Is Dinar Still a Currency? Find Out the Latest Updates

Is Dinar still a currency? If you have been following the currency market, you might be wondering if the dinar is still a currency that holds value …

Read Article

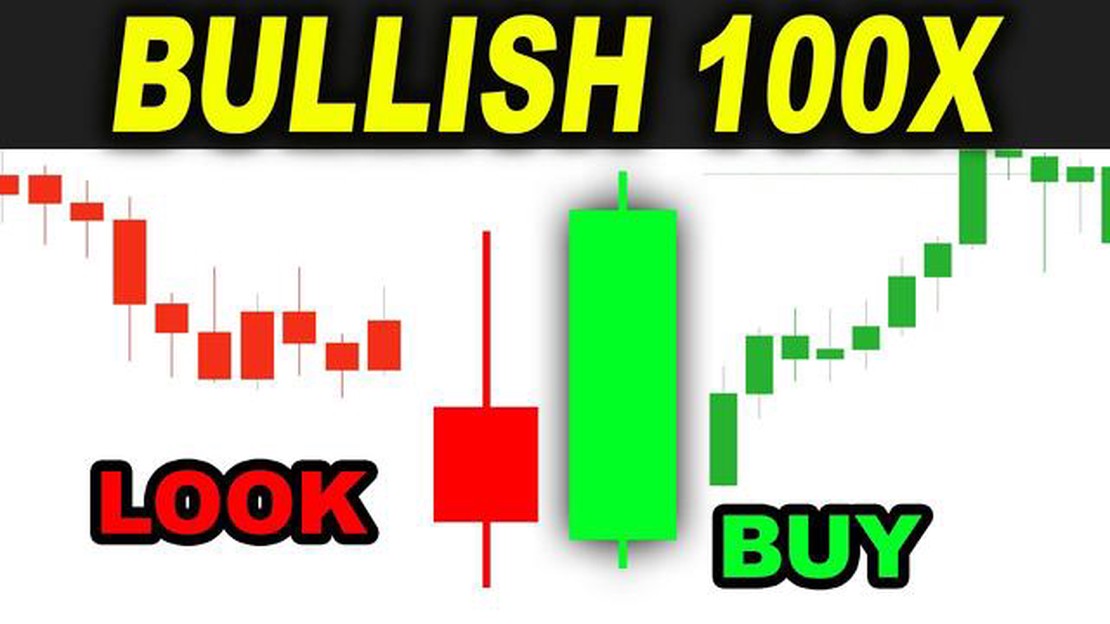

Engulfing candlestick patterns are widely used by traders to identify potential reversals in the market. This powerful strategy is based on the concept that a large candle completely engulfs the previous candle, indicating a shift in momentum.

When a bearish engulfing pattern occurs, it suggests that sellers have taken control and the price is likely to decrease. Conversely, a bullish engulfing pattern indicates that buyers are gaining dominance and the price is expected to rise.

One of the keys to successfully trading engulfing candle patterns is to look for confirmation. This can be done by analyzing other technical indicators, such as support and resistance levels, moving averages, or trendlines.

It’s important to note that the engulfing candle strategy works best in conjunction with a solid risk management plan. By setting proper stop-loss orders and taking profit targets into account, traders can minimize their losses and maximize their gains.

Overall, the engulfing candle strategy is a valuable tool in a trader’s arsenal. By identifying these patterns and using proper confirmation techniques, traders can increase their chances of making successful trades and maximizing their profits.

The engulfing candle strategy is a popular trading strategy used by technical analysts and traders to identify potential reversal points in the market. It is based on the observation of specific candlestick patterns that indicate a shift in market sentiment.

An engulfing candle pattern occurs when a smaller candlestick, known as the “engulfing” candle, completely engulfs the previous candle. The body of the engulfing candle is larger than the body of the previous candle, indicating a strong change in market direction.

The bullish engulfing pattern occurs when a smaller bearish candle is followed by a larger bullish candle. This pattern suggests that the buyers have taken control and that a bullish reversal may be imminent.

On the other hand, the bearish engulfing pattern occurs when a smaller bullish candle is followed by a larger bearish candle. This pattern suggests that the sellers have taken control and that a bearish reversal may be imminent.

Traders who use the engulfing candle strategy look for these patterns on price charts to help them make trading decisions. When they spot an engulfing candle pattern, they may choose to enter a trade in the direction of the reversal, placing a stop loss order below the low of the engulfing candle.

It’s important to note that while the engulfing candle strategy can be an effective tool for identifying potential reversals, it is not foolproof. Like any trading strategy, it should be used in conjunction with other technical analysis tools and risk management techniques to increase the likelihood of successful trades.

By understanding and applying the engulfing candle strategy, traders can improve their ability to identify profitable trading opportunities and manage risk while trading the financial markets.

The engulfing candle pattern is a popular trading strategy used by technical analysts to identify potential trend reversals. It is formed when a small candle is completely engulfed by the subsequent larger candle, indicating a shift in market sentiment.

Read Also: Is the funded trader real or fake? Discover the truth behind funded trading programs

There are two types of engulfing candle patterns: bullish engulfing and bearish engulfing. A bullish engulfing pattern occurs when a small bearish candle is followed by a larger bullish candle, suggesting a potential uptrend. Conversely, a bearish engulfing pattern occurs when a small bullish candle is followed by a larger bearish candle, indicating a potential downtrend.

To effectively trade the engulfing candle pattern, traders typically look for confirmation signals such as support or resistance levels, trend lines, or other technical indicators. These additional signals can help validate the potential reversal suggested by the engulfing candle pattern and provide more confidence in taking a trade.

It is important to note that the engulfing candle pattern is most reliable when it occurs at significant levels of support or resistance, or after a prolonged trend. This increases the likelihood that the pattern is indicative of a true reversal rather than just a temporary fluctuation.

Traders may use the engulfing candle pattern in conjunction with other technical analysis tools and strategies to increase the probability of successful trades. This can include using moving averages, oscillators, or price patterns to confirm signals and filter out false signals.

In conclusion, the engulfing candle pattern is a powerful tool for identifying potential trend reversals in trading. By understanding its structure and incorporating additional confirmation signals, traders can improve their chances of making successful trades and maximizing profits.

Engulfing candles are a powerful tool for traders to identify potential trend reversals and make profitable trading decisions. An engulfing candle occurs when the body of one candle fully engulfs or “engulfs” the body of the previous candle. This pattern indicates a shift in market sentiment and can provide valuable insights into future price movements.

Read Also: Understanding Parity in Forex: Everything You Need to Know

To identify an engulfing candle, look for a large bullish or bearish candle that completely engulfs the previous candle. The body of the engulfing candle should be larger than the body of the previous candle, and the wicks can be of any length. A bullish engulfing candle forms when a bearish candle is followed by a larger bullish candle, while a bearish engulfing candle forms when a bullish candle is followed by a larger bearish candle.

Once you have identified an engulfing candle, it is important to consider its context within the overall market trend. Engulfing candles are most effective when they occur at key support or resistance levels, or when they coincide with other technical indicators such as trendlines or moving averages. These confluences increase the probability that the engulfing candle is a valid signal.

One common strategy for trading engulfing candles is to wait for confirmation before entering a trade. This can be done by waiting for the next candle to close above or below the engulfing candle, depending on whether it is a bullish or bearish engulfing pattern. This confirmation helps to ensure that the engulfing candle is not a false signal and increases the likelihood of a successful trade.

When trading engulfing candles, it is important to manage risk by setting appropriate stop-loss orders. Stop-loss orders can be placed below the low of a bullish engulfing candle or above the high of a bearish engulfing candle. This helps to limit potential losses in case the market moves against the trade.

Engulfing candles can be a valuable tool for traders to identify potential trend reversals and make profitable trading decisions. By understanding how to identify and use engulfing candles effectively, traders can gain an edge in the market and improve their overall trading performance.

An engulfing candle strategy is a popular technical analysis pattern used in trading. It occurs when a smaller candle is completely engulfed by the subsequent larger candle. It is considered a reversal pattern, indicating a potential change in the direction of the market.

To identify an engulfing candle pattern, look for two consecutive candles. The first candle should be smaller and have a smaller body, while the second candle should be larger and completely cover the body of the first candle. The color of the candles can also provide additional information.

A bullish engulfing candle pattern occurs when a smaller bearish candle is followed by a larger bullish candle. This pattern suggests a potential reversal from a downtrend to an uptrend, indicating buying pressure and a possible increase in prices.

Engulfing candle patterns are considered reliable, especially when they occur at key support or resistance levels, or when combined with other technical indicators. However, like any trading strategy, there is no guarantee of success, so it’s important to use proper risk management and analysis.

The engulfing candle strategy can be used to identify potential trend reversals and trade in the direction of the engulfing candle. Traders can enter a long position when a bullish engulfing pattern occurs and place a stop loss below the low of the engulfing candle. Similarly, for a bearish engulfing pattern, traders can enter a short position and place a stop loss above the high of the engulfing candle.

The engulfing candle strategy is a technical analysis pattern that can be used to identify trend reversals in financial markets. It involves looking for a specific candlestick pattern where one candle completely engulfs the previous candle, signaling a potential shift in market sentiment.

Is Dinar still a currency? If you have been following the currency market, you might be wondering if the dinar is still a currency that holds value …

Read ArticleBest programming languages for trading In the fast-paced world of finance, where split-second decisions can make or break fortunes, trading platforms …

Read ArticleIs Intraday Trading Possible in Bank NIFTY? Bank NIFTY is a popular index in the Indian stock market that comprises the most liquid and actively …

Read ArticleDoes eToro use MT4? eToro is a well-known social trading platform that allows users to trade a variety of assets, including stocks, cryptocurrencies, …

Read ArticleTD Ameritrade Fees: Are They High? When it comes to investing, fees can play a significant role in determining your overall returns. TD Ameritrade is …

Read ArticleHow much margin should I use in forex trading? When it comes to forex trading, one of the most important factors to consider is the use of margin. …

Read Article