How Many Hours Does It Take to Master Forex? Expert Advice

How Long Does it Take to Master Forex Trading? Forex trading is a complex and dynamic field that requires extensive knowledge and experience to …

Read Article

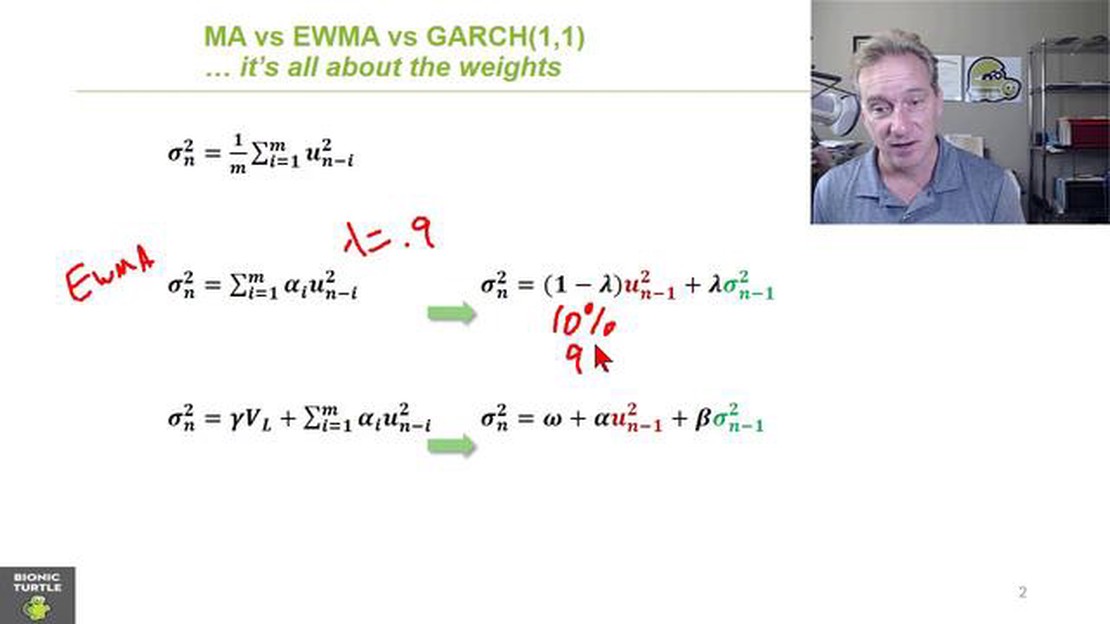

The exponentially weighted moving average (EWMA) is a commonly used statistical method for forecasting and time series analysis. It is widely utilized in various fields, such as finance, engineering, and economics, due to its simplicity and effectiveness in capturing trends and detecting changes in data. However, like any other statistical technique, EWMA has its limitations and drawbacks that need to be taken into consideration when using it.

One of the main disadvantages of EWMA is its sensitivity to outliers. Since EWMA gives more weight to recent observations, an extreme value can have a significant impact on the forecasted values. This means that if there are outliers in the data, the forecasted values may be skewed and may not accurately reflect the underlying trend. It is important to detect and handle outliers appropriately before applying the EWMA method to avoid this issue.

Another drawback of EWMA is its inability to capture sudden changes or shifts in the data. The smoothing effect of the method tends to dampen abrupt changes, resulting in a delay in detecting and reacting to significant shifts in the underlying process. This can be problematic in applications where timely detection of these changes is crucial, such as financial markets and quality control processes.

Furthermore, EWMA assumes that the data follow a normal distribution, which is not always the case in practice. If the data have a non-normal distribution or exhibit non-constant variability, the forecasts obtained using EWMA may be biased and imprecise. In such cases, alternative forecasting methods, such as the robust EWMA or non-parametric approaches, should be considered to handle the distributional assumptions and ensure reliable forecasts.

Overall, while EWMA is a valuable tool in forecasting and time series analysis, it is important to be aware of its limitations and potential pitfalls. Understanding these disadvantages will help researchers and practitioners make informed decisions and choose appropriate alternatives when necessary, ensuring more accurate and reliable forecasts.

While Exponentially Weighted Moving Average (EWMA) can be a useful tool in analyzing data and making forecasts, it is important to be aware of its limitations. Knowing the disadvantages of EWMA can help you make more informed decisions and avoid potential pitfalls. Here are some reasons why you should know the disadvantages of EWMA:

By understanding the disadvantages of EWMA, you can make more informed decisions when using this technique. It is important to consider these limitations and use EWMA in conjunction with other methods or techniques to ensure comprehensive and accurate analysis of your data.

Although the Exponential Weighted Moving Average (EWMA) is a popular method for estimating process parameters, it is not without its shortcomings. One of the main disadvantages of EWMA is its potential for inaccuracy.

Firstly, the accuracy of EWMA estimates heavily depends on the choice of the smoothing factor. This factor determines how fast historical data decays in importance and how much weight is given to the most recent observations. If the smoothing factor is not appropriately selected, the EWMA estimates can deviate significantly from the true values.

Additionally, EWMA assumes that the data follows a normal distribution. However, in practice, many datasets do not conform to this assumption. This can lead to inaccurate estimation results, especially when the underlying data is skewed or has heavy tails.

Another source of inaccuracy in EWMA estimation is the assumption of constant volatility. EWMA assumes that the data has a constant variance over time. However, in reality, volatility often changes, leading to inaccurate estimates. This is particularly problematic in financial markets where volatility can be highly variable.

Furthermore, EWMA is highly sensitive to outliers. In the presence of outliers, the estimates can be heavily influenced, leading to inaccurate results. This makes EWMA less robust compared to other methods that are more resistant to outlier effects.

Read Also: Understanding Forex Daily Change: How it Impacts the Market

In summary, while EWMA is a simple and widely used method for estimation, it is important to be aware of its inaccuracy potential. Careful consideration should be given to the choice of smoothing factor, the distributional assumptions, volatility changes, and the presence of outliers to mitigate these limitations.

One of the main disadvantages of Exponentially Weighted Moving Average (EWMA) is its sensitivity to outliers. An outlier is a data point that significantly deviates from the rest of the dataset. In the context of EWMA, an outlier can have a disproportionate impact on the calculation of the weighted average.

Read Also: Looking for an Alternative to Forex Tester 5? Check out these Top Options!

EWMA assigns different weights to each data point based on its recency, with more recent data points being given higher weights. The purpose of this weighting scheme is to provide more weight to recent data and less weight to older data, as a reflection of the assumption that recent data is more relevant for making predictions.

However, when an outlier occurs, it tends to have a strong influence on the weighted average, even if it is only a single data point among many others. This can lead to significant distortions in the calculated EWMA values, as the single outlier can dominate the weighted average and overshadow the influence of other data points.

As a result, if an outlier is present in the data, the EWMA may not accurately reflect the underlying trend or pattern in the dataset, making it less reliable for forecasting or other analytical purposes. Furthermore, the impact of outliers can be exacerbated when using shorter time periods or smaller smoothing factors in EWMA calculations.

To mitigate the sensitivity to outliers in EWMA, some techniques can be applied, such as winsorizing or trimming the dataset to remove extreme outliers, or using alternative methods like robust estimators or robust control charts. However, these techniques may not always be feasible or desirable, depending on the specific circumstances and objectives of the analysis.

Overall, it is important to be aware of the sensitivity to outliers in EWMA and consider the potential limitations it may introduce in data analysis. As with any statistical method, understanding the assumptions, strengths, and weaknesses of EWMA is crucial for obtaining meaningful and reliable results.

EWMA stands for Exponentially Weighted Moving Average. It is a statistical method used to calculate a weighted average of a given set of data.

EWMA works by assigning weights to each data point in a time series. The weights decrease exponentially as the data points get older. The final weighted average is calculated by summing the product of each data point and its respective weight.

Some advantages of using EWMA include its ability to give more weight to recent data points, allowing for quick adaptation to changes in the underlying process. It is also relatively easy to calculate and interpret. Additionally, it can be used for smoothing noisy data or to detect trends and patterns in the time series.

One major disadvantage of using EWMA is that it is very sensitive to the choice of the smoothing parameter. The choice of this parameter affects the speed at which the weights decrease and, therefore, can significantly impact the final result. Another disadvantage is that it only considers the most recent data points and may ignore important historical information. Additionally, EWMA assumes a constant volatility in the data, which may not always be the case.

While EWMA can be used for a wide range of data types, it may not be suitable for all situations. It is best suited for data that exhibits a steady, predictable trend or pattern. If the data is highly volatile or exhibits sudden changes, alternative methods may be more appropriate.

How Long Does it Take to Master Forex Trading? Forex trading is a complex and dynamic field that requires extensive knowledge and experience to …

Read ArticleCalculating EMA in JS: A Simple Guide If you are a JavaScript developer who is interested in working with financial data, you may come across the need …

Read ArticleStock Options Transfer to Spouse Upon Death: Explained Stock options are a popular form of compensation offered by many companies, allowing employees …

Read ArticleWhat is the Efficient Market Hypothesis in Forex? The foreign exchange market, commonly known as forex, is one of the largest and most liquid …

Read ArticleIs Forex Trading Available 7 Days a Week? Forex trading, also known as foreign exchange trading, is a global decentralized market where the world’s …

Read ArticleTrading Options on CFDs: Everything You Need to Know Welcome to our comprehensive guide on trading options on CFDs – Contract for Difference. CFDs are …

Read Article