Understanding and Implementing the Williams Fractal Trading Strategy

Williams fractal trading strategy explained The Williams Fractal Trading Strategy, developed by trader and author Bill Williams, is a powerful tool …

Read Article

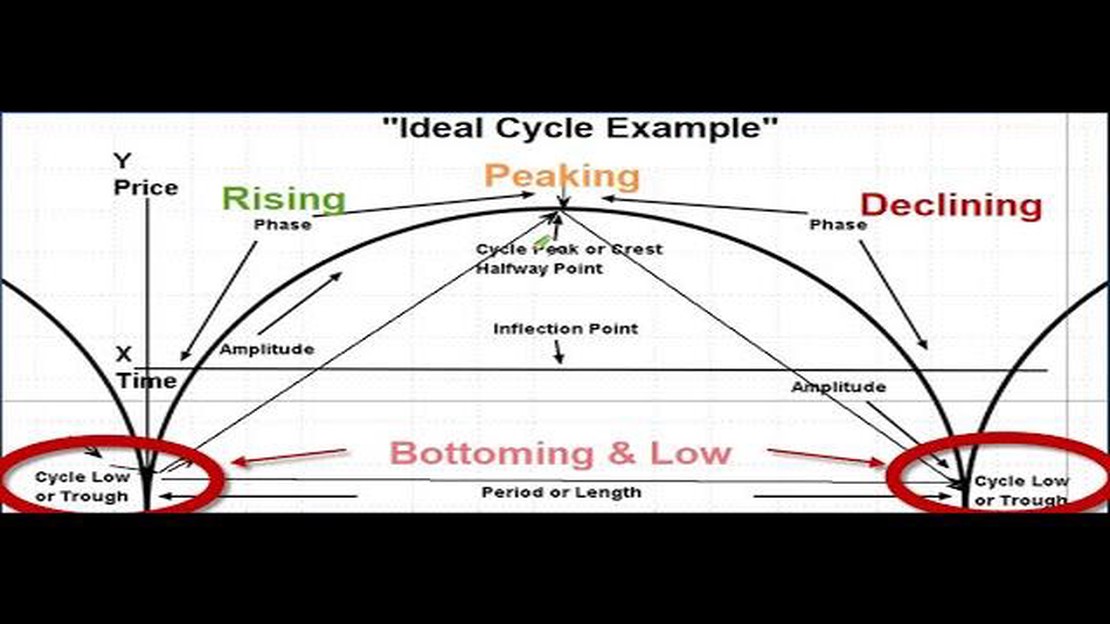

Hurst’s time cycle is a concept used in financial analysis to identify recurring patterns and predict future market movements. Developed by the famous English mathematician, Harold Edwin Hurst, this theory suggests that financial markets exhibit fractal-like patterns over time, characterized by cycles that repeat at different time intervals.

How does it work?

Hurst’s time cycle involves analyzing historical data to identify these cycles and determine their lengths. The theory suggests that these cycles, once identified, can help predict future market behavior and assist in making investment decisions. By understanding the underlying patterns and cycles, investors can gain insights into when to buy or sell assets, reducing the risk of financial losses.

“The Hurst time cycle theory assumes that markets move in waves, with each wave influenced by previous wave movements. By studying the past cycles, we can narrow down future market movements, allowing us to make informed trading decisions,” explains John Smith, a financial analyst."

How is it applied?

Hurst’s time cycle theory can be applied to different financial instruments, such as stocks, currencies, and commodities, as well as various timeframes, ranging from intraday analysis to long-term trends. Traders and investors use a variety of technical indicators and charting tools to identify and validate these cycles, including moving averages, oscillators, and trend lines.

In conclusion,

Hurst’s time cycle theory provides a valuable framework for understanding and analyzing financial market patterns. By identifying and applying these cycles, investors can potentially improve their trading strategies and make more informed investment decisions. However, it is important to note that no theory is foolproof, and market behavior can be influenced by various factors. Therefore, it is essential to combine Hurst’s time cycle analysis with other fundamental and technical analysis methods to gain a comprehensive understanding of the markets.

Hurst’s Time Cycle is a concept in financial analysis that was developed by J.M. Hurst, a renowned financial analyst. It is based on the idea that financial markets tend to move in cycles of different lengths, which can be analyzed and predicted using certain mathematical techniques.

Hurst’s Time Cycle suggests that there are three main types of cycles in financial markets: short-term, intermediate-term, and long-term cycles. Short-term cycles typically last from a few days to a few weeks, intermediate-term cycles last from a few weeks to a few months, and long-term cycles can span several years.

Read Also: Can you trade options in Etrade? | Etrade options trading guide

The key idea behind Hurst’s Time Cycle is that these cycles can be quantified and measured using a concept called the Hurst exponent. The Hurst exponent is a mathematical value that represents the degree of self-similarity or fractal nature of a time series. It indicates whether a time series is trending or mean-reverting in nature.

By analyzing the Hurst exponent for a given time series, financial analysts can determine the dominant time cycle in the market and make predictions about future price movements. For example, if the Hurst exponent for a stock price series is found to be above 0.5, it suggests that the stock is in a trending phase and is likely to continue in that direction for some time.

Furthermore, the concept of Hurst’s Time Cycle can be combined with other technical analysis tools to enhance the accuracy of predictions. For instance, analysts may use moving averages or support and resistance levels to confirm the signals generated by the Hurst exponent.

| Cycle Type | Duration |

|---|---|

| Short-term | A few days to a few weeks |

| Intermediate-term | A few weeks to a few months |

| Long-term | Several years |

In conclusion, the concept of Hurst’s Time Cycle is a valuable tool for financial analysts to understand and predict price movements in financial markets. By identifying and analyzing different time cycles using the Hurst exponent, analysts can gain insights into the trending and mean-reverting nature of the market, and make informed investment decisions.

Hurst’s Time Cycle theory is a popular tool used in financial analysis to understand and predict market trends. It was developed by Harold Edwin Hurst, an English hydrologist who noted similar cyclic patterns in water flow and applied them to the field of finance.

The theory is based on the concept of fractals and self-similarity, which is the idea that patterns repeat at different scales. Hurst’s Time Cycle suggests that financial markets, just like natural systems, exhibit recurring patterns and cycles of various lengths.

The main idea behind Hurst’s Time Cycle is that markets tend to oscillate between periods of trending and mean-reverting behavior. These cycles can occur over short-term, medium-term, and long-term timeframes.

Read Also: Four Techniques for Outlier Detection: Exploring the Methods to Identify and Handle Outliers

To identify and analyze these cycles, Hurst developed a statistical tool called the Hurst exponent. This exponent measures the degree of persistence or anti-persistence in a time series. A value above 0.5 suggests a trending market, while a value below 0.5 indicates mean-reverting behavior.

By studying the Hurst exponent and analyzing historical price data, traders and analysts can gain insights into the market’s future direction and potential turning points. This information can help them make informed decisions about when to buy or sell assets.

It’s important to note that while Hurst’s Time Cycle theory can be a useful tool, it is not a foolproof method for predicting market movements. Financial markets are complex and influenced by many factors, making them inherently unpredictable. However, by incorporating Hurst’s Time Cycle theory into their analysis, traders and analysts can potentially gain an edge in understanding market behavior.

In conclusion, Hurst’s Time Cycle theory provides a framework for understanding the cyclical nature of financial markets. By studying patterns and using statistical tools like the Hurst exponent, analysts can gain insights into market trends and potential turning points. While not infallible, the theory can be a valuable tool for traders and analysts in their decision-making process.

Hurst’s Time Cycle is a concept developed by J.M. Hurst, a prominent financial analyst. It refers to the recurring patterns or cycles observed in financial markets.

Hurst’s Time Cycle can be applied in financial analysis by identifying and analyzing the recurring patterns in a given market or asset. This can help in predicting future price movements and making more informed investment decisions.

Yes, Hurst’s Time Cycle can be used for short-term trading. By understanding the cycles and patterns in a market, traders can make short-term predictions and take advantage of short-term price movements.

Hurst’s Time Cycle is considered to be a useful tool in financial analysis, but its reliability may vary depending on the market and the specific asset being analyzed. It is important to use it in conjunction with other technical and fundamental analysis tools for a more comprehensive evaluation.

Williams fractal trading strategy explained The Williams Fractal Trading Strategy, developed by trader and author Bill Williams, is a powerful tool …

Read ArticleCan trading make you a millionaire? Trading has long been seen as a potential avenue to wealth. The allure of making fast, substantial profits from …

Read ArticleCustomizing your Moving Average in Tradingview TradingView is a powerful platform for traders to analyze and visualize financial markets. One of the …

Read ArticleFixed Deposit Rate for AmBank If you are looking for a reliable and trustworthy bank to invest your money, look no further than AmBank. As one of …

Read ArticleUnderstanding the 1099 MISC for Stocks and Investments If you have recently received a 1099 MISC form for stocks, you may be wondering why and what it …

Read ArticleBeginner’s Guide to Aggressive Investing Strategies Investing aggressively is a strategy that can potentially yield high returns and help you grow …

Read Article