Creating an Effective Trading Journal: What It Should Look Like

Creating an Effective Trading Journal: Key Elements and Examples Trading is a complex and fast-paced activity, where even the smallest details can …

Read Article

When it comes to running a successful business, accurate pricing forecasts are key. Being able to determine the right price for your products or services can greatly impact your sales and profitability. However, forecasting pricing can be a challenging task that requires careful analysis and calculation.

Forward pricing, also known as forward pricing analysis, is a method widely used by businesses to estimate the future price of their offerings. It involves examining various factors that influence pricing, such as market trends, competition, costs, and customer preferences. By considering these factors, businesses can make informed decisions about pricing strategies and stay ahead in the market.

Accurate pricing forecasts are crucial for maintaining profitability and staying competitive. Without accurate pricing, businesses risk underpricing their products, which can lead to lower profit margins and even financial losses. On the other hand, overpricing can deter customers and result in lost sales. Therefore, mastering the art of calculating forward pricing is essential for any business looking to succeed.

In this guide, we will walk you through the process of calculating forward pricing. We will explore the key factors to consider, the methods used for analysis, and the strategies for implementing accurate pricing forecasts. Whether you are a small business owner, a pricing analyst, or a marketing professional, this guide will provide you with valuable insights to help you make informed pricing decisions.

Calculating forward pricing is an essential task for businesses in order to accurately predict and plan for future pricing strategies. By analyzing market trends, competitor pricing, and internal costs, companies can make informed decisions and set competitive prices.

Here are some steps to help you calculate forward pricing:

By following these steps and continuously monitoring the market, you can calculate forward pricing that aligns with your business goals, ensures profitability, and maintains a competitive edge. Remember, pricing is a dynamic process that requires ongoing analysis and adjustment to stay ahead in the market.

Read Also: Choosing the Best Technical Indicator for Intraday Trading: A Comprehensive Guide

Forward pricing forecasts play a crucial role in accurately determining the future price of a product or service. These forecasts provide businesses with valuable insight into how market forces and other external factors may impact pricing in the future.

By analyzing historical data, current market trends, and relevant industry information, businesses can generate forward pricing forecasts. These forecasts serve as a guide for strategic decision-making, helping businesses determine optimal pricing strategies, assess potential risks, and identify opportunities for growth.

Why are forward pricing forecasts important?

Forward pricing forecasts allow businesses to take a proactive approach to pricing strategy. By accurately predicting future prices, businesses can effectively plan and allocate resources, adjust product offerings, and optimize revenue streams. These forecasts enable businesses to adapt to changing market conditions and stay competitive in a rapidly evolving business landscape.

The key components of forward pricing forecasts

There are several key components that businesses consider when generating forward pricing forecasts:

The limitations of forward pricing forecasts

While forward pricing forecasts provide valuable insights, businesses must also recognize their limitations. Market dynamics and external factors can be unpredictable, and unforeseen events can impact pricing in unexpected ways. It is important for businesses to continuously monitor and evaluate pricing forecasts to ensure they remain accurate and relevant.

Read Also: Here’s the Latest Share Price of Lnkd - Don't Miss Out!

In conclusion, forward pricing forecasts are an essential tool for businesses looking to make informed pricing decisions. By leveraging historical data, market trends, and industry information, businesses can navigate the complex pricing landscape and maximize their profitability.

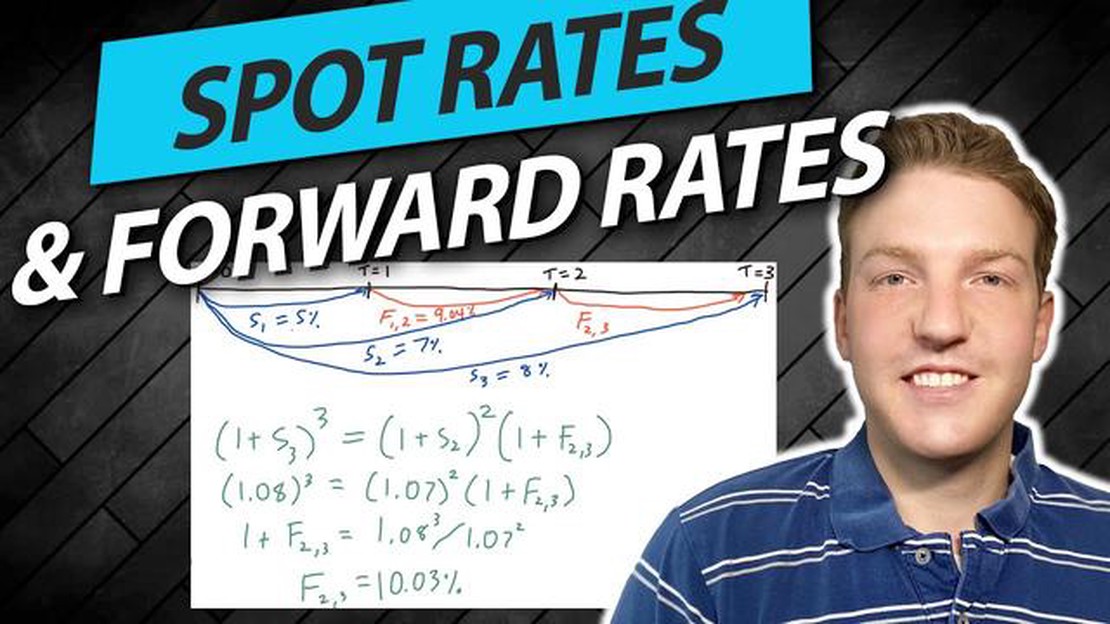

Forward pricing is a method of predicting the future value of a financial asset or security. It involves analyzing various factors such as market trends, historical data, and economic indicators to forecast the price of an asset in the future.

Forward pricing is important because it helps investors make informed decisions about buying or selling financial assets. By accurately predicting the future price of an asset, investors can determine whether it is a good time to buy or sell, thereby maximizing their potential profits and minimizing their risks.

There are several key factors to consider when calculating forward pricing. These include current market conditions, historical price data, supply and demand dynamics, interest rates, economic indicators, and geopolitical events. Additionally, it is important to use proper forecasting methods and analyze the data accurately to ensure the most accurate pricing forecast.

To improve the accuracy of forward pricing forecasts, you can employ several strategies. First, ensure that you have access to reliable and up-to-date data. Use advanced analytical techniques and models to analyze the data and identify trends and patterns. Additionally, consider using a combination of quantitative and qualitative analysis to gain a comprehensive understanding of the market. Regularly review and update your forecasts based on new information and adjust your strategies accordingly.

Creating an Effective Trading Journal: Key Elements and Examples Trading is a complex and fast-paced activity, where even the smallest details can …

Read ArticleWhat is the margin leverage for Interactive Brokers forex? Margin leverage is a key concept in forex trading, and Interactive Brokers is a well-known …

Read ArticleForex Trading in Interactive Brokers If you are interested in trading forex and considering Interactive Brokers as your broker, you may be wondering …

Read ArticleBenefits of Adaptive Moving Average The adaptive moving average (AMA) is a technical indicator that has revolutionized the field of financial …

Read ArticleCompanies that use endur Endur is a powerful software solution that is used by a wide range of companies across various industries. This innovative …

Read ArticleAnalyzing the Trading Market: A Comprehensive Guide Trading in the financial markets can be a lucrative endeavor if approached with the right …

Read Article