Everything You Need to Know About Kiwi in Forex Trading

Understanding the Role of the Kiwi in Forex Trading If you are new to forex trading, you may have come across the term “kiwi” and wondered what it …

Read Article

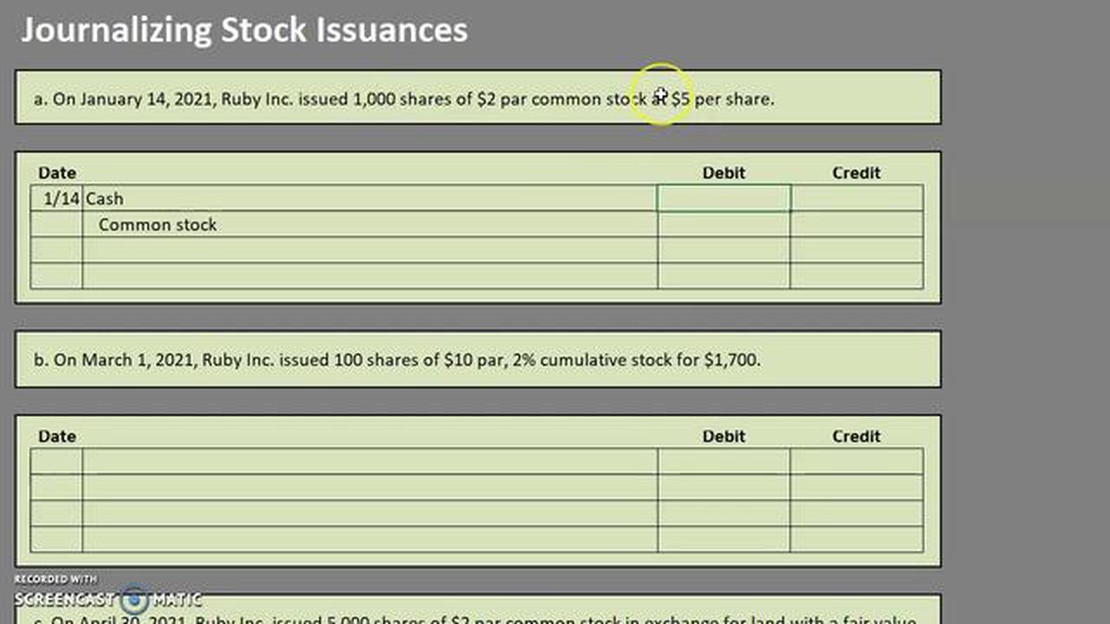

The issuance of stock is a critical event for a company, as it represents the sale of ownership in the business to investors. This process involves accounting for the inflow of cash from the sale of stock and properly recording the increase in shareholders’ equity. Additionally, it is important to track the number of shares issued and their par value.

Accounting for the issuance of stock requires several steps. First, the company must determine the par value of the stock, which is the nominal value assigned to each share. This value is typically set at a low amount to reflect the minimum value of a share of stock. The par value multiplied by the number of shares issued provides the initial recorded value of the stock sold.

Next, the company records the increase in shareholders’ equity by crediting the common stock or preferred stock account. This reflects the inflow of capital from the sale of stock and increases the company’s net assets. The corresponding entry is a debit to either cash or another asset account, depending on the form of payment received.

In addition to recording the issuance of stock, companies must also disclose relevant information in the financial statements. This includes the total number of shares issued, the par value of the shares, and any significant terms or conditions attached to the stock, such as voting rights or dividend preferences. This information is typically disclosed in the notes to the financial statements.

Recording the issuance of stock is an important accounting process that companies need to accurately document. It involves tracking the initial sale of company shares to investors and recording the associated transactions.

When a company decides to issue stock, it typically does so to raise capital for various purposes, such as funding expansion plans or paying off debts. The issuance process involves several steps that should be properly recorded to ensure accurate financial reporting.

Here are some key steps to consider when recording the issuance of stock:

Properly recording the issuance of stock is crucial for accurate financial reporting and transparency. It allows stakeholders to understand the company’s capital structure and its ability to raise funds through stock issuances. Additionally, it ensures compliance with accounting standards and regulations.

Overall, companies should have clear procedures in place for recording the issuance of stock to maintain accurate and transparent financial records. By following these steps and documenting the necessary information, companies can effectively track their stock issuances and provide stakeholders with the information they need.

When it comes to recording the issuance of stock, it’s important to understand the basics of accounting. This involves knowing the different types of stock and how they are classified.

Read Also: Is VectorVest worth it? Analyzing the benefits and drawbacks of VectorVest

Firstly, there are two main types of stock: common stock and preferred stock. Common stock represents ownership in a company and typically carries voting rights. Preferred stock, on the other hand, generally does not have voting rights but has a higher claim on the company’s assets and earnings.

Next, it’s important to understand how stock is classified in the balance sheet. Common stock is classified as part of the company’s equity section, specifically under the stockholders’ equity. Preferred stock is also classified under the stockholders’ equity, but it is usually separated from common stock.

When recording the issuance of stock, it’s necessary to create journal entries to document the transaction. These journal entries should include details such as the number of shares issued, the par value of the stock, and any additional proceeds or premiums received.

Additionally, it’s important to keep detailed records of the stock issuance for compliance and reporting purposes. This includes maintaining an accurate stock ledger, which tracks the ownership and transactions related to the company’s stock.

Overall, understanding the basics of stock issuance and accounting is crucial for accurately recording and reporting the issuance of stock. By knowing the different types of stock, how they are classified, and the necessary journal entries, businesses can ensure they are properly documenting these transactions.

When a company issues stock, it is important to properly record the transaction in its accounting records. There are several methods that can be used to record stock issuance, each with its own advantages and disadvantages.

Read Also: Why is JPY so volatile? | Understanding the fluctuations of the Japanese yen

1. Par Value Method: Under this method, the stock is recorded at its par value. The par value is a nominal value assigned to each share of stock. This method is simple and easy to understand, but it may not accurately reflect the true value of the stock.

2. Market Value Method: This method records the stock at its market value at the time of issuance. Market value is determined by factors such as supply and demand, company performance, and economic conditions. This method provides a more accurate reflection of the stock’s value, but it requires regular valuation updates.

3. Cost Method: Under this method, the stock is recorded at the cost of acquiring it. This includes any expenses incurred in the acquisition, such as brokerage fees. This method is straightforward, but it may not reflect changes in the stock’s value over time.

4. Treasury Stock Method: This method is used when a company buys back its own stock. The stock is recorded as treasury stock, which is a contra-equity account, reducing the company’s total equity. This method is useful for tracking stock transactions, but it does not provide information about the stock’s market value.

Overall, the method chosen for recording stock issuance depends on the company’s specific needs and requirements. It is important to consult with a qualified accountant or financial advisor to ensure that the chosen method accurately reflects the value of the stock and complies with accounting standards and regulations.

Stock issuance refers to the process of offering and selling shares of a company’s stock to investors. It is a way for a company to raise capital and allow investors to become partial owners of the business.

Companies issue stock as a way to raise funds for various purposes such as expanding their operations, funding new projects, paying off debts, or acquiring other companies. It allows companies to tap into the financial resources of investors and shareholders.

The issuance of stock is recorded in accounting by increasing two accounts - the cash account and the stockholders’ equity account. The cash account is increased by the amount of cash received from the sale of the stock, while the stockholders’ equity account is increased by the par value of the stock issued.

Yes, the issuance of stock can have an impact on a company’s financial statements. It can increase the company’s cash balance and stockholders’ equity, which can affect the balance sheet. It can also impact the earnings per share calculation and the statement of shareholders’ equity.

Understanding the Role of the Kiwi in Forex Trading If you are new to forex trading, you may have come across the term “kiwi” and wondered what it …

Read ArticleTrading Nikkei 225 Futures: A Comprehensive Guide If you are interested in trading futures and want to expand your portfolio, the Nikkei 225 futures …

Read ArticleUnderstanding the Forex Master Pattern: A Comprehensive Guide When it comes to forex trading, having a solid strategy is crucial for success. One …

Read ArticleForeign Exchange Market in India: An Overview The foreign exchange market, also known as the forex market, is the largest decentralized market for …

Read ArticleHow to Use the RSI Indicator: A Guide to Finding the Best Strategy When it comes to trading, having the right tools and strategies can make all the …

Read ArticleReasons to Consider Buying Weekly Options Weekly options have gained popularity among traders in recent years, offering an enticing opportunity for …

Read Article