GBP to CZK Exchange Rate in Prague: Latest Conversion Rates

GBP to CZK Exchange Rate in Prague Are you planning a trip to Prague and wondering about the current exchange rate between British Pound Sterling …

Read Article

When it comes to forex trading, volatility is a key factor that can greatly influence your trading profits. Volatility refers to the fluctuation in price of a currency pair over a certain period of time. Generally, the more volatile a currency pair is, the greater the potential for profits.

By trading the most volatile forex pairs, you can take advantage of larger price movements and increase your chances of making profitable trades. These volatile currency pairs often provide opportunities for traders to gain substantial profits in a short period of time, but they also come with higher risks.

Some of the most volatile forex pairs include GBP/JPY, EUR/JPY, and GBP/USD. These currency pairs are known for their rapid price movements and high volatility, which makes them attractive to traders looking for quick profits.

However, it is important to note that trading volatile forex pairs requires skill and experience. Without proper risk management and trading strategies, the volatility can quickly lead to significant losses. Therefore, it is crucial to have a solid understanding of the market and to use proper risk management techniques when trading these volatile currency pairs.

In conclusion, discovering and trading the most volatile forex pairs can be a profitable endeavor for experienced traders. By understanding the market and implementing proper risk management techniques, traders can take advantage of the large price movements and potentially boost their trading profits.

When it comes to forex trading, understanding and taking advantage of volatility is essential for maximizing profits. Volatility refers to the price fluctuations of a currency pair over a given period of time. Higher volatility means larger price swings, providing greater opportunities for traders to enter and exit positions at advantageous prices.

By focusing on high volatility forex pairs, traders can potentially increase their trading gains. These pairs tend to have wider price ranges and higher trading volumes, making them attractive options for traders seeking potential profits. However, it’s important to note that higher volatility also means increased risk, as larger price swings can result in larger losses if not managed properly.

One of the most well-known high volatility forex pairs is the GBP/JPY (British pound/Japanese yen). Both currencies are considered to be high risk, and when combined, they create a highly volatile pair. Traders often look to the GBP/JPY for trading opportunities due to its tendency to make large price movements in a short period of time.

Another popular high volatility pair is the USD/ZAR (US dollar/South African rand). South Africa is known for its volatile economy and political landscape, which can lead to significant price swings in the USD/ZAR pair. Traders who are able to capitalize on these movements can potentially see substantial gains.

The AUD/NZD (Australian dollar/New Zealand dollar) is also worth exploring for traders seeking high volatility forex pairs. Both currencies are commodity-based, meaning their prices are heavily influenced by factors such as global demand for commodities and economic conditions. This can result in large price movements and profitable trading opportunities.

Overall, exploring high volatility forex pairs can offer traders the potential for enhanced trading gains. However, it’s important to approach these pairs with caution and utilize risk management strategies to mitigate potential losses. By understanding the unique characteristics of these pairs and staying informed about market events and trends, traders can make informed decisions and potentially boost their trading profits.

Trading in the forex market can be highly rewarding, especially when it comes to volatile currency pairs. Volatility refers to the degree of price fluctuations in a particular currency pair. The higher the volatility, the greater the potential for profit.

Read Also: Top Brokers Supporting MetaTrader 4 | Choose the Best for Your Trading Needs

When trading volatile currency pairs, you have the opportunity to capitalize on price swings and take advantage of market movements. These pairs are known for their rapid price changes, making them attractive to traders who seek quick profits.

One of the most volatile currency pairs is the GBP/JPY. This pair combines the British pound sterling with the Japanese yen, two currencies that are heavily influenced by economic and political factors. The GBP/JPY often experiences large price movements, providing ample opportunities for traders to make profits.

Another highly volatile currency pair is the EUR/JPY. The euro, used by multiple European countries, and the Japanese yen are both considered major currencies. Their combination creates a pair that is prone to significant price fluctuations, resulting in potential trading opportunities.

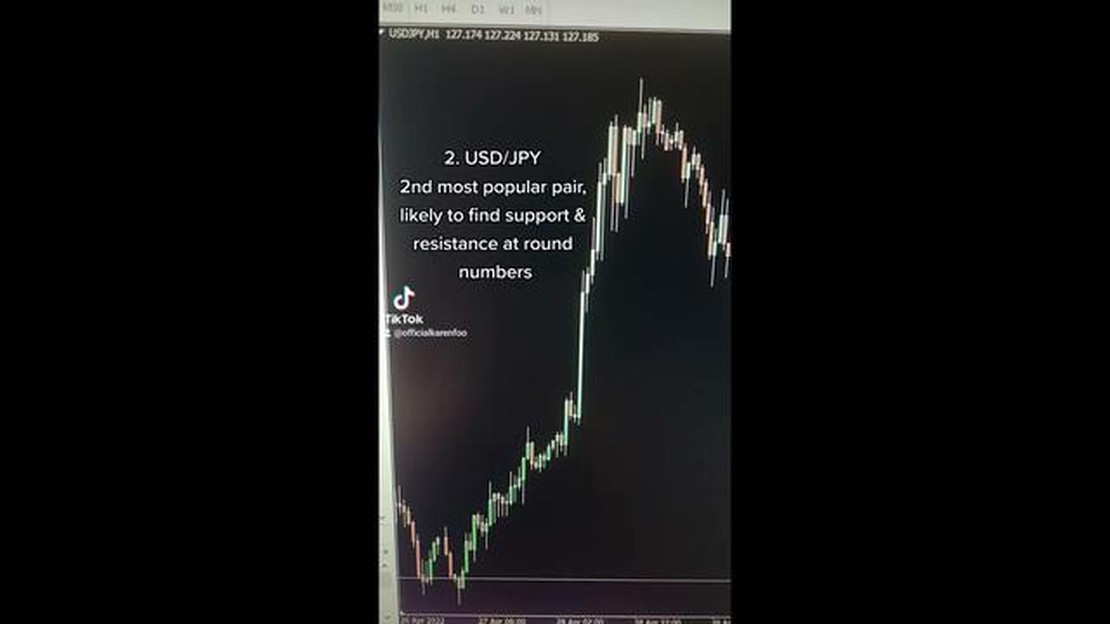

The USD/JPY is also a popular choice for traders looking to trade volatile currency pairs. As the Japanese yen is one of the major currencies, its pairing with the US dollar creates a pair that can undergo substantial price changes. This volatility can be advantageous for traders who are able to identify trends and make informed trading decisions.

It’s worth noting that while trading volatile currency pairs can offer significant profit potential, it also comes with higher risks. Volatility can work against you, leading to potential losses if not managed properly. Therefore, it’s important to have a solid trading strategy in place and adhere to risk management principles.

| Currency Pair | Volatility |

|---|---|

| GBP/JPY | High |

| EUR/JPY | High |

| USD/JPY | High |

To conclude, volatile currency pairs have the potential to boost your trading profits. By understanding the factors that influence volatility and using effective trading strategies, you can take advantage of price fluctuations and maximize your returns in the forex market.

Trading in the forex market can be highly profitable, especially if you focus on pairs with high levels of volatility. Volatility refers to the price fluctuations a currency pair experiences over a certain period of time. Higher volatility often leads to larger price movements, creating more trading opportunities to capitalize on.

Read Also: Understanding the Forex Poi Zone: Everything You Need to Know

Here are some reasons why trading high volatility forex pairs can help maximize your profits:

However, it’s important to note that trading high volatility pairs also carries higher risks. Larger price movements can result in larger losses if trades are not properly managed. It is crucial to have a solid risk management strategy in place and use risk mitigation tools such as stop-loss orders to protect your capital.

Overall, by focusing on high volatility forex pairs, you can maximize your trading profits through increased trading opportunities, larger price movements, higher profit potential, increased liquidity, and diversification. Stay informed about market events, monitor key economic indicators, and use technical analysis tools to identify high volatility pairs and make informed trading decisions.

The most volatile forex pairs are usually the ones that involve currencies from emerging economies or countries with unstable political or economic situations. Some examples include USD/ZAR, USD/BRL, and USD/TRY.

Trading volatile forex pairs can be profitable because they have bigger price movements, which means more opportunities for potential profits. However, it also comes with higher risks, so it’s important to have a solid trading strategy in place.

The main risk of trading volatile forex pairs is the increased potential for significant price fluctuations. This can lead to larger losses if the market moves against your position. It’s important to use proper risk management techniques, such as setting stop-loss orders and not risking more than a certain percentage of your account balance per trade.

To take advantage of volatile forex pairs, you can use strategies such as breakout trading or trend following. These involve entering trades when the price breaks out of a range or follows a strong trend. It’s important to conduct thorough technical and fundamental analysis to identify potential trading opportunities.

Yes, certain times and events can increase volatility in the forex market. For example, economic reports, central bank announcements, and geopolitical events can all cause significant price movements. It’s important to stay updated on the latest news and economic calendar to be aware of such events.

The most volatile forex pairs are the ones that have the highest average daily range. These pairs tend to have larger price movements and offer better trading opportunities for traders seeking to profit from short-term price fluctuations. Some of the most volatile forex pairs include GBP/JPY, AUD/JPY, GBP/USD, and EUR/JPY.

Trading volatile forex pairs can boost your profits because they offer greater trading opportunities. When a currency pair has high volatility, it means that the prices are more likely to experience significant price fluctuations, which can result in larger profits if you can accurately predict the direction of the price movement. However, it’s important to note that trading volatile pairs also carries higher risks, so it’s crucial to use proper risk management strategies.

GBP to CZK Exchange Rate in Prague Are you planning a trip to Prague and wondering about the current exchange rate between British Pound Sterling …

Read ArticleWhat are leg 1 and leg 2 in trading? Trading, especially in financial markets, can be a complex and challenging endeavor. One of the key concepts that …

Read ArticleImplementing a Trading System: Step-by-Step Guide If you have ever considered getting into trading, you have probably wondered how to implement a …

Read ArticleThe Best Strategy for Dividend Investing Dividend investing is a popular strategy for investors looking to maximize their returns. By focusing on …

Read ArticleDiscover the Best Engulfing Candle Strategy for Success Engulfing candlestick patterns are widely used by traders to identify potential reversals in …

Read ArticleWhere to Find FX Rates When it comes to foreign exchange rates, finding the best deal can save you a significant amount of money. Whether you’re …

Read Article