Understanding Binary Pay: How Does It Work?

How Does Binary Pay? Binary pay is a compensation structure commonly used in the world of multi-level marketing (MLM) and direct sales. It is a system …

Read Article

When conducting business internationally, companies often face the challenge of dealing with foreign exchange fluctuations, which can significantly impact their financial statements. To mitigate the risks associated with these fluctuations, many companies establish a Foreign Exchange Fluctuation Account. This article aims to provide a comprehensive understanding of what this account is and how it helps businesses navigate the volatile currency markets.

The Foreign Exchange Fluctuation Account, also known as the Exchange Gain/Loss Account or Currency Fluctuation Reserve, is a balance sheet account used to record gains or losses resulting from fluctuations in foreign exchange rates. This account is particularly crucial for companies that have significant foreign currency transactions, such as importers, exporters, and multinational corporations.

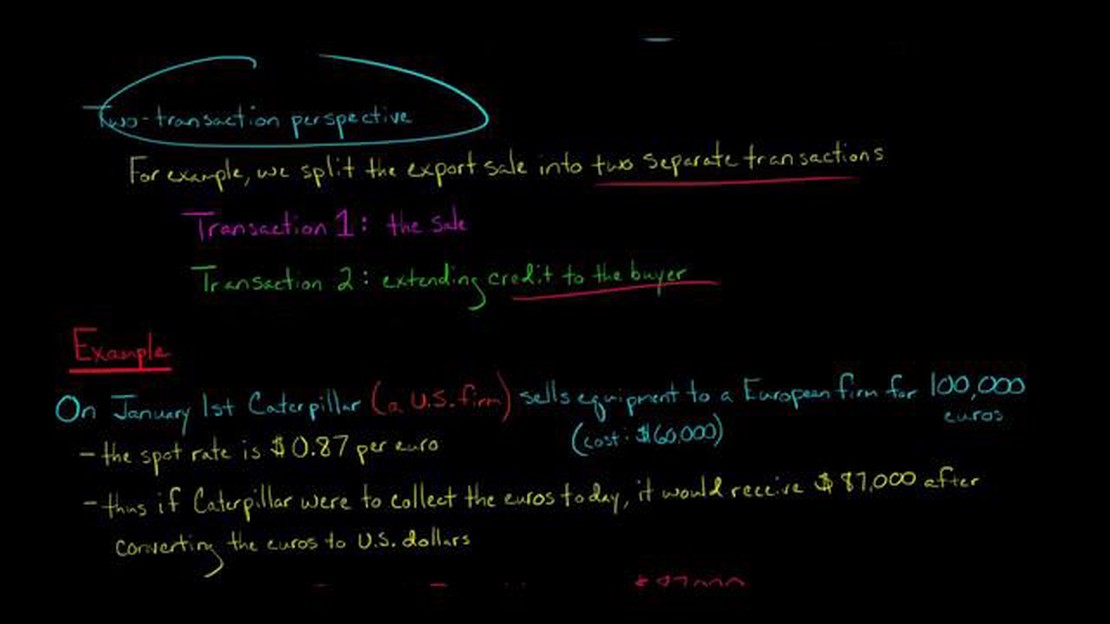

When a company conducts a transaction denominated in a foreign currency, the value of that currency may fluctuate against the company’s domestic currency between the transaction date and the settlement date. These fluctuations can result in foreign exchange gains or losses that impact the company’s financial statements. By maintaining a Foreign Exchange Fluctuation Account, companies can separate these gains or losses from their core operational activities, providing a clearer picture of their financial performance.

The Foreign Exchange Fluctuation Account serves several purposes. Firstly, it acts as a hedge against currency fluctuations, allowing companies to protect their financial statements from the volatility of the currency markets. Secondly, it helps companies accurately reflect the impact of currency fluctuations on their financial performance, ensuring transparency and accountability. Lastly, it provides a way for companies to mitigate the tax implications of foreign exchange gains or losses, as these gains or losses are often treated differently for tax purposes.

Foreign Exchange Fluctuation Account refers to an account that is used to record and manage the fluctuations in foreign exchange rates. It is maintained by companies or organizations that engage in international transactions and have exposure to foreign currency fluctuations.

When a company buys or sells goods or services in a foreign currency, the exchange rate between the domestic currency and the foreign currency can change over time. This change in exchange rates can lead to gains or losses for the company.

To account for these gains or losses, companies maintain a Foreign Exchange Fluctuation Account. This account is used to record the differences in exchange rates between the time of the transaction and the time of settlement. The gains or losses recorded in this account are later reflected in the company’s financial statements.

The Foreign Exchange Fluctuation Account is crucial for companies that deal with multiple currencies because it helps them accurately assess their financial position. Changes in exchange rates can have a significant impact on a company’s profits, especially when dealing with large-volume transactions or when operating in countries with volatile currencies.

By maintaining a Foreign Exchange Fluctuation Account, companies can better manage the risks associated with foreign currency fluctuations. They can track the gains or losses resulting from changes in exchange rates and take appropriate measures to minimize the impact on their financial performance.

In conclusion, the Foreign Exchange Fluctuation Account is an important tool for companies engaged in international transactions. It helps them monitor and manage the risks associated with fluctuations in foreign exchange rates, ultimately enabling them to make informed financial decisions.

Read Also: 10 Tips to Become Perfect in Forex Trading - Expert Advice

Foreign exchange, also known as forex or FX, refers to the global marketplace where various currencies are traded. In simple terms, it is the process of buying one currency and selling another at the same time. The primary purpose of foreign exchange is to facilitate international trade and investment by allowing businesses and individuals to convert currencies when conducting transactions.

The foreign exchange market operates 24 hours a day, five days a week, and is the largest financial market in the world. It is decentralized, meaning that it does not have a physical location or central exchange. Instead, it is an over-the-counter (OTC) market where currency transactions are conducted electronically.

In foreign exchange, currencies are quoted in pairs, with one currency being the base currency and the other being the quote currency. The value of a currency pair is determined by various factors, including interest rates, inflation rates, geopolitical events, and economic indicators. Traders and investors speculate on the fluctuations in currency rates to make a profit.

The foreign exchange market offers various instruments for trading, including spot transactions, forwards, futures, options, and swaps. Spot transactions involve the immediate exchange of currencies at the current exchange rate. Forwards, futures, options, and swaps are derivative contracts that allow market participants to hedge against or speculate on future changes in currency rates.

Read Also: Understanding the Potential Risks of Options Trading - Important Factors to Consider

Overall, foreign exchange plays a crucial role in the global economy by facilitating international trade, investment, and tourism. It allows businesses and individuals to convert currencies, manage risks, and take advantage of opportunities in the global marketplace.

A fluctuation account plays a crucial role in managing the uncertainties and risks associated with foreign exchange rates. Here are some key reasons why a fluctuation account is important:

In summary, a fluctuation account is important as it helps companies mitigate currency risks, facilitates foreign exchange transactions, ensures smooth cash flow, and enables compliance with accounting standards. By effectively managing foreign exchange fluctuations, companies can safeguard their financial performance and make informed decisions in the global marketplace.

A Foreign Exchange Fluctuation Account is a bank account used to record gains or losses from changes in the exchange rate between the functional currency and the foreign currency.

Companies use a Foreign Exchange Fluctuation Account to hedge against the risk of exchange rate fluctuations. By recording gains or losses in this account, companies can separate and manage the impact of currency fluctuations on their financial statements.

The Foreign Exchange Fluctuation Account works by recording gains or losses from changes in the exchange rate. When the exchange rate goes up, a gain is recorded in the account, and when the exchange rate goes down, a loss is recorded. These gains and losses are then reflected in the company’s financial statements.

Using a Foreign Exchange Fluctuation Account provides several benefits. It allows companies to manage and mitigate the risk of exchange rate fluctuations, helps in accurate financial reporting, and enables better decision making by providing a clearer picture of the financial performance.

Yes, there are some limitations and considerations when using a Foreign Exchange Fluctuation Account. The account only captures gains or losses from changes in the exchange rate and does not account for other factors that may impact the company’s financial performance. It is also important to accurately estimate and record these gains or losses to ensure the financial statements reflect the true impact of currency fluctuations.

A foreign exchange fluctuation account is an account that is used by companies to record gains or losses due to fluctuations in exchange rates.

How Does Binary Pay? Binary pay is a compensation structure commonly used in the world of multi-level marketing (MLM) and direct sales. It is a system …

Read ArticleExploring the Average Conveyancing Fee in the UK Conveyancing is an essential process when buying or selling a property in the UK. It involves …

Read ArticleCalculating the Real Effective Exchange Rate in Ireland The real effective exchange rate (REER) is a crucial indicator that measures the …

Read ArticleUnderstanding EOD in Stock Trading Stock trading can be a lucrative venture for those who are well-informed and prepared. One key aspect of successful …

Read ArticleHow Does Xe com Make Money? Xe com is a popular online platform that provides currency exchange and international money transfer services. It offers …

Read ArticleIs TMGM broker legit? When it comes to choosing a broker, one of the most important factors to consider is legitimacy. With the increasing number of …

Read Article