Choosing the Best Moving Averages for Effective Technical Analysis

Best Moving Averages for Technical Analysis When it comes to technical analysis in stock trading, moving averages play a crucial role in determining …

Read Article

When it comes to giving gifts, there are many options to consider. One question that often arises is whether to give cash or appreciated stock as a gift. While both options have their advantages, it ultimately depends on the individual’s preferences and financial situation.

Cash is the most straightforward and versatile form of gift. It provides the recipient with the freedom to use the money however they please, whether it’s to pay off debts, indulge in a splurge, or save for the future. Cash is also an excellent option for last-minute gifts or when the giver is unsure of the recipient’s preferences.

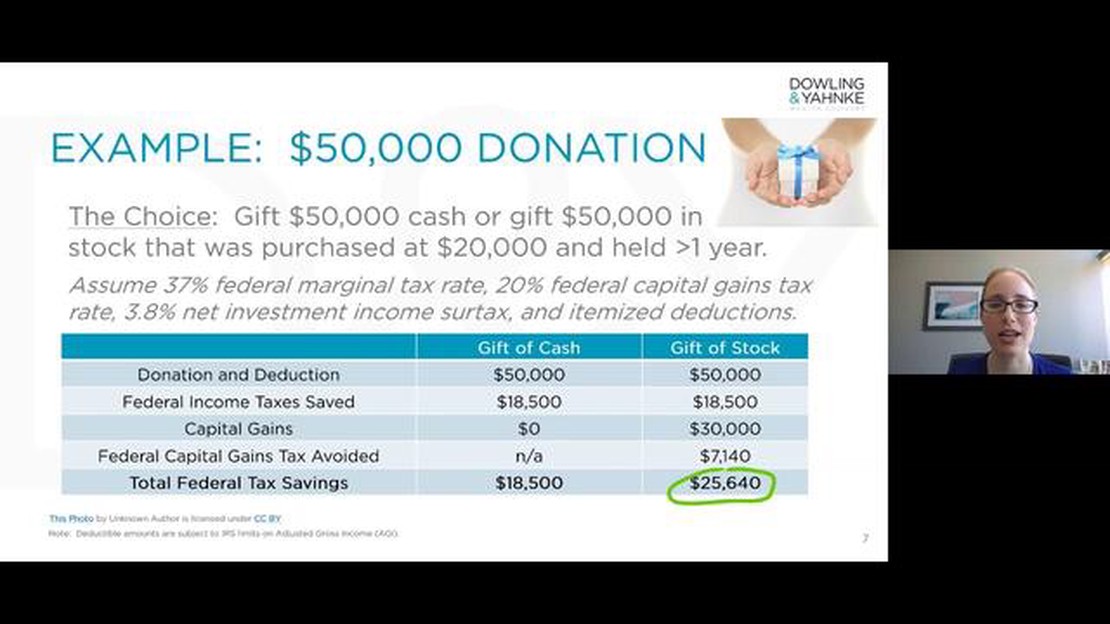

On the other hand, giving appreciated stock as a gift can offer unique benefits. If the stock has appreciated in value since the giver acquired it, the recipient can avoid paying capital gains taxes when they sell it. This can be particularly advantageous for high-value stocks or stocks that have seen significant growth. Additionally, appreciated stock can be a thoughtful gift for individuals with a keen interest in investing or who are looking to diversify their portfolio.

Ultimately, the choice between cash and appreciated stock as a gift depends on various factors, including the recipients’ preferences, financial goals, and tax considerations. It’s essential to weigh the pros and cons of each option and consider how it aligns with the recipient’s needs and interests. Whether it’s providing freedom and flexibility with cash or offering the potential for long-term financial benefits with appreciated stock, both options can be thoughtful and impactful gifts.

When considering whether to give cash as a gift, there are both pros and cons to take into account. Here are a few points to consider:

However, there are also some potential downsides to giving cash as a gift:

Read Also: Pros and Cons of Stock Options: Understand the Benefits and Risks

Ultimately, the decision to give cash as a gift depends on various factors including the occasion, the recipient’s preferences and needs, and the relationship between the giver and the receiver. By weighing the pros and cons, you can make an informed decision about whether cash is the best choice for a particular gift.

When it comes to gift giving, cash is often seen as a versatile and practical option. Here are some benefits of giving cash as a gift:

3. Avoiding wasteful gifts: By giving cash, you ensure that the recipient doesn’t receive something they don’t need or want. It eliminates the risk of giving a gift that may go unused or eventually be discarded. 4. Inclusion of everyone: Cash gifts are suitable for people of all ages, from children to adults. It’s a universal gift that can be appreciated by anyone, regardless of their personal preferences or interests. 5. Easy to send: Giving cash as a gift is convenient, especially if you’re unable to meet the recipient in person. You can send it through various methods such as electronic transfers or even traditional mail. 6. Avoiding complications: Sometimes, choosing the right gift can be challenging, particularly if you’re unfamiliar with the recipient’s preferences or hobbies. With cash, you don’t have to worry about getting the wrong gift or causing any awkwardness.

Read Also: Contacting Forex FNB: Everything You Need to Know

Overall, giving cash as a gift can be a thoughtful and practical gesture. It allows the recipient to make their own choices and ensures that your gift will be put to good use.

One benefit of giving cash as a gift is that it provides the recipient with the flexibility to use the money however they choose. Cash can be easily spent on immediate needs or saved for future expenses. Additionally, cash gifts do not require any extra paperwork or tax implications.

Yes, there are several advantages to giving appreciated stock as a gift. Firstly, by donating appreciated stock, you can avoid capital gains tax that would have been incurred if you sold the stock. Secondly, donating appreciated stock has the potential to provide a larger tax deduction than if you were to donate the same amount in cash. Lastly, appreciated stock can continue to grow in value for the recipient, providing long-term financial benefits.

One potential drawback of giving cash as a gift is that it may be seen as impersonal. Some people prefer to receive gifts that are more thoughtful and meaningful. Additionally, if the gift is a large sum of money, it may raise questions about the giver’s intentions or create awkwardness in the relationship. Lastly, cash gifts may be spent quickly and not provide the long-term benefits that other types of gifts can offer.

Giving appreciated stock as a gift can benefit the giver by allowing them to support a cause they care about while also potentially providing them with tax advantages. By donating appreciated stock, the giver can avoid capital gains tax and potentially receive a larger tax deduction than if they were to donate the same amount in cash. This can result in significant tax savings for the giver.

Best Moving Averages for Technical Analysis When it comes to technical analysis in stock trading, moving averages play a crucial role in determining …

Read ArticleUnderstanding the Difference Between Sell to Open and Sell to Close Options When it comes to options trading, there are two common phrases that you …

Read ArticleDiscovering the M3 4u Trading Strategy: Maximizing Profit Potential Investing in the financial markets can be both exciting and challenging. With so …

Read ArticlePython for Stock Trading: Can You Use it to Make Profit? Python has gained popularity among traders and investors for its versatility and ease of use …

Read ArticleHow is ADR calculated in Tradingview? Calculating Average Daily Range (ADR) is a crucial tool for traders, as it provides valuable insights into …

Read ArticleIs the forex market open on January 1? Forex trading is a decentralized market that operates 24 hours a day, 5 days a week. Traders around the world …

Read Article