Understanding the Definition and Importance of Option Date

Understanding the Meaning of Option Date Option date, also known as expiration date or expiry date, is a crucial concept in the field of finance and …

Read Article

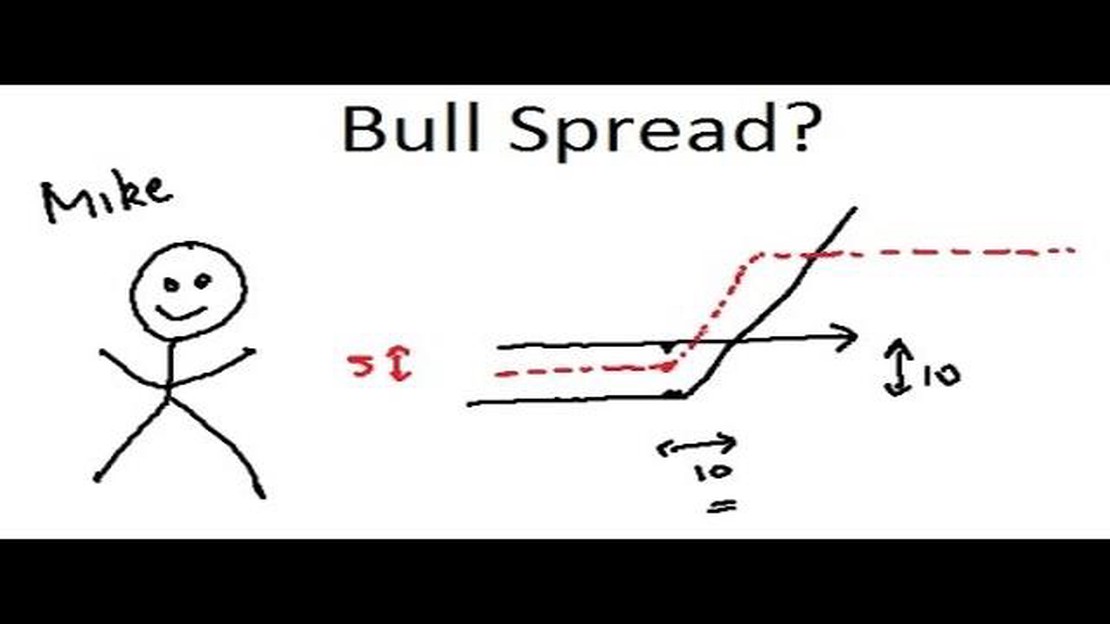

When it comes to investing, there are a variety of strategies to choose from. One strategy that you may want to consider is a bull spread. This type of spread involves purchasing call options at a certain strike price and simultaneously selling call options at a higher strike price. The goal of a bull spread is to profit from a rise in the price of the underlying asset.

There are several reasons why you should consider a bull spread for your investment strategy. First, a bull spread allows you to limit your downside risk. Since you are simultaneously buying and selling call options, you have the potential to profit from both the increase in the price of the underlying asset and the difference in the premiums of the call options. This helps to mitigate your losses if the price of the underlying asset does not rise as expected.

Second, a bull spread can provide you with a higher potential return on investment. By selling call options at a higher strike price, you are effectively reducing the cost of buying the call options at the lower strike price. This allows you to maximize your profits if the price of the underlying asset rises significantly.

Lastly, a bull spread can be a flexible strategy that can be used in various market conditions. Whether the market is trending up, down, or sideways, a bull spread can be adjusted to take advantage of different scenarios. This adaptability makes it an attractive option for investors who are looking to capitalize on market opportunities.

In conclusion, a bull spread can be an effective strategy for investors who are bullish on a particular asset. It allows you to limit your downside risk, potentially increase your return on investment, and adapt to changing market conditions. However, it is important to carefully consider your investment goals and risk tolerance before implementing a bull spread strategy.

A bull spread is an options strategy that can provide several benefits for investors:

In summary, a bull spread provides a lower-risk, cost-effective strategy with potential for profit in a rising market. It offers flexibility and limited loss potential, making it an attractive option for investors looking to capitalize on upward price movements.

When implementing a bull spread strategy, one of the key benefits is the increased profit potential. This options strategy allows investors to take advantage of both the upside potential of a stock or index while also limiting downside risk.

With a bull spread, an investor purchases a call option with a lower strike price and simultaneously sells a call option with a higher strike price. This creates a spread between the two options, which is where the strategy gets its name.

By employing a bull spread strategy, investors can benefit from the stock or index moving higher. If the underlying asset increases in value, the investor will profit from the call option they purchased at the lower strike price. At the same time, the call option they sold at the higher strike price will lose value, resulting in a lower overall cost for the spread.

If the stock or index reaches the higher strike price, the investor can either exercise their call option and profit from the increase in the stock’s value, or they can choose to sell the option for a gain. This allows the investor to participate in the potential upside while also having limited risk if the stock or index doesn’t perform as expected.

Read Also: Exploring Halal Trades in Islam: A Comprehensive Guide

Overall, a bull spread strategy provides investors with increased profit potential compared to simply buying a call option. By selling an option with a higher strike price, investors can offset some of the cost of the call option they purchase, making the strategy more affordable. Additionally, the limited risk of the strategy makes it an attractive option for many investors.

When considering a bull spread as part of your investment strategy, it is essential to have a solid risk management plan in place. Risk management involves assessing and mitigating the potential risks involved in your investment.

One of the primary risks when using a bull spread strategy is limited profit potential. Since a bull spread involves buying a call option with a higher strike price and selling a call option with a lower strike price, the maximum profit potential is capped. This means that even if the underlying asset’s price increases significantly, your profit will be limited.

Another risk to consider is the possibility of the underlying asset’s price not moving as expected or even moving in the opposite direction. If the price remains stagnant or decreases, you may experience a loss on your investment.

Read Also: Choosing the Right Indicator for Position Trading: Top Picks and Strategies

To manage these risks, consider setting stop-loss orders to protect your investment. A stop-loss order is placed at a predetermined price level, and it triggers the sale of your position if the price reaches or falls below that level. This can help limit your losses if the market moves against your position.

Additionally, diversification is key to managing risk in any investment strategy. By spreading your investments across different asset classes, sectors, and regions, you can reduce the impact of any single investment on your overall portfolio. This way, if one investment performs poorly, others may offset the losses.

| Risk | Description |

|---|---|

| Limited Profit Potential | A bull spread strategy has a capped profit potential, even if the underlying asset’s price increases significantly. |

| Opposite Market Movement | The underlying asset’s price may not move as expected or even move in the opposite direction, resulting in a potential loss. |

| Stop-loss Orders | Placing stop-loss orders can help limit losses by triggering the sale of the position if the price reaches or falls below a predetermined level. |

| Diversification | Diversifying your investments across various asset classes, sectors, and regions can reduce the impact of any single investment on your portfolio. |

By proactively managing these risks and being mindful of potential downsides, you can make more informed decisions when incorporating a bull spread into your investment strategy.

A bull spread is an options strategy that involves buying and selling two options with different strike prices but the same expiration date, with the goal of profiting from a rise in the price of the underlying asset.

A bull spread works by buying a call option with a lower strike price and selling a call option with a higher strike price. If the price of the underlying asset rises, the value of the call option with the lower strike price will increase more than the value of the call option with the higher strike price, resulting in a net profit.

Using a bull spread can limit the downside risk and potential loss compared to buying the underlying asset outright. It also allows for some flexibility in profiting from a rise in the price of the underlying asset, as the strategy can be adjusted based on market conditions.

Yes, there are risks associated with a bull spread. If the price of the underlying asset does not rise as expected, there is a potential for losses. Additionally, the maximum profit potential is limited, as the value of the call option with the lower strike price will eventually reach its maximum value.

A bull spread strategy is most effective when there is a bullish market outlook and the price of the underlying asset is expected to rise. It can be used in various market conditions, but it is important to carefully consider the potential risks and rewards before implementing the strategy.

Understanding the Meaning of Option Date Option date, also known as expiration date or expiry date, is a crucial concept in the field of finance and …

Read ArticleIs commodity trading profitable in India? Commodity trading has always been one of the oldest and most fundamental forms of trading. In India, this …

Read ArticleUnderstanding the concept of moving average in sales trend In the world of business, understanding and predicting sales trends is essential for …

Read ArticleIs it possible to live on forex? Forex trading has gained popularity over the years as more and more people look for alternative ways to earn money. …

Read ArticleWhat is Inventory at Moving Average? Inventory valuation is an essential aspect of accounting for any business that deals with physical products. It …

Read ArticleWhat is the permissible limit of foreign currency? Foreign currency limits refer to the amount of money that individuals are legally allowed to carry …

Read Article