on further stock price appreciation, the investor still benefits from the premium collected and can then reinvest the proceeds into other investments.

One advantage of a covered call strategy is that it allows investors to generate income from their stock holdings, especially in a stable or slightly bullish market. It can also provide a level of downside protection as the premium collected from selling the call option can offset potential losses in the stock.

Read Also: Understanding the Mechanism of Simplex: How Does it Work?

On the other hand, there are some disadvantages to consider. If the stock price experiences a significant increase, the investor may miss out on potential profits. Additionally, if the stock price declines sharply, the premium collected may not be enough to offset losses. It’s important for investors to carefully consider the potential risks and rewards before implementing a covered call strategy.

In conclusion, a covered call strategy is generally considered a bullish strategy as it allows investors to generate income and benefit from potential stock price appreciation. However, it’s important to weigh the advantages and disadvantages and understand the potential risks before implementing this options strategy.

A covered call strategy can be an effective way for investors to generate income on their stock holdings, but it is important to understand the potential advantages and disadvantages of this approach.

Income Generation: One of the main benefits of a covered call strategy is the ability to generate income from the premiums received for selling call options. This can help offset any potential downside risk in the stock’s price.

Reduced Cost Basis: By selling call options, investors can reduce the cost basis of their stock holdings. This can improve overall returns if the stock price remains relatively stable or only experiences small gains.

Flexibility: A covered call strategy allows investors to retain ownership of their stock while still generating income. They can choose the strike price and expiration date of the call options based on their investment objectives and market outlook.

Read Also: Understanding Bearish Japanese Candlesticks & their Impact on Trading

Protection Against Downside Risk: If the stock price decreases, the premium received from selling call options can help offset losses. The income generated from the strategy can provide a cushion against downside risk.

Potential Loss of Upside Gains: If the stock price rises significantly and surpasses the strike price of the call options, inve

A covered call strategy is an options trading strategy where an investor holds a long position in an underlying asset and sells call options on that same asset to generate income. It is a bullish strategy in the sense that it allows the investor to benefit from the upward movement of the underlying asset while also gaining income from selling the call options.

One advantage of using a covered call strategy is that it allows investors to generate income from their existing stock holdings. By selling call options on their stocks, investors can collect premiums, which can help to offset any losses or provide additional income. Additionally, the strategy can offer some downside protection as the premium received from selling the call options can help to cushion potential losses in the stock.

Yes, there are some potential disadvantages to using a covered call strategy. One disadvantage is that the strategy limits the potential upside of the underlying stock. When an investor sells a call option, they are obligated to sell their stock at the strike price if the option is exercised. This means that if the stock price rises above the strike price, the investor will not participate in the full gain. Additionally, if the stock price declines significantly, the premium received from selling the call option may not be enough to offset the losses.

A covered call strategy may not be suitable for all investors. It requires a certain level of understanding of options trading and the risks involved. Additionally, investors need to have a sufficient amount of the underlying stock to sell call options against. If an investor does not have a large enough stock position, they may not be able to generate enough income from selling call options to make the strategy worthwhile. It is important for investors to carefully consider their risk tolerance, investment goals, and available capital before implementing a covered call strategy.

Understanding the concept of moving average in sales trend In the world of business, understanding and predicting sales trends is essential for …

Read ArticleProfitability of Diagonal Spreads When it comes to options trading, there are countless strategies that traders can employ to try and maximize their …

Read ArticleDoes OANDA provide tax forms? When it comes to trading and investing, tax reporting is an important aspect that shouldn’t be overlooked. As an OANDA …

Read ArticleBest Ways to Invest $10,000 in Kenya Investing in Kenya can be an exciting opportunity for anyone looking to grow their wealth. With a diverse economy …

Read ArticleSteps to Write an Effective Risk Disclaimer Welcome to our ultimate guide on how to write a comprehensive risk disclaimer. If you have ever visited a …

Read ArticleCan you trade options at 4am? Trading options can be an exciting way to participate in the financial markets and potentially earn profits. However, …

Read Article