Exploring European Options in India: A Guide for Travelers

Exploring European Options in India India, with its vibrant culture, stunning landscapes, and rich history, is a country that offers a multitude of …

Read Article

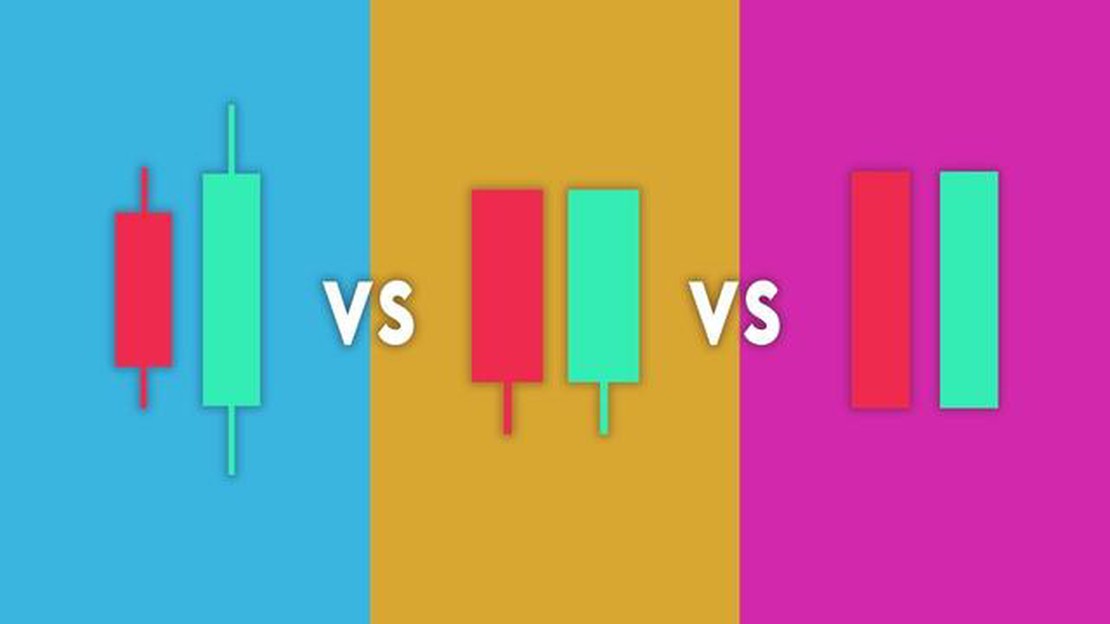

Candlestick patterns have been a popular tool for traders to analyze and predict market trends for centuries. Originally developed by Japanese rice traders in the 18th century, these patterns provide valuable insights into market psychology and can help traders make more informed decisions.

One of the main reasons why candlestick patterns are widely used is because they visually represent price action in a way that is easily understandable. Each candlestick displays the opening, closing, highest, and lowest prices for a given time period. By analyzing the patterns formed by these candlesticks, traders can identify potential reversals, continuations, or indecision in the market.

Do candlestick patterns really improve trading performance? The answer to this question is not as straightforward as a simple “yes” or “no”. While candlestick patterns can provide valuable insights, they are not foolproof indicators. Traders need to consider other technical indicators and fundamental factors before making any trading decisions.

However, when used in conjunction with other tools and strategies, candlestick patterns can be a powerful tool for traders. They can help traders identify potential profit targets, set stop-loss orders, and manage risk more effectively. By understanding the psychology behind these patterns, traders can gain an edge in the market and increase their chances of success.

It is important to note that no trading strategy is 100% accurate, and candlestick patterns are no exception. Traders should always practice proper risk management and use candlestick patterns as part of a comprehensive trading plan.

In conclusion, while candlestick patterns alone may not guarantee trading success, they can certainly improve trading performance when used in conjunction with other analysis methods. Their visual representation of price action and market psychology can provide valuable insights for traders. However, it is important for traders to approach candlestick patterns with caution and use them as one of many tools in their trading arsenal.

Candlestick patterns are a popular form of technical analysis used by traders to identify potential trend reversals or continuation patterns in financial markets. They provide valuable insights into the psychology of market participants and can help traders make more informed trading decisions.

Each candlestick represents a specific time period and is composed of four main elements: the open, high, low, and close prices. The body of the candlestick represents the range between the open and close prices, while the wicks or shadows represent the high and low prices during the time period.

By analyzing the shape, size, and position of candlestick patterns, traders can gain insight into market sentiment and potential price movements. There are numerous candlestick patterns, each with its own interpretation and significance.

Read Also: Understanding M5 in Trading: What You Need to Know

For example, a long bullish candlestick with a small or nonexistent upper wick and a long lower wick may indicate strong buying pressure and a potential upward trend. Conversely, a long bearish candlestick with a small or nonexistent lower wick and a long upper wick may indicate strong selling pressure and a potential downward trend.

Some common candlestick patterns include the doji, engulfing, hammer, and shooting star. The doji represents indecision in the market and may indicate a potential trend reversal. The engulfing pattern occurs when a small candlestick is followed by a larger candlestick that completely “engulfs” the previous one, indicating a potential trend reversal. The hammer and shooting star patterns are characterized by small bodies and long lower and upper wicks, respectively, and may indicate potential reversals or continuations.

While candlestick patterns can provide valuable insights into market sentiment, they should not be used as the sole basis for trading decisions. They are best used in conjunction with other technical analysis tools and indicators to confirm potential trading opportunities.

| Candlestick Pattern | Interpretation |

|---|---|

| Doji | Potential trend reversal |

| Engulfing | Potential trend reversal |

| Hammer | Potential reversal or continuation |

| Shooting Star | Potential reversal or continuation |

In conclusion, understanding candlestick patterns is essential for traders looking to improve their trading performance. By analyzing these patterns, traders can gain valuable insights into market sentiment and potential price movements. However, it is important to use candlestick patterns in conjunction with other technical analysis tools and indicators to confirm potential trading opportunities.

Candlestick patterns are a popular charting tool used by traders to identify potential market reversals and gain insights into future price movements. They originated in Japan during the 18th century and were used to analyze the rice market. Today, candlestick patterns are widely used in technical analysis across different financial markets, including stocks, forex, and cryptocurrencies.

A candlestick consists of four main parts: the body, the upper wick, the lower wick, and the color. The body represents the opening and closing prices of the period being analyzed. If the closing price is higher than the opening price, the body is usually colored green or white to indicate a bullish (upward) movement. Conversely, if the closing price is lower than the opening price, the body is usually colored red or black to indicate a bearish (downward) movement. The upper wick represents the highest price reached during the period, while the lower wick represents the lowest price reached.

Candlestick patterns are formed by the arrangement and combination of multiple candlesticks on a chart. Each pattern has its own unique interpretation and can signal different market sentiments. Some common candlestick patterns include doji, hammer, engulfing, shooting star, and spinning top.

Read Also: Is buying a stock the same as buying an option? Understand the key differences and implications

Traders analyze candlestick patterns to spot potential trading opportunities. For example, a bullish engulfing pattern, which consists of a small bearish candle followed by a larger bullish candle that engulfs it, may indicate a trend reversal from bearish to bullish. On the other hand, a shooting star pattern, which consists of a small bullish candle followed by a larger bearish candle with a long upper wick, may signal a trend reversal from bullish to bearish.

However, it is important to note that candlestick patterns should not be used in isolation. They are most effective when used in conjunction with other technical indicators and analysis tools. Traders should also consider the broader market context and other fundamental factors before making trading decisions based solely on candlestick patterns.

Candlestick patterns are graphical representations of price movements in the stock market. They show the opening, closing, high, and low prices for a specific time period. Traders use these patterns to make predictions about future price movements. By understanding and recognizing candlestick patterns, traders can make more informed decisions and improve their trading performance.

Candlestick patterns can provide valuable insights into potential future price movements, but they are not foolproof. While some patterns have been historically reliable, market conditions can change. It is important for traders to use candlestick patterns in conjunction with other technical indicators and fundamental analysis to increase the accuracy of their predictions.

There are several candlestick patterns that are considered to be effective in improving trading performance. Some of the most commonly used patterns include the doji, hammer, engulfing, and shooting star. These patterns can indicate potential reversals or continuations in price trends and are widely followed by traders.

While candlestick patterns can provide valuable insights, there are some drawbacks to relying solely on them for trading decisions. Market conditions can be unpredictable, and patterns may not always accurately predict future price movements. Traders should use candlestick patterns in conjunction with other forms of analysis and risk management strategies to mitigate potential drawbacks.

Yes, beginners can effectively use candlestick patterns to improve their trading performance. However, it is important for beginners to thoroughly study and understand the different patterns and their meanings before relying on them for trading decisions. It may also be beneficial for beginners to seek guidance from experienced traders or take educational courses to gain a better understanding of candlestick patterns.

Exploring European Options in India India, with its vibrant culture, stunning landscapes, and rich history, is a country that offers a multitude of …

Read ArticleReasons for Declined SBI Forex Card Transactions Having a State Bank of India (SBI) Forex Card can be a convenient way to manage your foreign exchange …

Read ArticleProjection for QQQ QQQ, also known as the Invesco QQQ Trust, is an exchange-traded fund (ETF) that tracks the performance of the Nasdaq-100 Index. As …

Read ArticleMastering the Art of Beating Forex: Proven Strategies and Tips for Success Forex trading can be a challenging yet highly rewarding venture. With …

Read ArticleIs XTB a Good Choice for Day Trading? When it comes to day trading, choosing the right platform is crucial for success. XTB is a leading online …

Read ArticleFormula for SMI Ergodic Indicator If you are a trader looking to enhance your trading strategy, the SMI Ergodic Indicator may be just what you need. …

Read Article