Can an individual trade options and profit?

Individual Options Trading: Everything You Need to Know Options trading can be a lucrative investment strategy for individuals who are willing to take …

Read Article

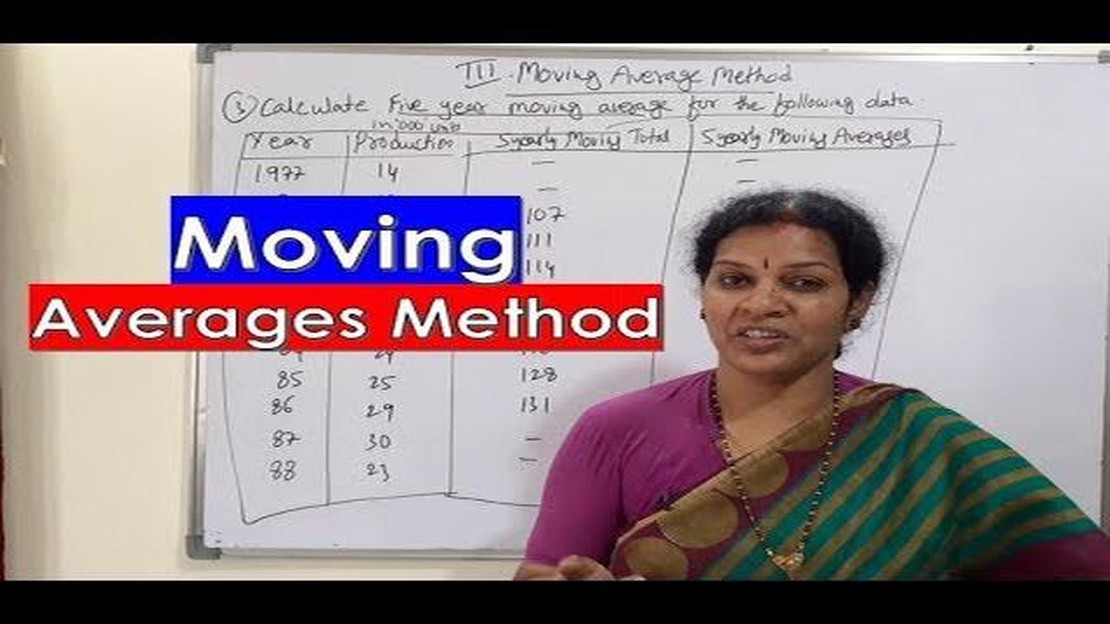

When analyzing trends in various data sets, it is essential to have reliable tools that can provide meaningful insights. One such tool is the moving average method, which is widely used in trend analysis. This method calculates the average value of a data series over a specific period to smooth out short-term fluctuations and reveal underlying trends.

The moving average method is based on the assumption that long-term trends are more relevant than short-term fluctuations. By averaging the values over a certain time frame, the method aims to filter out noise and highlight the overall direction of the data. This makes it easier for analysts to identify patterns, spot turning points, and make informed decisions.

The calculation of a moving average involves the following steps:

For example, if we are analyzing the monthly sales of a company over a period of 12 months, we would add up the sales for each month and divide the sum by 12 to calculate the 12-month moving average.

The moving average method can be applied to various types of data, including stock prices, economic indicators, weather patterns, and more. By observing the trends revealed through moving averages, analysts can better understand the direction of the data, predict future movements, and make informed decisions based on these insights.

In conclusion, the moving average method is a powerful tool in trend analysis that helps filter out noise and reveal meaningful patterns. By calculating the average value of a data series over a specific time frame, analysts can better understand long-term trends and make informed decisions based on these insights.

Moving averages are a common tool used in trend analysis to help smooth out fluctuations in data and identify the direction of a trend. By calculating an average over a certain number of data points and updating it as new data becomes available, moving averages provide a visual representation of the overall trend.

To use a moving average in trend analysis, follow these steps:

While moving averages are simple to calculate and interpret, it’s important to remember that they are lagging indicators and may not always accurately predict future trends. Therefore, it’s necessary to use them in conjunction with other technical analysis tools and indicators for a comprehensive trend analysis.

Read Also: Understanding the Moving Average of Time Series Trend: Definition, Calculation, and Importance

In conclusion, using moving averages in trend analysis can help you identify and confirm the direction of a trend. By following the steps outlined above, you can effectively incorporate moving averages into your trading or investment strategy.

The moving average is a technical analysis tool that is used to smooth out price data and identify trends over a specific period of time. It is calculated by taking the average of a set of data points over a given period of time, and then plotting that average on a chart.

There are different types of moving averages, including simple moving average (SMA), exponential moving average (EMA), and weighted moving average (WMA). The simple moving average is the most basic type, where all data points are given equal weight. The exponential moving average gives more weight to recent data points, while the weighted moving average assigns different weights to different data points.

The moving average is often used in trend analysis to determine the direction of a trend and to filter out noise in price data. It can be used to identify support and resistance levels, as well as to generate buy and sell signals. A moving average can also be used to smooth out price data and make it easier to identify trends and patterns.

Read Also: Understanding the 10 Percent Shareholder Rule for ISO: Everything You Need to Know

Traders and investors use moving averages to find potential entry and exit points for trades. When the price crosses above the moving average, it is often seen as a bullish signal, indicating that the trend may be shifting upwards. Conversely, when the price crosses below the moving average, it is seen as a bearish signal, indicating a potential downward trend.

It is important to note that moving averages lag behind the current price, as they are based on past data. Therefore, it is often used in combination with other technical indicators to confirm signals and improve the accuracy of predictions.

In conclusion, the moving average is a useful tool in trend analysis that can help traders and investors identify trends, filter out noise, and make more informed trading decisions. It is important to understand the different types of moving averages and how they are calculated in order to effectively use this tool in technical analysis.

The method of moving average in trend analysis is a statistical calculation used to analyze trends in data over a specified period of time. It involves calculating the average value of a series of data points within a certain window, and then moving that window along the data set to create a series of average values. These average values can be used to identify trends and patterns in the data.

The moving average method works by calculating the average value of a series of data points within a specified window. The window is slid along the data set, one data point at a time, and the average value is recalculated each time. This creates a series of average values that can be plotted on a graph to identify trends and patterns in the data. The size of the window used can vary depending on the specific analysis being performed.

There are several advantages of using moving averages in trend analysis. Firstly, moving averages help to smooth out fluctuations in the data, making it easier to identify long-term trends. They also provide a simple and easy-to-understand visual representation of the data. Additionally, moving averages can be used to generate buy and sell signals in technical analysis of financial markets. Overall, moving averages are a valuable tool for trend analysis.

Yes, there are some limitations to using moving averages in trend analysis. Moving averages rely on historical data, so they may not accurately predict future trends. Additionally, moving averages can lag behind sudden changes or reversals in the data. They are also sensitive to the choice of window size – a small window may produce a lot of noise, while a large window may miss short-term trends. It’s important to use moving averages in conjunction with other analysis techniques for a more comprehensive understanding of the data.

Moving averages have a wide range of practical applications in trend analysis. They are commonly used in financial analysis to analyze stock price trends and generate buy and sell signals. Moving averages can also be used in forecasting models to predict future trends in various industries. In addition, moving averages are used in technical analysis of charts and graphs to identify support and resistance levels. Overall, the method of moving average is a versatile tool that can be applied to many different fields.

Individual Options Trading: Everything You Need to Know Options trading can be a lucrative investment strategy for individuals who are willing to take …

Read ArticleHow to Achieve a 10% Return on Investment When it comes to investing, everyone wants to get the highest return possible. Whether you’re a seasoned …

Read ArticleTwo Types of Foreign Trade: Explained Foreign trade plays a crucial role in the global economy, facilitating the exchange of goods and services …

Read ArticleHas Forex Trading Come to an End? Forex trading, also known as foreign exchange trading, has been a popular investment option for individuals all over …

Read ArticleWhen is the Forex Market? The Forex market, also known as the foreign exchange market, is the largest financial market in the world. It offers traders …

Read ArticleUnderstanding Cyclone Software: Everything You Need to Know Cyclone Software is a cutting-edge technology that aims to revolutionize the way …

Read Article