Understanding the Pricing of Call Options in the Financial Market

Understanding the Pricing of Call Options In the financial markets, call options play a crucial role in providing investors with the opportunity to …

Read Article

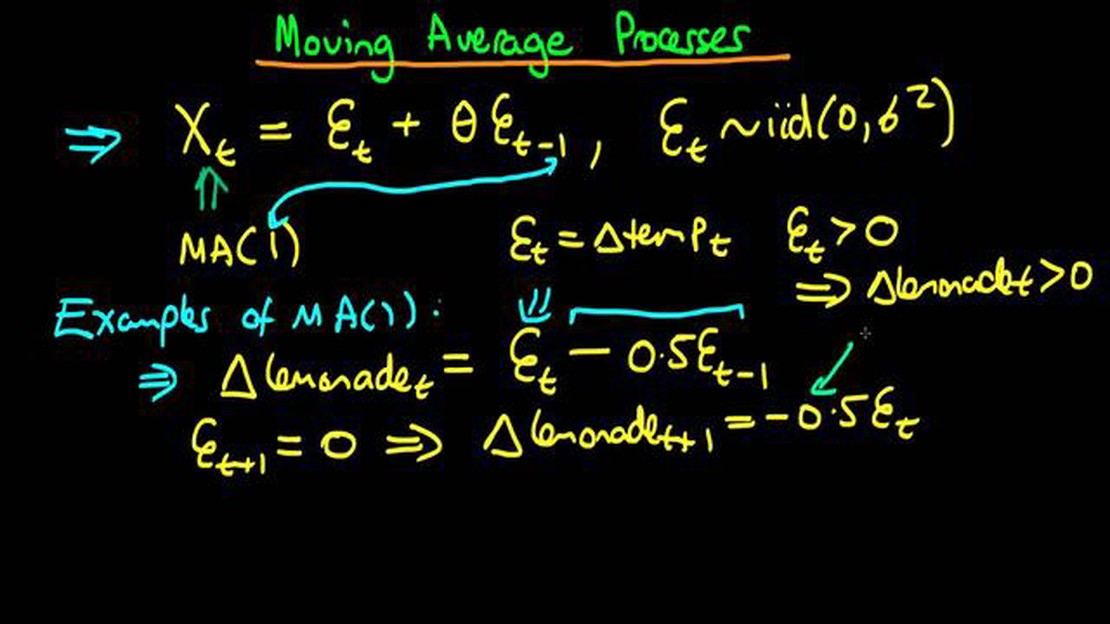

MA (Moving Average) models are a popular tool in the field of time series analysis. They are used to analyze and forecast trends in data by taking into account the moving average of past observations. One specific type of MA model is the MA 1 model.

In a MA 1 model, the forecasted value at a given time is a linear combination of the past observation and a random error term. The “1” in MA 1 refers to the fact that the forecasted value only depends on the most recent observation and one lagged error term. This means that the model only looks at two time points to generate a forecast.

The MA 1 model is particularly useful in situations where there is a short-term effect or influence in the data. For example, if you are analyzing daily stock prices, the MA 1 model can help capture any short-term fluctuations or random shocks in the market. It provides a simple yet effective way to account for these factors in forecasting future values.

Overall, MA (Moving Average) models, including the MA 1 model, are valuable tools for analyzing and forecasting trends in data. They allow researchers and analysts to take into account the moving average of past observations and incorporate any short-term effects or influences. Understanding and implementing these models can greatly improve the accuracy of forecasts in a wide range of fields.

Introduction

An MA 1 model, or Moving Average 1 model, is a type of time series model used in statistics and econometrics. It is a simple and widely used model that helps analyze and predict fluctuations in data over time.

What is an MA 1 Model?

An MA 1 model is a specific type of moving average model. In an MA 1 model, the current value of a variable is predicted based on the weighted average of the current and one previous value of the variable. The “1” in MA 1 refers to the number of lagged values included in the model.

How Does an MA 1 Model Work?

In an MA 1 model, the prediction for the current value of a variable is calculated using the formula:

*Y(t) = E(t) + θ(1)E(t-1)

where Y(t) is the current value of the variable, E(t) is the prediction error at time t, and θ(1) is the weight assigned to the previous prediction error.

Key Features of MA 1 Models

• MA 1 models are characterized by a constant mean and a constant variance.

• MA 1 models exhibit a predictable pattern of oscillation, with the values generally reverting back to the mean over time.

Read Also: Understanding 100000 Contract Size in Forex: A Comprehensive Guide

• MA 1 models are widely used in time series analysis, forecasting, and trend analysis.

Applications of MA 1 Models

• Financial forecasting: MA 1 models are used to predict future stock prices, exchange rates, and other financial variables.

• Inventory management: MA 1 models help determine optimal inventory levels and predict demand fluctuations.

Read Also: A Comprehensive Guide on Understanding Stock Options in Your Offer Letter

• Quality control: MA 1 models are used to detect and predict deviations from quality standards in manufacturing processes.

Conclusion

MA 1 models provide a useful tool for analyzing and predicting fluctuations in data over time. By understanding the principles behind MA 1 models and their applications, you can effectively incorporate them into your statistical analysis and make more informed decisions based on the data.

A MA 1 model, or Moving Average 1 model, is a type of time series model used in forecasting and analysis. It is a simple form of the moving average model that considers only the current value and the immediately preceding value to make predictions.

The MA 1 model assumes that the value of a variable is a linear combination of past error terms. The term “MA 1” refers to the order of the model, where “1” represents that it only considers one preceding value in the calculation of the moving average.

The formula for the MA 1 model can be expressed as follows:

Xt = μ + εt + θ1εt-1

Where:

The MA 1 model is often used to analyze and forecast time series data with random fluctuations or noise. It can be employed in various fields such as finance, economics, and engineering.

By estimating the coefficients of the model, analysts can gain insights into the relationship between the variables and make predictions about future values. The MA 1 model is particularly useful when the time series data exhibits a specific pattern or trend.

Overall, the MA 1 model provides a simple yet effective framework for understanding and forecasting time series data. It is a valuable tool in the field of statistical analysis and plays a significant role in various domains.

A MA 1 (Moving Average 1) model is a type of time series model that is used to forecast future values based on the average of past observations. It is a simple model that assumes the current value of a variable is a linear combination of the most recent observation and a constant. The model takes into account only the immediate past observation and is useful for capturing short-term trends and patterns in the data.

A MA 1 model works by calculating the average of the most recent observation and a constant to forecast future values. It assumes that the current value of a variable depends only on the immediate past observation and a constant term. The model updates as new observations become available, incorporating the latest information into the forecast. The forecasted values from a MA 1 model can be useful for predicting short-term trends and patterns in time series data.

Understanding the Pricing of Call Options In the financial markets, call options play a crucial role in providing investors with the opportunity to …

Read ArticleUnderstanding the Decay Rate of 0DTE Options When it comes to trading options, understanding the decay rate is crucial. It is especially important to …

Read ArticleConvert $1 Pesos to US dollars When traveling to Mexico, one might wonder how much their money is worth in US dollars. Specifically, if you have …

Read ArticleExploring the Formula for EMA in SMA The moving average is a popular technical analysis indicator used by traders to identify trends and predict …

Read ArticlePros and Cons of Cash Deficiency and Cash Surplus for Companies Managing cash flow is a critical aspect of running a successful business. However, …

Read ArticleBest API for Algorithmic Trading: Exploring the Top Choices Algorithmic trading has revolutionized the way traders make investment decisions. With the …

Read Article