Understanding the Rules and Techniques for Drawing Trendlines

What Are the Rules for Trendlines? Drawing trendlines is an essential skill for any technical analyst or trader. Trendlines help to identify the …

Read Article

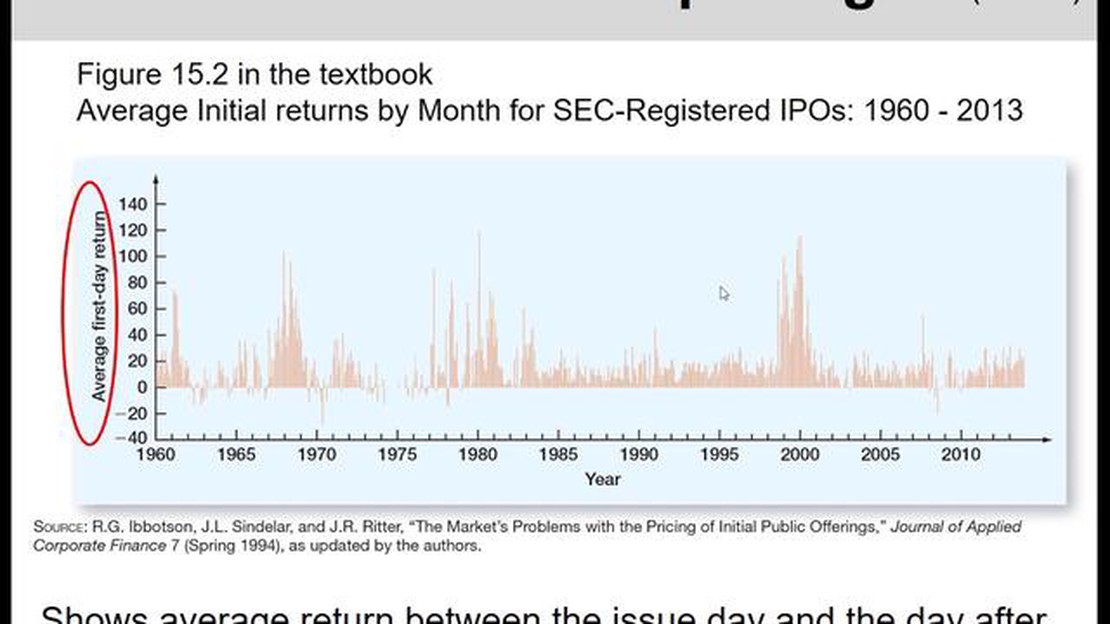

Initial Public Offerings (IPOs) are one of the most common ways for companies to raise capital and enter the public markets. However, a puzzling phenomenon often occurs during IPOs – underpricing. Underpricing refers to the situation where the offer price of a newly issued stock is set below its actual market value, causing the stock to surge in price on its first day of trading.

The reasons behind underpricing in IPOs have been the subject of much debate and speculation. Some argue that underpricing serves as a mechanism to attract investors and create a positive market perception for the newly listed company. By setting the offer price lower than the market value, companies can generate hype and demand for their shares.

Others suggest that underpricing is a result of information asymmetry between the company and potential investors. The company may possess inside information about its future prospects, leading them to set a lower offer price to induce investors to take the risk. In this scenario, underpricing acts as a compensation for the investors’ uncertainty.

“Underpricing not only benefits the company by providing it with a successful debut on the stock market, but it also benefits the underwriters and institutional investors who often receive allocations of the IPO shares at the offer price.”

However, the impact of underpricing goes beyond the initial trading day. Research has shown that underpriced IPOs experience positive long-term performance, leading to higher returns for investors who were able to secure shares at the offer price. On the other hand, this phenomenon can result in significant losses for retail investors who purchase the shares at their inflated post-IPO prices.

Understanding the causes and implications of underpricing in IPOs is crucial for both companies and investors. By gaining insights into this phenomenon, companies can make more informed decisions about pricing their IPOs. Likewise, investors can better assess the risks and potential rewards associated with underpriced IPOs.

Underpricing in initial public offerings (IPOs) occurs when the issue price of a newly listed stock is lower than its market value after it starts trading. This phenomenon can have several causes, and understanding them is crucial for investors and companies considering going public. The following are some of the primary factors contributing to underpricing in IPOs:

Understanding the causes of underpricing in IPOs can help investors make informed decisions and mitigate risks. It is important for companies to carefully consider these factors when determining the offering price and conducting an IPO.

The underpricing phenomenon refers to the tendency for initial public offerings (IPOs) to be undervalued and priced below their intrinsic value. This means that the offering price of a newly issued stock is lower than its market value on the first day of trading.

Read Also: Open Market GBP to PKR: Latest Exchange Rates and Conversion

There are several theories that attempt to explain the reasons behind underpricing in IPOs. One theory is the information asymmetry hypothesis, which suggests that underpricing is the result of a lack of information available to investors. In this scenario, issuers intentionally set the offering price below the expected market value in order to attract investors and compensate them for the risk associated with the limited information.

Another theory is the signaling hypothesis, which proposes that underpricing serves as a signal of a firm’s quality. By setting the IPO price below market value, companies can attract a larger number of investors, signaling confidence in their future prospects. This signal can help to establish a positive reputation for the company in the market.

The winner’s curse theory suggests that underpricing occurs because investors in IPOs typically bid too aggressively for shares due to competition. As a result, the winning bidders may end up overestimating the value of the shares, leading to financial losses when the market price stabilizes.

Underpricing can have both positive and negative impacts. From a positive perspective, it can generate excitement and momentum in the market, leading to increased demand for the company’s stock. This can provide a boost to the company’s market value and help it raise additional capital in the future.

Read Also: Understanding Long Put Options: A Comprehensive Guide

However, underpricing can also have negative consequences. It can result in a loss of capital for the company, as it is not receiving the full value for its shares. Additionally, underpricing can lead to a transfer of wealth from the company to the investors, reducing the company’s ability to fund its growth and development initiatives.

In conclusion, the underpricing phenomenon in IPOs is a complex and multifaceted issue. It can be attributed to factors such as information asymmetry, signaling, and the winner’s curse. While underpricing can have positive effects in terms of generating market excitement, it also has potential negative consequences for both the company and its investors.

Underpricing in IPO refers to the situation when the offering price of a company’s shares is set lower than their actual market value. This can result in a significant increase in the stock price on the first day of trading.

There are several reasons why companies may choose to underprice their IPOs. One reason is to create a positive perception of the company among investors, as a lower offering price may attract more buyers. Additionally, underpricing can help generate a high trading volume and liquidity for the stock, which can benefit the company in the long run.

Underpricing in IPO can have both positive and negative effects on the company. On one hand, it can attract a large number of investors and create a positive buzz around the company. On the other hand, it can lead to a loss of potential funds for the company, as the shares are sold at a lower price than their actual value. It can also result in dilution of control for existing shareholders.

There are several factors that contribute to underpricing in IPO. One factor is the uncertainty and risk associated with investing in a newly listed company. Investors may demand a lower price for the shares to compensate for this risk. Another factor is the asymmetric information between the company and investors, where the company may have better information about its value and prospects. Finally, underwriters may underprice IPOs to ensure a successful offering and to build long-term relationships with the issuing company.

The consequences of underpricing in IPO can vary. For the company, it can result in a loss of potential funds and dilution of control. It can also lead to a missed opportunity to raise capital at a higher valuation. For investors, underpricing can provide an opportunity for quick profits, but it can also lead to a perception that they missed out on potential gains if the stock price increases significantly after the IPO. Finally, underpricing can have broader implications for the efficiency and integrity of the IPO market, as it may discourage companies from going public or lead to misallocation of resources.

What Are the Rules for Trendlines? Drawing trendlines is an essential skill for any technical analyst or trader. Trendlines help to identify the …

Read ArticleTrading SPY Options 24 Hours: What You Need to Know SPY options are a popular choice among traders looking to take advantage of the movements in the …

Read Article1 Dollar to Rupiah Conversion The exchange rate between the US Dollar (USD) and the Indonesian Rupiah (IDR) is an important aspect of international …

Read Article4 Types of Forex Traders: Exploring Different Trading Styles When it comes to forex trading, everyone has their own unique approach. Some traders …

Read ArticleUnderstanding the SMS Alert Service: Benefits and Features In today’s fast-paced world, effective and efficient communication is crucial for …

Read ArticleHow Can NRI Get Forex in India? India is home to a large number of Non-Resident Indians (NRIs) who have settled in different parts of the world. Many …

Read Article