Understanding TTF Pricing: Everything You Need to Know

Understanding TTF Pricing In the world of domain names, TTF stands for “Tied-To-Fee” pricing, which has become increasingly popular in recent years. …

Read Article

Option date, also known as expiration date or expiry date, is a crucial concept in the field of finance and investing. It refers to the date on which an option contract expires and becomes invalid. Options are financial derivatives that give the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specific timeframe. The option date determines when this right can be exercised or when the contract is terminated.

The importance of option date lies in its role in determining the viability and profitability of an options contract. As the option date approaches, the value of the option may fluctuate based on the movement of the underlying asset’s price. Traders and investors closely monitor option dates to make informed decisions about buying, selling, or exercising their options.

Understanding the option date is crucial for option traders as it allows them to plan their strategies and manage their risk effectively. Different option strategies have varying timeframes, and the option date plays a critical role in determining the success or failure of these strategies.

Option dates are predetermined and set at the time the option contract is created. They can range from a few days to several years, depending on the type of option and the underlying asset. It is important for investors to be aware of the option date and any associated deadlines to ensure they can take timely action and capitalize on potential opportunities in the market.

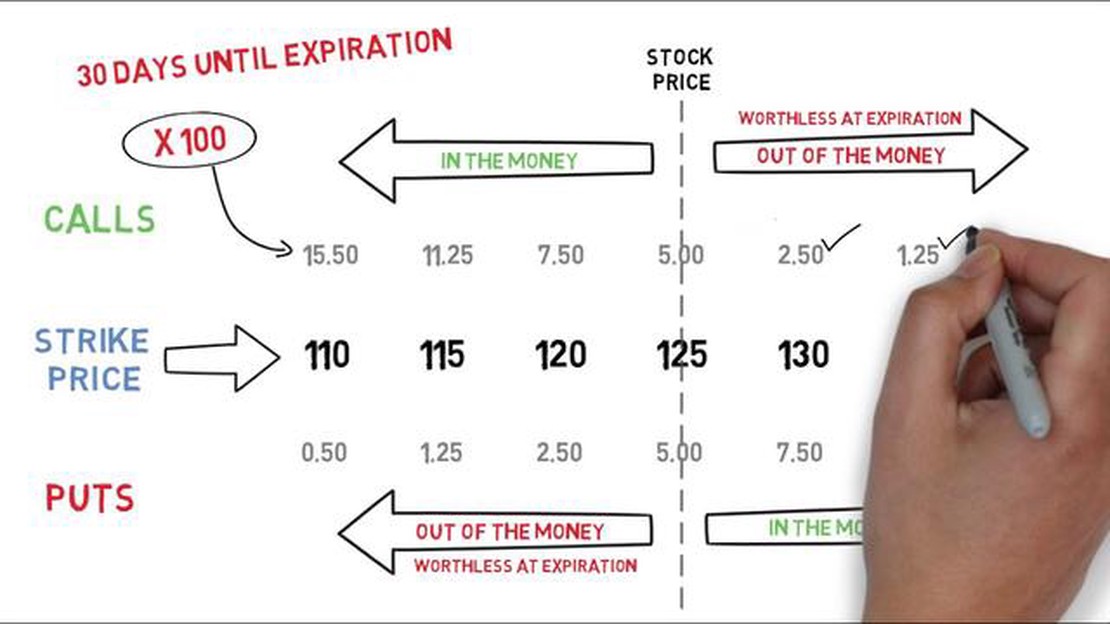

In the world of finance and investments, an option date refers to the specific date on which an option contract expires. An option contract grants the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price, known as the strike price, on or before the option date.

The option date is of great importance because it determines the timeframe within which the option holder can exercise their right to buy or sell the underlying asset. If the option is not exercised by the option date, it becomes worthless, and the holder loses their rights to the asset. Therefore, understanding and keeping track of the option date is crucial for investors and traders engaging in options trading.

Furthermore, the option date plays a significant role in pricing options and assessing their value. As the option approaches its expiration date, its value may change due to market conditions and the time remaining until expiration. This change in value is influenced by factors such as the price of the underlying asset, market volatility, and the time decay of the option. Traders and investors closely monitor these changes to make informed decisions about when to exercise or sell their options.

Read Also: Is 500:1 Leverage Risky? Exploring the Benefits and Potential Pitfalls

Moreover, the option date also affects the pricing of options as it determines the length of time the option holder has to profit from their position. Generally, options with longer expiration periods tend to have higher premiums, as there is more time for the underlying asset to move in a favorable direction. Conversely, options with shorter expiration dates are more affordable but carry higher risks, as there is less time for the asset to reach the desired price level.

In summary, the option date is a critical component of option contracts. It sets the expiration date for buying or selling the underlying asset and determines the timeframe within which options can be exercised. It is important for traders and investors to pay close attention to the option date, as it greatly impacts the value and pricing of options, as well as the potential for profit or loss.

An option date refers to the specific date on which an option contract expires. An option contract gives the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a certain time period. The option date marks the end of this time period, after which the contract loses its validity.

Option dates are crucial in options trading as they determine the duration of the contract and when the holder can exercise their rights. The option date is agreed upon when the contract is created and is typically set in the future, allowing the holder ample time to decide whether or not to exercise their option.

When the option date arrives, the contract can either be exercised or allowed to expire. If the holder decides to exercise the option, they can either buy or sell the underlying asset at the predetermined price, depending on the type of option. If the holder chooses not to exercise the option, it simply expires and becomes worthless.

The concept of option dates is important for both options traders and investors. Traders need to carefully consider the option date when making their trading decisions, as it affects the potential profitability of the trade. Investors who hold options as part of their portfolio also need to be aware of the option dates to effectively manage their investments.

In conclusion, the option date is a critical component of option contracts that determines their validity and duration. It is the date on which the option contract expires, after which the holder must decide whether to exercise their option or let it expire. Understanding option dates is essential for successful options trading and portfolio management.

An option expiration date is the date on which an options contract expires and becomes null and void. After this date, the option can no longer be exercised by the holder and all rights associated with the option cease to exist.

Read Also: Understanding Momentum Trading: Key Indicators to Watch

The option expiration date is important because it sets a deadline for the holder of the option to exercise their rights. It also allows the option writer to know when their obligations will be completed. Additionally, the expiration date affects the price of the option, as the closer it gets to expiration, the higher the chances of the option becoming worthless.

In some cases, an option expiration date can be extended if both parties agree to do so. This can happen through a negotiation between the option holder and the option writer. However, it is important to note that extending the expiration date is not a common practice and usually requires specific circumstances.

If you do not exercise an option before the expiration date, the option becomes worthless and you lose the opportunity to buy or sell the underlying asset at the agreed-upon price. It is important to keep track of expiration dates and take action before the deadline if you want to realize the value of your option.

The expiration date affects the price of an option because as it gets closer to expiration, the time value of the option decreases. Time value is one of the factors that determine the price of an option, and as the expiration date approaches, the chances of the option becoming profitable decrease. Therefore, options with longer expiration dates usually have higher prices.

Option date refers to the specified date in an option contract when the option holder can exercise their right to buy or sell the underlying asset.

Understanding TTF Pricing In the world of domain names, TTF stands for “Tied-To-Fee” pricing, which has become increasingly popular in recent years. …

Read ArticleUnderstanding OTA Strategy: Effective Techniques for Online Travel Agencies In today’s digital age, the hospitality industry is experiencing a …

Read ArticleWhat is the EUR MYR forecast for 2023? The EUR to MYR exchange rate is a topic of interest for investors and businesses alike. As we move into 2023, …

Read ArticleWho is a swap dealer under Dodd-Frank? The Dodd-Frank Wall Street Reform and Consumer Protection Act, passed in 2010, brought significant changes to …

Read ArticleMinimum Deposit for MT4 Trading: Everything You Need to Know MT4 trading is a popular choice for traders around the world. It is a powerful platform …

Read ArticleUnderstanding the Foreign Exchange Market in Nigeria Nigeria, often referred to as the “Giant of Africa”, is not only the largest economy on the …

Read Article