Can I Trade Options with Margin? Explained

Trading Options with Margin: Everything You Need to Know Trading options with margin can be a lucrative strategy for experienced traders, but it is …

Read Article

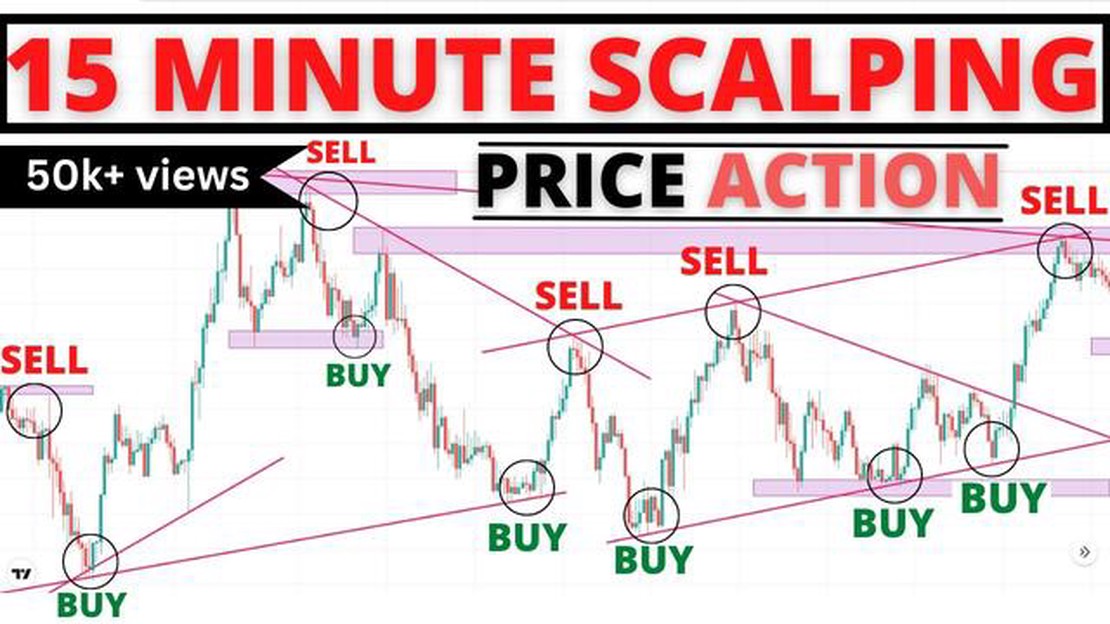

In the fast-paced world of forex trading, having a solid strategy is essential for success. One popular strategy among traders is the M15 strategy, which is based on the 15-minute timeframe. This strategy allows traders to take advantage of short-term price movements and make quick profits.

The M15 strategy involves analyzing the price charts and identifying trends and patterns within the 15-minute timeframe. Traders use various technical indicators and tools, such as moving averages, oscillators, and support and resistance levels, to make informed decisions about when to enter and exit trades.

One of the main advantages of the M15 strategy is its flexibility. Traders can use this strategy in different market conditions, including trending and ranging markets. It allows them to adapt to changing market conditions and take advantage of various opportunities.

However, like any trading strategy, the M15 strategy also has its drawbacks. The short timeframe may lead to increased market noise and false signals, which can result in losses. Therefore, it is important for traders to carefully analyze and confirm signals before entering trades.

By understanding and mastering the M15 strategy, you can enhance your trading performance and increase your chances of success in the dynamic forex market.

The M15 strategy refers to a specific time frame used in Forex trading, known as the 15-minute chart. Traders who employ the M15 strategy analyze price action and make trading decisions based on the movements and patterns observed within this particular time frame.

The M15 strategy is considered a short-term trading strategy, as it focuses on capturing smaller market movements over a 15-minute period. This time frame allows traders to take advantage of intraday price fluctuations and potential profit opportunities.

Traders using the M15 strategy often combine it with other technical indicators and tools to enhance their analysis and decision-making process. They may look for support and resistance levels, trend lines, and candlestick patterns to identify potential entry and exit points.

The M15 strategy is favored by day traders who are looking to make quick trades and capitalize on short-term price movements. It requires constant monitoring of the market and the ability to react quickly to changing conditions.

It is important to note that the M15 strategy is just one of many different strategies used in Forex trading. Traders should choose a strategy that aligns with their trading style, risk tolerance, and market conditions.

| Pros of the M15 strategy | Cons of the M15 strategy |

| - Can provide numerous trading opportunities within a short period | - Requires constant monitoring and attention |

| - Allows traders to capitalize on short-term price movements | - May result in more frequent trading costs |

| - Can be combined with other technical indicators for enhanced analysis | - May be more suitable for experienced traders |

In conclusion, the M15 strategy is a short-term trading approach that focuses on capturing smaller market movements within a 15-minute time frame. Traders should carefully consider their trading style and risk tolerance when deciding whether to implement this strategy, as it requires constant monitoring and quick decision-making.

The M15 strategy in forex trading offers several benefits to traders looking for short-term trading opportunities. Here are some of the key advantages:

Read Also: Understanding W1 in trading: Key factors and implications

1. Increased trading opportunities: The M15 strategy focuses on trading within a 15-minute timeframe, allowing traders to identify and execute multiple trades throughout the day. This increases the potential for profits as there are more opportunities to enter and exit the market.

2. Quick decision-making: Since the M15 strategy is based on shorter timeframes, traders can make quick decisions on entering or exiting trades. This allows for greater flexibility and agility in response to market conditions.

Read Also: Understanding The Concepts of 'Open' and 'Close' in Forex Trading

3. Reduced risk exposure: Shorter timeframes typically involve smaller price movements, reducing the risk exposure of traders. This can be beneficial for those who prefer a more conservative trading approach and want to limit their potential losses.

4. Better trade precision: The M15 strategy allows traders to closely monitor market trends and price movements within a specific timeframe. This can provide more accurate insights into market behavior and improve trade precision.

5. Suitable for beginners: The M15 strategy is relatively simple and easy to understand, making it suitable for beginner traders. It provides a good starting point for learning about technical analysis and developing trading skills.

6. Compatible with various trading styles: The M15 strategy can be used with different trading styles, such as scalping or day trading. Traders can adapt the strategy to their preferred style and trading goals, making it versatile and adaptable.

7. Potential for consistent profits: With proper risk management and disciplined execution, the M15 strategy has the potential to generate consistent profits. Traders can take advantage of frequent trading opportunities and capitalize on short-term price movements.

In conclusion, the M15 strategy offers several benefits to forex traders, including increased trading opportunities, quick decision-making, reduced risk exposure, better trade precision, suitability for beginners, compatibility with various trading styles, and the potential for consistent profits.

The M15 strategy in Forex trading refers to a trading strategy that is based on using the 15-minute time frame for making trading decisions. Traders who follow this strategy analyze the price movements and indicators on the M15 chart to identify potential trading opportunities. They look for patterns, support and resistance levels, and other technical indicators to determine entry and exit points for their trades. The strategy works by taking advantage of short-term price fluctuations and aiming to profit from quick trades.

Using the M15 strategy in Forex trading offers several benefits. First, it allows traders to make quick trades and take advantage of short-term price movements. This can lead to more frequent trading opportunities and potentially higher profits. Second, the 15-minute time frame provides a balanced perspective between short-term and long-term trends, allowing traders to identify both short-term and medium-term trading opportunities. Finally, the strategy reduces the risk of overnight market gaps, as traders close their positions before the end of the trading day.

While the M15 strategy has its advantages, it also has some drawbacks. One drawback is that it requires traders to constantly monitor the market, as trading opportunities can arise and disappear within the 15-minute time frame. This can be time-consuming and may not be suitable for traders with limited time availability. Additionally, the strategy may be more prone to false signals and market noise compared to longer-term strategies, as it focuses on short-term price fluctuations. Traders using the M15 strategy need to have a good understanding of technical analysis and risk management to filter out potential false signals.

Traders using the M15 strategy can utilize a range of indicators and tools to help them make trading decisions. Some commonly used indicators include moving averages, trend lines, support and resistance levels, and oscillators like the Relative Strength Index (RSI) and Stochastic Oscillator. Additionally, traders can use chart patterns, such as head and shoulders, flags, and triangles, to identify potential market reversals or continuation patterns. It’s important for traders to experiment with different indicators and tools to find the ones that work best for their trading style and preferences.

Yes, the M15 strategy can be combined with other strategies to enhance trading decisions. Some traders may use longer-term strategies, like the daily or weekly time frames, to identify the overall trend direction, and then use the M15 strategy to fine-tune their entries and exits within that trend. This combination can provide a broader perspective on the market and reduce the risk of entering trades against the prevailing trend. It’s important for traders to backtest and thoroughly analyze any combination of strategies to ensure that they complement each other and align with their trading goals.

The M15 strategy in forex trading refers to a trading strategy that focuses on analyzing and making trading decisions based on the 15-minute time frame. Traders using this strategy will look for trading opportunities using technical analysis indicators and patterns that are effective within this specific time frame.

Trading Options with Margin: Everything You Need to Know Trading options with margin can be a lucrative strategy for experienced traders, but it is …

Read ArticleHow to interpret a PSY indicator Understanding and interpreting the PSY (Psychological Price Index) indicator can be a valuable tool for traders and …

Read ArticleEU ETS emitters: A Complete Guide The European Union Emissions Trading System (EU ETS) is a key policy tool used by the European Union member states …

Read ArticleIs Metatrader 4 legal in Canada? Metatrader 4 (MT4) is a popular trading platform used by individuals and brokerage firms around the world. However, …

Read ArticleWhat is a mini 30 good for? If you’re looking for a versatile and compact rifle, the Mini 30 might be just what you need. The Ruger Mini 30 is a …

Read ArticleIs there a future for Twilio? Twilio, a cloud communications platform, has been gaining significant attention in recent years as businesses …

Read Article