Understanding the Exponentially Weighted Moving Average (EWMA) and Its Functionality

Understanding the Purpose and Function of EWMA The Exponentially Weighted Moving Average (EWMA) is a statistical method used in data analysis to …

Read Article

Trading in the financial markets can be a complex endeavor, but it doesn’t have to be. The e-mini Nasdaq 100 futures contract is one instrument that offers traders the opportunity to gain exposure to the technology-heavy Nasdaq stock exchange index. Whether you’re new to trading or an experienced investor, understanding the basics of e-mini Nasdaq 100 futures can help you make more informed decisions and potentially enhance your portfolio.

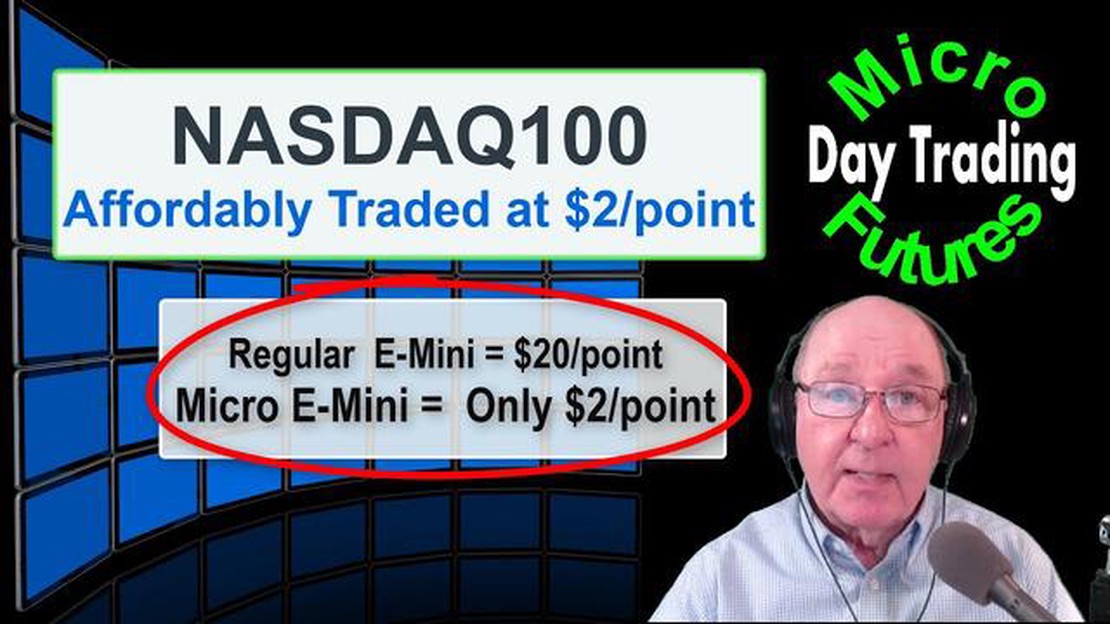

The e-mini Nasdaq 100 futures contract is a derivative instrument that allows traders to speculate on the future direction of the Nasdaq 100 index. It represents a fraction of the value of the full-size Nasdaq 100 futures contract, making it more accessible to individual traders with smaller accounts. This smaller contract size also allows for greater liquidity and tighter bid-ask spreads, making it easier to enter and exit positions.

When trading e-mini Nasdaq 100 futures, it’s important to understand the concept of leverage. By trading on margin, traders can control a larger position with a smaller amount of capital. While leverage can amplify potential profits, it can also magnify losses, so risk management is crucial. Understanding and setting appropriate stop-loss orders can help protect your trading capital and limit potential losses.

Furthermore, it’s important to keep an eye on market news and trends that can affect the Nasdaq 100 index. As a technology-heavy index, the Nasdaq 100 is particularly sensitive to changes in the tech industry. Monitoring earnings reports, regulatory developments, and macroeconomic events can help you stay informed and make more informed trading decisions.

In conclusion, e-mini Nasdaq 100 futures can be a valuable instrument for traders seeking exposure to the technology sector. By understanding the basics of e-mini Nasdaq 100 futures, including its contract size, leverage, risk management, and market trends, traders can potentially enhance their trading strategies and achieve their financial goals.

Disclaimer: Trading futures carries a high level of risk and may not be suitable for all investors. Past performance is not indicative of future results. Please consult a financial advisor before trading futures contracts.

Understanding e-mini Nasdaq 100 futures is essential for anyone looking to trade in the stock market. These futures contracts are a popular way to gain exposure to the technology-heavy Nasdaq 100 index, which consists of the 100 largest non-financial companies listed on the Nasdaq stock exchange.

By trading e-mini Nasdaq 100 futures, investors can participate in the price movements of the index without having to own the actual stocks that make up the index. This can be especially advantageous for traders who want to take advantage of short-term price fluctuations or hedge their existing positions in the stock market.

One of the key benefits of e-mini Nasdaq 100 futures is their liquidity. The futures market is highly liquid, meaning there are always buyers and sellers ready to transact at any given time. This liquidity makes it easier for traders to enter and exit positions quickly, without experiencing significant price slippage.

Another important aspect of understanding e-mini Nasdaq 100 futures is their leverage. Unlike traditional stocks, futures contracts allow traders to control a large amount of underlying value with a relatively small amount of capital. This can amplify both potential gains and losses, so it is crucial to fully understand the risks involved before trading these contracts.

Lastly, understanding e-mini Nasdaq 100 futures involves knowledge of technical analysis and market trends. Traders should be familiar with chart patterns, indicators, and trading strategies commonly used in futures trading. Additionally, keeping up to date with news and developments that can impact the Nasdaq 100 index is important for making informed trading decisions.

Read Also: How are option expiration dates determined?

| Benefits of Understanding e-mini Nasdaq 100 Futures |

|---|

| 1. Gain exposure to the Nasdaq 100 index without owning the actual stocks |

| 2. Take advantage of short-term price fluctuations |

| 3. Hedge existing positions in the stock market |

| 4. Trade with high liquidity and minimal price slippage |

| 5. Control a significant amount of value with a small amount of capital |

| 6. Understand technical analysis and market trends |

| 7. Stay informed about news and developments affecting the Nasdaq 100 index |

In conclusion, understanding e-mini Nasdaq 100 futures is crucial for traders looking to participate in the stock market. By gaining knowledge of these futures contracts, traders can take advantage of the benefits they offer, such as exposure to the Nasdaq 100 index, liquidity, leverage, and the ability to implement technical analysis and stay informed about market trends.

E-mini Nasdaq 100 futures are a type of futures contract that allows traders to speculate on the future price movements of the Nasdaq 100 index. The Nasdaq 100 index is composed of 100 of the largest non-financial companies listed on the Nasdaq stock exchange. It includes well-known tech giants like Apple, Google, and Amazon.

The e-mini Nasdaq 100 futures contract represents a fraction of the value of the full-size contract, making it more accessible to individual traders. The contract size is based on the value of the underlying Nasdaq 100 index, with each contract representing a certain dollar amount per index point.

Read Also: Are Hammer Candlesticks Reliable in Stock Trading?

Traders can go long (buy) or go short (sell) e-mini Nasdaq 100 futures contracts, depending on their market outlook. Going long means the trader expects the price of the Nasdaq 100 index to rise, while going short indicates the expectation of a price decline.

Trading e-mini Nasdaq 100 futures provides investors with opportunities for diversification, as the Nasdaq 100 index is heavily weighted towards technology stocks. It also allows for potential profit from both upward and downward price movements, providing traders with flexibility and potential hedging strategies.

Before trading e-mini Nasdaq 100 futures, it is crucial to understand the risks involved, as futures trading involves a high level of leverage and can result in substantial losses. It is recommended to have a solid understanding of market dynamics and risk management strategies before engaging in futures trading.

E-mini Nasdaq 100 futures are electronically traded futures contracts that represent a portion of the Nasdaq 100 stock index. They allow investors to trade the index without having to buy or sell each of the individual stocks that make up the index.

E-mini Nasdaq 100 futures are traded on the Chicago Mercantile Exchange (CME) and can be bought or sold through a futures brokerage account. The contracts are traded electronically and have specific expiration dates and contract sizes.

The contract size for e-mini Nasdaq 100 futures is based on the value of the index and is currently 20 times the index value. For example, if the Nasdaq 100 index is trading at 10,000, each e-mini Nasdaq 100 futures contract would have a value of $200,000 (10,000 x 20).

There are several advantages to trading e-mini Nasdaq 100 futures. They provide diversification because they represent a basket of stocks rather than just one stock. They also offer liquidity and ease of trading, as they are electronically traded and have high trading volumes. Additionally, they allow for leverage, meaning traders can control a larger position with a smaller amount of capital.

Trading e-mini Nasdaq 100 futures carries certain risks. The value of the futures contracts can fluctuate based on the performance of the underlying index, so there is the potential for losses. Additionally, leverage can magnify both gains and losses, so traders should be aware of the risks involved and trade responsibly. It is important to have a solid understanding of the market and use risk management strategies.

E-mini Nasdaq 100 Futures is a financial contract that allows investors to trade on the future performance of the Nasdaq 100 Index. It is a popular instrument used by traders to speculate on the price movement of the technology companies listed on the Nasdaq exchange.

Understanding the Purpose and Function of EWMA The Exponentially Weighted Moving Average (EWMA) is a statistical method used in data analysis to …

Read ArticleUnderstanding the CAC 40 Index Sector: An Overview The CAC 40 Index is a benchmark stock market index that represents the performance of the 40 …

Read ArticleUnderstanding the 4-Hour Candle Pattern: A Comprehensive Guide When it comes to trading in the financial markets, understanding the patterns and …

Read ArticleUnderstanding the Foreign Exchange Fluctuation Account When conducting business internationally, companies often face the challenge of dealing with …

Read ArticleUnderstanding Stock Option Grants Stock option grants are a powerful tool used by companies to attract and retain talented employees. They offer …

Read ArticleUnderstanding the Difference Between Fair Market Value and Share Price When it comes to investing in stocks, understanding the difference between fair …

Read Article