Learn about LuLu Forex charges and fees

LuLu forex charges: How much does it cost? When it comes to international money transfers and currency exchange, it’s important to understand the fees …

Read Article

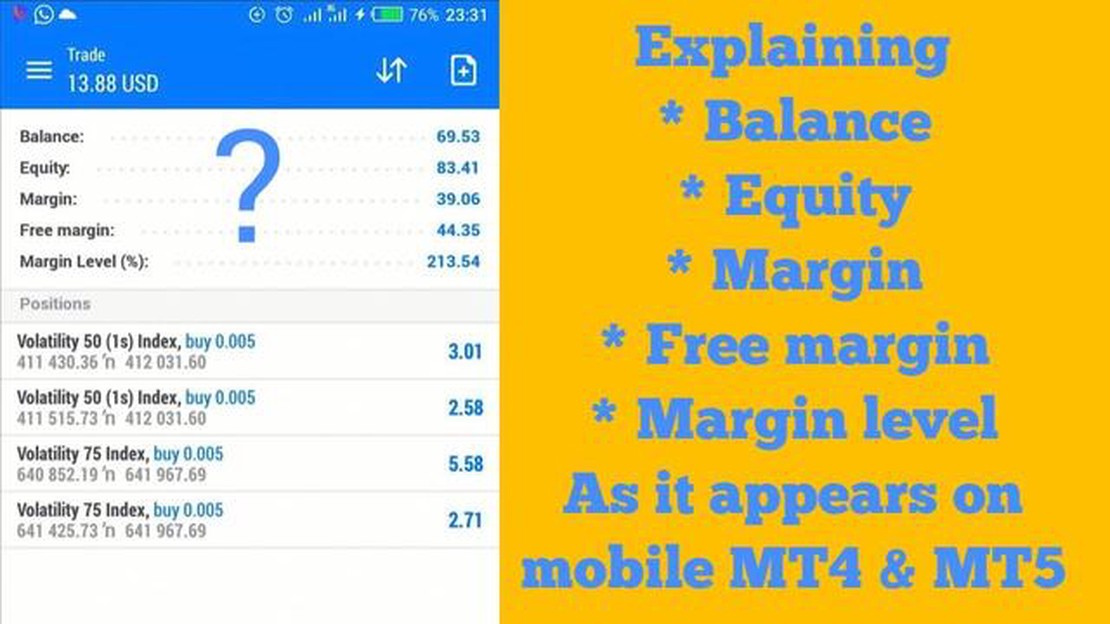

Forex trading is a complex financial market that involves buying and selling currencies. One of the key concepts in forex trading is the notion of free margin. Free margin refers to the amount of money a trader has available in their trading account that can be used to open new positions or cover potential losses.

Free margin is calculated by subtracting the required margin from the account equity. The required margin is the amount of money that a trader needs to keep in their account in order to maintain an open position. It acts as a safety net, ensuring that traders have enough funds to cover any potential losses.

Understanding free margin is crucial for forex traders as it determines their ability to make additional trades. If a trader has a low free margin, it means they have less money available to open new positions. On the other hand, a high free margin gives traders the flexibility to take advantage of new opportunities in the market.

In volatile markets, free margin becomes even more important as it allows traders to manage risk effectively. By having a healthy amount of free margin, traders can weather market fluctuations and potential losses without risking a margin call.

Overall, free margin plays a critical role in forex trading as it directly impacts a trader’s ability to make new trades and manage risk. By understanding this concept and monitoring their free margin levels, traders can make informed decisions and maximize their potential for profitability in the forex market.

Forex free margin refers to the available funds in a trader’s account that can be used to open new positions or sustain existing ones without triggering a margin call. It is the difference between a trader’s equity and the margin required to hold open positions.

When a trader enters a trade, a certain amount of margin gets tied up to maintain that position. This margin acts as a deposit or collateral against potential losses. As the trade moves in the trader’s favor, the value of the position increases, which also increases the equity in the trader’s account.

The free margin is calculated by subtracting the margin required to hold positions from the equity. If the free margin goes below a certain level, known as the margin call level, the broker may issue a margin call, requiring the trader to either close positions or deposit more funds into the account to maintain the required margin.

Here’s a simplified example to understand how free margin works:

Understanding and managing free margin is crucial in forex trading, as it determines the trader’s ability to open new positions and handle potential losses. Traders should always monitor their free margin to ensure they have enough available funds to sustain their trading strategies.

Read Also: What You Need to Know: Forex Stop Loss Hunting

The foreign exchange market, commonly known as forex, is the largest and most liquid financial market in the world. Forex trading involves the buying and selling of currencies with the aim of making a profit. Traders in the forex market speculate on the changes in exchange rates between different currencies.

Forex trading takes place in the global decentralized marketplace, where participants such as banks, financial institutions, and individual traders exchange currencies. The forex market operates 24 hours a day, five days a week, allowing traders to trade at any time convenient for them.

Read Also: Is Nifty Future Trading Profitable? Find Out Here!

One of the key concepts in forex trading is currency pairs. A currency pair represents the value of one currency relative to another. For example, the EUR/USD pair represents the value of the euro compared to the US dollar. Forex traders can choose from a wide range of currency pairs to trade, depending on their trading strategy and market conditions.

Another important aspect of forex trading is leverage. Leverage allows traders to control a larger amount of money in the market with a smaller amount of capital. It magnifies both profits and losses, so traders should use leverage wisely and manage their risk effectively.

Forex trading involves analyzing and interpreting various factors that affect currency exchange rates, such as economic indicators, political events, and market sentiment. Traders use different technical and fundamental analysis tools to make informed trading decisions.

To participate in forex trading, individuals and institutions need to open a forex trading account with a broker. The broker acts as an intermediary between the trader and the forex market. Traders can execute trades through various trading platforms provided by brokers, which offer real-time price quotes, charts, and analysis tools.

Forex trading offers potential opportunities for profit, but it also carries risks. It is important for traders to have a solid understanding of the basics of forex trading, develop a trading strategy, and manage their risk effectively. Continuous learning and practice are essential for success in the forex market.

Forex free margin refers to the amount of funds that are available in a trader’s account to open additional positions. It is the difference between the account equity and the used margin. In other words, it is the additional amount of funds that a trader can use to place new trades or increase the size of existing trades.

Forex free margin can be calculated by subtracting the used margin from the account equity. The used margin is the amount of funds that is currently being used to maintain open positions, while the account equity is the total value of the account including profits or losses from open positions. By subtracting the used margin from the account equity, you can determine the available free margin in the account.

Forex free margin is important because it represents the amount of funds that a trader has available to take advantage of new trading opportunities. It allows traders to open new positions or increase the size of existing positions without the need to deposit additional funds. Having sufficient free margin is crucial for traders to maintain flexibility and manage their risk effectively in the forex market.

If the forex free margin becomes negative, it means that the trader does not have enough funds in their account to cover the required margin for the existing positions. This can lead to a margin call from the broker, where the trader is asked to deposit additional funds to bring the margin level back to an acceptable level. If the trader fails to meet the margin call, the broker may close out some or all of the trader’s positions to mitigate the risk of further losses.

LuLu forex charges: How much does it cost? When it comes to international money transfers and currency exchange, it’s important to understand the fees …

Read ArticleUnderstanding Technical Analysis Strategies Successful trading in the financial markets requires a comprehensive understanding of various analysis …

Read ArticleUnderstanding the Mechanisms of Binary Options Trading Binary options trading is a popular form of investing that allows traders to speculate on the …

Read ArticleUnderstanding CCI Price Divergence: Explained The Commodity Channel Index (CCI) is a powerful technical indicator that can help traders identify …

Read ArticleExchange Rate in Manila: Currency to BDT The currency exchange rate refers to the rate at which one currency can be exchanged for another. In this …

Read ArticleWhat is the Best Stop Loss Rule? Stop loss rule is a crucial aspect of trading that helps protect traders from excessive losses. It is a predefined …

Read Article