Does the trend Magic indicator repaint? Find out the truth here!

Does trend Magic indicator repaint? Every trader wants to find a reliable indicator that can accurately predict market trends and provide profitable …

Read Article

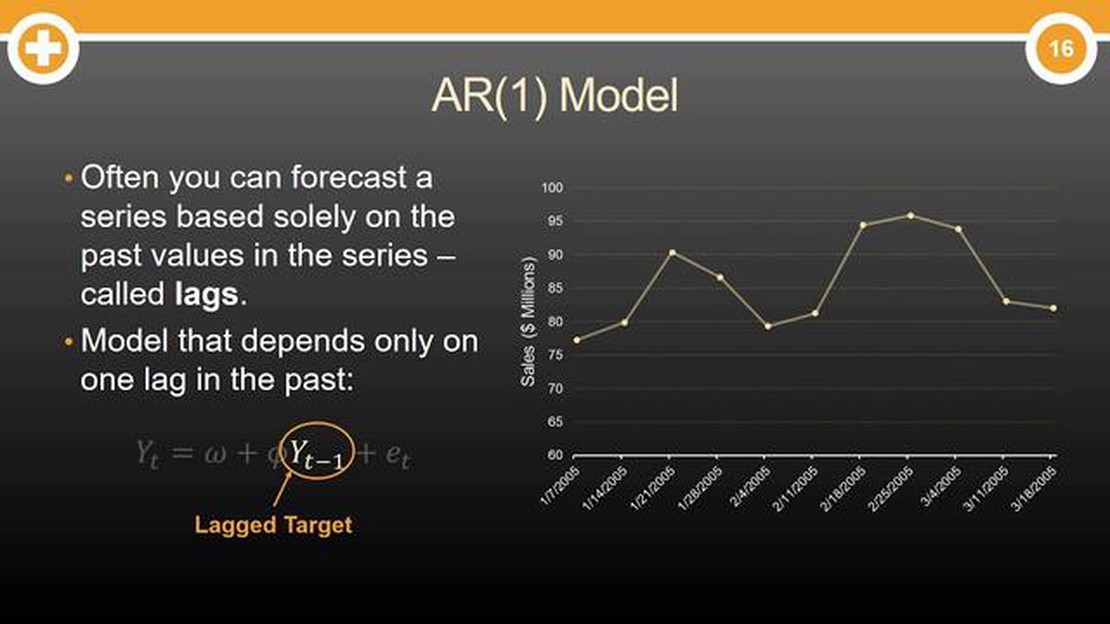

The autoregressive model, also known as AR model, is a fundamental concept in time series analysis. It is widely used to predict future values based on past observations. Understanding the autoregressive model formula is crucial for anyone interested in analyzing and forecasting time series data.

At its core, the autoregressive model formula represents a linear regression model where the dependent variable is regressed against its lagged values. In other words, the current value of a time series is modeled as a linear combination of its past values. This allows us to capture the inherent temporal dependencies and patterns in the data.

The autoregressive model can be represented mathematically as AR(p), where p denotes the order of the model. The order p indicates the number of lagged values used as predictors in the regression equation. For example, an AR(1) model uses only one past value, while an AR(2) model includes two past values as predictors.

The autoregressive model formula can be expressed as:

yt = c + Φ1y(t-1) + Φ2y(t-2) + … + Φp*y(t-p) + εt

Where yt represents the current value of the time series, c is a constant term, Φ1,…,Φp are the coefficients corresponding to the lagged values, εt is the error term, and y(t-1),…,y(t-p) are the lagged values used as predictors in the model.

By estimating the coefficients Φ1,…,Φp, we can make predictions for future values of the time series based on its past behavior. The autoregressive model provides a powerful framework for modeling and forecasting time series data, making it a valuable tool in various fields such as finance, economics, and meteorology.

An autoregressive model uses the characteristics of a variable to predict its future values. It is a statistical method that allows us to understand and forecast time series data. The formula of an autoregressive model is as follows:

y(t) = c + Σ(φ(i)y(t-i)) + ε(t)

Where:

The autoregressive model formula can be used to predict future values of a variable based on its past values. By analyzing the correlation between the variable and its lagged values, we can determine the impact of the previous values on the current value. The coefficient values φ(i) indicate the strength and direction of this impact.

The significance of the autoregressive model formula lies in its ability to capture patterns and trends in time series data. By understanding the relationship between the variable and its past values, we can make accurate predictions and inform decision-making processes.

Additionally, the autoregressive model formula allows us to assess the statistical significance of the relationship between the variable and its lagged values. This helps in determining the reliability of the model and the validity of the predictions.

The autoregressive model formula is widely used in various fields such as economics, finance, and environmental sciences. It provides a powerful tool for analyzing and forecasting time series data, allowing researchers and practitioners to gain insights and make informed decisions.

| Variable | Coefficient |

|---|---|

| y(t) | Value of the variable at time t |

| c | Constant term |

| φ(i) | Coefficient for the ith lag |

| y(t-i) | Value of the variable at time t-i |

| ε(t) | Error term at time t |

An autoregressive model (AR) is a statistical model used in time series analysis to forecast future values based on past observations. It assumes that the current value in a time series can be predicted by a linear combination of its previous values, potentially with the addition of a random error term.

The autoregressive model is often denoted as AR(p), where p represents the order of the autoregressive model. The order p specifies the number of past observations used to predict the current value. For example, if p=1, the current value is predicted based on only the immediately preceding value. If p=2, the current value is predicted based on two prior values, and so on.

The autoregressive model formula can be written as:

Read Also: Current euro exchange rate at Johnny's in Szczecin - Find out the cost of euro at Johnny's

AR(p): 𝑌𝑡 = 𝑐 + 𝑎1𝑌𝑡−1 + 𝑎2𝑌𝑡−2 + ⋯ + 𝑎𝑝𝑌𝑡−𝑝 + 𝜖𝑡

Where:

The goal of an autoregressive model is to estimate the parameters a1, a2, …, ap in order to make accurate predictions of future values in the time series based on the historical data. These models are commonly used in fields such as finance, economics, and meteorology to forecast stock prices, economic indicators, and weather conditions, respectively.

A comprehensive understanding of the autoregressive model formula is essential for effectively utilizing this statistical model for time series analysis and forecasting.

The autoregressive model formula has wide-ranging applications in various fields. Here are some of the key use cases:

1. Time Series Analysis:

The autoregressive model is commonly used in time series analysis to predict future values based on past observations. It helps in detecting patterns, trends, and anomalies in data, enabling better decision-making and forecasting.

2. Economic Forecasting:

Read Also: Can options be used for speculation? Learn more about using options for speculative trading

In economics, autoregressive models are used to forecast economic indicators such as GDP growth, unemployment rates, and stock prices. By analyzing historical data, economists can make informed predictions about future economic trends.

3. Financial Modeling:

In finance, autoregressive models are applied to analyze and predict financial data, such as stock prices, exchange rates, and interest rates. These models help traders, investors, and financial institutions make informed decisions about their investments.

4. Signal Processing:

Autoregressive models are widely used in signal processing applications, such as speech recognition, image processing, and audio compression. These models help in analyzing and extracting useful information from signals, enabling better understanding and manipulation of data.

5. Climate Forecasting:

In climatology, autoregressive models are used to forecast climatic variables like temperature, rainfall, and air pollution levels. By analyzing historical climate data, scientists can make predictions about future climate patterns and changes.

6. Quality Control:

Autoregressive models are employed in quality control processes to monitor and improve product quality. These models help in identifying patterns and trends in data, allowing organizations to take corrective actions and optimize their manufacturing processes.

Overall, the autoregressive model formula has proven to be a valuable tool in various domains, providing insights and predictions based on historical data. Its applications continue to expand as more industries recognize its potential value.

An autoregressive model is a time series model that predicts future values based on past values of the same variable. It assumes that the future values are linearly dependent on the previous values.

The autoregressive model is useful for analyzing and forecasting time series data. It can capture patterns and trends in the data, making it an effective tool for predicting future values.

The formula for the autoregressive model of order p, AR(p), is: Y_t = c + φ_1Y_{t-1} + φ_2Y_{t-2} + … + φ_p*Y_{t-p} + ε_t, where Y_t is the current value, c is a constant, φ_1, φ_2, …, φ_p are the autoregressive coefficients, Y_{t-1}, Y_{t-2}, …, Y_{t-p} are the lagged values, and ε_t is the error term.

The order of the autoregressive model, p, can be determined using techniques such as the autocorrelation function (ACF) and the partial autocorrelation function (PACF). These functions help identify the significant lags in the data and determine the appropriate order for the autoregressive model.

No, the autoregressive model is a linear model that assumes a linear relationship between the current value and the previous values. It may not be suitable for non-linear data, as it may not capture the non-linear patterns and relationships present in the data.

An autoregressive model is a time series model that predicts the future values of a variable based on its past values.

Does trend Magic indicator repaint? Every trader wants to find a reliable indicator that can accurately predict market trends and provide profitable …

Read ArticleUnderstanding the M15 Strategy in Forex Trading In the fast-paced world of forex trading, having a solid strategy is essential for success. One …

Read ArticleUnderstanding the Buyer Seller Percentage Indicator in MT4 The Buyer Seller Percentage Indicator is a powerful tool in the MetaTrader 4 (MT4) platform …

Read ArticleWhat is the role of high-frequency traders in the FX market? High-frequency traders (HFTs) have had a significant impact on the foreign exchange (FX) …

Read ArticleHow to Find Average Code in Java Calculating the average value of a set of numbers is a common task in many programming languages, including Java. …

Read ArticleUnderstanding Section 721 of the Dodd-Frank Act Section 721 of the Dodd-Frank Wall Street Reform and Consumer Protection Act, also known as the …

Read Article