Top Reasons Why Traders Choose Dubai as Their Trade Hub

Why do traders go to Dubai? The choice of a trade hub plays a crucial role in the success of any business. Dubai, the cosmopolitan city of the United …

Read Article

IC Markets Australia is a renowned forex and CFD broker that offers a wide range of trading opportunities to traders worldwide. If you are considering opening an account with IC Markets, it is essential to understand the minimum deposit requirement, as it can significantly impact your trading experience.

What is the minimum deposit requirement at IC Markets Australia?

The minimum deposit requirement at IC Markets Australia depends on the type of account you choose. Their Standard account requires a minimum deposit of $200, making it an ideal option for beginner traders or those with limited funds. On the other hand, their Raw Spread account has a higher minimum deposit requirement of $500, but offers tighter spreads and ECN pricing.

Why is the minimum deposit important?

The minimum deposit serves multiple purposes. Firstly, it acts as a barrier to entry, ensuring that traders have sufficient funds to participate in the market. Secondly, it helps protect traders from excessive risk, as a higher minimum deposit can discourage individuals from depositing funds they cannot afford to lose. Lastly, the minimum deposit requirement may also reflect the quality of services and resources provided by the broker.

How does IC Markets Australia compare to other brokers?

When compared to other brokers in the industry, IC Markets Australia’s minimum deposit requirement is considered relatively low. This makes it a popular choice among traders who are just starting or have limited trading capital. However, it is vital to also consider other factors, such as trading conditions, customer support, and regulatory compliance, when choosing a broker.

In conclusion, the minimum deposit requirement at IC Markets Australia varies depending on the type of account chosen. It is essential to assess your trading goals, risk tolerance, and budget before deciding on the right account type for you. Remember to thoroughly research and compare different brokers to ensure you find the best fit for your trading needs.

When it comes to trading with IC Markets Australia, it is important to be aware of the minimum deposit requirements. These requirements determine the amount of money that you need to have in your trading account in order to start trading.

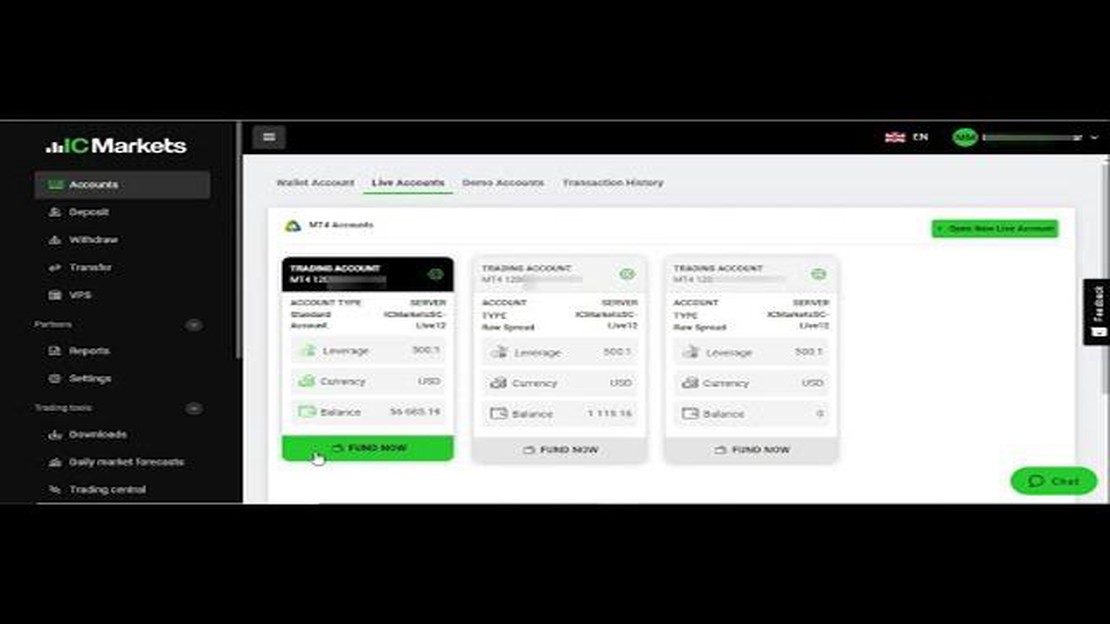

The minimum deposit requirements at IC Markets Australia vary depending on the type of trading account you choose. The three types of accounts available are Standard, Raw Spread, and cTrader. Here is an overview of the minimum deposit requirements for each account:

| Account Type | Minimum Deposit |

|---|---|

| Standard | $200 |

| Raw Spread | $200 |

| cTrader | $200 |

It is important to note that these minimum deposit requirements apply to the initial deposit only. Once you have made the minimum deposit, there is no requirement to maintain a specific balance in your account.

Having a clear understanding of the minimum deposit requirements can help you plan your trading strategy and ensure that you have enough funds to start trading with IC Markets Australia.

Read Also: Forex Market Open Hours Today in India: Find the Exact Time to Trade

IC Markets Australia is a leading online broker that offers a wide range of trading products and services. There are several reasons why traders choose IC Markets Australia:

Overall, IC Markets Australia is a trusted broker that provides traders with a secure and efficient trading environment, competitive trading conditions, and excellent customer support. Whether you are a beginner or an experienced trader, IC Markets Australia has the tools and services to meet your needs.

When choosing a brokerage firm for forex trading, one of the important factors to consider is the minimum deposit requirement. The minimum deposit is the amount of money that you need to deposit in your trading account in order to open and maintain it. Understanding the minimum deposit requirement can help you choose a brokerage firm that aligns with your budget and trading goals.

IC Markets Australia is a popular brokerage firm that offers competitive trading conditions, including a low minimum deposit requirement. As of the time of writing, the minimum deposit requirement at IC Markets Australia is $200 for most account types. This means that you need to deposit at least $200 in your trading account to start trading.

Read Also: Trading Iraqi Dinar on Forex: Everything You Need to Know

It’s important to note that the minimum deposit requirement may vary depending on the account type you choose. Some brokers offer different account types with varying minimum deposit requirements based on the trading features and benefits offered. It’s advisable to check the specific account types and their minimum deposit requirements before making a decision.

Having a low minimum deposit requirement can be beneficial for traders, especially for those who are new to forex trading and want to start with a smaller amount of capital. It allows traders to test the trading platform, practice their trading strategies, and gain experience without risking a large amount of money.

However, it’s important to remember that the minimum deposit requirement is just one aspect to consider when choosing a brokerage firm. Other factors such as trading fees, available trading instruments, customer support, and regulation should also be taken into account. It’s advisable to do thorough research and compare different brokerage firms before making a decision.

In conclusion, the minimum deposit requirement is an important factor to consider when choosing a brokerage firm for forex trading. IC Markets Australia offers a low minimum deposit requirement of $200, but it’s essential to check the specific account types and their minimum deposit requirements. Taking into account other factors such as trading conditions and customer support can help you make an informed decision.

The minimum deposit requirement at IC Markets Australia is $200.

No, the minimum deposit requirement at IC Markets Australia is $200.

Yes, the minimum deposit requirement of $200 applies to all account types at IC Markets Australia.

No, there are no additional fees or charges associated with the minimum deposit requirement at IC Markets Australia.

IC Markets Australia accepts various payment methods, including bank transfers, credit/debit cards, and online payment processors like Skrill and Neteller.

The minimum deposit requirement at IC Markets Australia is $200 for both Standard and Raw Spread accounts.

No, the minimum deposit requirement at IC Markets Australia is $200.

Why do traders go to Dubai? The choice of a trade hub plays a crucial role in the success of any business. Dubai, the cosmopolitan city of the United …

Read ArticleUnderstanding the Role of Fundamental Analysis in the Stock Market When it comes to investing in the stock market, it’s important to have a thorough …

Read ArticleAccounting for Call Options: A Comprehensive Guide Call options are financial instruments that give the holder the right, but not the obligation, to …

Read ArticleWho bought Alcatel? Alcatel, the multinational telecommunications equipment company, has recently been acquired by an industry-leading corporation. …

Read ArticleAre Traders Subject to Tax in Singapore? When it comes to trading in Singapore, understanding your tax obligations is crucial. Singapore has a unique …

Read ArticleDoes AT&T allow trade-ins? Are you thinking about upgrading your device? Want to know if ATT allows trade ins? Look no further! In this article, we …

Read Article