How to Make a Day Trade: Tips and Strategies for Success

How to Make a Day Trade? If you’re interested in making money in the stock market, day trading can be a lucrative option. Day trading involves buying …

Read Article

Profit is a key indicator of business success, and understanding how to calculate it is essential for entrepreneurs and business owners. Whether you are starting a new venture or managing an existing one, knowing the formula for profit can help you make informed decisions about pricing, investments, and overall profitability.

The formula for profit can be expressed as:

Profit = Revenue - Costs

Revenue represents the total income generated from selling goods or services. It can include sales, fees, subscriptions, or any other source of income. Costs, on the other hand, refer to the expenses incurred in the production or delivery of goods and services. This can include raw materials, labor, rent, utilities, and any other expenses directly related to the business operations.

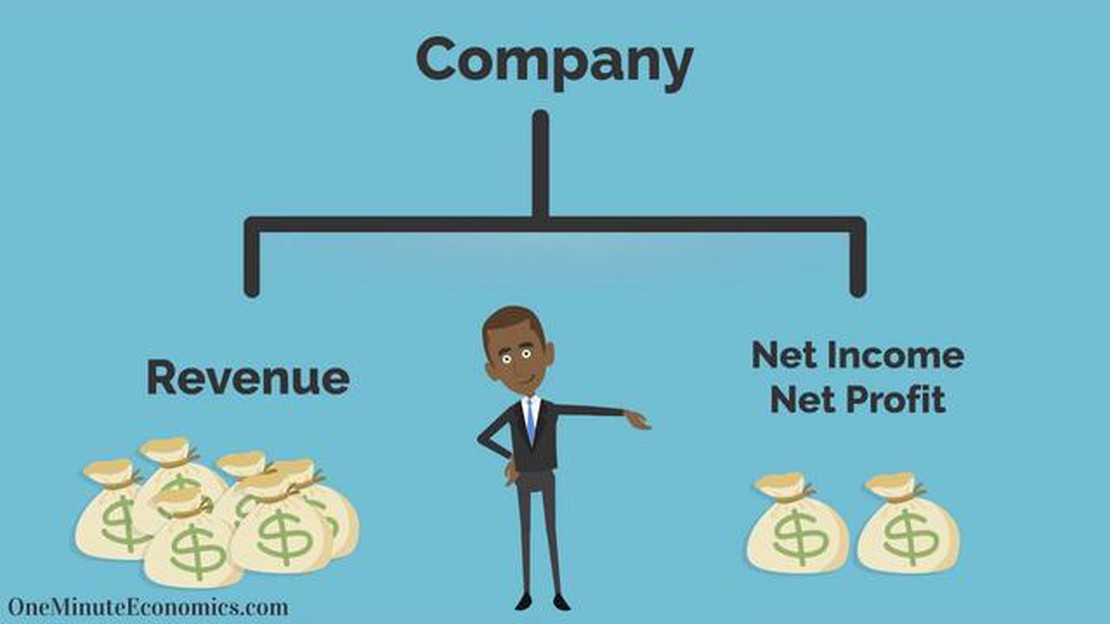

The profit formula allows businesses to determine their net income after deducting all costs from their revenue. This net income can then be reinvested in the business, used to pay dividends to shareholders, or allocated for other purposes such as debt repayment or expansion.

Calculating profit is crucial for evaluating business performance, setting financial goals, and making strategic decisions. By analyzing profit margins, businesses can identify areas of improvement, optimize pricing strategies, control costs, and ultimately increase their bottom line.

Profit is a key financial metric that measures the financial success of a business. It is the amount of money that remains after deducting all expenses from the revenue generated by a company. Understanding profit is essential for assessing the health and performance of a business.

To calculate profit, you need to have a clear understanding of revenue and expenses. Revenue refers to the total amount of money generated by selling goods or services. Expenses, on the other hand, encompass all costs associated with running a business, such as rent, salaries, utilities, and raw materials.

The formula to calculate profit is:

Profit = Revenue - Expenses

When revenue is higher than expenses, it results in a positive profit, indicating that the business is making money. Conversely, when expenses exceed revenue, it leads to a negative profit, meaning that the business is operating at a loss.

Profit is a vital metric that helps business owners and investors evaluate the financial performance and sustainability of a company. It provides insights into the effectiveness of business operations and helps guide decision-making processes.

Read Also: Understanding the Importance of Calculating Seasonal Indexes | Website Name

It is worth noting that profit can be expressed in different ways. Gross profit refers to the profit earned after deducting the cost of goods sold from revenue. Operating profit is the profit earned after subtracting both the cost of goods sold and operating expenses. Net profit is the final amount of profit remaining after deducting all expenses, including taxes and interest.

In conclusion, understanding profit is crucial for assessing the financial health and success of a business. By calculating profit, businesses can analyze their revenue, expenses, and overall profitability. This information can then be used to make informed decisions and drive the growth and sustainability of the company.

In order to calculate profit, you need to have two essential pieces of information: revenue and expenses. Once you have these figures, you can use the formula for calculating profit:

Profit = Revenue - Expenses

Read Also: Will Marlin rifles be made again? | Marlin Firearms Updates

The term “revenue” refers to the total amount of money generated from sales or other sources of income. This includes both cash and credit transactions, as well as any discounts or returns.

On the other hand, “expenses” represent the costs incurred in running a business. This includes both direct costs, such as the cost of purchasing inventory or raw materials, as well as indirect costs like utilities, rent, and employee salaries.

By subtracting the expenses from the revenue, you can determine the profit or loss of a business. A positive profit indicates that the business made more money than it spent, while a negative profit indicates a loss.

It’s important to note that profit is just one measure of a business’s financial performance. Other factors, such as cash flow, return on investment, and gross margin, should also be considered when evaluating the overall health and success of a business.

Profit is the financial gain that a business or individual receives after deducting expenses from revenue.

To calculate profit, subtract total expenses from total revenue.

Sure! Let’s say a business has total revenue of $10,000 and total expenses of $7,000. To calculate profit, you would subtract $7,000 from $10,000, resulting in a profit of $3,000.

Yes, profit is often referred to as net income or net profit. It represents the amount of money a business or individual earns after all expenses and taxes have been deducted.

Yes, there are different types of profit, such as gross profit, operating profit, and net profit. Gross profit is the revenue minus the cost of goods sold, operating profit is the gross profit minus operating expenses, and net profit is the operating profit minus taxes and other expenses.

Profit is the financial gain obtained from a business or investment after deducting all expenses and costs.

How to Make a Day Trade? If you’re interested in making money in the stock market, day trading can be a lucrative option. Day trading involves buying …

Read ArticleCan You Trade Options After Hours? The world of options trading is constantly evolving, and with it, the opportunity to trade outside of regular …

Read ArticleUnderstanding the Concept of Trading Strategy Trading in the financial markets can be a highly lucrative venture, but it also comes with its fair …

Read ArticleUnderstanding ECN Forex Brokers: How They Work and What They Offer When it comes to trading on the foreign exchange market, having a reliable and …

Read ArticleWho is the owner of BFC bank in Bahrain? If you have ever wondered about the owner of BFC Bank in Bahrain, look no further. In this article, we will …

Read ArticleTarget Price for UOB: Exploring the Potential Value of UOB’s Stocks United Overseas Bank (UOB) is one of the leading banks in Singapore, with a strong …

Read Article