How Much Is 0.01 Lot? Explained | Learn Forex Trading Basics

Understanding the Value of 0.01 Lot in Forex Trading When it comes to forex trading, one of the most common questions that beginners ask is, “How much …

Read Article

Forex trading, also known as foreign exchange trading, is a global decentralized market for trading currencies. It is the largest and most liquid financial market in the world, with an average daily trading volume of over $5 trillion. With its high liquidity and 24/5 availability, forex trading has become a popular investment option for individuals and institutions alike.

When it comes to forex trading, there are various strategies and concepts that traders use to analyze and predict market movements. One such concept is the use of technical indicators, which are mathematical calculations based on historical price and volume data. These indicators help traders identify potential trading opportunities and make informed decisions.

One popular technical indicator used in forex trading is the concept of Bo, or Bollinger Bands. Developed by John Bollinger, Bollinger Bands are a volatility indicator that consists of a centerline and two standard deviation lines. The centerline is typically a simple moving average, while the standard deviation lines are usually set two standard deviations away from the centerline.

The main idea behind Bollinger Bands is that they provide a visual representation of price volatility. When the price is trading within the upper and lower standard deviation lines, it is considered to be in a normal trading range. However, when the price touches or penetrates the upper or lower bands, it is seen as an indication of overbought or oversold conditions, respectively.

By understanding the concept of Bo and incorporating Bollinger Bands into their trading strategies, forex traders can better identify potential trend reversals, entry and exit points, and overall market volatility. However, it’s important to note that no indicator can guarantee profitable trading decisions, and it’s always recommended to use technical indicators in conjunction with other analysis tools and risk management strategies.

Bo, short for “binary options,” is a trading strategy that involves predicting the direction of price movements in foreign currency pairs. It is a type of financial contract where traders speculate on whether the price of a specific currency pair will go up or down within a predetermined timeframe.

In binary options trading, traders do not actually buy or sell the underlying currency but rather make bets on whether the price will rise or fall. They place trades based on their assessment of market conditions, technical analysis, and fundamental factors.

When trading binary options in the forex market, traders have two options: a call option or a put option. A call option is placed when a trader believes that the price of the currency pair will rise, while a put option is placed when a trader believes that the price will fall.

The timeframe for binary options trades can vary, ranging from a few seconds to several hours or even days. Traders need to determine the expiry time for each trade before placing the order.

The outcome of a binary options trade is determined by whether the trader’s prediction was correct or not. If the trader’s prediction is correct, they will receive a fixed payout, typically ranging from 60-90% of the invested amount. However, if the prediction is incorrect, the trader will lose the entire investment.

| Advantages of Bo in Forex Trading | Disadvantages of Bo in Forex Trading |

|---|---|

| 1. Simplicity: Binary options trading is relatively easy to understand and execute, making it accessible to both novice and experienced traders. | 1. Limited Profit Potential: While binary options trading can offer high returns on successful trades, the potential profits are capped at the predetermined payout percentage. |

| 2. Fixed Risk and Reward: Traders know the potential risk and reward from the outset, allowing for better risk management. | 2. Lack of Regulation: Binary options trading is not regulated in many countries, increasing the risk of fraud and unfair practices. |

| 3. Variety of Assets: Binary options trading allows traders to speculate on various currency pairs and other financial assets. | 3. Time Constraints: Binary options trades have predetermined expiry times, which may not always align with the trader’s preferred trading strategy. |

It’s important for traders to carefully assess the risks and rewards associated with binary options trading before getting involved. Having a solid understanding of market conditions, technical analysis, and risk management strategies can help traders make informed decisions and improve their chances of success.

Bo, or binary options, can provide several benefits for traders in the forex market. These benefits include:

1. Simplicity:

Read Also: Can Candlestick Patterns Really Improve Trading Performance?

Bo trading is known for its simplicity. Traders only need to predict the direction of the price movement of an asset within a specified time frame. This simplicity can be advantageous for both beginner and experienced traders.

2. Flexibility:

Bo trading offers flexibility in terms of trade duration. Traders can choose short-term options with expiration times as low as 60 seconds, or they can opt for longer-term options that can last for hours or even days. This flexibility allows traders to adapt their strategies to different market conditions.

3. Limited Risk:

One of the key benefits of Bo trading is the limited risk involved. Traders know the maximum potential loss upfront, as opposed to traditional forex trading where losses can exceed the initial investment. This allows traders to effectively manage their risk and protect their capital.

4. Potential for High Returns:

Read Also: Discover the Best Indicator for RSI Trading Strategies in 2021

Despite the limited risk, Bo trading can offer high returns on investment if the trade is successful. Traders can earn fixed payouts, which are predetermined before entering the trade. This potential for high returns makes Bo trading attractive to many traders.

5. Wide Range of Assets:

Bo trading allows traders to trade a wide range of assets, including currency pairs, commodities, stocks, and indices. This variety of options enables traders to diversify their portfolios and take advantage of different market opportunities.

6. Accessibility:

Bo trading platforms are easily accessible, with many brokers offering online trading platforms that can be accessed from anywhere with an internet connection. This accessibility allows traders to trade forex and other assets at any time, making it convenient for those with busy schedules.

7. Lower Capital Requirements:

Compared to traditional forex trading, Bo trading often requires lower capital requirements. Traders can start with small amounts and gradually increase their investment as they gain experience and confidence in their trading strategies.

In conclusion, Bo trading in the forex market provides simplicity, flexibility, limited risk, potential for high returns, a wide range of assets to choose from, accessibility, and lower capital requirements. These benefits make Bo trading an attractive option for traders looking to profit from forex trading.

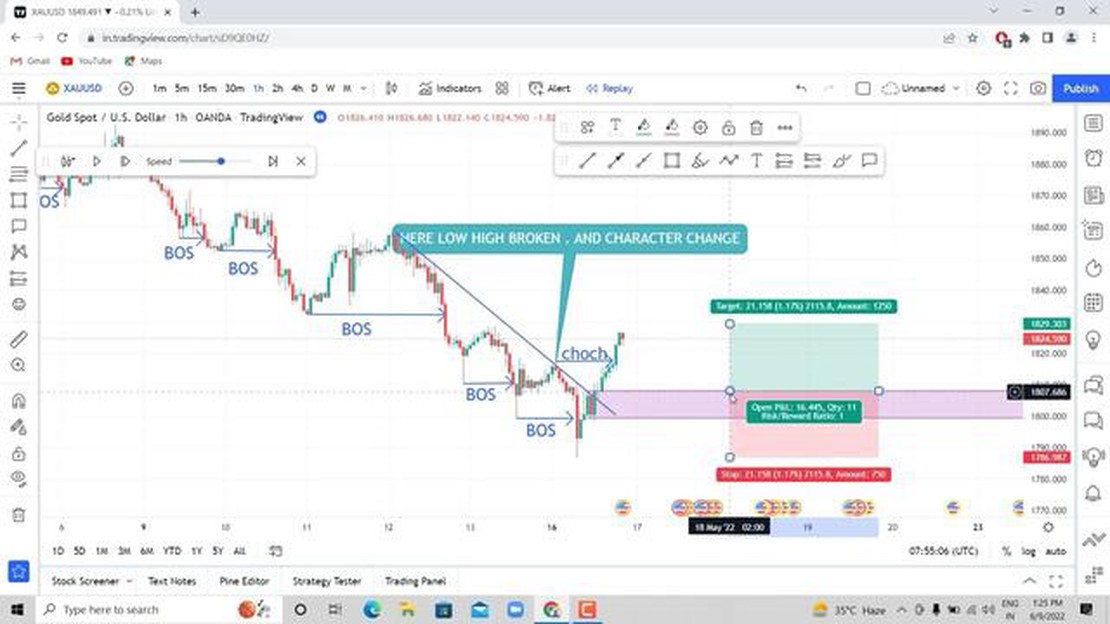

Bo, also known as breakout, is a concept in forex trading where the price of a currency pair moves outside a defined support or resistance level. It signifies a potential change in market sentiment and can be a signal for traders to enter trades.

Identifying a breakout in forex trading involves monitoring price movements and looking for significant price movements that breach a support or resistance level. Traders can use technical analysis tools such as trend lines or moving averages to identify potential breakout points.

Trading breakouts in forex can offer several benefits. Firstly, it allows traders to enter trades at the early stages of a potential trend and potentially capture larger profits. Secondly, breakouts can provide clear entry and exit points, making it easier for traders to set stop-loss and take-profit levels. Lastly, breakouts can result in strong momentum and volatility, creating lucrative trading opportunities.

Yes, there are risks associated with trading breakouts in forex. False breakouts can occur, where the price briefly breaches a support or resistance level only to reverse quickly. This can result in traders entering losing trades. Additionally, breakouts can be accompanied by increased volatility, which can lead to wider spreads and slippage, potentially impacting trading results.

Effectively trading breakouts in forex involves a combination of technical analysis and risk management. Traders should identify key support and resistance levels, use confirmatory indicators or patterns, and set appropriate stop-loss and take-profit levels. It is also important to manage risk by diversifying the trading portfolio, using proper position sizing, and being disciplined in following the trading plan.

Understanding the Value of 0.01 Lot in Forex Trading When it comes to forex trading, one of the most common questions that beginners ask is, “How much …

Read ArticlePredicting Trend Reversal in Forex: A Comprehensive Guide Recognizing a trend reversal in forex trading can be a tricky task, but it is a crucial …

Read ArticleProjected Price of Merck Stock Merck & Co., Inc. is a leading multinational pharmaceutical company that has been on the radar of many investors in …

Read ArticleUnderstanding the Significance of a Lower Bollinger Band Break The Bollinger Bands is a popular technical analysis tool that is widely used by traders …

Read ArticleUnderstanding the Role of a SRA: All you need to know Software Requirements Analysis (SRA) is a crucial step in the software development process. It …

Read ArticleExplore the Best Alternatives to Forex Tester 5 Forex Tester 5 is a popular software used by traders to test and optimize trading strategies. However, …

Read Article