Risk Assessment: Unveiling the Perils of Credit Spread Options

Risks of Credit Spread Options Credit spread options are a popular financial instrument that allow investors to speculate on the movement of credit …

Read Article

Managing your money effectively is crucial when it comes to trading. Without a proper money management plan, you may find yourself taking unnecessary risks and making poor decisions that can lead to losses. One way to stay on top of your finances is by creating a money management Excel sheet. This simple tool can help you track your expenses, set realistic goals, and make informed trading decisions.

First, start by setting up a table in Excel to track your income and expenses. Use columns to enter the date, description, type (income or expense), and amount for each transaction. This will give you a clear overview of your cash flow and help you identify any patterns or trends.

Next, create formulas to calculate key metrics such as your total income, total expenses, and net income. By subtracting your expenses from your income, you can determine how much money you have left at the end of each period. This will allow you to see if you’re spending within your means or if adjustments are needed.

In addition to tracking your income and expenses, it’s important to set aside money for savings and investments. Allocate a specific percentage or amount of your income to be saved or invested each month. This will help you build an emergency fund and grow your wealth over time.

Finally, regularly review and update your money management Excel sheet to ensure its accuracy. By keeping track of your financial situation, you’ll be able to make better trading decisions and stay on top of your goals. Remember, a well-planned money management strategy is the key to long-term success in trading.

When creating a money management Excel sheet for trading, it’s essential to start by setting up the spreadsheet correctly. This step will lay the foundation for organizing and tracking your trading activities effectively.

Here are the key components to include in your spreadsheet:

1. Account Information:

Begin by entering your account information, such as the name of the brokerage or trading platform, account number, and starting balance. This information will help you keep track of your trading performance and account balance over time.

2. Transaction History:

Create a table to record your transaction history. Include columns for the date, type of transaction (buy/sell), the name of the financial instrument, quantity, purchase price, and any fees or commissions associated with the trade. This section will provide a comprehensive overview of your trading activities.

3. Current Holdings:

Keep a list of your current holdings, which includes the financial instruments you currently own. This list will help you stay updated on your positions and understand your overall portfolio composition at a glance.

Read Also: Explore the Three Types of Portfolio Management for Optimal Investment

4. Profit/Loss Tracking:

In this section, calculate and track your profit or loss for each transaction. Use formulas to automatically calculate the net gain or loss by subtracting the purchase price and fees from the proceeds of a sale. This tracking will allow you to assess your trading performance accurately.

5. Statistics and Performance Metrics:

Include a section to calculate and display various performance metrics, such as the overall return on investment (ROI), the average return per trade, and the win/loss ratio. These statistics will provide valuable insights into your trading strategies and outcomes.

Read Also: How to Determine the Price of Spread Options: Understanding the Basics

By setting up your spreadsheet with these key components, you’ll have a solid foundation for managing your trading activities and analyzing your performance effectively.

Before you start creating your money management Excel sheet for trading, it is crucial to define your trading goals and risk tolerance. This step will help you establish a clear framework and guide your decision-making process in the trading journey.

When defining your trading goals, it is important to be specific and realistic. Consider what you want to achieve in terms of profits, timeframes, and overall financial objectives. Your goals can include targets such as a certain percentage return on investment or a specific dollar amount you aim to reach. It’s essential to set achievable goals that align with your trading experience, resources, and time commitment.

Another crucial aspect to consider is your risk tolerance. This refers to the amount of risk you are willing to take on in your trades. Some traders have a high risk tolerance and are comfortable with more aggressive trading strategies, while others prefer a more conservative approach. It is important to determine the level of risk you are comfortable with, as this will influence your position sizing and money management decisions.

To help define your risk tolerance, you can assess your financial situation, investment knowledge, and previous trading experience. Consider factors such as your available capital, the time you can dedicate to trading, and your ability to withstand potential losses. This assessment will provide you with a better understanding of your risk appetite and help you determine the appropriate risk level for your trading activities.

Once you have established your trading goals and risk tolerance, you can proceed to the next step in creating your money management Excel sheet, which is defining your trading strategies and rules.

| Key Points: |

|---|

| - Define specific and realistic trading goals. |

| - Consider your risk tolerance and determine the level of risk you are comfortable with. |

| - Assess your financial situation, investment knowledge, and previous trading experience to define your risk appetite. |

| - Proceed to the next step of creating your money management Excel sheet, which is defining your trading strategies and rules. |

The purpose of creating a money management Excel sheet for trading is to help traders track their investments, keep record of their trades, calculate their risk and reward ratios, and make informed decisions about their trading strategy.

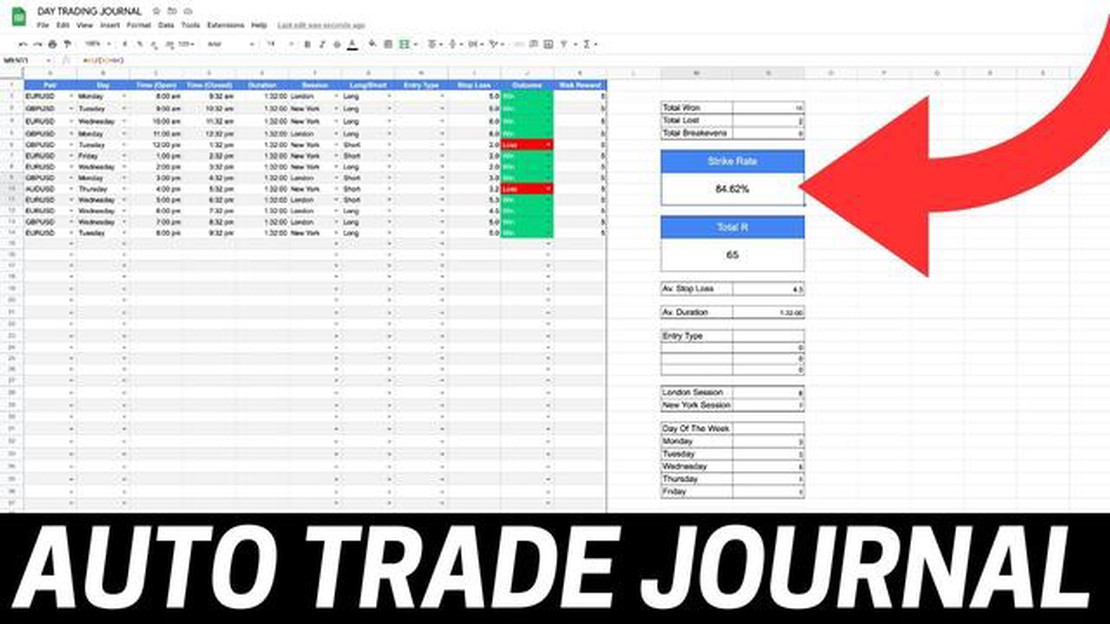

To create a money management Excel sheet for trading, you can start by creating different columns to track your trades, such as date, time, trade direction, entry price, stop loss, take profit, and trade result. You can then use formulas and conditional formatting to calculate your risk and reward ratios, and analyze your trading performance.

Using a money management Excel sheet for trading can help you stay organized, make informed trading decisions, and track your trading performance. It can also help you identify any patterns or trends in your trading strategy, and adjust your approach accordingly.

Yes, there are many templates and resources available online for creating a money management Excel sheet for trading. You can search for Excel templates specifically designed for traders, or you can customize a template to fit your needs. You can also find tutorials and guides that provide step-by-step instructions on how to create a money management Excel sheet for trading.

Risks of Credit Spread Options Credit spread options are a popular financial instrument that allow investors to speculate on the movement of credit …

Read ArticleWhat is the Moving Average of the Time Series Trend? Time series analysis is an essential tool in various fields, such as finance, economics, and …

Read ArticleWhat is the VaR at 95 confidence level? Value at Risk (VaR) is a statistical measure used to quantify the potential loss an investment or portfolio …

Read ArticleWhere do ultra rich invest? When it comes to investing, the ultra rich have their own set of strategies. These individuals, with their vast wealth, …

Read ArticleHow to Update a Running Average Calculating and updating a running average is a common task in various fields, including statistics, computer science, …

Read ArticleCan a bullish pinbar be red? A bullish pinbar is a popular candlestick pattern that is often used by traders to predict potential trend reversals in …

Read Article