Does CBA offer foreign currency accounts?

Does CBA offer foreign currency accounts? CBA (Commonwealth Bank of Australia) is one of the largest banks in Australia, offering a wide range of …

Read Article

Binary options trading is a popular form of investing that allows traders to speculate on the price movements of various assets. Unlike traditional trading methods, binary options trading has a fixed outcome, meaning traders know exactly what they stand to gain or lose before entering a trade.

Binary options trading operates on a simple premise - traders must predict whether the price of an asset will rise or fall within a specific time frame. If their prediction is correct, they receive a fixed payout; if their prediction is incorrect, they lose their initial investment.

One of the key features of binary options trading is the ability to trade on a wide range of assets, including stocks, currencies, commodities, and indices. This allows traders to diversify their portfolio and take advantage of different market conditions.

However, it is important to note that binary options trading carries a high level of risk. Traders must carefully analyze market trends, use technical indicators, and develop effective strategies to increase their chances of success. Additionally, traders should only invest money that they can afford to lose and should never rely solely on binary options trading for their financial needs.

Binary options are a type of financial instrument that allow traders to speculate on the direction of an asset’s price movement. Unlike traditional investing methods, binary options have a fixed payout and a fixed expiration time, making them a popular choice for short-term traders.

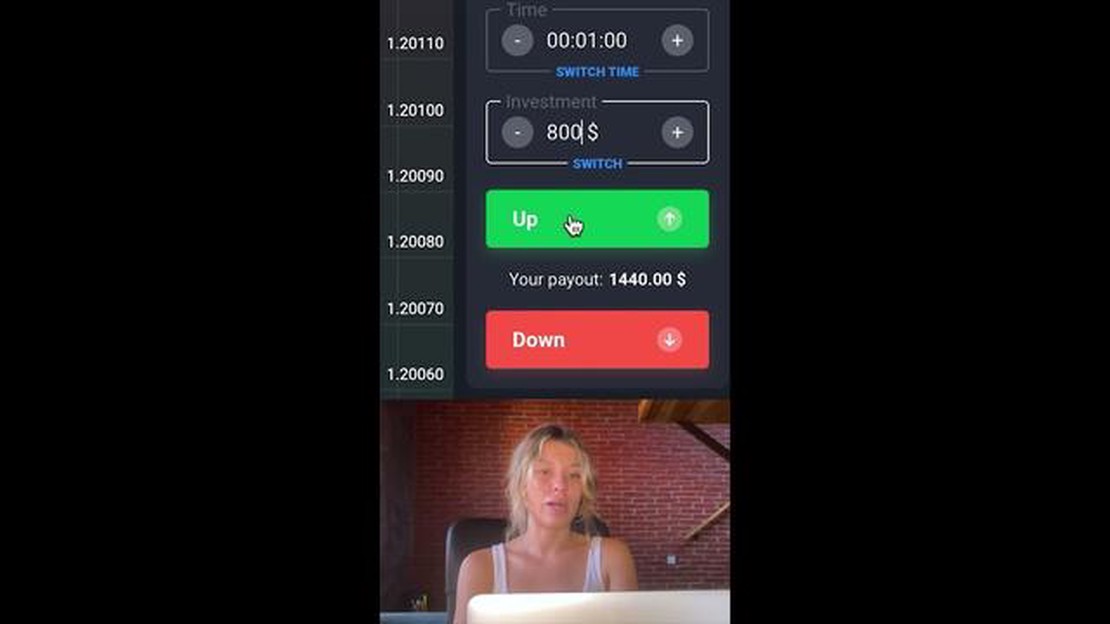

When trading binary options, the trader must select one of two possible outcomes for a given asset: either the price will go up (known as a “Call” option) or the price will go down (known as a “Put” option). If the trader’s prediction is correct at the time of expiration, they will receive a predetermined payout. However, if their prediction is incorrect, they will lose the amount they invested in the trade.

Binary options can be traded on a wide range of assets, including stocks, currencies, commodities, and indices. Traders can choose the specific asset they want to trade, as well as the expiration time, which can range from minutes to months.

One of the advantages of binary options trading is that it offers a fixed risk and reward profile. This means that traders know the potential payout and the potential loss before entering a trade, allowing them to manage their risk more effectively.

Binary options are also known for their simplicity, making them accessible to traders of all experience levels. Unlike traditional options trading, binary options have a straightforward payout structure, with a fixed percentage return on investment.

| Pros | Cons |

|---|---|

| - Potential for high returns | - Risk of losing invested amount |

| - Fixed risk and reward profile | - Limited trading strategies compared to other financial instruments |

| - Wide range of assets to trade | - Market volatility can impact trade outcomes |

| - Accessible to traders of all experience levels | - Limited regulatory oversight |

In conclusion, binary options are a simple and accessible financial instrument that allow traders to speculate on asset price movement. While they offer the potential for high returns, traders should be aware of the risks involved and carefully manage their trades to minimize losses.

Binary options trading is a simple and straightforward method of trading financial assets, where traders make predictions about the future price movement of a specific asset. These predictions are made by traders based on their analysis and understanding of various factors that can influence the market.

Read Also: When Was USD Equal to CAD? A Look at the History of Exchange Rates

When trading binary options, traders are not actually buying or selling the underlying asset. Instead, they are entering into a contract that gives them the right, but not the obligation, to buy or sell the asset at a predetermined price within a specific time frame. The outcome of the trade is based on whether the trader’s prediction is correct or not.

One of the key mechanics of binary options trading is the concept of expiry time. This is the time duration within which the trade must reach its predicted outcome. If the trade expires in the money, meaning the trader’s prediction is correct, they will receive a predetermined payout. If the trade expires out of the money, meaning the trader’s prediction is incorrect, they will lose the amount they invested in the trade.

Read Also: Explaining the Unique Characteristics of European Options

Furthermore, traders have the ability to choose the specific asset they want to trade, such as stocks, currencies, commodities, or indices. They can also choose the amount they want to invest in each trade, as well as the expiry time. It is important for traders to have a clear understanding of their chosen asset and the factors that can influence its price movement in order to make accurate predictions and increase their chances of success.

Binary options trading relies heavily on analysis, both technical and fundamental, to make informed predictions. Traders use various tools and indicators to analyze historical price data, market trends, and economic news to identify potential trading opportunities. It is important for traders to continuously educate themselves and stay updated with the latest market information to make profitable trades.

In conclusion, the mechanics of binary options trading involve making predictions about the future price movement of assets within a specific time frame. Traders enter into contracts based on these predictions and are rewarded or penalized based on the accuracy of their predictions. Understanding the various aspects of binary options trading, including expiry time, chosen assets, and analysis techniques, is crucial for success in this form of trading.

Binary options are a type of financial derivative where traders bet on the price movement of various underlying assets, such as stocks, currencies, or commodities. Traders must predict whether the price will go up or down within a specified time frame.

Binary options trading involves three main components: the underlying asset, the prediction, and the expiry time. Traders choose an asset, such as a stock or currency pair, then predict whether its price will go up or down by the chosen expiry time. If the trader’s prediction is correct, they receive a fixed payout; if it’s wrong, they lose the initial investment.

Binary options trading can be seen as a form of gambling as it involves making predictions based on uncertain outcomes. However, unlike traditional gambling, binary options trading requires some level of knowledge and analysis to improve the chances of making accurate predictions.

Binary options trading carries certain risks, including the potential loss of the entire investment. The fixed nature of payouts means that if the trade is unsuccessful, the trader will lose the entire amount invested. Additionally, some binary options platforms may be unregulated, leading to potential scams or unfair trading practices.

Binary options trading has the potential to be profitable if traders make accurate predictions consistently. However, it requires a deep understanding of the market, technical analysis skills, and risk management strategies. It is important to remember that trading binary options is not a guaranteed way to make money and involves a level of risk.

Binary options are a type of financial option with a fixed payoff. They are called binary options because there are only two possible outcomes - the trader either wins a fixed amount of money or loses the entire investment.

Binary options trading involves predicting whether the price of an underlying asset will go up or down within a certain time frame. Traders need to select a specific asset, choose a direction (up or down), and set an expiration time for the option. If the prediction is correct at the time of expiration, the trader receives a fixed payout.

Does CBA offer foreign currency accounts? CBA (Commonwealth Bank of Australia) is one of the largest banks in Australia, offering a wide range of …

Read ArticleUnderstanding How Block Trade Works Block trades are a method of executing large trades in the financial markets. These trades involve the buying or …

Read ArticleUnderstanding if stock options are considered deferred compensation Stock options are a popular form of compensation for employees, especially those …

Read ArticleHow to Back Test Forex Strategies: A Step-by-Step Guide Back testing is a crucial step in developing a successful forex trading strategy. It allows …

Read ArticleWithdrawing from OANDA: Limits and Procedures As a trader on the OANDA platform, one of the important considerations is the withdrawal limits. It is …

Read ArticleUnderstanding the Difference between a Forex Card and a Credit Card When it comes to international travel or online shopping from foreign websites, …

Read Article