Is XM a Dealing Desk Broker? Find Out the Truth Here!

Is XM a dealing desk broker? There are many different types of brokers in the forex market, including dealing desk brokers and no dealing desk …

Read Article

When it comes to trading in the financial markets, understanding the patterns and movements of price is essential. One pattern that is widely used by traders is the 4-hour candle pattern. This pattern, formed by the 4-hour candlesticks on the price chart, can provide valuable insights into market trends and potential trading opportunities.

The 4-hour candle pattern is a type of technical analysis tool that helps traders identify and predict future price movements. It is based on the concept that the price of an asset can be analyzed by studying the patterns and formations of the 4-hour candlesticks. By carefully observing the highs, lows, open, and close of each candlestick, traders can gain a better understanding of market sentiment and make informed trading decisions.

One of the key advantages of the 4-hour candle pattern is its ability to provide a longer-term perspective compared to shorter timeframes, such as 1-hour or 15-minute charts. By analyzing the 4-hour candlesticks, traders can filter out some of the noise and focus on the broader trends in the market. This can be particularly useful for swing traders and position traders who are looking to capture larger price movements over several days or weeks.

However, it is important to note that the 4-hour candle pattern is not foolproof and should be used in conjunction with other technical analysis tools and indicators. Traders should also consider other factors such as market fundamentals, news events, and risk management strategies when making trading decisions.

In this complete guide, we will explore the different types of 4-hour candle patterns, how to interpret them, and how to incorporate them into your trading strategy. Whether you are a beginner or an experienced trader, understanding the 4-hour candle pattern can help improve your trading accuracy and profitability.

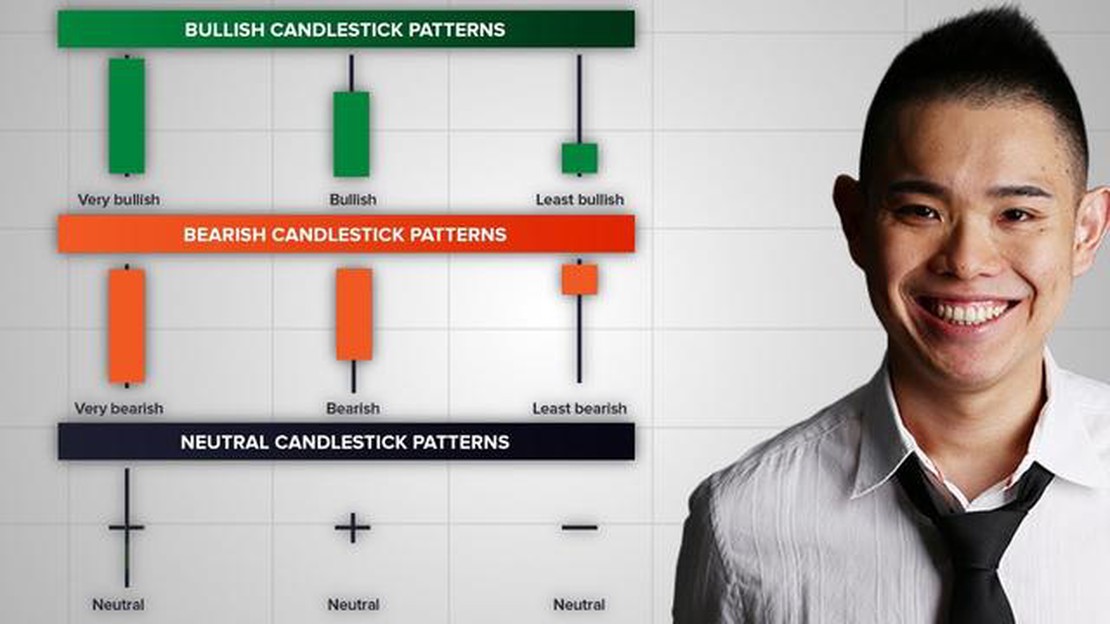

Candlestick patterns are graphical representations of price movements in financial markets, commonly used in technical analysis. They are formed by a series of price bars or candlesticks, each representing a specific time period, such as 1 hour, 4 hours, or a day.

Candlestick patterns provide valuable information about the psychology of market participants and can help identify potential trend reversals or continuations. Traders and investors use these patterns to make informed decisions about buying or selling assets.

Each candlestick consists of a real body and wicks or shadows. The real body represents the price range between the opening and closing prices of a given period, and the wicks or shadows represent the high and low prices reached during that period.

There are numerous candlestick patterns, each with its own interpretation and significance. Some common patterns include doji, hammer, shooting star, engulfing pattern, and spinning top, among others. Traders study the formation and occurrence of these patterns to gain insights into the future direction of prices.

Candlestick patterns also provide visual cues for determining support and resistance levels, as well as potential entry and exit points for trades. By combining candlestick patterns with other analytical tools, traders can increase the probability of successful trades and improve their overall trading strategies.

It is important to note that while candlestick patterns can provide valuable insights into market trends and price movements, they should not be used in isolation. It is always recommended to use them in conjunction with other technical indicators and analysis methods to confirm signals and minimize false signals.

In conclusion, candlestick patterns are a powerful tool in technical analysis, used by traders and investors to analyze price movements and make informed trading decisions. Understanding and recognizing these patterns can significantly improve trading strategies and ultimately lead to more successful trades in the financial markets.

Read Also: St Pancras Currency Exchange: Everything You Need to Know

The 4-hour candlestick pattern is highly important in technical analysis as it provides valuable information about the price action within a specific time frame. It helps traders and investors identify potential trend reversals, market trends, and entry and exit points.

Pattern Recognition: By analyzing the 4-hour candlestick patterns, traders can identify recurring patterns such as doji, hammer, engulfing, and shooting star, among others. These patterns indicate important levels of support and resistance, which can help traders make informed decisions about when to buy or sell.

Read Also: Discover the Secret of Hedging: A Comprehensive Guide

Trend Reversal Signals: The 4-hour candlestick patterns can also indicate potential trend reversals. For example, if a bearish pattern forms after a prolonged uptrend, it may suggest that the market sentiment is shifting and a bearish trend could be imminent. Traders can use these patterns to enter short positions and take advantage of potential price declines.

Confirmation of Trends: The 4-hour candlestick patterns can confirm the continuation of existing trends. If a bullish pattern forms during an uptrend, it may suggest that the market sentiment remains bullish and prices are likely to increase further. Traders can use these patterns as a confirmation signal to enter long positions and ride the trend.

Entry and Exit Points: The 4-hour candlestick patterns can also help traders identify optimal entry and exit points. By combining these patterns with other technical indicators, traders can fine-tune their trading strategies and increase their chances of making profitable trades.

Risk Management: Another important aspect of 4-hour candlestick patterns is their role in risk management. By analyzing these patterns, traders can set stop-loss orders at appropriate levels to limit potential losses. They can also set profit targets based on the patterns to secure their gains.

In conclusion, understanding and analyzing 4-hour candlestick patterns is crucial for traders and investors in the financial markets. These patterns provide valuable insights into market trends, potential reversals, and entry and exit points, helping traders make informed trading decisions and manage their risks effectively.

The 4-hour candle pattern refers to a specific pattern that forms on a candlestick chart over a period of 4 hours. It is used by traders to analyze the market and make trading decisions.

To identify the 4-hour candle pattern, you need to look at the candlestick chart and observe the formation of the candles over a 4-hour period. Look for specific candlestick patterns, such as doji, engulfing, or hammer, that indicate a potential shift in the market.

The 4-hour timeframe is significant because it provides a balance between shorter timeframes, such as 1-hour or 15-minute, and longer timeframes, such as daily or weekly. It allows traders to capture more detailed market movements while still providing a broader view of the overall market trends.

You can use the 4-hour candle pattern in your trading strategy by incorporating it as a confirmation signal or as a basis for your entry and exit points. For example, if you see a bullish engulfing pattern on the 4-hour chart, you may consider entering a long position. However, it is important to combine the 4-hour pattern with other technical indicators and analysis for more accurate predictions.

Yes, there are limitations and risks associated with using the 4-hour candle pattern. Firstly, it is not a foolproof indicator and can give false signals. Secondly, relying solely on the 4-hour pattern may not provide a complete picture of the market and may lead to missed opportunities or wrong trading decisions. Lastly, the volatility of the market can also affect the accuracy of the 4-hour pattern. It is important to use it in conjunction with other analysis techniques and risk management strategies.

Is XM a dealing desk broker? There are many different types of brokers in the forex market, including dealing desk brokers and no dealing desk …

Read ArticleUnderstanding UTP Market Data Market data plays a crucial role in the world of trading. It provides traders with the necessary information to make …

Read ArticleForex Reserve of Bhutan: Key Facts and Figures Bhutan, a small mountainous country nestled in the Eastern Himalayas, is known for its rich cultural …

Read ArticleCalculating Delta for FX Options Delta is a crucial risk measure used in the world of foreign exchange (FX) options. It quantifies the sensitivity of …

Read ArticleForex Pairs with Low Volume: A Comprehensive Guide When it comes to trading on the foreign exchange market, it’s important to be aware of the volume …

Read ArticleWho can use ECN? ECN, or Electronic Communication Network, is a technology that has revolutionized the way trading is done in the financial markets. …

Read Article