What to Expect for the Dollar in the Fall of 2023: Predictions and Analysis

What will happen to the dollar in the fall of 2023? In the ever-changing world of international finance, the value of the dollar remains a hot topic …

Read Article

If you’re a trader in the foreign exchange market, you’ve undoubtedly heard of the FX butterfly. This complex trading strategy has intrigued traders for years with its potential for high returns and its mysterious nature. In this guide, we’ll delve into the intricacies of the FX butterfly and show you how to navigate its complexities to maximize your trading success.

So, what exactly is the FX butterfly? It’s a trading strategy that involves combining multiple options positions to create a unique risk profile. The name “butterfly” comes from the shape of the risk graph, which resembles the wings of a butterfly. This strategy aims to profit from a specific range of prices and is popular among traders who expect a moderate level of price movement in the underlying asset.

One of the key aspects of the FX butterfly is its use of options. Options are financial contracts that give the holder the right, but not the obligation, to buy or sell an asset at a specific price within a specific time period. By utilizing different options positions, traders can create a risk profile that allows for potential profit in a specific price range, while limiting losses outside of that range.

However, the FX butterfly is not without its challenges. It requires a deep understanding of options trading and the ability to predict price movements within a specific range. Traders must also be adept at managing risk and constantly adjusting their positions as market conditions change. But for those who are willing to put in the time and effort, the FX butterfly can be a rewarding and profitable trading strategy.

Butterfly trading is a popular strategy used by forex traders to profit from market volatility and price fluctuations. This strategy involves taking positions in three different options contracts with the same expiration date, but different strike prices.

The basic concept behind butterfly trading is to combine both bullish and bearish positions to create a neutral position. This neutral position allows traders to profit from small price movements while limiting their risk exposure.

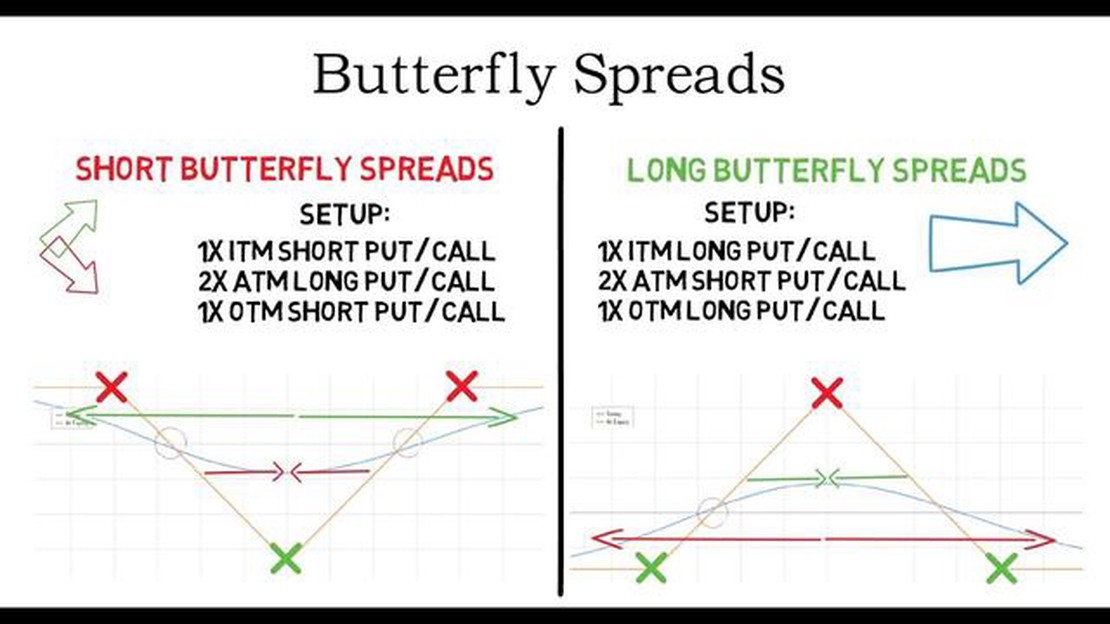

In a butterfly trade, the trader sells two at-the-money options and buys one in-the-money and one out-of-the-money option. This combination allows the trader to collect premium from selling the two options, while limiting the potential losses from the in-the-money and out-of-the-money options.

One of the key advantages of butterfly trading is its versatility. Traders can adjust the strike prices and quantities of the options contracts to create different butterfly spreads depending on their market outlook.

For example, a trader may choose to create a bullish butterfly spread by buying two out-of-the-money options and selling one at-the-money option. This strategy would profit if the price of the underlying asset remains stable or increases slightly.

On the other hand, a trader may choose to create a bearish butterfly spread by buying one in-the-money option and selling two out-of-the-money options. This strategy would profit if the price of the underlying asset remains stable or decreases slightly.

Read Also: Is Travelex better than Wise? A comprehensive comparison

While butterfly trading can be a profitable strategy, it does come with some risks. If the price of the underlying asset moves significantly in one direction, the trader may incur losses on the in-the-money or out-of-the-money options. Therefore, it is important for traders to carefully monitor their positions and manage their risk accordingly.

In conclusion, butterfly trading is a versatile strategy that allows forex traders to profit from small price movements while limiting their risk exposure. By understanding the basics of butterfly trading and adjusting the strike prices and quantities of options contracts, traders can create different butterfly spreads to suit their market outlook and trading goals.

Butterfly strategies are a popular approach in the world of foreign exchange (FX) trading. These strategies involve the purchase and sale of options contracts at three different strike prices, creating a spread that resembles the wings of a butterfly. While butterfly strategies may seem complex, they can be highly profitable when executed correctly.

One of the secrets to a profitable butterfly strategy is understanding and analyzing market volatility. By carefully assessing the level of volatility in the market, traders can identify opportunities to enter butterfly positions at favorable prices. Volatility can impact the price of options contracts, so it’s crucial to evaluate the potential risks and rewards before initiating a butterfly trade.

Another secret to success with butterfly strategies is proper risk management. Because butterfly trades involve multiple options contracts, there are potential risks if the market moves against the trader. Setting stop-loss orders and regularly monitoring positions can help mitigate these risks and preserve capital.

Timing is also key when it comes to profitable butterfly strategies. Traders need to carefully analyze market trends and identify potential turning points or reversals. By entering butterfly trades at the right time, traders can maximize their profit potential.

Read Also: What Happens When Employee Stock Options Expire? Explained

Furthermore, traders should consider employing a combination of technical and fundamental analysis when implementing butterfly strategies. Technical analysis can help identify patterns or signals that indicate potential market movements, while fundamental analysis can provide insights into economic factors that may impact the currency pair being traded.

Lastly, continuously educating oneself and staying updated with the latest market news and trends is crucial for successful butterfly strategies. The FX market is constantly evolving, and staying ahead of the curve can give traders an edge in executing profitable trades.

| Key Points |

|---|

| Carefully analyze market volatility before entering butterfly positions |

| Implement proper risk management to mitigate potential losses |

| Time butterfly trades strategically to maximize profit potential |

| Combine technical and fundamental analysis for a well-rounded approach |

| Stay updated with market trends and news for continued success |

An FX butterfly is a complex options strategy that involves the simultaneous buying and selling of options contracts on a specific currency pair, with a specific expiration date and strike price.

An FX butterfly involves buying one options contract at a lower strike price, selling two contracts at an intermediate strike price, and buying one contract at a higher strike price. The goal is to profit from changes in the relationship between the spot rate and the strike prices of the options contracts.

The benefits of trading FX butterflies include limited risk, potential for high returns, and the ability to profit from a range of market conditions. They can also be used to hedge against currency exposure or as a speculative strategy.

Some key factors to consider when trading FX butterflies include the volatility of the underlying currency pair, the time to expiration, the strike prices of the options contracts, and the overall market conditions. It is also important to have a clear understanding of the strategy and how it works.

FX butterflies can be complex and require a certain level of knowledge and experience in options trading. They may not be suitable for all traders, especially those who are new to options or have a low risk tolerance. It is important to carefully consider your own financial situation and risk appetite before trading FX butterflies.

What will happen to the dollar in the fall of 2023? In the ever-changing world of international finance, the value of the dollar remains a hot topic …

Read ArticleUnderstanding the Taxation of Non-Qualified Stock Options Non-qualified stock options (NQSOs) are a popular form of employee compensation that allow …

Read ArticleWhat is Forex Games? If you’ve ever wanted to learn about the intricacies of trading currency, but were put off by the complexity and risk, then forex …

Read ArticleUnderstanding Puts and Options: A Comprehensive Guide Welcome to “Learn the Basics of Puts and Options: The Ultimate Guide”! Whether you’re new to …

Read ArticleExamples of Transaction Costs Transaction costs play a crucial role in any economic activity or exchange. They are the expenses and efforts associated …

Read ArticleRegulated swaps by the CFTC: An overview The Commodity Futures Trading Commission (CFTC) is the regulatory body responsible for overseeing and …

Read Article