Is Greece still a democratic country? Exploring the current state of democracy in Greece

Is Greece still a democratic country? Greece, often referred to as the birthplace of democracy, has a long and storied history of democratic …

Read Article

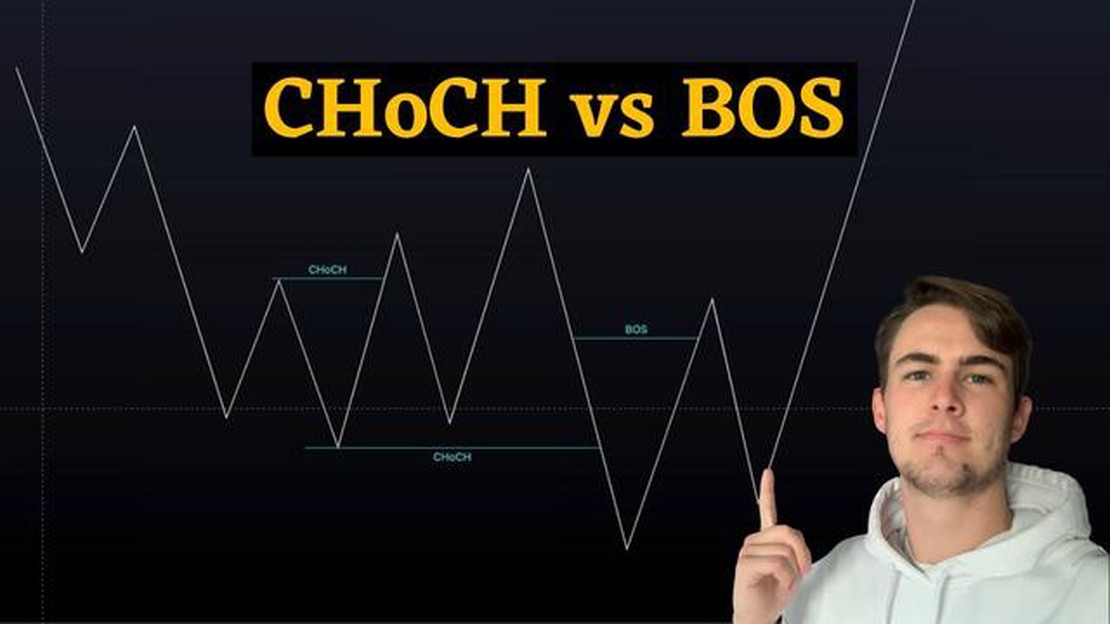

Forex trading, also known as foreign exchange trading, is the buying and selling of currencies with the aim of making a profit. It is a highly volatile market that attracts millions of traders worldwide. To excel in forex trading, it is crucial to understand various strategies and indicators that can help traders make informed decisions. Two popular indicators used by forex traders are Bos and ChoCh.

Bos stands for Bands of Support and refers to a technical analysis tool that helps traders identify support levels. Support levels are price levels at which a currency pair tends to find buying interest and reverse its downward trend. Bos uses moving averages to calculate support levels and provides traders with clear entry and exit points. By understanding Bos, traders can predict potential price reversals and take advantage of these opportunities to make profitable trades.

ChoCh, on the other hand, stands for Channels of Chaos and refers to a volatility indicator that helps traders determine the range within which a currency pair is likely to move. It is particularly useful for traders who prefer to trade within a specific range rather than taking positions in trending markets. ChoCh uses a range-based approach and provides traders with upper and lower boundaries that indicate potential price movements. By understanding ChoCh, traders can set realistic profit targets and manage risks effectively.

By incorporating Bos and ChoCh into their trading strategies, forex traders can improve their chances of making profitable trades. These indicators provide valuable insights into market trends and help traders make informed decisions based on price movements and volatility. However, it is important to note that no indicator guarantees success in forex trading. Traders must also consider other factors such as economic news, geopolitical events, and market sentiment to make well-rounded trading decisions.

In conclusion, understanding Bos and ChoCh is essential for forex traders who want to stay ahead in the dynamic forex market. These indicators provide valuable information about support levels, price reversals, and market volatility. By incorporating these indicators into their trading strategies, traders can make well-informed decisions and increase their chances of making profitable trades. However, it is important to remember that successful trading requires a combination of technical analysis, fundamental analysis, and a deep understanding of market dynamics.

Bos and ChoCh are two key terms used in forex trading that refer to specific patterns or formations on price charts. These patterns provide traders with valuable insights and serve as signals for potential trade setups.

Bos, short for “Bullish Outside Bar,” is a pattern that occurs when the high and low of a candlestick are both higher than the previous candlestick’s high and low. The appearance of a Bos signifies a potential bullish reversal in the market. Traders often view this pattern as a buying signal, as it suggests that buyers are gaining control and the price may continue to rise.

On the other hand, ChoCh, short for “Bearish Inside Bar,” is a pattern that occurs when the high and low of a candlestick are both lower than the previous candlestick’s high and low. The appearance of a ChoCh suggests a potential bearish reversal in the market. Traders consider this pattern as a selling signal, indicating that sellers may take control and the price may decline further.

Both Bos and ChoCh patterns can be found in various timeframes and can be applied to different trading strategies. They are often used in conjunction with other technical indicators and analysis tools to confirm trading decisions and increase the probability of success.

It is important for traders to recognize and understand these patterns in order to effectively identify potential trade setups, manage risk, and make informed trading decisions in the forex market.

Forex trading, also known as foreign exchange trading, is the buying and selling of currencies on the global market. It is one of the largest financial markets, with trillions of dollars traded daily.

Below are some key concepts to understand in forex trading:

1. Currency pairs: Forex trading involves trading currency pairs, such as EUR/USD or GBP/JPY. The first currency in a pair is called the base currency, while the second currency is called the quote currency. The exchange rate represents the value of one currency compared to another.

Read Also: Understanding GID in Morgan Stanley: All You Need to Know

2. Bid and ask prices: In forex trading, there are two prices for each currency pair: the bid price, which represents the price at which you can sell the base currency, and the ask price, which represents the price at which you can buy the base currency. The difference between the bid and ask price is known as the spread.

3. Leverage: Leverage allows traders to control larger positions with a smaller amount of capital. It amplifies both profits and losses, so it is essential to use it wisely. Traders should be aware of the risks involved in trading with leverage.

Read Also: Mastering CFD Trading: A Comprehensive Guide to Success

4. Margin: Margin is the amount of money required to open and maintain a leveraged position. It acts as collateral for potential losses. Margin requirements vary depending on the broker and the trading platform.

5. Pips: A pip, short for percentage in point, is the smallest unit of measurement in forex trading. It represents the fourth decimal place in most currency pairs. Most forex pairs are quoted to four decimal places, except for the Japanese yen pairs, which are quoted to two decimal places.

6. Technical analysis: Technical analysis is a method of analyzing currency price movements using historical data and charts. Traders use various indicators and patterns to make trading decisions.

7. Fundamental analysis: Fundamental analysis involves analyzing economic, social, and political factors that may affect currency values. Traders monitor news releases and economic indicators to make trading decisions.

8. Risk management: Risk management is crucial in forex trading. Traders should set stop-loss orders to limit potential losses and use proper position sizing. They should also diversify their portfolio and avoid risking too much of their capital on a single trade.

9. Trading plan: A trading plan is a set of rules and guidelines that traders follow to make consistent and disciplined trading decisions. It helps traders avoid impulsive decisions and stick to their strategies.

By understanding these key concepts, traders can develop a solid foundation in forex trading and make informed trading decisions.

Bos refers to Bollinger Bands Oscillator and ChoCh refers to Choppiness Index. These are technical indicators used in forex trading to analyze price volatility and momentum.

Bos and ChoCh can help traders identify potential entry and exit points in the forex market by providing signals of overbought or oversold conditions and detecting periods of high or low volatility. By using these indicators, traders can make more informed trading decisions.

Bollinger Bands Oscillator, or Bos, is a technical indicator that measures the volatility and potential reversal points in the forex market. It is based on the concept of Bollinger Bands, which are bands plotted around a moving average to indicate the upper and lower price levels. The Bos calculates the distance between the price and the Bollinger Bands and presents it as an oscillator.

Choppiness Index, or ChoCh, is a technical indicator used to measure the market’s trendiness or choppiness. It helps traders determine whether the market is in a trending or ranging phase. A high ChoCh value indicates a choppy market with no clear trend, while a low value suggests a trending market. Traders can use this information to adjust their trading strategies accordingly.

Bos and ChoCh are widely used indicators in forex trading, but like any other technical indicator, they should not be used in isolation. Traders should combine them with other analysis tools, such as trend lines, support and resistance levels, and candlestick patterns, to get a more accurate and comprehensive view of the market. It is important to remember that no indicator can guarantee profitable trades, and traders should perform their own analysis and risk management.

Is Greece still a democratic country? Greece, often referred to as the birthplace of democracy, has a long and storied history of democratic …

Read ArticleExploring the Concepts of Fibonacci Indicators When it comes to technical analysis in the financial markets, Fibonacci indicators have become a …

Read ArticleWhere was smoke signals made? Smoke Signals is a critically acclaimed independent film that was released in 1998. Directed by Chris Eyre and written …

Read ArticleSalary of a L4 at Google Google, one of the largest and most influential tech companies in the world, offers a wide range of career opportunities for …

Read ArticleThe Origin of Forex Trading in South Africa Forex trading, or the foreign exchange market, has a long and fascinating history in South Africa. The …

Read ArticleScalping in Forex: Is it Profitable? In the world of forex trading, there are various strategies that traders employ to maximize their profits. One …

Read Article