Understanding the Meaning and Significance of the Upper Control Limit

What is the upper control limit? When it comes to statistical process control (SPC), the upper control limit (UCL) plays a crucial role in monitoring …

Read Article

Option trading can be a lucrative investment strategy, but it also involves risks. One way to manage these risks is by placing a stop loss order. A stop loss order is an instruction given to your broker to sell a security if it reaches a certain price. This can help protect your investment by limiting potential losses.

HDFC Securities is one of the leading brokerage firms in India, and they offer a user-friendly platform for option trading. Placing a stop loss order on HDFC Securities is a straightforward process, and this step-by-step guide will walk you through it.

Step 1: Log In or Create an Account

First, log in to your HDFC Securities account. If you don’t have an account, you can easily create one by following the instructions on their website. Once you’re logged in, navigate to the option trading section of the platform.

Step 2: Select the Option Contract

Choose the option contract for which you want to place a stop loss order. You can select the desired contract from the available list on the platform. Take into consideration the strike price and the expiration date of the option.

Step 3: Set the Stop Loss Price

Decide on the stop loss price at which you want your order to get executed. This price should be below the current market price if you want a stop loss order to sell, or above the current market price if you want a stop loss order to buy.

Step 4: Choose Stop Loss Order Type

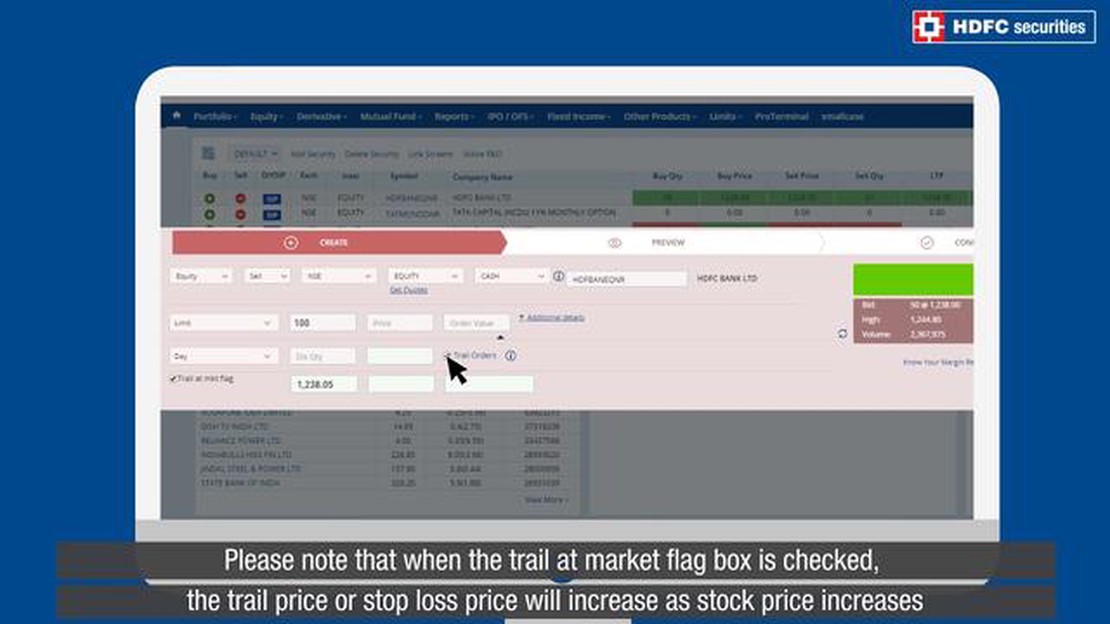

HDFC Securities offers different types of stop loss orders, such as stop limit orders and trailing stop orders. Select the type that suits your trading strategy and enter the required details.

Step 5: Review and Confirm

Before placing the stop loss order, it’s important to review all the details for accuracy. Make sure the stop loss price, quantity, and order type are all correct. Once you’re satisfied, confirm the order and wait for it to get executed.

Placing a stop loss order in option trading on HDFC Securities is a simple process that can help protect your investments. By following this step-by-step guide, you can effectively manage your risks and increase your chances of success in option trading.

Read Also: Discover the Founder of Option Trading | Complete Guide

Stop Loss is an important risk management tool used in option trading. It is a predetermined point at which a trader will exit a trade to limit their potential losses. When trading options, it is crucial to have a clear plan in place to protect your investment and prevent excessive losses in case the market moves against your position.

A stop loss order is an instruction given to your broker to sell an option contract if it reaches a certain price. This price is known as the stop price or the stop loss level. It is set below the current market price for a long position and above the current market price for a short position. When the stop price is reached, the option is sold, cutting off any further losses.

The main purpose of using stop loss in option trading is to protect your capital and minimize potential losses. By setting a stop loss level, you can limit the amount of money you are willing to lose on a trade. This helps to control emotions and reduce the risk of making impulsive decisions based on market fluctuations.

When placing a stop loss order, it is important to consider factors such as the volatility of the underlying security, the desired risk-reward ratio, and the overall market conditions. These factors will help you determine an appropriate stop loss level that aligns with your trading strategy and risk tolerance.

Read Also: Understanding the Distinction: Margin vs. Leverage in Forex Trading

It is worth noting that using a stop loss does not guarantee that you will avoid losses entirely. In fast-moving markets or during periods of extreme volatility, there may be slippage, which means the executed price may be different from the stop price. However, stop loss orders are still a valuable tool for managing risk and protecting your capital in option trading.

To summarize, stop loss orders are an essential tool for risk management in option trading. They allow traders to protect their capital, limit potential losses, and avoid making impulsive decisions. By understanding and effectively using stop loss orders, traders can maintain a disciplined approach to trading and increase their chances of long-term success.

Stop loss is an important tool that can help you manage risk and protect your investments in option trading. By setting a stop loss order, you can define the maximum amount of loss you are willing to tolerate on a trade. This can help you limit your losses and avoid significant financial setbacks.

Here is a step-by-step guide on how to place a stop loss in option trading on HDFC Securities:

It is important to note that placing a stop loss order does not guarantee that your trade will be executed at the specified stop loss price. Market conditions can sometimes cause slippage, resulting in your order being executed at a different price. Therefore, it is important to regularly monitor your trades and adjust your stop loss order if needed.

By using the stop loss feature on HDFC Securities, you can have better control over your option trades and limit your potential losses. It is a valuable tool for risk management and can help you protect your investments in the highly volatile options market.

A stop loss in option trading is a predetermined level at which a trader decides to sell their options to limit their losses.

To place a stop loss on HDFC Securities, you can follow these step-by-step instructions. First, login to your HDFC Securities account. Then, navigate to the options trading section. Next, select the options contract you want to place a stop loss for. Finally, set the stop loss level and confirm your order.

Placing a stop loss in option trading is important because it helps limit potential losses and manage risk. It allows traders to have a predetermined exit point if the market moves against their positions.

Yes, you can change or remove a stop loss order once it is placed on HDFC Securities. Simply go to the options trading section, select the options contract with the stop loss order, and modify or cancel the order as desired.

When determining the stop loss level in option trading, you should consider factors such as your risk tolerance, the underlying stock’s volatility, recent price movements, and support/resistance levels. It is also important to have a clear trading plan and stick to it.

A stop loss in option trading is a pre-determined price level at which an investor decides to sell their position to limit potential losses. It is an order placed with a broker to automatically sell an option when it reaches a certain price.

What is the upper control limit? When it comes to statistical process control (SPC), the upper control limit (UCL) plays a crucial role in monitoring …

Read ArticleUnderstanding the Bollinger Bands Indicator Signal The Bollinger Bands indicator is a popular technical analysis tool that helps traders identify …

Read ArticleExploring the Intriguing Vegas Tunnels: Secrets Unveiled Las Vegas is known for its bright lights, bustling casinos, and vibrant entertainment scene. …

Read ArticleWeizmann Share Price Prediction The Weizmann Group is a leading diversified manufacturing and engineering organization, with interests in textiles, …

Read ArticleWhat is the Secret Strategy of Forex Trading? Forex trading, also known as foreign exchange trading, is the largest and most liquid financial market …

Read ArticleHow to Cash Out Options Options trading is a popular investment strategy that allows traders to speculate on the future price movements of various …

Read Article