Understanding FX Credit Risk: Essential Concepts and Risk Mitigation

Understanding FX Credit Risk: A Comprehensive Guide Foreign exchange (FX) credit risk is an important and complex concept in the world of finance. It …

Read Article

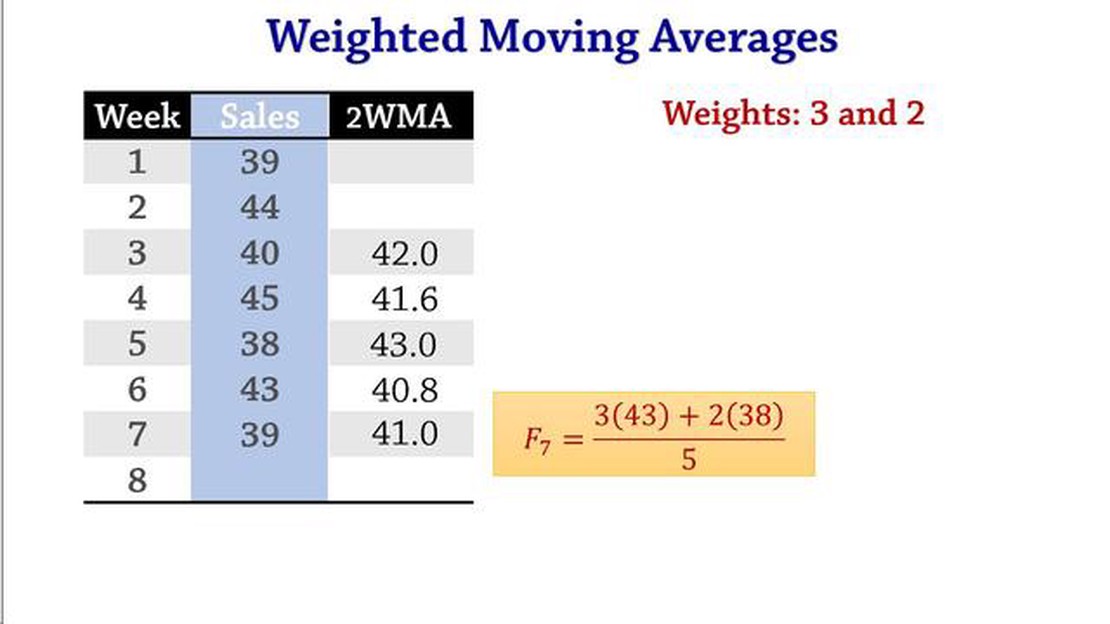

The weighted moving average method is a powerful tool used in data analysis and forecasting. This method assigns different weights to the data points in a time series, giving more importance to recent observations. By incorporating weights, the technique is able to capture short-term trends and fluctuations in the data, providing a more accurate representation of the underlying patterns.

One of the main benefits of using the weighted moving average method is its ability to adapt to changing circumstances. Unlike simple moving averages that equally weigh all data points, the weighted moving average gives more weight to recent data, which is often a better indicator of the current state of affairs. This flexibility allows analysts to respond quickly to sudden shifts in the data and make informed decisions based on the most up-to-date information.

Another advantage of the weighted moving average method is its ability to smooth out noise and eliminate outliers in the data. By assigning higher weights to recent observations, the technique reduces the impact of random fluctuations and focuses on the underlying trends. This makes it easier to identify long-term patterns and make reliable forecasts.

The weighted moving average method is widely used in various industries and fields, including finance, economics, and marketing. Its versatility and accuracy make it a valuable tool for trend analysis, demand forecasting, and budget planning. By using this method, businesses can gain valuable insights into market trends, make more accurate predictions, and make informed decisions that drive success.

The weighted moving average technique is a popular method used in various industries and fields of study. It offers several advantages that make it a valuable tool for analysts and decision-makers. Below are some of the key benefits of using the weighted moving average technique:

Read Also: Understanding forex buying rate and its significance in currency trading

In conclusion, the weighted moving average technique offers several advantages that make it a valuable tool for analyzing and forecasting data. Its accurate representation, smoother trend identification, flexibility, responsiveness to changes, and ease of implementation make it a preferred choice in various industries and fields.

The weighted moving average method is widely used in forecasting as it takes into account the importance of recent data points. However, there are several ways to enhance the accuracy of the forecast when using this method.

1. Adjusting the weights: One way to improve forecast accuracy is by adjusting the weights assigned to each data point. By assigning higher weights to more recent data, the forecast will be more responsive to recent changes in the data. This can help capture short-term trends and reduce the impact of outliers.

2. Using different time periods: Another way to enhance forecast accuracy is by using different time periods for the moving average calculation. Instead of using the same time period for all data points, you can vary the length of the moving average based on the characteristics of the data. For example, if the data exhibits a seasonal pattern, you can use a shorter time period to capture the seasonal fluctuations.

3. Incorporating other factors: To further improve forecast accuracy, you can consider incorporating other factors that may affect the data. For example, you can include dummy variables to account for holidays or other special events that may impact the data. By including these additional factors, the forecast will be better able to capture the underlying drivers of the data.

4. Monitoring and updating: It is important to regularly monitor and update the forecast to ensure its accuracy. As new data becomes available, the forecast should be adjusted accordingly. This will help capture any changes or trends in the data and improve the accuracy of the forecast over time.

In conclusion, while the weighted moving average method is a useful tool for forecasting, there are several ways to enhance its accuracy. By adjusting the weights, using different time periods, incorporating other factors, and regularly updating the forecast, you can improve the accuracy of your predictions and make more informed decisions based on the forecasted data.

Using the weighted moving average method can help you predict future trends more accurately by giving more weight to recent data points. This can be especially useful in situations where the most recent data is more relevant or impactful than older data.

Read Also: Can Forex Trading Really Make You a Lot of Money? - Exploring the Potential Profits of Forex Trading

The weighted moving average method differs from the simple moving average method by assigning different weights to each data point. In a simple moving average, all data points are given equal weight. In a weighted moving average, recent data points are given more weight, while older data points are given less weight. This allows the weighted moving average to be more responsive to recent changes in the data.

The weighted moving average method is particularly useful in situations where recent data is more relevant or impactful than older data. If you have reason to believe that recent trends or changes in the data are more indicative of future patterns, then the weighted moving average method can help you make more accurate predictions.

Yes, the weighted moving average method can be used for both short-term and long-term forecasting. The length of the time period used to calculate the moving average will determine whether the forecast is more short-term or long-term. Shorter time periods, such as weeks or months, will result in shorter-term forecasts, while longer time periods, such as years, will result in longer-term forecasts.

One potential drawback of using the weighted moving average method is that it can be more complicated to implement and calculate compared to simpler forecasting techniques. Additionally, the weights assigned to each data point are subjective and can vary depending on the specific analysis or situation. This subjectivity can introduce bias into the forecast. It is also worth noting that the weighted moving average method may not be suitable for all types of data or forecasting scenarios.

Understanding FX Credit Risk: A Comprehensive Guide Foreign exchange (FX) credit risk is an important and complex concept in the world of finance. It …

Read ArticleCan Indians trade in Singapore stock market? Are you an Indian investor interested in exploring opportunities in the global financial markets? The …

Read ArticleWhat happens if a calendar spread expires? A calendar spread is an options strategy that involves buying and selling two options with different …

Read ArticleWhat is the best BTST strategy? When it comes to trading on the stock market, there are a multitude of strategies to choose from. One popular and …

Read ArticleGuide to Calculating Moving Average in C Moving averages are widely used in financial analysis, signal processing, and data smoothing. They help to …

Read ArticleUnderstanding the Moving Average on a Graph In the field of finance, analyzing trends and patterns from data is crucial for making informed decisions. …

Read Article