What is over that one Cannot take stock crossword - Unraveling the Mystery

What is over that one Cannot take stock crossword? The crossword puzzle has long been a favorite pastime for millions of people around the world. With …

Read Article

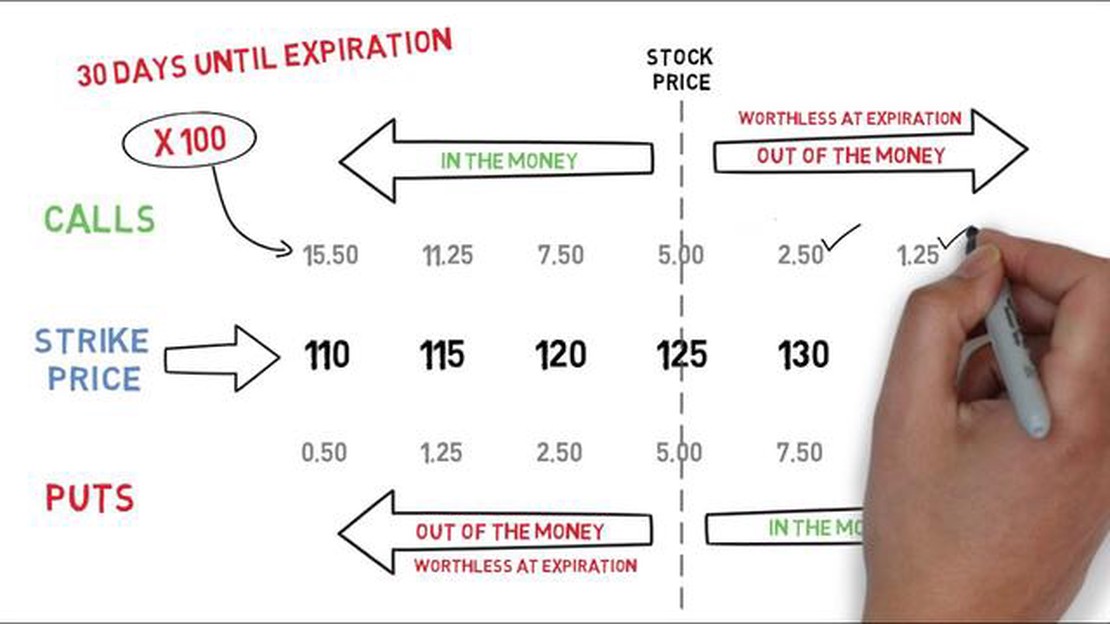

In the financial markets, call options play a crucial role in providing investors with the opportunity to profit from the price movements of a particular asset. A call option gives the holder the right, but not the obligation, to buy the underlying asset at a specific price (known as the strike price) within a certain timeframe. Understanding the pricing of call options is essential for investors looking to optimize their investment strategies and minimize risks.

There are several factors that influence the pricing of call options. The most important factors include the current price of the underlying asset, the strike price, the time remaining until expiration, market conditions, and volatility. The relationship between these factors determines the price at which the call option is traded in the market.

Volatility is a key component in pricing call options. Higher volatility increases the likelihood of large price swings in the underlying asset, which in turn increases the potential profitability of the call option. This is because a volatile market provides more opportunities for the underlying asset’s price to exceed the strike price, resulting in higher profit for the call option holder. Conversely, when volatility is low, call options may be priced lower as there is less chance for significant price movements.

Another important factor in pricing call options is time remaining until expiration. As the expiration date approaches, the time value of the option decreases. This means that the longer the time remaining, the higher the price of the call option, as there is more time for the underlying asset’s price to reach or exceed the strike price. As the expiration date nears, the time value diminishes, and the price of the call option may decline.

Understanding the intricacies of call option pricing is vital for investors looking to make informed decisions in the financial market. By analyzing and interpreting the factors that drive call option prices, investors can better assess their risks and potential profits. Moreover, an understanding of call option pricing allows investors to develop strategies that align with their risk tolerance and investment objectives.

A call option is a financial contract that gives the holder the right, but not the obligation, to buy a specific underlying asset at a predetermined price within a specified time period. The underlying asset can be a stock, an index, a commodity, or even a currency.

When an investor purchases a call option, they are essentially buying the right to purchase the underlying asset at the strike price, which is the predetermined price mentioned earlier. This option can be exercised anytime before the expiration date of the contract.

The price at which the option is bought is known as the premium. The premium is determined by a variety of factors, including the current market price of the underlying asset, the strike price, the time remaining until expiration, and the volatility of the underlying asset.

If the underlying asset’s market price rises above the strike price, the call option becomes in-the-money, and the holder can exercise their option to buy the asset at the strike price. They can then sell the asset at the market price, making a profit equal to the difference between the market price and the strike price, minus the premium paid for the option.

On the other hand, if the underlying asset’s market price remains below the strike price or decreases, the call option is out-of-the-money, and the holder may choose not to exercise their option. In this case, the holder only loses the premium they paid for the option.

Read Also: How to Optimize Your Trading Strategy: Proven Techniques and Best Practices

Call options provide investors with the opportunity to benefit from the potential upside of an asset without having to commit to buying the asset outright. They also allow investors to hedge their positions or speculate on the future movements of the underlying asset.

It is important for investors to carefully consider their investment objectives, risk tolerance, and market conditions before engaging in call options trading. Understanding the basics of call options can help investors make informed decisions and manage their risks effectively.

Call option prices in the financial market are influenced by several factors. Traders and investors need to understand these factors in order to make informed decisions when trading call options. The following are the key factors that affect call option prices:

| Factor | Description |

|---|---|

| Underlying Stock Price | The price of the underlying stock has a direct impact on the price of a call option. As the price of the stock increases, the call option becomes more valuable, as it gives the holder the right to buy the stock at a lower price and potentially profit from the price difference. |

| Strike Price | The strike price is the predetermined price at which the holder of the call option can buy the underlying stock. The relationship between the strike price and the current stock price affects the call option price. Generally, the closer the strike price is to the current stock price, the higher the call option price. |

| Time to Expiration | The time remaining until the expiration of the call option affects its price. As the expiration date approaches, the call option becomes less valuable, as there is less time for the stock price to move in a favorable direction. The longer the time to expiration, the higher the call option price. |

| Volatility | Volatility refers to the degree of price fluctuations in the underlying stock. Higher volatility leads to higher call option prices, as there is a greater likelihood of the stock price reaching or surpassing the strike price before the option expires. |

| Interest Rates | Changes in interest rates also impact call option prices. As interest rates increase, call option prices generally decrease, as the cost of carrying the stock position increases. Conversely, when interest rates decrease, call option prices tend to increase. |

| Dividends | If the underlying stock pays dividends, it affects the price of the call option. When a dividend is paid, the stock price typically decreases, leading to a decrease in the call option price. |

Understanding these factors and how they influence call option prices is essential for traders and investors to effectively navigate the options market and make informed trading decisions.

There are several popular pricing models used to determine the value of call options in the financial market. These models are based on various assumptions and mathematical equations that take into account factors such as the stock price, strike price, time to expiration, risk-free interest rate, and volatility.

Read Also: What is the minimum deposit in MetaTrader 5? | Learn about the minimum deposit required for MetaTrader 5 trading3. Cox-Ross-Rubinstein Model: Also known as the binomial option pricing model, this pricing model is an extension of the original binomial model. It adds the concept of the risk-neutral probability, which adjusts the probabilities of up and down movements in the stock price based on the risk-free interest rate. This model is commonly used for valuing options with multiple time steps.

4. Monte Carlo Simulation: This pricing model uses randomly generated stock price paths to estimate the value of an option. By simulating a large number of possible future paths and calculating the average value, the option price can be estimated. Monte Carlo simulation takes into account the randomness and volatility of the stock price movement.

5. Finite Difference Methods: These numerical methods solve the partial differential equation that represents the option pricing problem. The finite difference methods discretize the time and price domains and approximate the derivatives in the equation. These methods are computationally intensive but can handle complex option pricing problems with various factors.

4. Monte Carlo Simulation: This pricing model uses randomly generated stock price paths to estimate the value of an option. By simulating a large number of possible future paths and calculating the average value, the option price can be estimated. Monte Carlo simulation takes into account the randomness and volatility of the stock price movement.

5. Finite Difference Methods: These numerical methods solve the partial differential equation that represents the option pricing problem. The finite difference methods discretize the time and price domains and approximate the derivatives in the equation. These methods are computationally intensive but can handle complex option pricing problems with various factors.

Call options are financial derivatives that give the holder the right, but not the obligation, to buy a specified quantity of a security at a predetermined price, called the strike price, within a certain period of time.

Call options are priced based on several factors, including the current price of the underlying security, the strike price, the time to expiration, the expected volatility of the underlying security, and the risk-free interest rate. These factors are used to calculate an option’s theoretical value using various pricing models, such as the Black-Scholes model.

The price of a call option generally increases as the price of the underlying security increases. This is because as the price of the underlying security rises, the potential for the option to be exercised and for the holder to profit also increases.

As time to expiration decreases, the price of a call option tends to decrease. This is because the likelihood of the option being in-the-money and profitable decreases as time passes. Additionally, time decay, or the erosion of the option’s time value, occurs as the option approaches expiration.

Implied volatility is a measure of the market’s expectation of the future volatility of the underlying security. Higher implied volatility generally leads to higher option prices, including call options. This is because higher volatility increases the likelihood of large price movements, which can result in larger potential gains for call option holders.

Call options are financial contracts that give the holder the right, but not the obligation, to buy a specified quantity of an underlying asset at a predetermined price within a given time period. They are commonly used in the financial market to speculate on the price of the underlying asset or to hedge existing positions.

What is over that one Cannot take stock crossword? The crossword puzzle has long been a favorite pastime for millions of people around the world. With …

Read ArticleCan I transfer shares of stock from one broker to another? Investing in the stock market can be an exciting and rewarding experience. However, as an …

Read Article1 NZD to JPY Exchange Rate: Current Conversion Rate The exchange rate between the New Zealand dollar (NZD) and the Japanese yen (JPY) is an important …

Read ArticleHow Long Should I Test My Trading Strategy? Developing a successful trading strategy requires careful planning, analysis, and extensive testing. One …

Read ArticleWhat is the Best Time of Day to Buy Stocks? Timing is crucial in the world of stock market investing. Knowing when to buy and sell stocks can make a …

Read ArticleHow much money do equity traders make? Equity trading is a lucrative field that attracts many individuals with its promise of high earning potential. …

Read Article