How to Invest Money: A Comprehensive Guide for Beginners

Investing Tips: How to Invest Money Wisely Investing money can seem like a daunting task, especially for beginners who have little to no knowledge …

Read Article

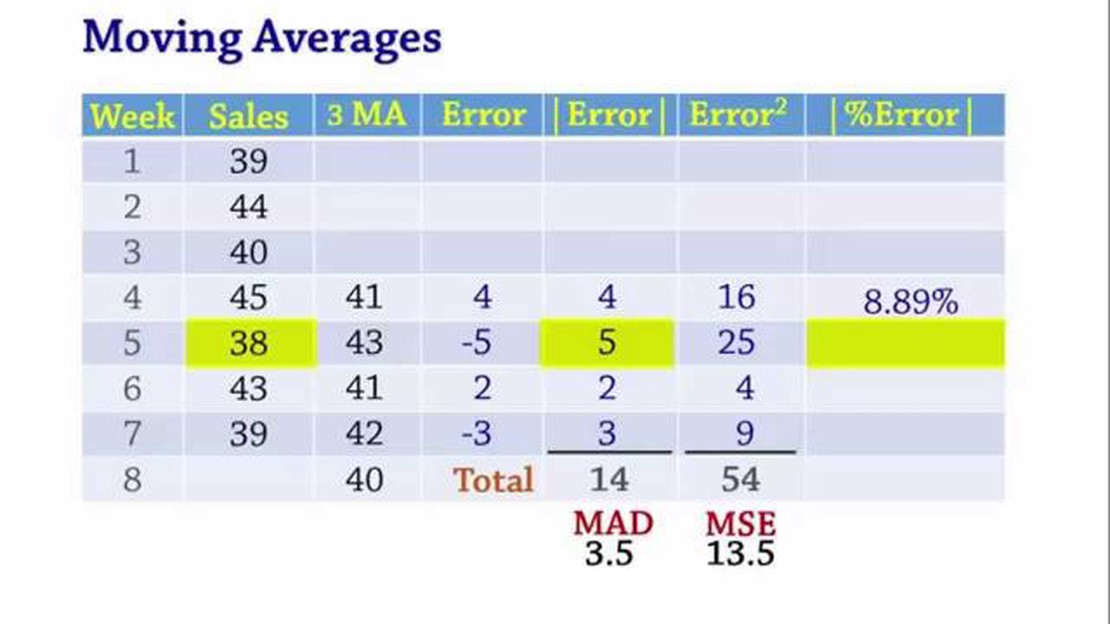

The 2 Period Moving Average (MA) forecast is a widely used statistical technique that helps in predicting future trends and patterns based on historical data. It is specifically designed to analyze data points over a specific time frame and calculate the average value over that period. This forecasting method is considered simple but effective, making it a valuable tool for investors, analysts, and researchers.

The concept behind the 2 Period Moving Average forecast revolves around the idea that past trends and patterns can provide insights into the future. By analyzing historical data, this technique helps to identify potential changes in the market and predict future movements.

To calculate the 2 Period Moving Average forecast:

- Take the sum of the closing prices for the current and previous periods.

It’s important to note that the 2 Period Moving Average forecast is a short-term forecasting technique. It looks at recent data points to determine the average value, which makes it more responsive to immediate changes in the market. This can be advantageous for short-term traders who want to predict short-term price movements.

Benefits of using the 2 Period Moving Average forecast:

- Simplicity: The calculation is straightforward and easy to understand, making it accessible to beginners in the field.

In conclusion, the 2 Period Moving Average forecast is a valuable technique for analyzing and predicting short-term trends in financial markets. By calculating the average value of historical data points, it provides insights into potential changes and helps traders and analysts make informed decisions. However, it’s important to remember that no forecasting method is foolproof, and it should be used in conjunction with other analysis tools for comprehensive market analysis.

A moving average forecast is a statistical technique used to analyze time series data and make predictions about future values. It is based on the concept of averaging a series of data points over a specific time period to identify patterns and trends.

The moving average forecast calculates the average of a set of data points within a given time frame, and then uses this average to estimate future values. It is commonly used in finance, economics, and other fields where analyzing trends and making predictions is important.

Read Also: Are MACD and RSI Enough: Exploring the Limits of Technical Indicators

The two-period moving average forecast is a particularly simple and commonly used variation of this technique. It calculates the average of the current and previous data points to make a forecast for the next period. This method is easy to understand and implement, making it a popular choice for forecasting in various industries.

The moving average forecast can be used to smooth out noisy or erratic data, highlight underlying patterns, and make predictions based on historical data. It is often used as a starting point for more complex forecasting models and can provide a useful baseline for comparison.

Overall, the moving average forecast provides a simple and effective way to analyze time series data and make predictions. By understanding the principles behind this technique and its variations, individuals and businesses can gain valuable insights into future trends and make informed decisions.

A 2 period moving average is a simple and commonly used forecasting technique that can provide valuable insights into trend patterns and short-term variations in data. It is particularly useful for analyzing time series data when we want to understand the general direction of the data points over a short period of time.

Read Also: What does hyper trading do? Learn about the benefits of hyper trading

There are several reasons why a 2 period moving average can be beneficial:

1. Smoothing Out Noise: A 2 period moving average helps to smooth out short-term fluctuations in the data, making it easier to identify underlying trends. By averaging the data points over a short period, it reduces the impact of individual outliers or random variations, making it easier to spot the overall pattern.

2. Quick Response: A 2 period moving average reacts quickly to changes in the data. Since it only considers the two most recent data points, it can capture sudden shifts or reversals in the trend. This responsiveness makes it a useful tool for short-term forecasting and identifying potential turning points.

3. Easy Interpretation: The simplicity of a 2 period moving average makes it easy to interpret and communicate the forecast. The average of the two most recent data points provides a clear indication of the current trend direction and can be easily understood by both analysts and stakeholders.

4. Low Lag: A 2 period moving average has a low lag compared to longer period moving averages. Lag refers to the time it takes for the moving average to reflect changes in the underlying data. A 2 period moving average is able to respond quickly to new information, reducing the lag and allowing for more timely insights.

Overall, a 2 period moving average is a useful tool for analyzing short-term trends and identifying potential changes in the data. While it may not capture long-term patterns as effectively as longer period moving averages, it provides a quick and simple method for forecasting and understanding the general direction of the data.

The 2 period moving average forecast calculates the average of the last two periods’ data points to predict future values. It is a simple and intuitive forecasting method that can be used for smoothing out fluctuations and identifying trends.

The moving average forecast is used to predict future values based on past data. It is commonly used in financial analysis, time series analysis, and demand forecasting to identify trends and make informed decisions.

The 2 period moving average forecast is calculated by adding the values of the last two periods and dividing by 2. This gives the average of the two periods’ data points, which is used as the forecast for the next period.

The 2 period moving average forecast is most suitable for data that exhibits a stable and predictable pattern. It may not work well for data that has high volatility or irregular fluctuations.

One limitation of the 2 period moving average forecast is that it gives equal weight to all data points, regardless of their age. This means that old data has the same influence on the forecast as recent data. Additionally, the moving average forecast may not capture sudden changes or outliers in the data.

Investing Tips: How to Invest Money Wisely Investing money can seem like a daunting task, especially for beginners who have little to no knowledge …

Read ArticleMajor Trading Centers in Ancient India Ancient India was a hub of trade and commerce, with a network of major trading centers bustling with activity. …

Read ArticleWhat is the best cryptocurrency to use for a trading bot? Are you looking to maximize your profits in the world of cryptocurrency trading? One of the …

Read ArticleIs the CBOE still in operation? The Chicago Board Options Exchange (CBOE) has a long history in the financial industry, serving as a central hub for …

Read ArticleTrading Strategies: Is Focusing on a Single Pair the Best Approach? When it comes to forex trading, one question that often arises is whether it is …

Read ArticleIs Bloomberg a Good Platform for Forex Trading? When it comes to forex trading platforms, reliability is a crucial factor to consider. Bloomberg, a …

Read Article