Understanding Dilution: How Stock Options Work

Understanding the Mechanics of Stock Option Dilution When it comes to understanding the inner mechanics of the stock market, one concept that can …

Read Article

Time series analysis is an essential tool in various fields, such as finance, economics, and engineering. One of the fundamental concepts in time series analysis is the moving average, which helps identify trends and patterns within a dataset. By calculating the moving average, analysts can smooth out fluctuations and highlight underlying trends, providing valuable insights into the data.

The moving average is a statistical technique used to analyze time series data by calculating the average of a specified number of consecutive data points. It creates a rolling average, which moves along the time series, updating the average as new data becomes available. This approach allows for the identification and analysis of trends over time, making it a powerful tool for forecasting and decision-making.

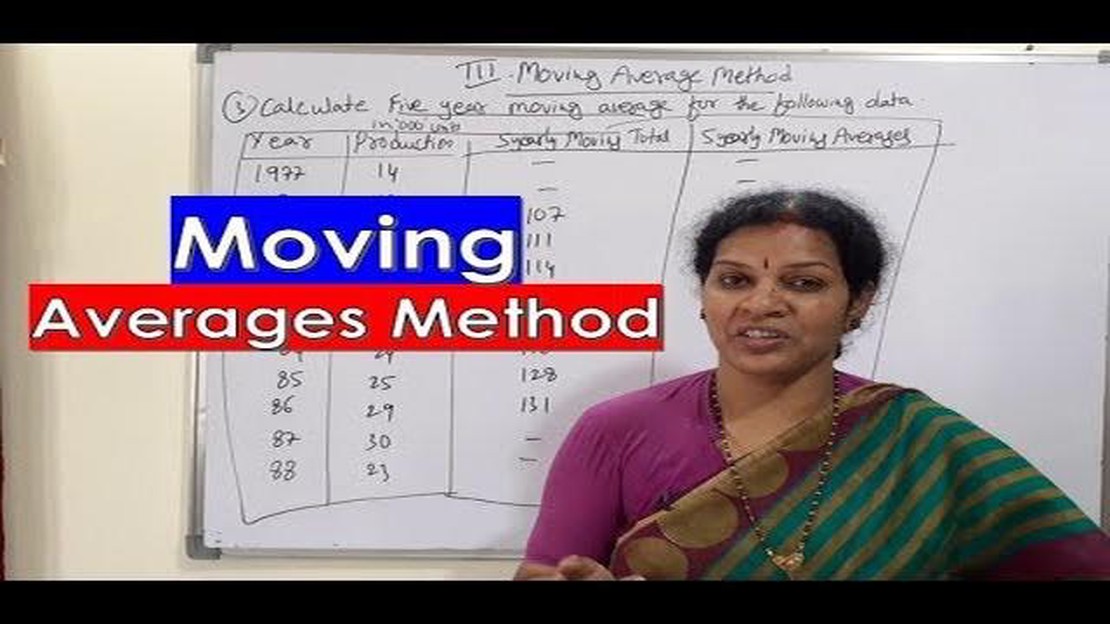

To calculate the moving average, a window or interval is defined, which specifies the number of data points included in the average calculation. The window size can be adjusted based on the desired level of smoothing and the specific characteristics of the dataset. The moving average is calculated by summing the values within the window and dividing by the number of data points in the window.

The moving average is important because it provides a clearer picture of the underlying trend in the data. It helps filter out random fluctuations and noise, allowing analysts to focus on the long-term movement of the series. By identifying and understanding these trends, analysts can make informed decisions, predict future values, and detect anomalies or irregularities in the data.

In conclusion, the moving average is a valuable tool in time series analysis for understanding trends and patterns within a dataset. By calculating the average of a specified window of data points, the moving average helps to identify and analyze trends over time. Its importance lies in its ability to provide a smoothed representation of the data, allowing for better decision-making and forecasting. Whether in finance, economics, or engineering, understanding the moving average is essential for gaining insights and making informed choices based on time series data.

A moving average is a commonly used statistical technique that helps identify the trend in a time series dataset. It smooths out random fluctuations and provides a clearer picture of the underlying pattern or trend. Understanding the moving average can be crucial in making informed decisions in various fields, such as finance, economics, and market research.

To calculate the moving average, a specific number of data points are selected, and their average is taken. This window of selected data points then moves forward through the dataset, updating the calculations at each step. The window size, also known as the period or lag, determines how many data points contribute to the average at any given time. Common period lengths include 3, 5, 10, or 20 data points, depending on the dataset and desired level of smoothing.

| Data Point | Moving Average (Period=3) |

|---|---|

| 10 | |

| 15 | |

| 20 | 15 |

| 18 | 17.67 |

| 22 | 20 |

| 25 | 21.67 |

In the above table, we have a time series dataset consisting of six data points. By applying a moving average with a period of 3, the moving average values are calculated and displayed in the second column. For example, the first moving average value of 15 is obtained by averaging the first three data points (10+15+20) and dividing by 3.

Read Also: Can I exchange currency at the bank? | Currency exchange guide for banks

The moving average is primarily used to identify the overall trend in a time series dataset. When the moving average is rising, it indicates an upward trend, while a declining moving average signifies a downward trend. By observing changes in the moving average over time, analysts can gain insights into the direction and strength of the underlying trend.

Moreover, the moving average can help smooth out short-term fluctuations caused by random noise, making it easier to spot longer-term patterns and anomalies. This can be particularly valuable in forecasting future values, as it filters out the noise and highlights the essential characteristics of the dataset.

Overall, understanding the moving average of a time series trend is key to analyzing and interpreting data accurately. By applying this statistical technique, analysts can extract meaningful information, make more informed decisions, and gain valuable insights into the behavior of a dataset over time.

A moving average is a statistical calculation used to analyze time series data. It is commonly used in finance and economics to identify trends and patterns in the data. The moving average is calculated by taking the average of a series of data points over a specific time period.

When calculating a moving average, a fixed number of data points are considered, usually over a set timeframe such as days, weeks, or months. The average is calculated by summing up the values of all the data points within the time period and dividing it by the number of data points.

The moving average is often used to smooth out fluctuations in the data and to identify the underlying trend. It helps to highlight the long-term direction of the data by removing the noise caused by short-term fluctuations.

The moving average can be calculated using different methods, such as the simple moving average (SMA) or the exponential moving average (EMA). SMA calculates the average by simply summing up the values and dividing by the number of data points. EMA, on the other hand, gives more weight to recent data points, making it more responsive to changes in the trend.

The moving average is widely used in technical analysis, where it is often plotted on a chart along with the original data. Traders and analysts use moving averages to identify buy and sell signals, as well as to determine support and resistance levels.

Read Also: Mastering the Art of Forex Trading with Pivot Points

In conclusion, the moving average is a powerful tool for analyzing time series data and identifying trends. It helps to smooth out fluctuations in the data and highlight the underlying trend. By calculating the average over a specific time period, it provides useful insights into the direction of the data, making it a valuable tool for traders and analysts.

A moving average of a time series trend is a statistical calculation that provides a smoothed representation of the underlying trend in the data. It is calculated by averaging a set number of data points over a specified time period.

The moving average of a time series trend is calculated by summing up a set number of data points and dividing the sum by the number of data points. This calculation is done for each point in the time series, resulting in a new series of averaged values.

Understanding the moving average of a time series trend is important because it helps identify patterns and forecast future trends. By smoothing out the fluctuations in the data, it provides a clearer picture of the overall direction of the trend, making it easier to make informed decisions.

There are various types of moving averages, including simple moving average (SMA), exponential moving average (EMA), and weighted moving average (WMA). Each type has its own calculation method and is suitable for different types of data and analysis purposes.

While the moving average of a time series trend can provide insights into the overall direction of the data, it may not be accurate in predicting exact future values. It is more suitable for identifying trends and making general forecasts based on the smoothed representation of the data.

A moving average is a statistical calculation used to analyze data points over a certain period of time to understand the trend in a time series. It smoothes out the data and highlights the overall direction of the trend.

The moving average is calculated by taking the average of a specified number of data points over a specific time period. The most common type is the simple moving average (SMA), which calculates the average by summing up the values and dividing by the number of data points. There are also other types, such as the exponential moving average (EMA) which gives more weight to recent data points.

Understanding the Mechanics of Stock Option Dilution When it comes to understanding the inner mechanics of the stock market, one concept that can …

Read ArticleReasons for the Low GBP Exchange Rate The pound sterling, the official currency of the United Kingdom, has been experiencing a significant decrease in …

Read ArticleThe Advantages of a Stock Swap Stock swaps have become an increasingly popular method for business mergers and acquisitions. This exchange of stocks …

Read ArticleWhat is a Good INR Rate? When it comes to foreign exchange rates, the Indian Rupee (INR) is a currency that is closely watched by global markets. …

Read ArticleUnderstanding stock options as a form of compensation In today’s competitive job market, companies are constantly looking for ways to attract and …

Read ArticleThe Atlantic Trade System: An Overview of its History and Impact The Atlantic Trade System, also known as the Triangular Trade or Transatlantic Slave …

Read Article